CBT-100S

STATE OF NEW JERSEY

DIVISION OF TAXATION |

CORPORATION TAX |

INSTRUCTIONS FOR S CORPORATION BUSINESS TAX RETURN

(Form CBT-100S - 1999)

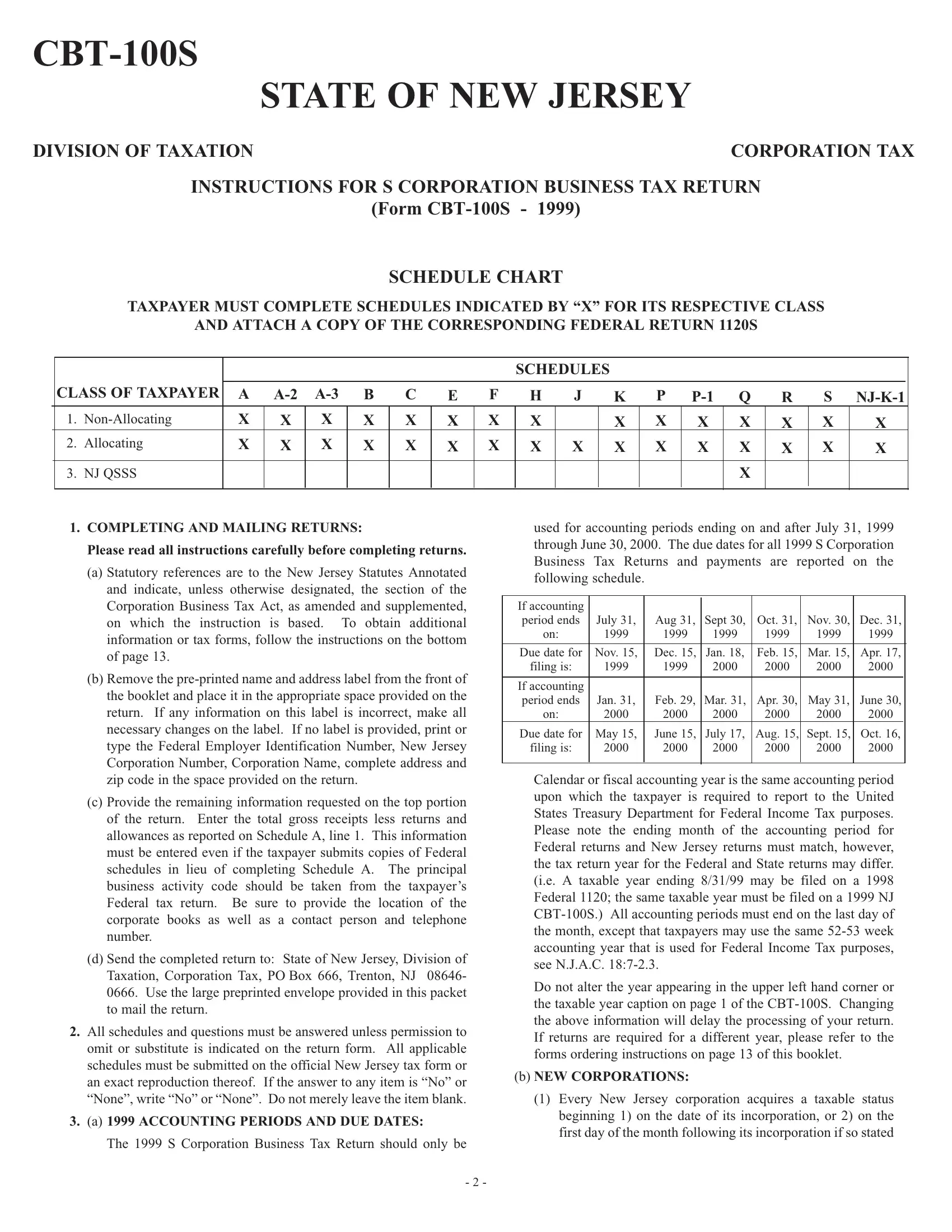

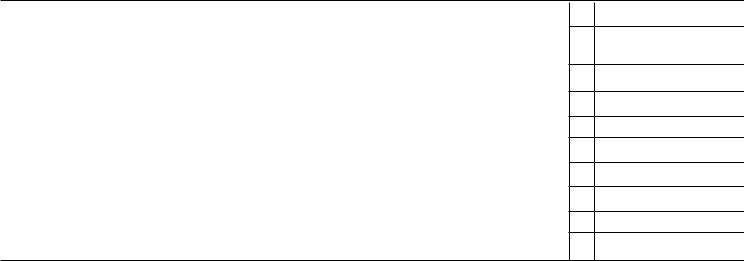

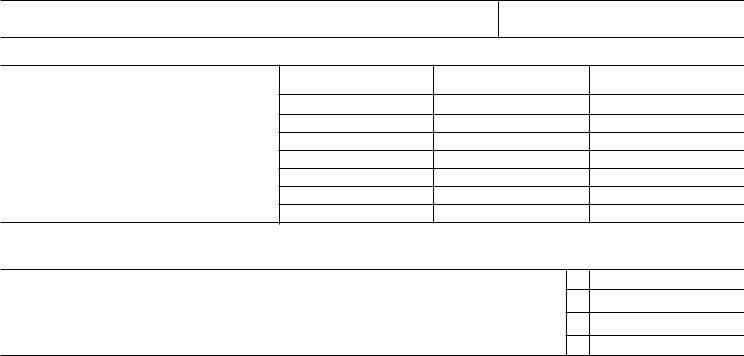

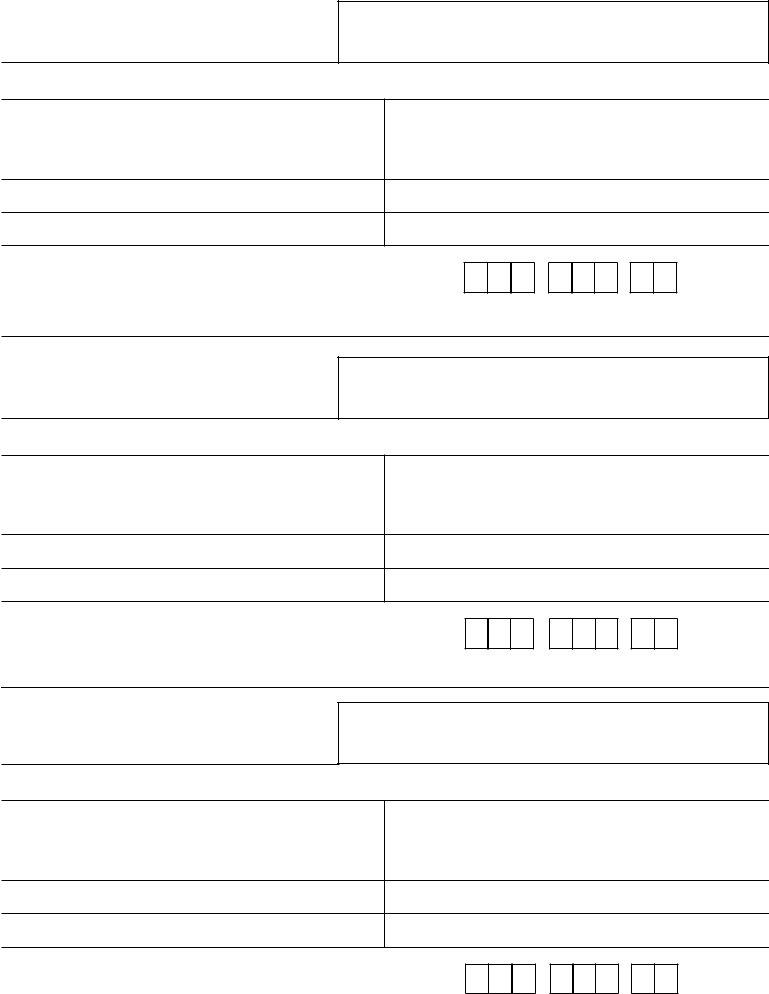

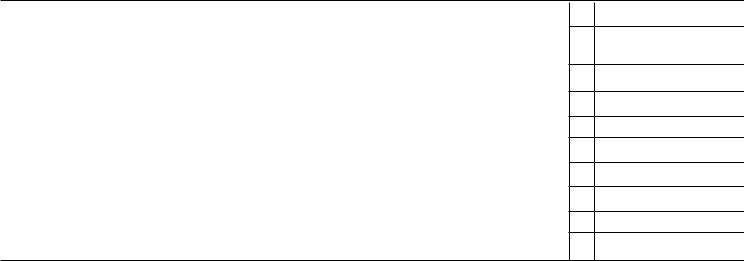

SCHEDULE CHART

TAXPAYER MUST COMPLETE SCHEDULES INDICATED BY “X” FOR ITS RESPECTIVE CLASS

AND ATTACH A COPY OF THE CORRESPONDING FEDERAL RETURN 1120S

|

|

|

|

|

|

|

|

|

|

SCHEDULES |

|

|

|

|

|

|

|

|

|

CLASS OF TAXPAYER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

A-2 A-3 |

B |

C |

E |

F |

H |

J |

K |

P |

P-1 |

Q |

R |

S |

NJ-K-1 |

|

1. |

Non-Allocating |

X |

X |

X |

X |

X |

X |

X |

X |

|

|

X |

X |

X |

X |

X |

X |

X |

|

2. |

Allocating |

X |

X |

X |

X |

X |

X |

X |

X |

X |

|

X |

X |

X |

X |

X |

X |

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

NJ QSSS |

