The BE-10A Bank form, crucial for the comprehensive 2004 Benchmark Survey of U.S. Direct Investment Abroad by the Bureau of Economic Analysis, U.S. Department of Commerce, gathers detailed financial and operational data from U.S. banks with foreign affiliates. It's designed to ensure that accurate and confidential data regarding U.S. direct investments abroad are collected, emphasizing the significance of reporting by U.S. entities that are banks and have one or more foreign affiliates. This form is part of a mandatory survey underpinned by the International Investment and Trade in Services Survey Act, aiming to enhance the understanding and formulate policies concerning U.S. direct investment abroad. Reporting entities must provide a gamut of information, including total income, net income or loss after taxes, total assets at the close of the fiscal year 2004, and details on employee compensation. Distinctly, the form underlines the requirement for these entities to report on a fully consolidated basis domestically while reporting operations of foreign affiliates separately. Furthermore, the survey includes stiffer penalties to ensure compliance, underscoring the importance of timely and accurate submissions. With deadlines set for May 31, 2005, or June 30, 2005, depending on the number of foreign affiliate reports required, the form facilitates a structured approach to gathering vital statistics, aiding in the objective assessment of U.S. direct investment abroad.

| Question | Answer |

|---|---|

| Form Name | Form Be 10A Bank |

| Form Length | 7 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 45 sec |

| Other names | form be 10a instructions, be 10a form, form be 10 pdf, be 10 instructions |

|

303 |

|

OMB No. |

||

U.S. DEPARTMENT OF COMMERCE |

2004 BENCHMARK SURVEY OF |

|

Economic and Statistics Administration |

||

|

||

BUREAU OF ECONOMIC ANALYSIS |

U.S. DIRECT INVESTMENT ABROAD |

|

|

||

|

MANDATORY — CONFIDENTIAL |

|

FORM |

||

DUE DATE — A completed

May 31, 2005 for a U.S. Reporter required to file fewer than 50 Forms

MAIL REPORTS TO:

U.S. Department of Commerce

Bureau of Economic Analysis

Washington, DC 20230

OR

DELIVER REPORTS TO:

U.S. Department of Commerce

Bureau of Economic Analysis

Shipping and Receiving,

Section

1441 L Street, NW

Washington, DC 20005

BEA USE ONLY Reporter ID Number

1.Name and address of U.S. Reporter

IMPORTANT

D

IMPORTANT

Please read the Instruction Booklet, which contains definitions and reporting requirements, before completing this form. The Instruction Booklet, Part I.C., has information for U.S. Reporters and foreign affiliates that are banks. "Additional" Instructions specific to line items are provided at the back of this form.

For purposes of the

クWho must report — Form

Note: A U.S. Reporter that is not a bank but owns a majority interest in a U.S. bank, must file the bank, including all of its domestic subsidiaries or units, on Form

クU.S. Reporter’s 2004 fiscal year — The U.S. Reporter’s financial reporting year that has an ending date in calendar year 2004. See

INSTRUCTION BOOKLET, Part II.A.

