Once you open the online tool for PDF editing by FormsPal, you can complete or alter Form Ar4Ec here. In order to make our tool better and simpler to use, we constantly design new features, with our users' feedback in mind. By taking a few simple steps, you can begin your PDF journey:

Step 1: Click on the "Get Form" button in the top section of this webpage to get into our PDF editor.

Step 2: With this state-of-the-art PDF editor, it is easy to accomplish more than simply complete blank fields. Edit away and make your forms look perfect with customized text added in, or adjust the original input to excellence - all backed up by the capability to insert stunning graphics and sign the file off.

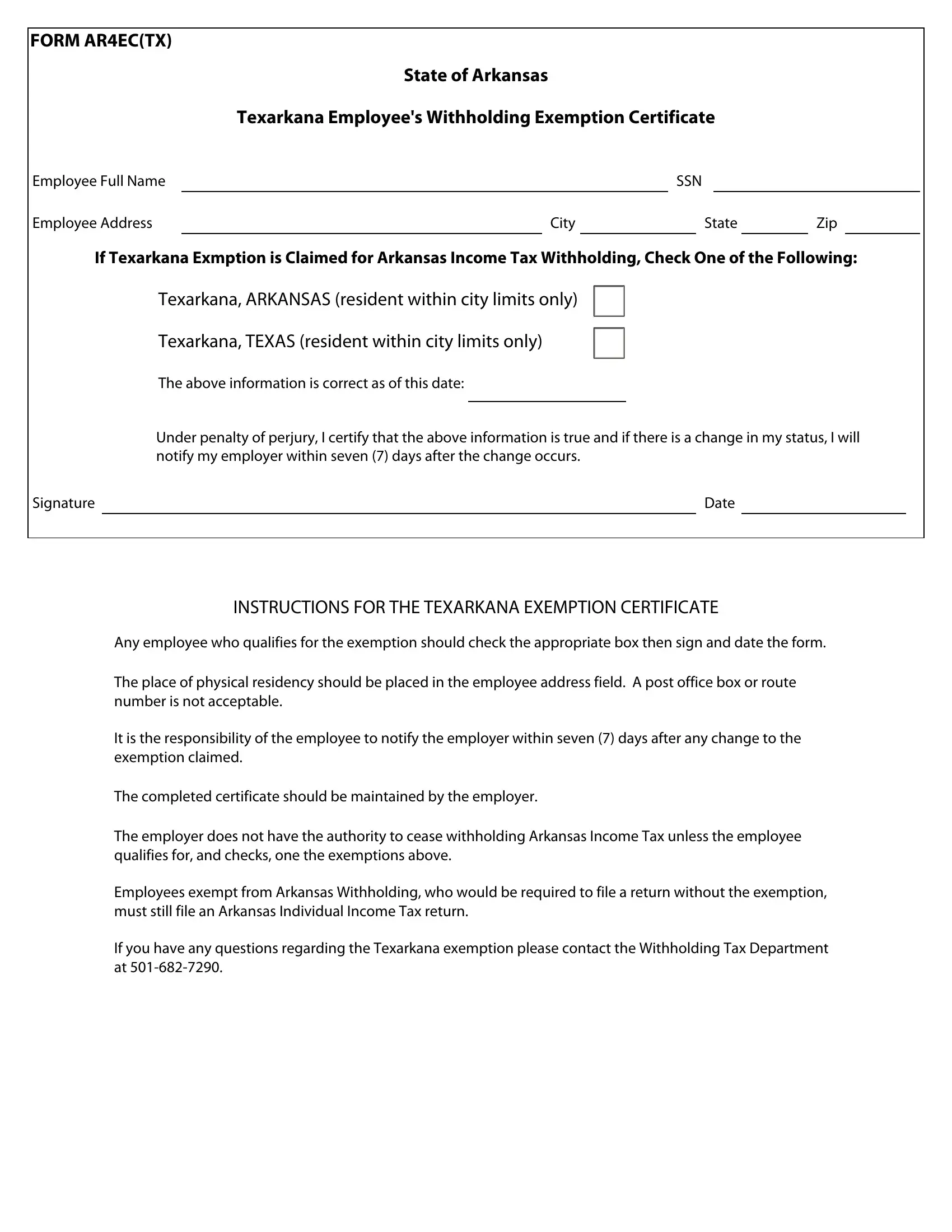

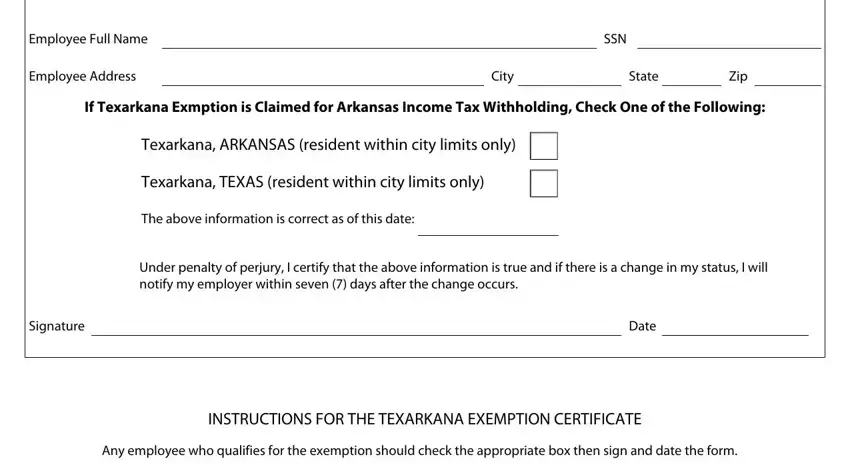

In an effort to fill out this document, make sure you enter the necessary information in every single blank:

1. The Form Ar4Ec will require particular details to be entered. Be sure the subsequent fields are completed:

Step 3: Right after you have looked once again at the details entered, simply click "Done" to finalize your document generation. Try a free trial plan at FormsPal and get instant access to Form Ar4Ec - download or modify from your personal cabinet. We do not share any information that you provide when working with documents at our website.