|

|

|

|

|

|

|

|

|

|

|

|

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

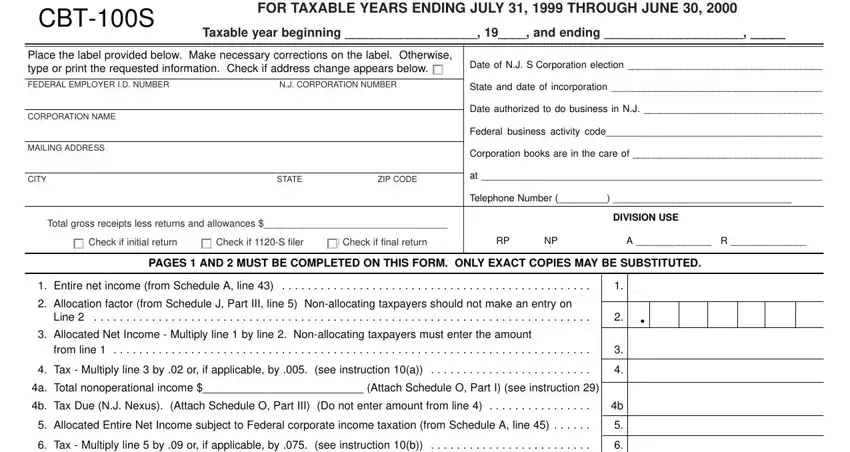

1.COMPLETING AND MAILING RETURNS:

Please read all instructions carefully before completing returns.

(a)Statutory references are to the New Jersey Statutes Annotated and indicate, unless otherwise designated, the section of the Corporation Business Tax Act, as amended and supplemented, on which the instruction is based. To obtain additional information or tax forms, follow the instructions on the bottom of page 13.

(b)Remove the pre-printed name and address label from the front of the booklet and place it in the appropriate space provided on the return. If any information on this label is incorrect, make all necessary changes on the label. If no label is provided, print or type the Federal Employer Identification Number, New Jersey Corporation Number, Corporation Name, complete address and zip code in the space provided on the return.

(c)Provide the remaining information requested on the top portion of the return. Enter the total gross receipts less returns and allowances as reported on Schedule A, line 1. This information must be entered even if the taxpayer submits copies of Federal schedules in lieu of completing Schedule A. The principal business activity code should be taken from the taxpayer’s Federal tax return. Be sure to provide the location of the corporate books as well as a contact person and telephone number.

(d)Send the completed return to: State of New Jersey, Division of Taxation, Corporation Tax, PO Box 666, Trenton, NJ 08646- 0666. Use the large preprinted envelope provided in this packet to mail the return.

2.All schedules and questions must be answered unless permission to omit or substitute is indicated on the return form. All applicable schedules must be submitted on the official New Jersey tax form or an exact reproduction thereof. If the answer to any item is “No” or “None”, write “No” or “None”. Do not merely leave the item blank.