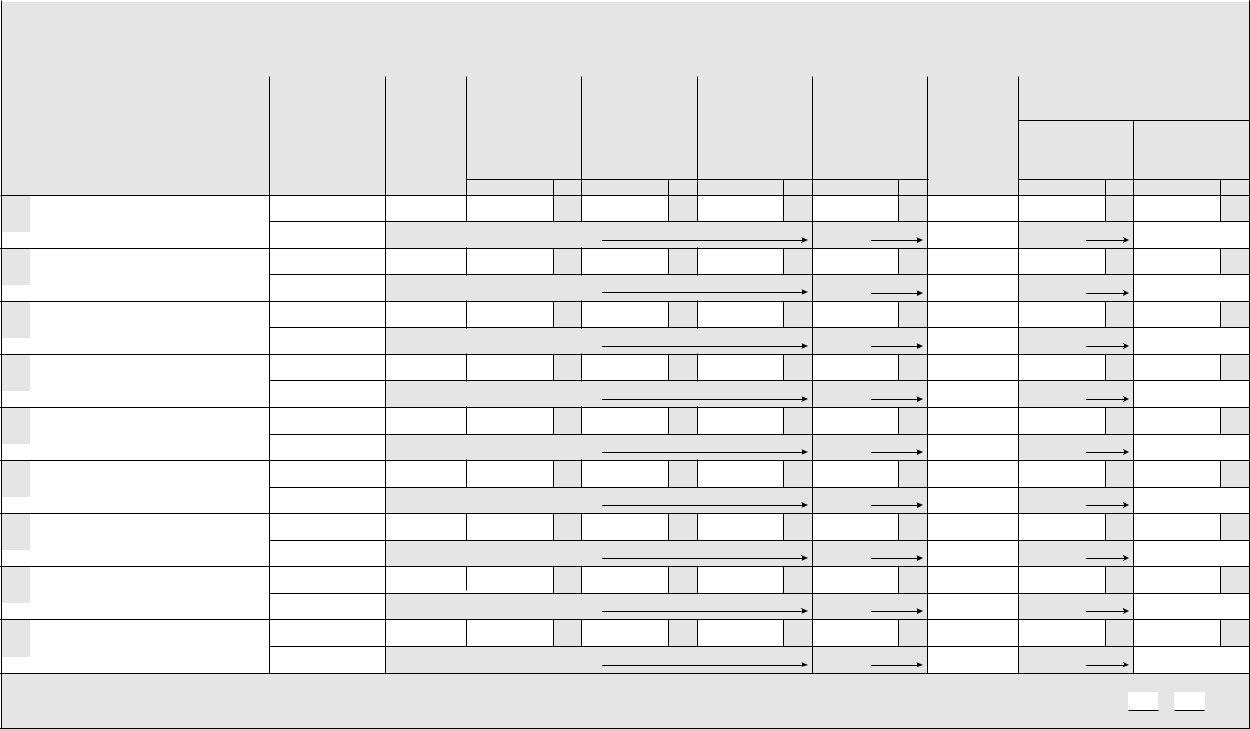

ク Currency amounts — Report in U.S. dollars rounded to thousands (omitting 000). Do not |

|

|

|

|

Bil. |

Mil. |

Thous. Dols. |

||

enter amounts in the shaded portions of each line. EXAMPLE – If amount is $1,334,891.00, report as |

|

|

|

|

|

|

|

|

|

If an item is between + or – $500.00, enter "0." Use parenthesis () to indicate negative numbers. |

|

|

|

|

|

|

|

|

|

クAdditional copies — For additional copies of

クContact us for help — Telephone:

Public reporting burden for this

This survey is being conducted under the International Investment and Trade in Services Survey Act (P.L.

MANDATORY94-472, 90 Stat. 2059, 22 U.S.C.

|

|

|

The Act provides that your report to this Bureau is confidential and may be used only for analytical or statistical |

||||||

CONFIDENTIALITY |

purposes. Without your prior written permission, the information filed in your report cannot be presented in a |

||||||||

manner that allows it to be individually identified. Your report cannot be used for purposes of taxation, |

|||||||||

|

|

|

|||||||

|

|

|

investigation, or regulation. Copies retained in your files are immune from legal process. |

||||||

|

|

|

|

|

|

|

|||

|

|

|

Whoever fails to report shall be subject to a civil penalty of not less than $2,500, and not more than $25,000, and |

||||||

|

|

|

to injunctive relief commanding such person to comply, or both. Whoever willfully fails to report shall be fined |

||||||

|

|

|

not more than $10,000 and, if an individual, may be imprisoned for not more than one year, or both. Any officer, |

||||||

|

|

|

director, employee, or agent of any corporation who knowingly participates in such violations, upon conviction, |

||||||

PENALTIES |

|

may be punished by a like fine, imprisonment or both. (22 U.S.C. 3105) |

|

|

|||||

|

|

|

|

|

|

|

|||

|

|

|

Notwithstanding any other provision of the law, no person is required to respond to, nor shall any person be |

||||||

|

|

|

subject to a penalty for failure to comply with, a collection of information subject to the requirements of the |

||||||

|

|

|

Paperwork Reduction Act, unless that collection of information displays a currently valid OMB Control Number. |

||||||

|

|

|

|

|

|

|

|||

PERSON TO CONSULT CONCERNING QUESTIONS ABOUT THIS |

|

|

|

|

|||||

REPORT — Enter name and address |

|

CERTIFICATION — The undersigned official certifies that this |

|||||||

|

|

|

|

|

|||||

|

|

|

|

|

report has been prepared in accordance with the applicable |

||||

Name |

|

|

|

|

instructions, is complete, and is substantially accurate except |

||||

|

|

|

|

|

that, in accordance with Part IV.E of the INSTRUCTION BOOKLET, |

||||

Address |

|

|

|

estimates may have been provided. |

|

|

|||

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Authorized official’s signature |

|

Date |

||

|

|

|

|

|

|

|

|

|

|

TELEPHONE |

Area code |

Number |

Extension |

Print or type name and title |

|

|

|||

NUMBER |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

FAX NUMBER |

Area code |

Number |

|

Telephone number |

|

FAX number |

|||

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

May we use

relating to this survey, including questions that may contain |

|

1 |

|

1000 |

|||

1 |

|||

information about your company that you may consider |

|

||

|

|||

|

|

||

confidential? (Note that electronic mail is not inherently confidential; |

|

1 2 |

|

we will treat information we receive as confidential, but |

|

not necessarily secure against interception by a third party.)

