Having the goal of making it as simple to go with as possible, we built the PDF editor. The process of creating the ar1000ec tax form will be uncomplicated should you comply with the following steps.

Step 1: Click the orange button "Get Form Here" on the following webpage.

Step 2: Now, you're on the document editing page. You may add information, edit current details, highlight certain words or phrases, insert crosses or checks, add images, sign the form, erase unneeded fields, etc.

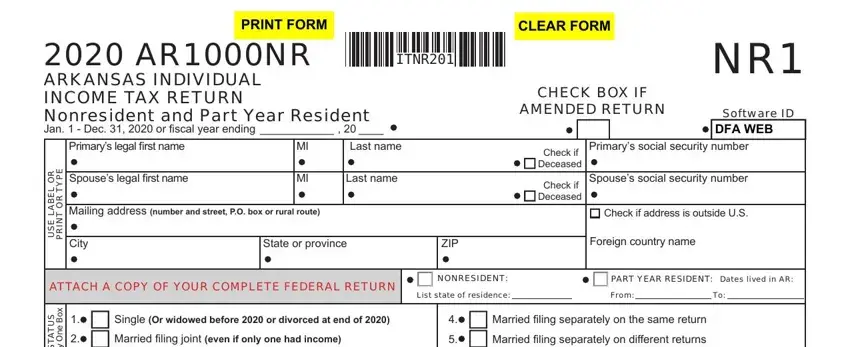

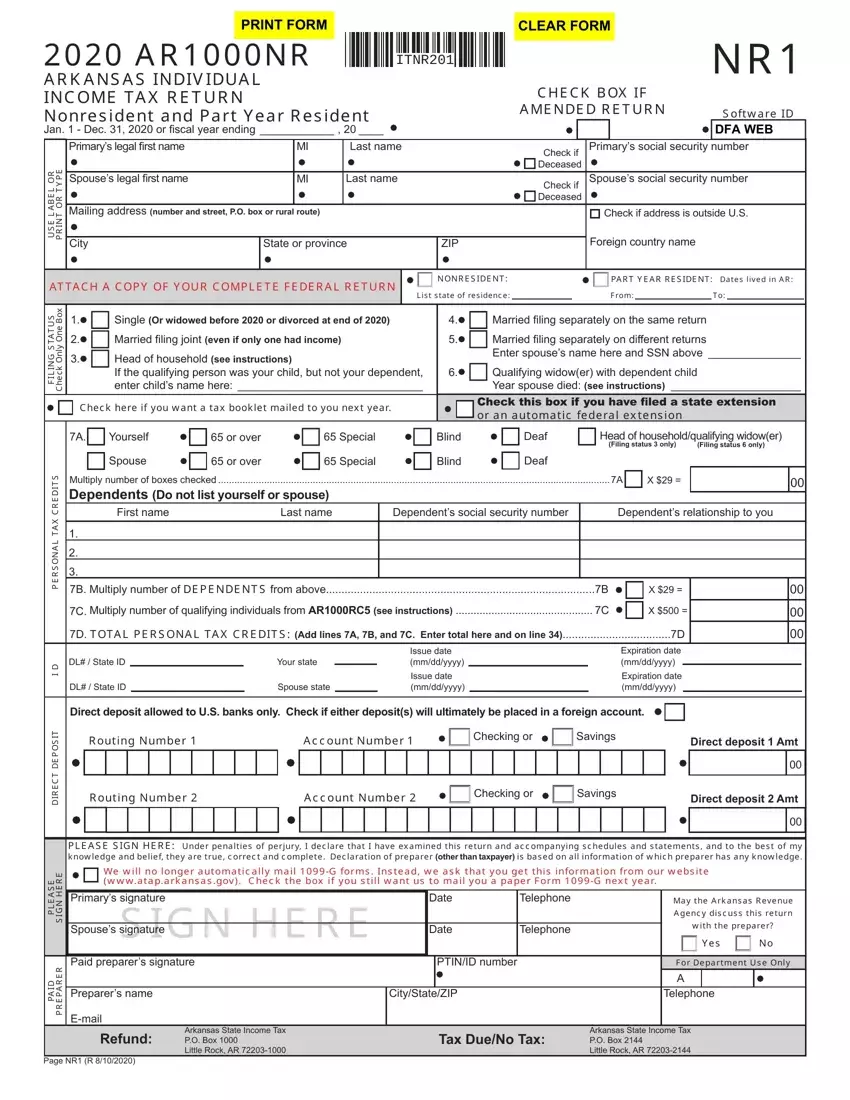

The following parts are in the PDF template you'll be creating.

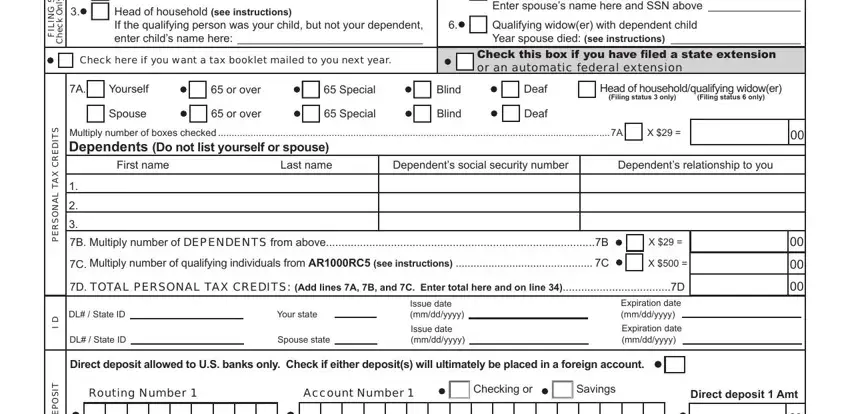

Remember to put down your particulars inside the area S U T A T S G N I L I F, x o B e n O y l n O k c e h C, cidcidcid, cid, Check here if you want a tax, cidcidcidcidcidcidcidcid, cidcidcidcidcidcid, cidcidcidcidcidcidcidcidcidcid, cidcidcidcidcidcidcidcidcidcid, cidcidcidcidcidcidcidcidcidcid, cidcidcidcidcidcidcidcidcidcid, cidcidcid cid, cidcidcid cid, cidcidcidcidcid, and cidcidcidcidcid.

