Submitting files together with our PDF editor is easier compared to most things. To manage Form Becu 6873 the file, you'll find nothing you have to do - basically stick to the actions down below:

Step 1: Press the orange "Get Form Now" button on the following web page.

Step 2: Now you're on the form editing page. You can enhance and add text to the document, highlight words and phrases, cross or check selected words, add images, insert a signature on it, get rid of unrequired fields, or remove them completely.

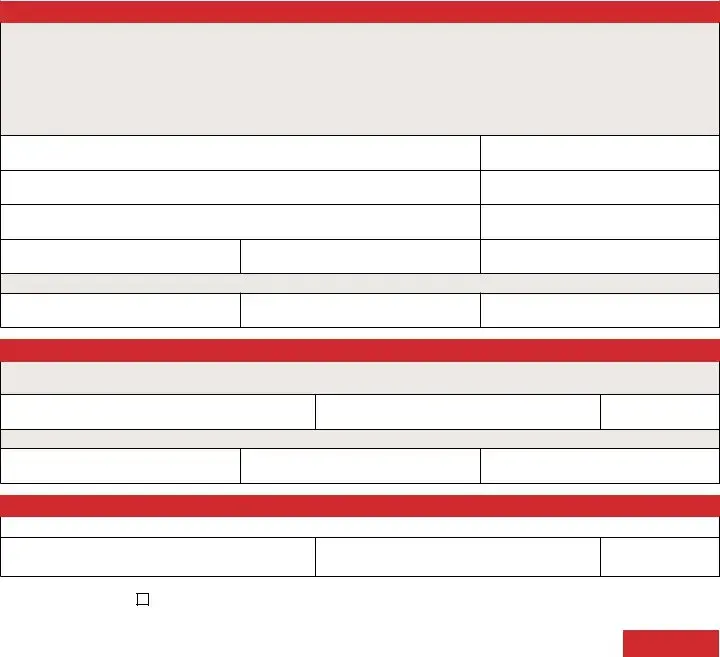

Provide the required information in every single part to create the PDF Form Becu 6873