Yes — If yes, please provide your

No

1

1001

304

Part I – IDENTIFICATION OF U.S. REPORTER

See ADDITIONAL INSTRUCTIONS for Part I on page 7 at the back of this form.

2. Form of organization of U.S. Reporter — Mark (X) one.

1002 1 1

1 3

Corporation

Other — Specify

3.If the U.S. Reporter is a corporation, is the corporation owned to the extent of more than 50% of its voting stock by another U.S. business enterprise that is a bank?

1003 1 1

1 2

Yes — Complete the

No — Complete the remainder of this form.

4.Enter Employer Identification Number(s) used by U.S. Reporter to file income and payroll taxes. Show additional numbers on a separate sheet if necessary.

1004 1

2

5. The number of foreign affiliate reports

1005

Number

1

If you also have exempt foreign affiliates, list them on the

6. The ending date of this U.S. Reporter’s 2004 fiscal year.

|

Month |

Day |

Year |

|

|

|

|

1006 |

1 |

|

|

|

|

|

2004 |

|

|

|

|

|

|

|

|

7.Was there a change in the entity due to mergers, acquisitions, divestitures, etc., or a change in accounting methods or principles during FY 2004 that caused FY 2003 data to be restated?

1007 1 1

1 2

Yes No

8.If the U.S. Reporter is a corporation, are all U.S. domestic entities covered by the definition of fully consolidated U.S. Reporter? See INSTRUCTION BOOKLET, Part I.B.1.b.

1009 1 1

1 2

Yes

No — PERMISSION MUST HAVE BEEN REQUESTED OF, AND GRANTED BY, BEA TO FILE ON AN UNCONSOLIDATED BASIS. You must file a separate Form

Industry classification of fully consolidated domestic U.S. Reporter, (based on sales or gross operating revenues.) Enter in columns (1) and (2) respectively, the

|

|

|

|

|

|

|

|

|

|

Sales or gross |

|

|

|

|

|

|

|

|

|

|

ISI code |

operating revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) |

|

|

|

|

|

|

|

|

|

|

(1) |

|

|

|

|

|

|

|

|

|

|

|

Bil. Mil. Thous. Dols. |

||

|

|

|

|

|

|

|

|

|

1 |

2 |

|

9. |

BANKING (depository institutions — ISI code 5221) |

|

|

|

5221 |

$ |

|

||||

|

|

1015 |

|

||||||||

|

|

|

|

|

|

|

|

|

1 |

2 |

|

10. |

2nd largest sales or gross operating revenues |

|

|

|

|

|

|

||||

|

|

1016 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

1 |

2 |

|

11. |

3rd largest sales or gross operating revenues |

|

|

|

|

|

|

||||

|

|

1017 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

1 |

2 |

|

12. |

4th largest sales or gross operating revenues |

|

|

|

|

|

|

||||

|

|

1018 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

1 |

2 |

|

13. |

5th largest sales or gross operating revenues |

|

|

|

|

|

|

||||

|

|

1019 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

2 |

|

14. |

Sales or gross operating revenues not accounted for above. |

|

|

|

|

|

|

||||

|

|

1026 |

|

|

|

||||||

15. |

TOTAL SALES OR GROSS OPERATING REVENUES — Sum of items 9 |

|

|

2 |

|

||||||

|

|

$ |

|

||||||||

|

|

|

|||||||||

|

through 14 |

|

|

|

|

|

|

1027 |

|

|

|

|

|

|

|

|

|

|

|

|

|||

16. |

BEA USE |

1028 |

1 |

2 |

3 |

|

|

4 |

5 |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|||

|

ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1128 |

1 |

2 |

3 |

|

|

4 |

5 |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

FORM |

Page 2 |

305

|

Reporter ID Number |

|

|

|

Part II – SELECTED FINANCIAL AND OPERATING DATA OF U.S. REPORTER |

||

|

See ADDITIONAL INSTRUCTIONS for Part II on page 7 at the back of this form. |

||

D

Section A — Income and Assets |

|

|

Amount |

||

|

|

|

Bil. |

Mil. |

Thous. Dols. |

ク INCOME |

|

|

|

|

|

|

1 |

|

|

||

17. |

Total income |

3041 |

$ |

|

|

|

|

|

1 |

|

|

18. |

Net income (loss) after provision for U.S. Federal, state, and local income taxes |