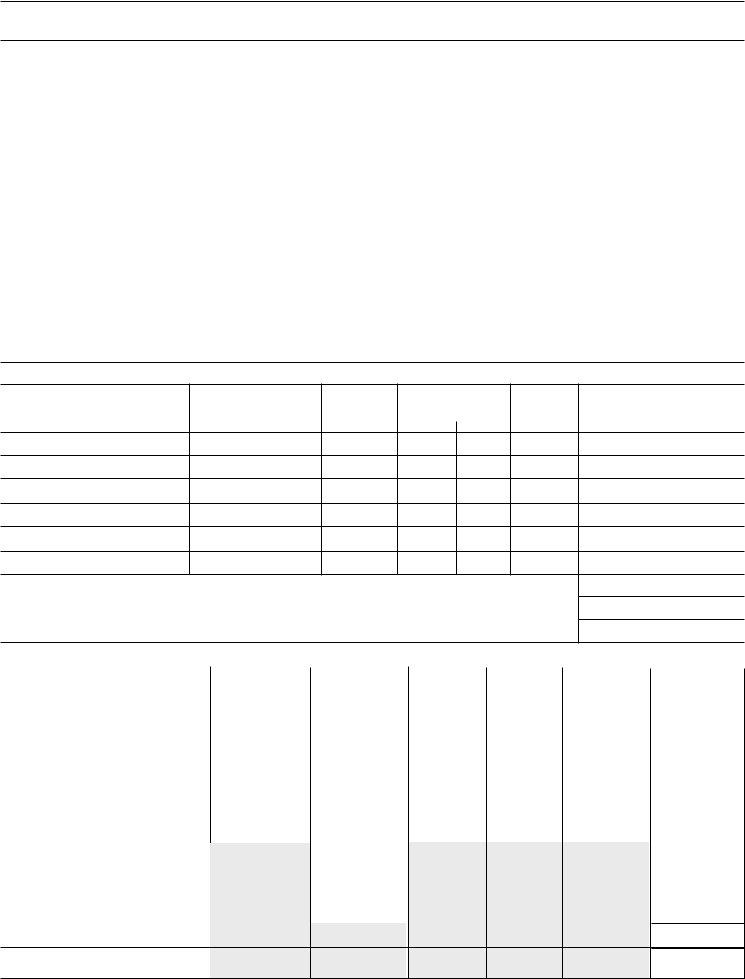

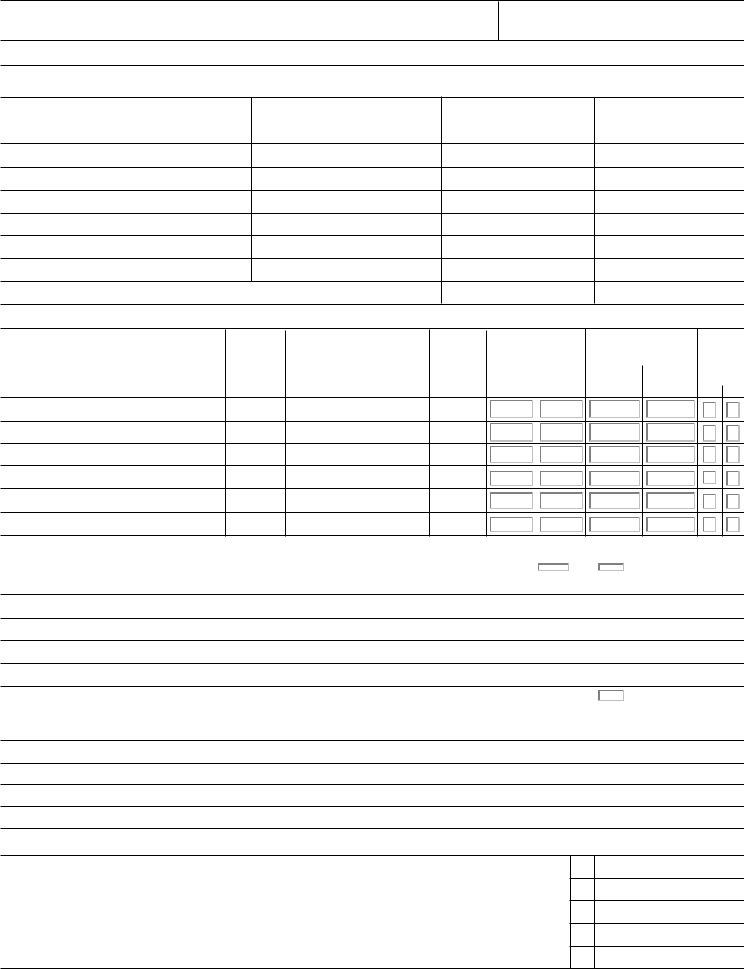

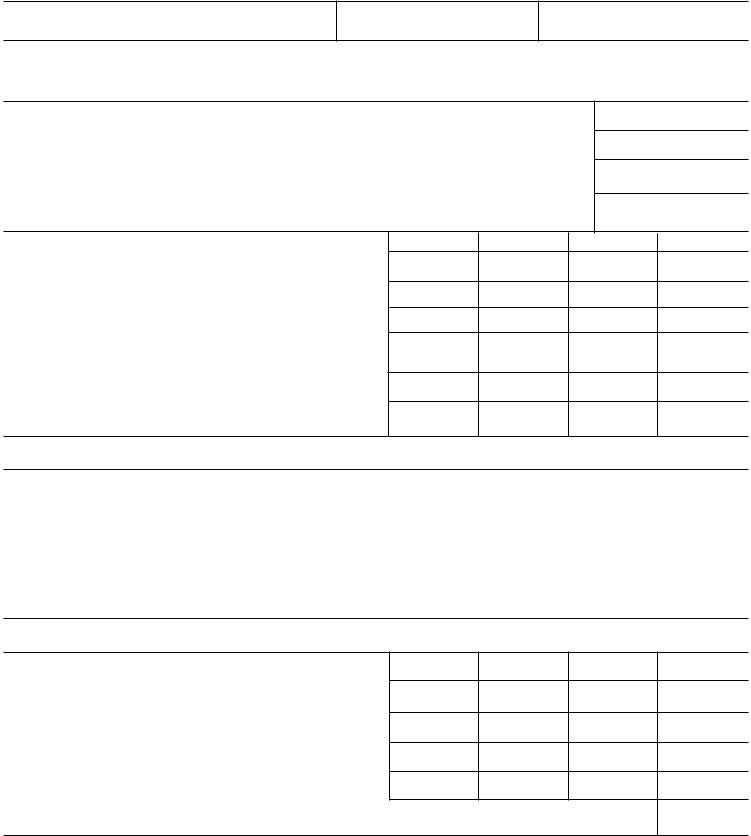

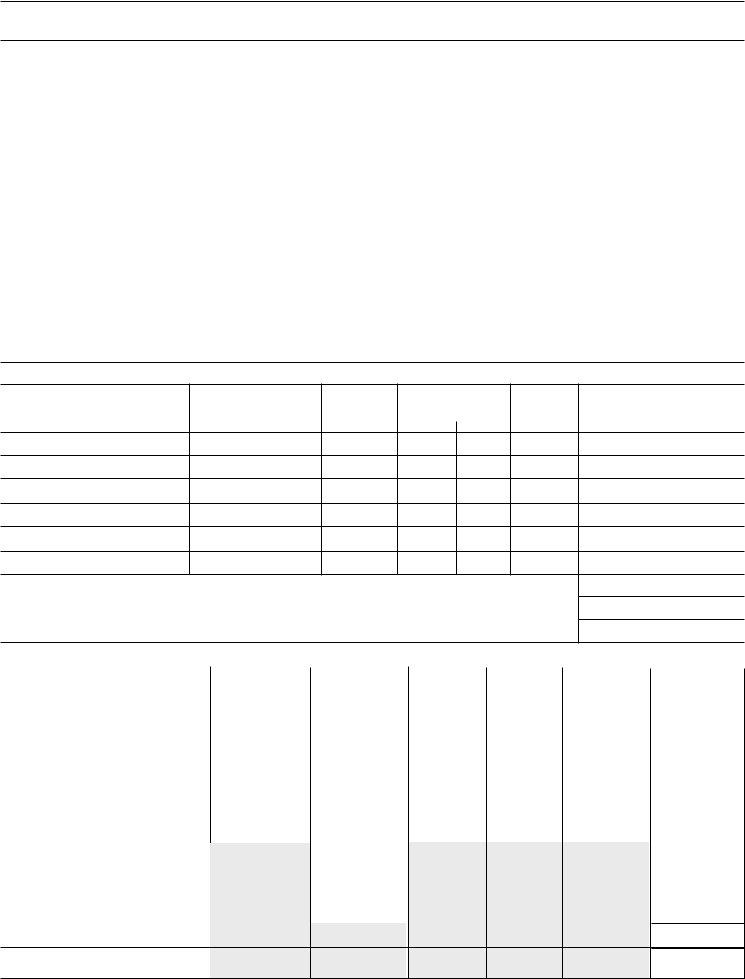

3.(a) 1999 ACCOUNTING PERIODS AND DUE DATES:

The 1999 S Corporation Business Tax Return should only be

used for accounting periods ending on and after July 31, 1999 through June 30, 2000. The due dates for all 1999 S Corporation Business Tax Returns and payments are reported on the following schedule.

If accounting |

|

|

|

|

|

|

|

|

|

|

|

|

period ends |

July 31, |

Aug 31, |

Sept 30, |

Oct. 31, |

Nov. 30, |

Dec. 31, |

on: |

1999 |

1999 |

1999 |

1999 |

1999 |

1999 |

|

|

|

|

|

|

|

Due date for |

Nov. 15, |

Dec. 15, |

Jan. 18, |

Feb. 15, |

Mar. 15, |

Apr. 17, |

filing is: |

1999 |

1999 |

2000 |

2000 |

2000 |

2000 |

|

|

|

|

|

|

|

If accounting |

|

|

|

|

|

|

period ends |

Jan. 31, |

Feb. 29, |

Mar. 31, |

Apr. 30, |

May 31, |

June 30, |

on: |

2000 |

2000 |

2000 |

2000 |

2000 |

2000 |

Due date for |

May 15, |

June 15, |

July 17, |

Aug. 15, |

Sept. 15, |

Oct. 16, |

filing is: |

2000 |

2000 |

2000 |

2000 |

2000 |

2000 |

|

|

|

|

|

|

|

Calendar or fiscal accounting year is the same accounting period upon which the taxpayer is required to report to the United States Treasury Department for Federal Income Tax purposes. Please note the ending month of the accounting period for Federal returns and New Jersey returns must match, however, the tax return year for the Federal and State returns may differ. (i.e. A taxable year ending 8/31/99 may be filed on a 1998 Federal 1120; the same taxable year must be filed on a 1999 NJ CBT-100S.) All accounting periods must end on the last day of the month, except that taxpayers may use the same 52-53 week accounting year that is used for Federal Income Tax purposes, see N.J.A.C. 18:7-2.3.