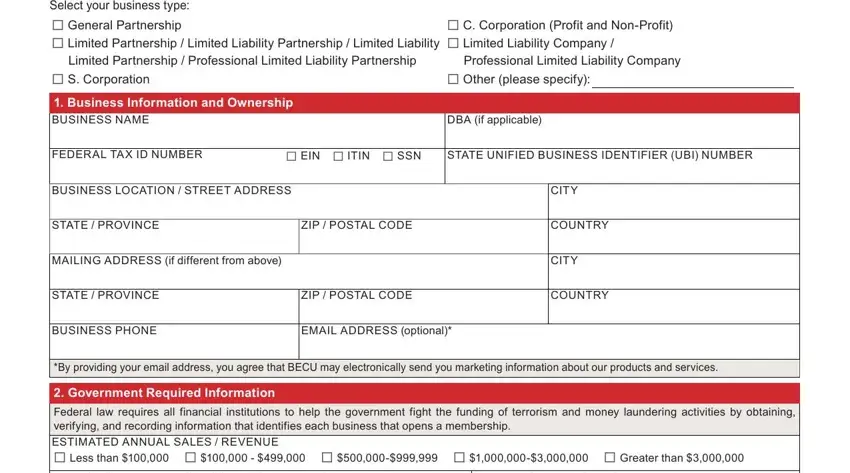

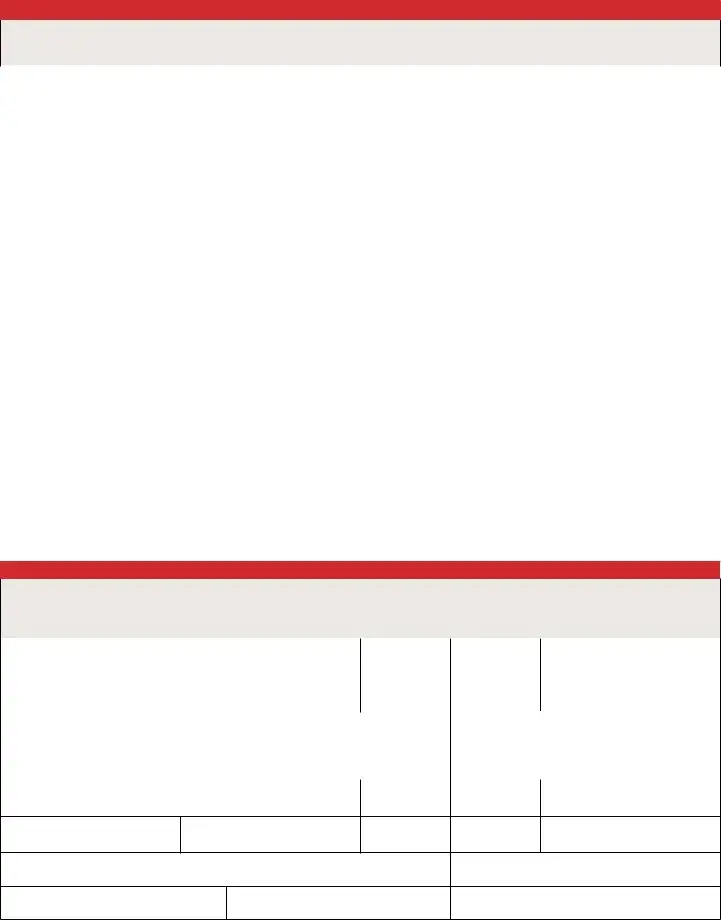

Jot down the information in the Is your business a nonprofit, NUMBER OF EMPLOYEES, STATE OF ENTITY FORMATION, DATE BUSINESS ESTABLISHED, COUNTRY WHERE BUSINESS ESTABLISHED, NAICS CODE, TYPE OF BUSINESS PRIMARY FUNCTION, I acknowledge my business does, gambling sites or marijuana, Does the business receive revenue, What is the of income or revenue, Anticipated transaction, Monthly number of cash deposits, Monthly number of cash withdrawals, and Monthly number of domestic wires area.