3046 |

|

|

|

ク ASSETS |

|

1 |

|

|

|

|

|

|

|

||

19. |

Total assets at close of FY 2004 |

3371 |

|

|

|

クADDENDUM

20.INSURANCE INDUSTRY ACTIVITIES — Premiums earned and losses incurred

Report premiums earned and losses incurred for insurance related activities covered by industry codes 5243 (Insurance carriers, except life insurance carriers) and 5249 (life insurance carriers).

a.Of the total sales and gross operating revenues reported in item 15, column 2, were any of the sales or revenues generated by insurance related activities covered by industry codes 5243 or 5249?

3047 |

|

1 |

1 |

|

|

Yes – Answer items b and c |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

2 |

|

|

No – Skip to item 21 |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTE: Complete items b and c ONLY if item a is answered "Yes."

b.Premiums earned – Report premiums, gross of commissions, included in revenue during the reporting year. Calculate as direct premiums written (including renewals) net of cancellations, plus reinsurance premiums assumed, minus reinsurance premiums ceded, plus unearned premiums at the beginning of the year, minus unearned premiums at the end of the year.

Exclude all annuity premiums. Also exclude premiums and policy fees related to universal and |

|

adjustable life, variable and |

3048 |

c.Losses incurred — Report losses incurred for the insurance products covered by b. above. Exclude loss adjustment expenses and losses that relate to annuities. Also exclude losses related to universal and adjustable life, variable and

For property and casualty insurance, calculate as net losses paid during the reporting year, minus net unpaid losses at the beginning of the year, plus net unpaid losses at the end of the year. In the calculation of net losses, include losses on reinsurance assumed from other companies and exclude losses on reinsurance ceded to other companies. Unpaid losses include both case reserves and losses incurred but not reported.

For life insurance, losses reflect policy claims on reinsurance assumed or on primary insurance sold, minus losses recovered from reinsurance ceded, adjusted for changes in claims due, unpaid, and in the course of settlement.

3049

Amount

Bil. Mil. Thous. Dols.

1

$

1

$

Section B — Distribution of Sales or Gross Operating Revenues |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

|

|

|

|

|

|

Column (1) equals the |

Sales to U.S. persons |

|

Sales to foreign persons |

|||

|

|

sum of columns (2) |

|

|||||

|

|

|

|

|

|

|

||

|

|

|

and (3) |

|

|

|

|

|

|

|

|

(1) |

|

(2) |

|

|

(3) |

21. Sales or gross |

|

Bil. Mil. |

Thous. Dols. |

Bil. Mil. |

Thous. |

Dols. Bil. |

Mil. |

Thous. Dols. |

operating revenues, |

|

|

|

|

|

|

|

|

|

1 |

|

2 |

|

4 |

|

|

|

excluding sales taxes |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

Column (1) must equal |

|

|

|

|

|

|

|

|

item 15, column (2). |

3147 |

$ |

|

$ |

|

$ |

|

|

Section C — Number of Employees and Employee Compensation

NUMBER OF EMPLOYEES — Employees on the payroll at the end of FY 2004, including

EMPLOYEE COMPENSATION — Expenditures made by an employer in connection with the employment of workers including cash payments, payments

|

|

|

|

|

|

|

|

Number of employees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

22. TOTAL NUMBER OF EMPLOYEES — Report the total number of employees for the year. |

3253 |

|

|

|

|||||

23. TOTAL EMPLOYEE COMPENSATION — Report, for all employees, the sum of |

|

|

Amount |

||||||

|

|

|

|

||||||

|

Bil. |

Mil. |

Thous. Dols. |

||||||

a. Wages and salaries — Employees’ gross earnings (before payroll deductions), and direct and |

|

||||||||

|

|

|

|

||||||

|

1 |

|

|

||||||

|

|

|

|

|

|||||

b. Employee benefit plan — Employer expenditures for all employee benefit plans |

|

$ |

|

|

|||||

3257 |

|

|

|||||||

Section D — Interest |

|

|

|

|

|

Amount |

|||

|

|

|

|

|

|

|

|||

|

|

|

|

Bil. |

Mil. |

Thous. Dols. |

|||

24. Interest income — Interest received or due to the U.S. Reporter from all payors (including affiliated |

|

||||||||

|

|

|

|

||||||

|

1 |

|

|

||||||

persons), net of tax withheld at the source. Include all interest receipts included in item 17. Do not |