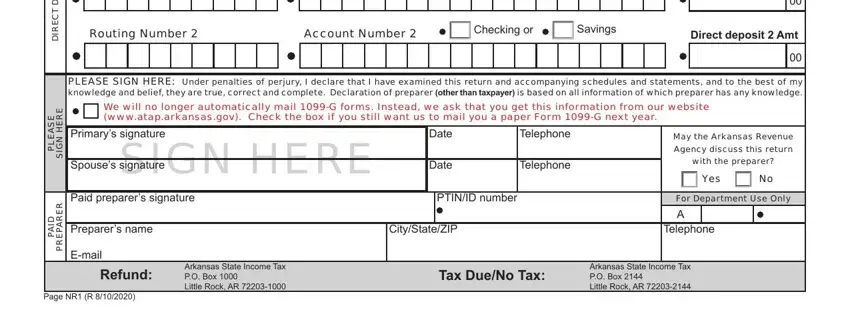

The application will request information to easily fill up the section Routing Number, Account Number, cidcidcidcidcidcidcidcidcidcidcid, cidcidcidcidcidcidcid, Direct deposit Amt, PLEASE SIGN HERE Under penalties, We will no longer automatically, SIGN HERE, cidcidcidcid, cidcidcidcid, cidcidcidcidcidcidcidcidcid, cidcidcidcidcidcidcidcidcid, May the Arkansas Revenue, Agency discuss this return, and with the preparer.

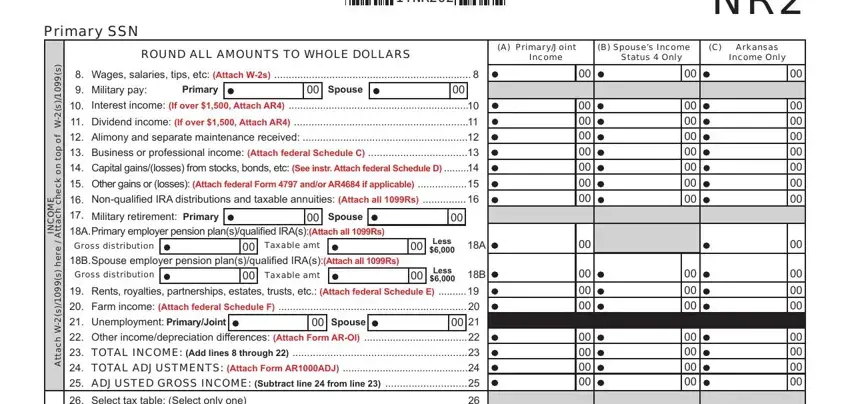

The Primary SSN, ITNR, ROUND ALL AMOUNTS TO WHOLE DOLLARS, A PrimaryJoint, B Spouses Income, Income, Status Only, C Arkansas Income Only, s s W, f o p o t n o k c e h c h c a t t A, E M O C N, e r e h s s W h c a t t A, Primary, Spouse, and Spouse section is the place where either side can describe their rights and obligations.

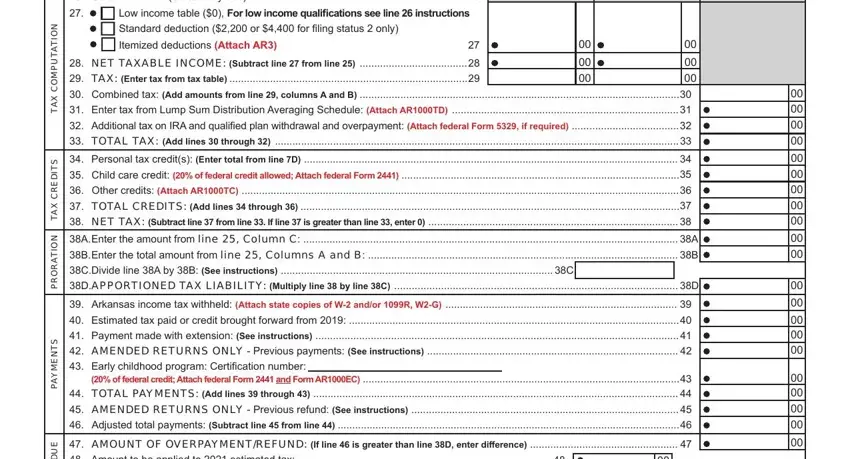

Finish by analyzing all of these sections and completing the suitable information: N O I T A T U P M O C X A T, S T I D E R C X A T, N O I T A R O R P, S T N E M Y A P, E U D X A T R O D N U F E R, NET TAXABLE INCOME Subtract line, A B C, and AMOUNT OF OVERPAYMENTREFUND.

Step 3: Choose the "Done" button. You can now export your PDF file to your electronic device. As well as that, you may deliver it via electronic mail.

Step 4: Make sure you stay clear of potential complications by creating as much as a couple of duplicates of the form.

ITNR201

ITNR201

NONRESIDENT:

NONRESIDENT:

ITNR202

ITNR202