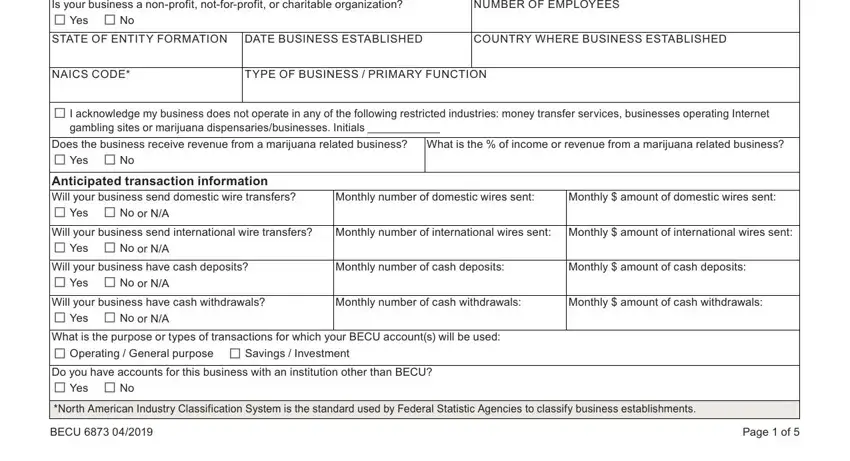

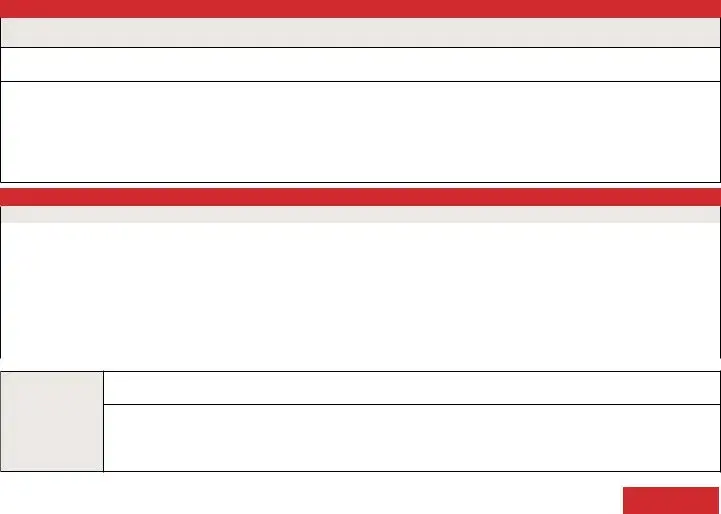

Inside the segment discussing By signing below whether the, SIGNATURE, TITLE POSITION, BECU Use Only, NFC verification select one, Secretary of State or My DOR, Partnerships and LLCs, FULL LEGAL NAME, DATE, Business Services Specialist, Membership Agreements Continued, SECTION REQUIRED SIGNATURES, Single owned Owners signature, Person opening the business, and General Partnership Limited, you are required to note some appropriate details.