Do not alter the year appearing in the upper left hand corner or the taxable year caption on page 1 of the CBT-100S. Changing the above information will delay the processing of your return. If returns are required for a different year, please refer to the forms ordering instructions on page 13 of this booklet.

(b)NEW CORPORATIONS:

(1)Every New Jersey corporation acquires a taxable status beginning 1) on the date of its incorporation, or 2) on the first day of the month following its incorporation if so stated

in its certificate of incorporation. Every corporation which incorporates, qualifies or otherwise acquires a taxable status in New Jersey must file a Corporation Business Tax Return. A tax return must be filed for each fiscal period, or part thereof, beginning on the date the corporation acquired a taxable status in New Jersey regardless of whether it had any assets or conducted any business activities. No return may cover a period exceeding twelve (12) months, even by a day.

(2)Every corporation which incorporates, qualifies or otherwise acquires a taxable status in New Jersey and which has adopted a fiscal year other than December 31, shall advise the Division of Taxation promptly of the date of such accounting period. If no such advice is received on or before April 17, 2000, the taxpayer will be deemed “delinquent” if no return is filed on or before April 17, 2000.

(3)Every corporation that elects to be a New Jersey S corporation must file a “New Jersey S Corporation or New Jersey QSSS Election” (Form CBT-2553) within one calendar month subsequent to the Federal S corporation filing requirement.

(c)TRANSACTING BUSINESS WITHOUT A CERTIFICATE OF AUTHORITY: In addition to any other liabilities imposed by law, a foreign corporation which transacts business in this State without a certificate of authority shall forfeit to the State a penalty of not less than $200.00, nor more than $1,000.00 for each calendar year, not more than 5 years prior thereto, in which it shall have transacted business in this State without a certificate of authority. N.J.S.A. 14A:13-11(3).

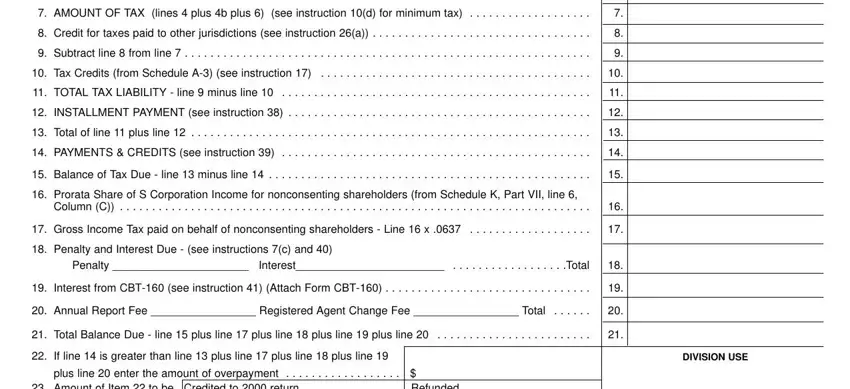

4.(a) PAYMENT OF TAX: Make remittance payable to “State of New Jersey - CBT” and forward with the preprinted payment voucher, CAR-100, provided in this packet. MAKE OUT A

SEPARATE REMITTANCE FOR EACH TAX RETURN (CBT-100S) OR ESTIMATED PAYMENT VOUCHER (CBT-150) SUBMITTED. Do not remit the tax for two or more returns in one check. Indicate the taxpayer’s Federal Employer Identification Number on each remittance.

(b)All corporations are required to make installment payments of estimated tax. Generally, these payments are remitted with the form CBT-150. Refer to Instruction 38 for further information.

5.ELECTRONIC FUNDS TRANSFERS: The Division of Revenue has established procedures to allow the remittance of tax payments through Electronic Funds Transfer (EFT). Taxpayers with a prior year’s liability of $20,000 or more in any one tax are required to remit all tax payments using EFT. If you have any questions concerning the EFT program, call (609) 984-9830 or write to N.J. Division of Revenue EFT Section, PO Box 191, Trenton, N.J. 08646-0191.

6.PERSONAL LIABILITY OF OFFICERS AND DIRECTORS: Any officer or director of any corporation who shall distribute or cause to be distributed any assets in dissolution or liquidation to the stockholders without having first paid all corporation franchise taxes, fees, penalties and interest imposed upon said corporation, in accordance with N.J.S.A. 14A:6-12, N.J.S.A. 54:50-18 and other applicable provisions of law, shall be personally liable for said unpaid taxes, fees, penalties and interest. Compliance with N.J.S.A. 54:50-13 is also required in the case of certain mergers, consolidations and dissolutions.

