Our PDF editor that you will work with was developed by our best software engineers. It is easy to obtain the Form C 1Fr document promptly and conveniently with our application. Just keep up with the following instruction to start out.

Step 1: At first, select the orange "Get form now" button.

Step 2: At the moment, you can alter the Form C 1Fr. This multifunctional toolbar allows you to insert, delete, transform, highlight, as well as do several other commands to the words and phrases and areas within the document.

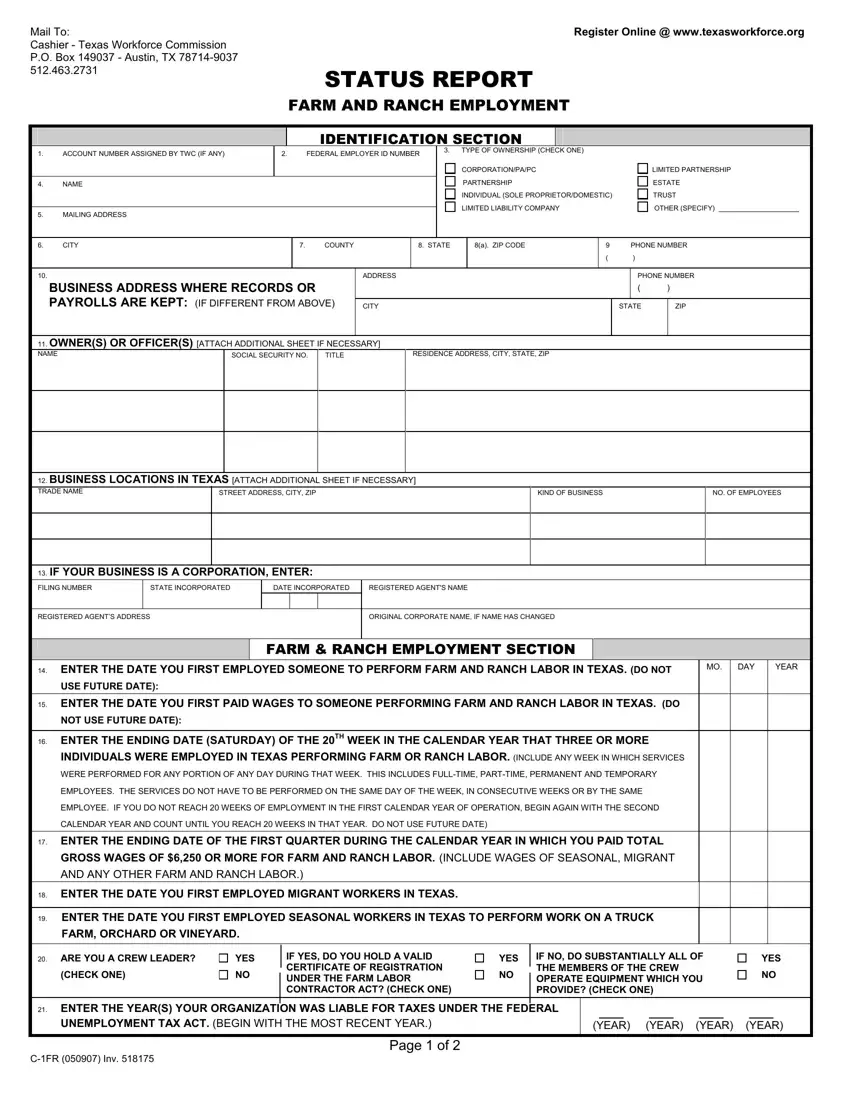

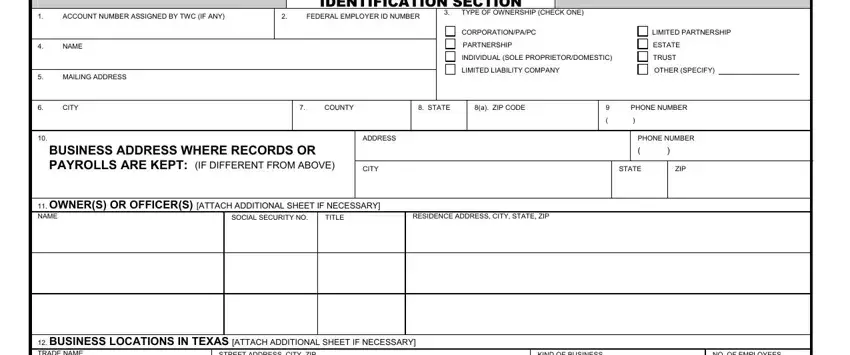

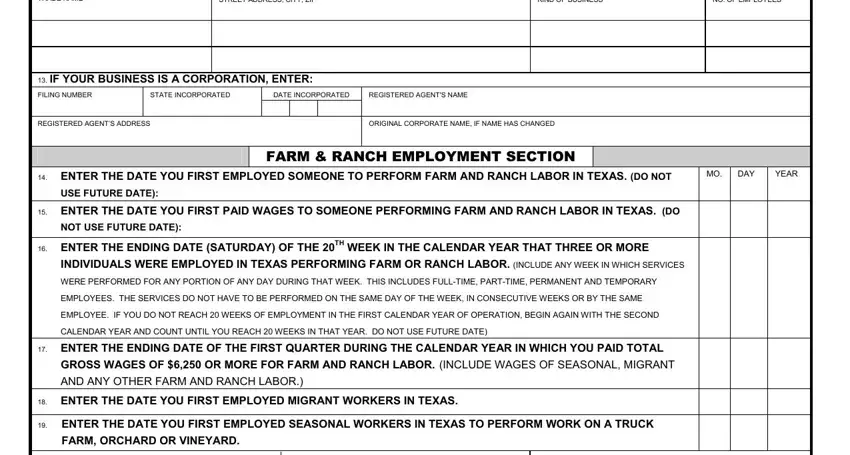

You should enter the following details to prepare the Form C 1Fr PDF:

Fill out the BUSINESS LOCATIONS IN TEXAS, STREET ADDRESS CITY ZIP, KIND OF BUSINESS, NO OF EMPLOYEES, IF YOUR BUSINESS IS A CORPORATION, FILING NUMB, STATE INCO, RPORATED, DATE INCORPORATED, REGISTERED AGENTS NAME, REGISTERED, AGENTS ADDRESS, ORIGINAL CO, RPORATE NAME IF NAME HAS CHANGED, and ENTER THE DATE YOU FIRST EMPLOYED fields with any particulars that may be asked by the program.

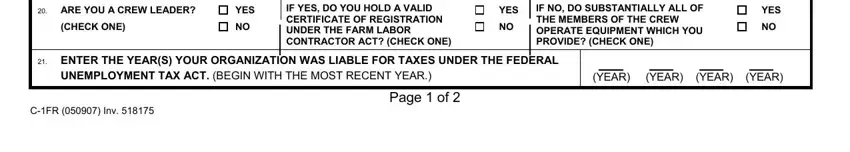

Write down the significant data in ARE YOU A CREW LEADER, CHECK ONE, YES, IF YES DO YOU HOLD A VALID, YES, IF NO DO SUBSTANTIALLY ALL OF THE, YES, ENTER THE YEARS YOUR ORGANIZATION, UNEMPLOYMENT TAX ACT BEGIN WITH, YEAR YEAR YEAR YEAR, CFR Inv, and Page of box.

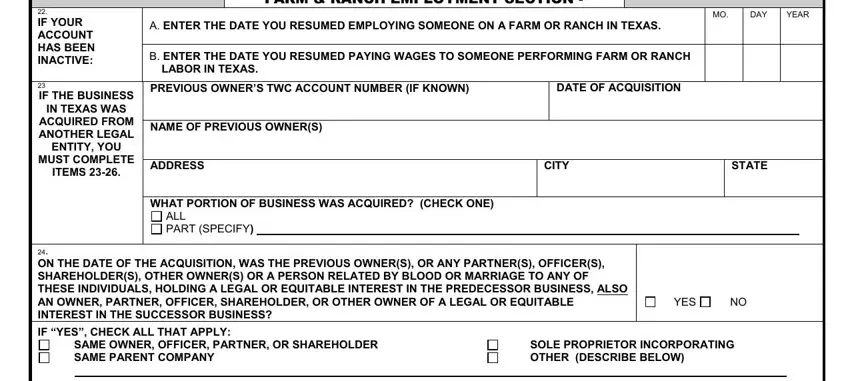

The IF YOUR ACCOUNT HAS BEEN INACTIVE, IF THE BUSINESS IN TEXAS WAS, FARM RANCH EMPLOYMENT SECTION, A ENTER THE DATE YOU RESUMED, DAY, YEAR, B ENTER THE DATE YOU RESUMED, PREVIOUS OWNERS TWC ACCOUNT NUMBER, DATE OF ACQUISITION, NAME OF PREVIOUS OWNERS, ADDRESS, CITY, STATE, WHAT PORTION OF BUSINESS WAS, and ALL PART SPECIFY area is the place where both parties can place their rights and obligations.

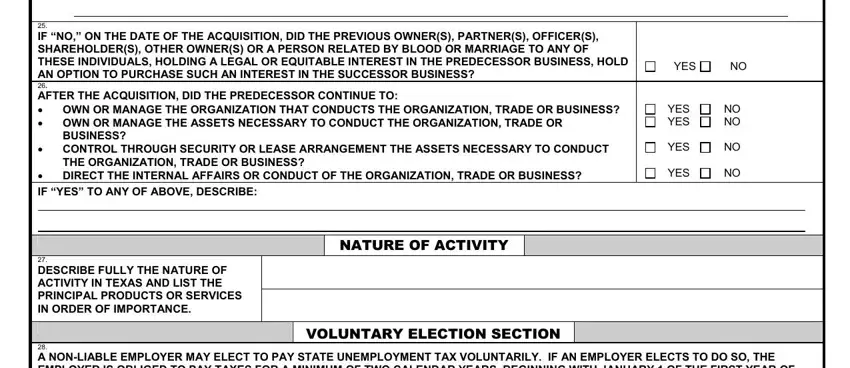

Fill out the file by reading these areas: IF NO ON THE DATE OF THE, BUSINESS CONTROL THROUGH SECURITY, IF YES TO ANY OF ABOVE DESCRIBE, YES, YES YES, NO NO, YES, YES, DESCRIBE FULLY THE NATURE OF, NATURE OF ACTIVITY, A NONLIABLE EMPLOYER MAY ELECT TO, and VOLUNTARY ELECTION SECTION.

Step 3: Select "Done". It's now possible to upload the PDF form.

Step 4: Have a duplicate of every document. It's going to save you time and enable you to stay away from misunderstandings in the long run. Also, your data isn't distributed or monitored by us.