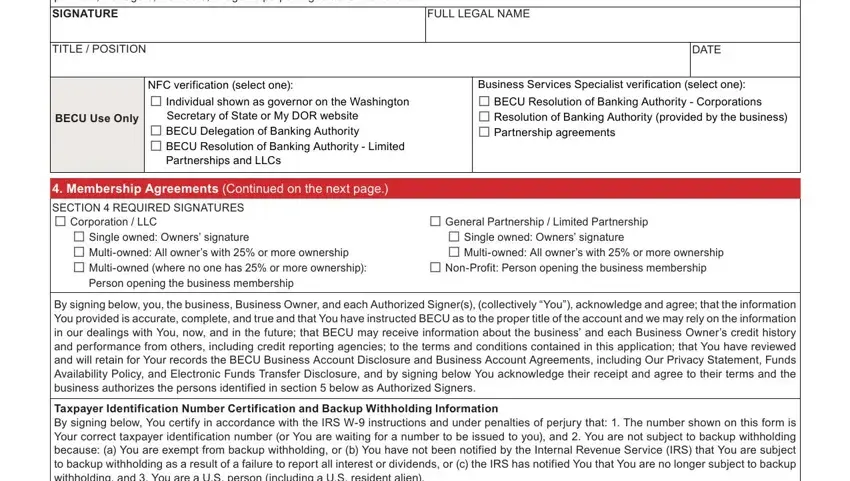

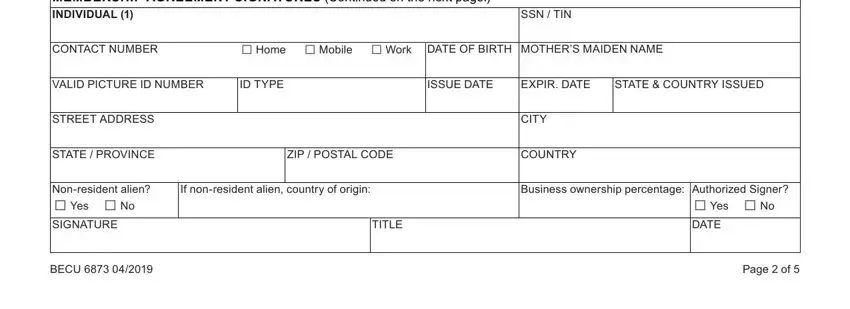

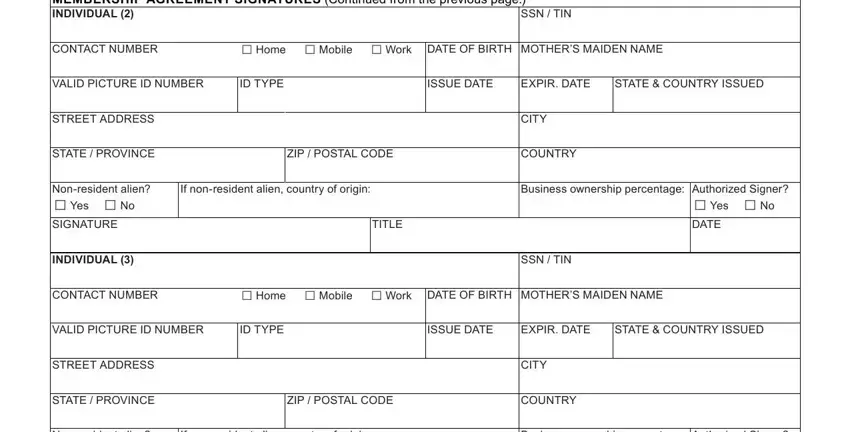

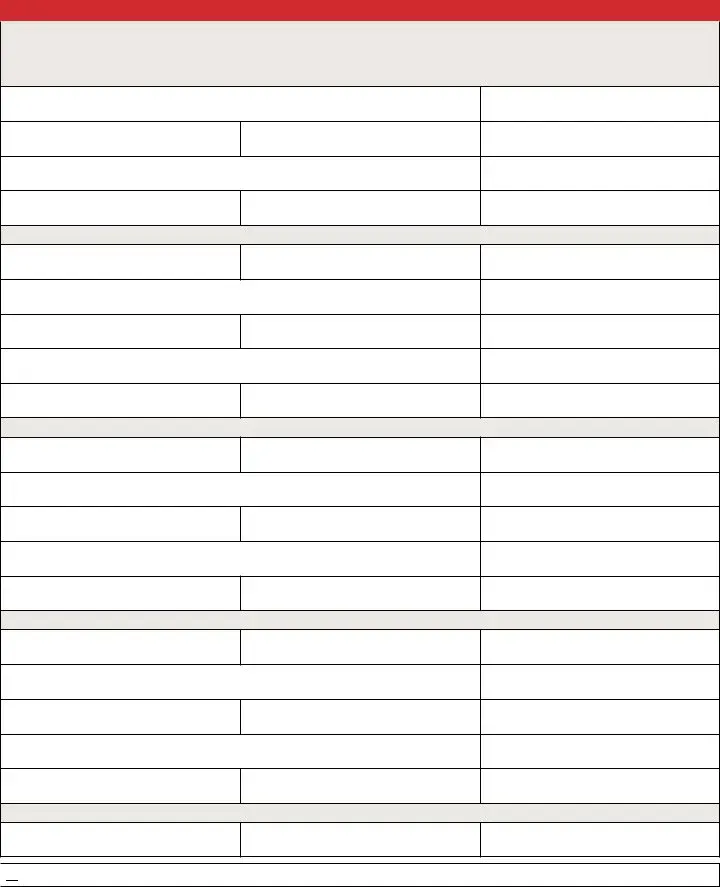

The MEMBERSHIP AGREEMENT SIGNATURES, SSN TIN, CONTACT NUMBER Home Mobile Work, VALID PICTURE ID NUMBER, ID TYPE, ISSUE DATE, EXPIR DATE, STATE COUNTRY ISSUED, STREET ADDRESS, CITY, STATE PROVINCE, ZIP POSTAL CODE, COUNTRY, Nonresident alien Yes No, and SIGNATURE field is the place where each side can insert their rights and obligations.

Finish by reading all these fields and filling them in accordingly: MEMBERSHIP AGREEMENT SIGNATURES, SSN TIN, CONTACT NUMBER Home Mobile Work, VALID PICTURE ID NUMBER, ID TYPE, ISSUE DATE, EXPIR DATE, STATE COUNTRY ISSUED, STREET ADDRESS, CITY, STATE PROVINCE, ZIP POSTAL CODE, COUNTRY, Nonresident alien Yes No, and SIGNATURE.

Step 3: Once you have selected the Done button, your form will be obtainable for transfer to every gadget or email address you specify.

Step 4: Be certain to keep away from future worries by getting as much as two duplicates of the file.

Beneficial Owner with 25% or more ownership not applicable.

Beneficial Owner with 25% or more ownership not applicable.