|

|

|

||||||

|

|

|

|

||||||

net against interest expensed, item 25. |

|

|

|

3587 |

$ |

|

|

||

25. Interest expensed or capitalized — Interest expensed or capitalized by the U.S. Reporter, |

|

1 |

|

|

|||||

paid or due to all payees (including affiliated persons), gross of tax withheld. Do not net |

|

|

|

|

|||||

against interest income, item 24. |

|

|

|

3588 |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

26. BEA |

1 |

2 |

|

3 |

|

4 |

|

|

|

USE |

|

|

|

|

|

|

|

|

|

ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1029 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM |

|

Page 3 |

|

|

|

|

|||

306

Remarks

Reporter ID Number

D

FORM |

Page 4 |

FORM |

U.S. DEPARTMENT OF COMMERCE |

BEA USE ONLY |

Reporter ID Number |

|

D |

(REV. 12/2004) |

BUREAU OF ECONOMIC ANALYSIS |

|

|||

|

|

|

|

||

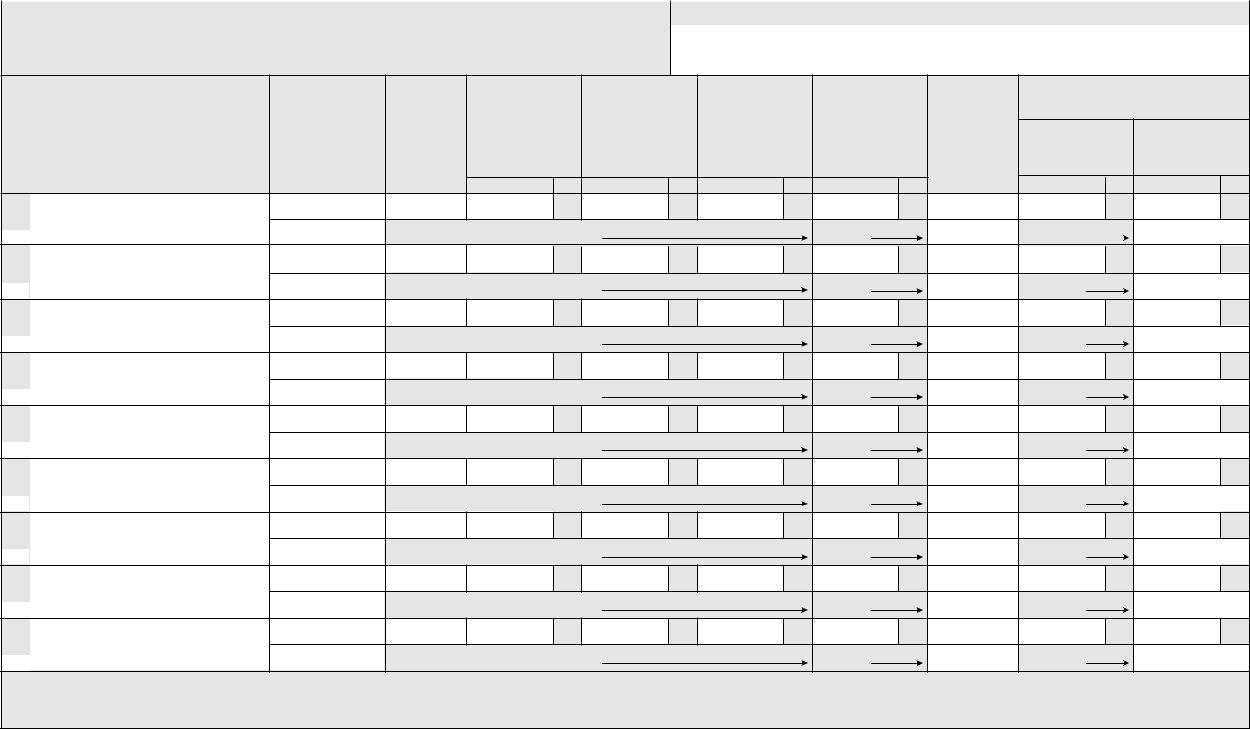

LISTING OF FOREIGN AFFILIATES |

|

|

|

|

|

|

Name of U.S. Reporter |

|

|

|

|

With Assets, Sales or Gross Operating Revenues, AND Net Income (loss) |

|

|

|

|

|

of $10 Million or Less |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt and intercompany balances |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