7.EXTENSION OF TIME TO FILE RETURN:

(a)The Division of Taxation will grant an automatic extension of

six (6) months for filing the final Corporation Business Tax Return. In general, the extended period may not exceed six

(6)months from the original due date of the return. No extensions will be granted unless requested on tentative return form CBT-200-T which must be postmarked on or before the due date for filing the return. The Tentative Return must show the full name, address, Federal Employer Identification Number, N.J. Corporation Number, the tax liability, and must be submitted with payment for the total amount due. A preprinted CBT-200-T voucher is included in this packet.

(b)If an extension has been requested, the corporation should notify all shareholders of such request.

(c)Installment Payment - Any taxpayer with a tax liability of less than $500 on line 1, may make a payment of 50 percent of line 1 in lieu of making the installment payments otherwise required. Taxpayers who report a tax liability of $500 or more on line 1 should not make an entry on line 2 and are required to make installment payments as indicated in Instruction 38.

(d)PENALTIES AND INTEREST

(1)Interest - The annual interest rate is 3% above the average predominant prime rate. Interest is imposed each month or fraction thereof on the unpaid balance of tax from the original due date to the date of payment. At the end of each calendar year, any tax, penalties and interest remaining due will become part of the balance on which interest will be charged. The interest rates assessed by the Division of Taxation are published in the quarterly issues of the New Jersey State Tax News. To obtain a copy, refer to the instructions at the bottom of page 13.

NOTE: The average predominant prime rate is the rate as determined by the Board of Governors of the Federal Reserve System, quoted by commercial banks to large businesses on December 1st of the calendar year immediately preceding the calendar year in which payment was due or as redetermined by the Director in accordance with N.J.S.A. 54:48-2.

(2)Insufficiency Penalty - If the amount paid with the Tentative Return, Form CBT-200-T, is less than 90% of the tax liability computed on Form CBT-100S, or in the case of a taxpayer whose preceding return covered a full 12 month period, is less than the amount of the tax computed at the rates applicable to the current accounting year but on the basis of the facts shown and the law applicable to the preceding accounting year, the taxpayer may be liable for a penalty of 5% per month or fraction thereof not to exceed 25% of the amount of underpayment from the original due date to the date of actual payment.

8.ACCOUNTING METHOD: The return must be completed using the same method of accounting, cash, accrual or other, that was employed in the taxpayer’s Federal Income Tax Return.

9.RIDERS: Where space is insufficient, attach riders in the same form as the original printed sheets. Only write on one side of the sheet.

10.TAX RATES:

(a)The tax rate on entire net income that is not subject to federal income taxation or such portion thereof as may be allocable to New Jersey is 2.0% (.02). For taxpayers with total entire net income (Schedule A, line 41) of $100,000 or less, the applicable tax rate for entire net income that is not subject to Federal corporate taxation is 0.5% (.005). Tax periods of less than 12 months qualify for this reduced rate if the prorated entire net income does not exceed $8,333 per month.

(b)The tax rate is 9.00% (.09) of entire net income that is subject to federal income taxation or such portion thereof as may be allocable to New Jersey. For taxpayers with total entire net income (Schedule A, line 41) of $100,000 or less, the applicable tax rate for entire net income that is subject to federal corporate taxation is 7.50% (.075). Tax periods of less than 12 months qualify for this reduced rate if the prorated entire net income does not exceed $8,333 per month.

(c)The tax rate on the net pro rata share of the S corporation income allocated to New Jersey for the nonconsenting shareholders is 6.37% (.0637).

(d)MINIMUM TAX: The minimum tax requirement for all periods is $200 for both domestic and foreign corporations. The minimum tax cannot be prorated. Zero (0) returns are not permitted.

11.CORPORATIONS REQUIRED TO FILE THIS RETURN:

(a)Every corporation that has elected and qualifies pursuant to Section 1361 of the Internal Revenue Code and has qualified and been accepted as a New Jersey S Corporation is required to file a CBT-100S.

(b)Foreign corporations that meet the filing requirements and whose income is immune from tax pursuant to Public Law 86- 272, 15 U.S.C. § 381 et seq., must obtain and complete Schedule N, Nexus - Immune Activity Declaration, and remit the minimum tax with the CBT-100S. Refer to instruction 28.

(c)Any corporation who for Federal purposes is treated as a Qualified Subchapter S Subsidiary is eligible to be a New Jersey Qualified Subchapter S Subsidiary. Every corporation that has qualified and been accepted as a New Jersey Qualified Subchapter S Subsidiary is required to file a New Jersey Corporation Business Tax Return remitting only the minimum tax liability of $200.

