The PDF editor makes writing forms hassle-free. It is rather effortless manage the [FORMNAME] form. Check out these actions if you want to do this:

Step 1: To start with, pick the orange "Get form now" button.

Step 2: You're now on the document editing page. You can edit, add content, highlight certain words or phrases, place crosses or checks, and put images.

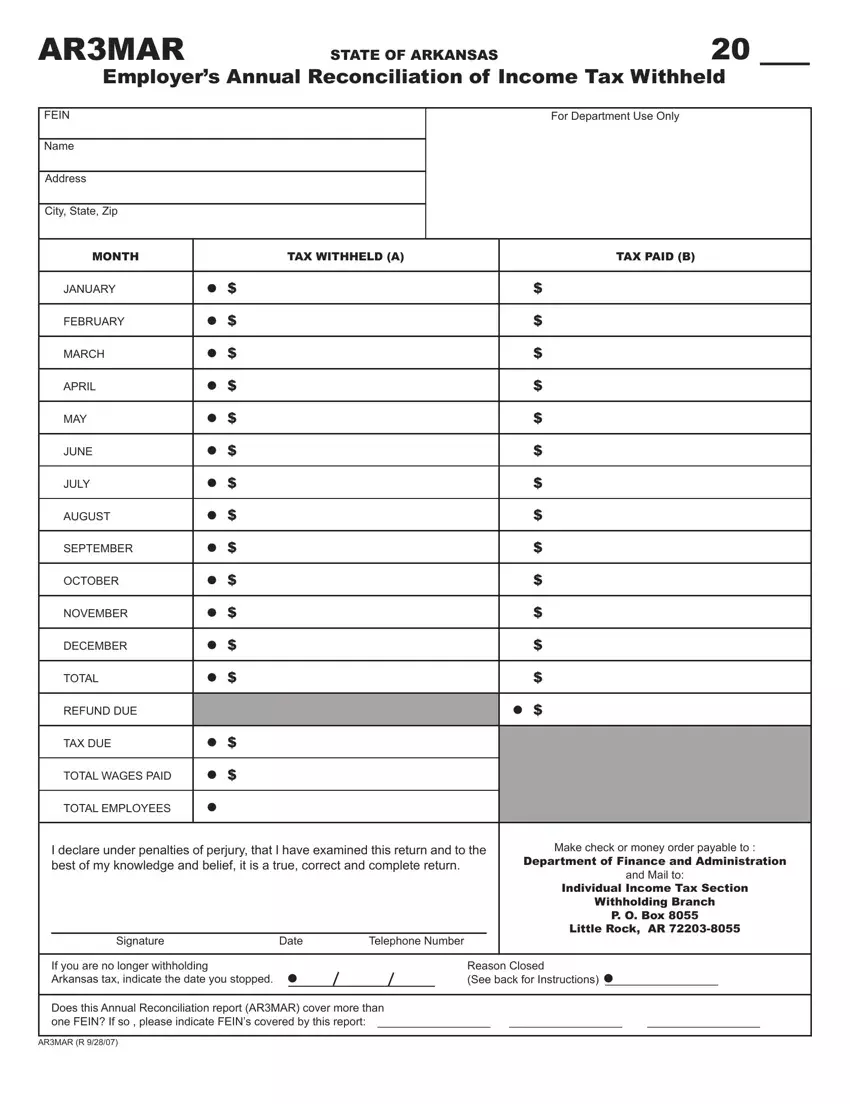

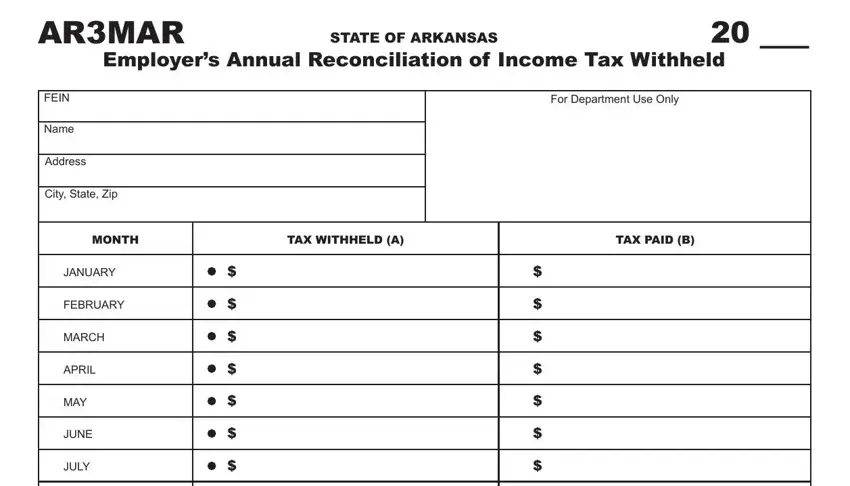

The next sections will help make up the PDF document:

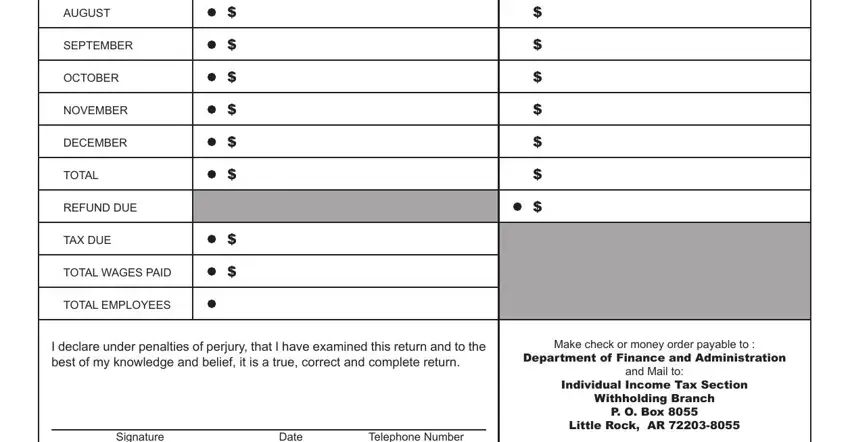

You need to fill up the AUGUST, SEPTEMBER, OCTOBER, NOVEMBER, DECEMBER, TOTAL, REFUND DUE, TAX DUE, TOTAL WAGES PAID, TOTAL EMPLOYEES, I declare under penalties of, Make check or money order payable, Signature, Date, and Telephone Number area with the appropriate particulars.

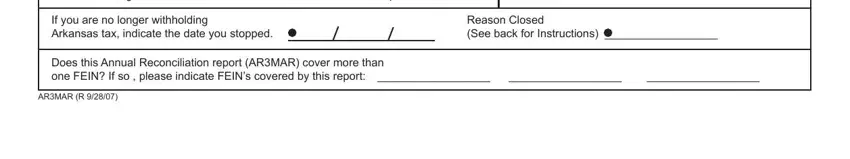

The software will demand you to present some key details to conveniently complete the section Signature, Date, Telephone Number, If you are no longer withholding, Reason Closed See back for, Does this Annual Reconciliation, and ARMAR R.

Step 3: In case you are done, choose the "Done" button to transfer the PDF form.

Step 4: Generate minimally several copies of your document to remain away from different possible difficulties.