between U.S. Reporter and foreign |

|

|

||||

|

|

|

|

|

|

|

|

|

|

Sales or gross |

|

|

|

|

|

|

affiliate 3 |

|

|

|

|||

|

|

Country of |

Primary |

Total assets |

|

Total liabilities |

Net income (loss) |

Number of |

|

|

|

|

|

|

|

||||||||

|

Name of foreign affiliate |

|

operating revenues |

|

|

|

|

|

|

|

|||||||||||||

|

location |

industry code1 |

|

|

|

|

|

|

after foreign |

|

employees |

Owed to U.S. |

Owed to foreign |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

income tax |

|

|

|

Reporter by |

|

affiliate by U.S. |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

foreign affiliate |

Reporter |

|

|

|||

|

|

|

|

|

(4) |

|

|

(5) |

|

|

(6) |

|

|

(7) |

|

|

|

(9) |

|

|

(10) |

|

|

|

(1) |

(2) |

(3) |

Mil. |

Thous. |

Dols. |

Mil. |

Thous. |

Dols. |

Mil. |

Thous. |

Dols. |

Mil. |

Thous. |

Dols. |

(8) |

Mil. |

Thous. |

Dols. |

Mil. |

Thous. |

Dols. |

|

|

1 |

|

3 |

4 |

|

|

5 |

|

|

6 |

|

|

7 |

|

|

8 |

9 |

|

|

10 |

|

|

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

|

$ |

|

|

$ |

|

|

|

|

2 |

BEA USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

|

12 |

. |

|

|

|

5002 |

|

U.S. Reporter’s percentage of ownership2 |

|

|

|

|

|

Direct (11) |

|

. |

% Indirect (12) |

|

|

% |

|

|||||||

|

1 |

|

3 |

4 |

|

|

5 |

|

|

6 |

|

|

7 |

|

|

8 |

9 |

|

|

10 |

|

|

|

|

2 |

BEA USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

|

12 |

. |

|

|

|

5003 |

|

U.S. Reporter’s percentage of ownership2 |

|

|

|

|

|

Direct (11) |

|

. |

% Indirect (12) |

|

|

% |

|

|||||||

|

1 |

|

3 |

4 |

|

|

5 |

|

|

6 |

|

|

7 |

|

|

8 |

9 |

|

|

10 |

|

|

|

|

2 |

BEA USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

|

12 |

. |

|

|

Page 5 |

5004 |

|

U.S. Reporter’s percentage of ownership2 |

|

|

|

|

|

Direct (11) |

|

. |

% Indirect (12) |

|

|

% |

|

|||||||

1 |

|

3 |

4 |

|

|

5 |

|

|

6 |

|

|

7 |

|

|

8 |

9 |

|

|

10 |

|

|

|

|

2 |

BEA USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

||||

|

5005 |

|

U.S. Reporter’s percentage of ownership2 |

|

|

|

|

|

Direct (11) |

|

. |

% Indirect (12) |

|

|

% |

|

|||||||

|

1 |

|

3 |

4 |

|

|

5 |

|

|

6 |

|

|

7 |

|

|

8 |

9 |

|

|

10 |

|

|

|

|

2 |

BEA USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

|

12 |

. |

|

|

|

5006 |

|

U.S. Reporter’s percentage of ownership2 |

|

|

|

|

|

Direct (11) |

|

. |

% Indirect (12) |

|

|

% |

|

|||||||

|

1 |

|

3 |

4 |

|

|

5 |

|

|

6 |

|

|

7 |

|

|

8 |

9 |

|

|

10 |

|

|

|

|

2 |

BEA USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

|

12 |

. |

|

|

|

5007 |

|

U.S. Reporter’s percentage of ownership2 |

|

|

|

|

|

Direct (11) |

|

. |

% Indirect (12) |

|

|

% |

|

|||||||

|

1 |

|

3 |

4 |

|

|

5 |

|

|

6 |

|

|

7 |

|

|

8 |

9 |

|

|

10 |

|

|

|

|

2 |

BEA USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

|

12 |

. |

|

|

|

5008 |

|

U.S. Reporter’s percentage of ownership2 |

|

|

|

|

|

Direct (11) |

|

. |

% Indirect (12) |

|

|

% |

|

|||||||

|

1 |

|

3 |

4 |

|

|

5 |

|

|

6 |

|

|

7 |

|

|

8 |

9 |

|

|

10 |

|

|

|

|

2 |

BEA USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

|

12 |

. |

|

|

CONTINUE ON |

5009 |

|

U.S. Reporter’s percentage of ownership2 |

|

|

|

|

|

Direct (11) |

|

. |

% Indirect (12) |

|

|

% |

|

|||||||

1 |

|

3 |

4 |

|

|

5 |

|

|

6 |

|

|

7 |

|

|

8 |

9 |

|

|

10 |

|

|

|

|

2 |

BEA USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

|

12 |

. |

|

307 |

|

5010 |

|

U.S. Reporter’s percentage of ownership2 |

|

|

|

|

|

Direct (11) |

|

. |

% Indirect (12) |

|

|

% |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

REVERSE |

1See Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

code: enter code which accounts for largest amount of sales or gross operating revenues, excluding sales taxes. |

|

|

|

|

|

|

|

|

|

|

Page No. |

of |

pages |

|

|||||||||

2 To calculate indirect ownership percentages — See INSTRUCTION BOOKLET, Part I.A.2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

3 For bank affiliate, report U.S. Reporter’s permanent debt investment in col. 9 and leave col. 10 blank. See |

|

|

|

|

|

|

|

of this Supplement A |

|

|

|||||||||||||

FORM |

U.S. DEPARTMENT OF COMMERCE |

BEA USE ONLY |

Reporter ID Number |

|

D |

(REV. 12/2004) |

BUREAU OF ECONOMIC ANALYSIS |

|

|

|

|

|

|

|

|

|

|

LISTING OF FOREIGN AFFILIATES |

|

Name of U.S. Reporter |

|

|

|

|

|

|

|

|

|

With Assets, Sales or Gross Operating Revenues, AND Net Income (loss) |

|

|

|

|

|

of $10 Million or Less |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt and intercompany balances |

308 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

between U.S. Reporter and foreign |

|

|||

|

|

|

|

|

|

|

|

|

Sales or gross |

|

|

|

|

|

affiliate3 |

|

|

||

|

|

Country of |

Primary |

Total assets |

Total liabilities |

Net income (loss) |

Number of |

|

|

|

|

|

|||||||

|

Name of foreign affiliate |

operating revenues |

|

|

|

|

|

||||||||||||

|

location |

industry code1 |

|

|

|

|

|

after foreign |

|

employees |

Owed to U.S. |

Owed to foreign |

|||||||

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

income tax |

|

|

|

Reporter by |

affiliate by U.S. |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

foreign affiliate |

|

Reporter |

|

|

|

|

|

|

|

(4) |

|

(5) |

|

|

(6) |

|

(7) |

|

|

|

(9) |

|

(10) |

|

|

(1) |

(2) |

(3) |

Mil. |

Thous. Dols. |

Mil. |

Thous. |

Dols. |

Mil. |

Thous. Dols. |

Mil. |

Thous. |

Dols. |

(8) |

Mil. |

Thous. Dols. |

Mil. |

Thous. |

Dols. |

|

1 |

|

3 |

4 |

|

5 |

|

|

6 |

|

7 |

|

|

8 |

9 |

|

10 |

|

|

|

|

|

|

$ |

|

$ |

|

|

$ |

|

$ |

|

|

|

$ |

|

$ |

|

|

|

2 |

BEA USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

12 |

. |

|

|

5011 |

|

U.S. Reporter’s percentage of ownership2 |

|

|

|

|

Direct (11) |

|

. |

% Indirect (12) |

|

% |

||||||

|

1 |

|

3 |

4 |

|

5 |

|

|

6 |

|

7 |

|

|

8 |

9 |

|

10 |

|

|

|

2 |

BEA USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

12 |

. |

|

|

5012 |

|

U.S. Reporter’s percentage of ownership2 |

|

|

|

|

Direct (11) |

|

. |

% Indirect (12) |

|

% |

||||||

|

1 |

|

3 |

4 |

|

5 |

|

|

6 |

|

7 |

|

|

8 |

9 |

|

10 |

|

|

|

2 |

BEA USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

12 |

. |

|

Page6 |

5013 |

|

U.S. Reporter’s percentage of ownership2 |

|

|

|

|

Direct (11) |

|

. |

% Indirect (12) |

|

% |

||||||

1 |

|

3 |

4 |

|

5 |

|

|

6 |

|

7 |

|

|

8 |

9 |

|

10 |

|

|

|

|

2 |

BEA USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

12 |

. |

|

|

5014 |

|

U.S. Reporter’s percentage of ownership2 |

|

|

|

|

Direct (11) |

|

. |

% Indirect (12) |

|

% |

||||||

|

1 |

|

3 |

4 |

|

5 |

|

|

6 |

|

7 |

|

|

8 |

9 |

|

10 |

|

|

|

2 |

BEA USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

12 |

. |

|

|

5015 |

|

U.S. Reporter’s percentage of ownership2 |

|

|

|

|

Direct (11) |

|

. |

% Indirect (12) |

|

% |

||||||

|

1 |

|

3 |

4 |

|

5 |

|

|

6 |

|

7 |

|

|

8 |

9 |

|

10 |

|

|

|

2 |

BEA USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

12 |

. |

|

|

5016 |

|

U.S. Reporter’s percentage of ownership2 |

|

|

|

|

Direct (11) |

|

. |

% Indirect (12) |

|

% |

||||||

|

1 |

|

3 |

4 |

|

5 |

|

|

6 |

|

7 |

|

|

8 |

9 |

|

10 |

|

|

|

2 |

BEA USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

12 |

. |

|

|

5017 |

|

U.S. Reporter’s percentage of ownership2 |

|

|

|

|

Direct (11) |

|

. |

% Indirect (12) |

|

% |

||||||

|

1 |

|

3 |

4 |

|

5 |

|

|

6 |

|

7 |

|

|

8 |

9 |

|

10 |

|

|

|

2 |

BEA USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

12 |

. |

|

|

5018 |

|

U.S. Reporter’s percentage of ownership2 |

|

|

|

|

Direct (11) |

|

. |

% Indirect (12) |

|

% |

||||||

|

1 |

|

3 |

4 |

|

5 |

|

|

6 |

|

7 |

|

|

8 |

9 |

|

10 |

|

|

|

2 |

BEA USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

12 |

. |

|

|

5019 |

|

U.S. Reporter’s percentage of ownership2 |

|

|

|

|

Direct (11) |

|

. |

% Indirect (12) |

|

% |

||||||

1See Form

2 To calculate indirect ownership percentages — See INSTRUCTION BOOKLET, Part I.A.2. |

Page No. |

|

of |

|

pages |

3 For bank affiliate, report U.S. Reporter’s permanent debt investment in col. 9 and leave col. 10 blank. — See |

|

|

|||

of this Supplement A |

|

||||

Use additional sheets, if necessary, to account for all affiliates. |

|

||||

|

|

|

|

|

|

309

BENCHMARK SURVEY OF U.S. DIRECT INVESTMENT ABROAD — 2004

FORM

ADDITIONAL INSTRUCTIONS BY ITEM

Part I — IDENTIFICATION OF U.S. REPORTER

Sales or gross operating revenues of fully consolidated domestic U.S. Reporter by industry of sales or gross operating revenues.

If fewer than five ISI codes are used, account for total sales or gross operating revenues in items 9 through 13. Do not include realized gains or losses due to profit or loss on the sale or maturity of investments here. Instead, report them as part of item 17 (Total income).

Part II — SELECTED FINANCIAL AND OPERATING DATA

OF U.S. REPORTER

17.Total income — include:

a.Sales or gross operating revenues.

b.Income from equity investments in affiliates (domestic and foreign). For affiliates owned 20 percent or more (including

c.Certain realized and unrealized gains (losses). Report gross before income tax effect. Include:

1.Sales or disposition of investment securities, and FAS 115 impairment losses. Dealers in financial instruments (including securities, currencies, derivatives, and other financial instruments) and finance and insurance companies;

2.Sales or disposition of land, other property, plant and equipment, or other assets, and FAS 144 impairment losses. Exclude gains or losses from the sale of inventory assets in the ordinary course of trade or business;

3.Goodwill impairment as defined by FAS 142;

4.Restructuring. Include restructuring costs that reflect

5.Disposals of discontinued operations. Exclude income from the operations of a discontinued segment. Report such income as part of your income from operations in items 9 through 14;

6.

7.Extraordinary, unusual, or infrequently occurring items that are material. Include losses from accidental damage or disasters, after estimated insurance reimbursement. Include other material items, including

8.The cumulative effect of a change in accounting principle.

Do not include unrealized holding gains and losses due to changes in the value of

d. Other income

23.Total employee compensation

Wages and salaries — Report gross earnings of all employees before deduction of employees’ payroll withholding taxes, social insurance contributions, group insurance premiums, union dues, etc. Include time and piece rate payments, cost of living adjustments, overtime pay and shift differentials, bonuses, profit sharing amounts, and commissions. Exclude commissions paid to independent personnel who are not employees.

Include direct payments by employers for vacations, sick leave, severance (redundancy) pay, etc. Exclude payments made by, or on behalf of, benefit funds rather than by the employer.

Include

Employee benefit plans — Report employer expenditures for all employee benefit plans including those mandated by government statute, those resulting from collective bargaining contracts, and those that are voluntary. Include Social Security and other retirement plans, life and disability insurance, guaranteed sick pay programs, workers’ compensation insurance, medical insurance, family allowances, unemployment insurance, severance pay funds, etc. Also, include deferred postemployment and post retirement expenses per FAS 106. If plans are financed jointly by the employer and the employee, include only the contributions of the employer.

FORM |

Page 7 |