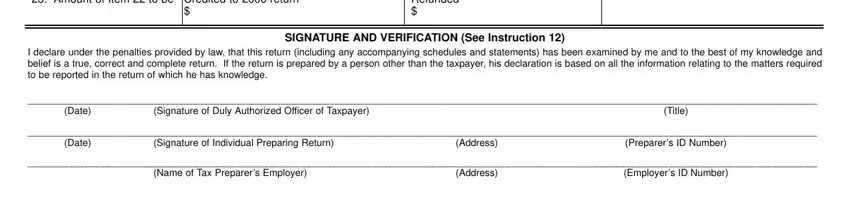

12.SIGNATURE: Each return must be signed by an officer of the corporation who is authorized to attest to the truth of the statements contained therein. The fact that an individual’s name is signed on the return shall be prima facie evidence that such individual is authorized to sign the return on behalf of the corporation. Tax preparers who fail to sign the return or provide their assigned tax identification number shall be liable for a $25.00 penalty for each such failure. If the tax preparer is not self-employed, the name of the tax preparer’s employer and the employer’s tax identification number should also be provided. In the case of a corporation in liquidation or in the hands of a receiver or trustee, certification shall be made by the person responsible for the conduct of the affairs of such corporation.

13.FINAL DETERMINATION OF NET INCOME BY FEDERAL GOVERNMENT: Any change or correction made by the Internal Revenue Service or other competent authority to taxable income must be reported to the Division within ninety (90) days. Also, amended NJ-K-1’s must be provided to the appropriate shareholders. To amend CBT-100S returns, use the CBT-100S form for the appropriate tax year and write “AMENDED RETURN” clearly on the front page of the form.

FEDERAL/STATE TAX AGREEMENT: The New Jersey Division of Taxation and the Internal Revenue Service participate in a Federal/State program for the mutual exchange of tax information to verify the accuracy and consistency of information reported on Federal and New Jersey tax returns

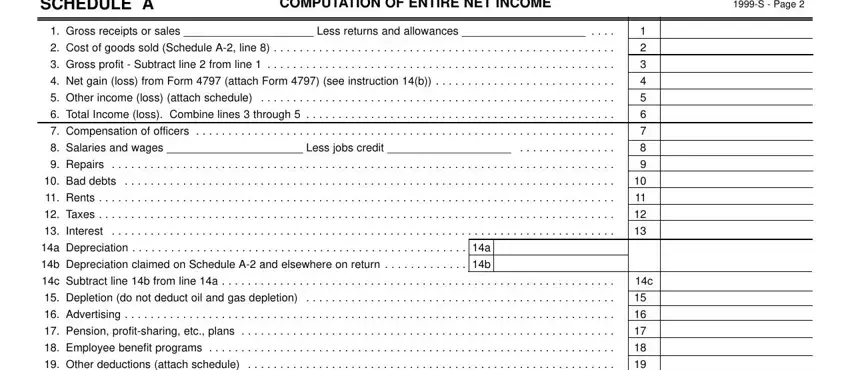

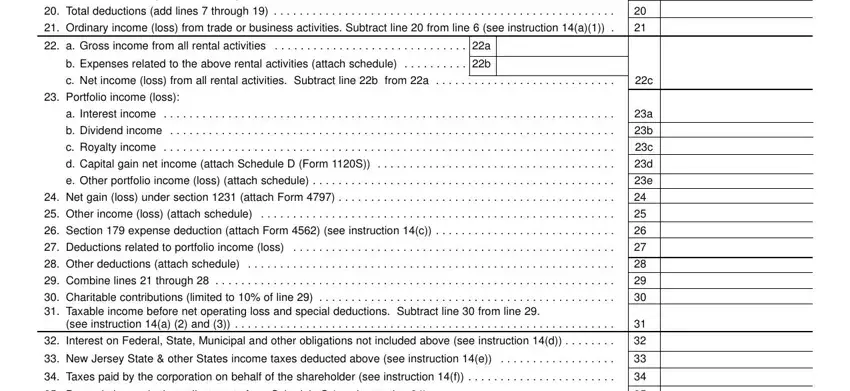

14.SCHEDULE A - COMPUTATION OF ENTIRE NET INCOME: Every taxpayer must complete this schedule on the form provided. In lieu of completing lines 1 to 21, taxpayers may

submit a copy of the corresponding Federal Income Tax return, Form 1120S.

(a)GENERAL:

(1)The figures shown on lines 1 to 21 must be the same as lines 1 to 21 on page 1 of the Federal Income Tax Return, Form 1120S.

(2)Line 31 - Must reflect entire net income in the same manner and to the same extent as if no Federal Income Tax S or New Jersey S election had been made.

(3)A copy of the Federal Form 1120S, including Schedule K, must be submitted with the CBT-100S.

(b)Line 4: Add a rider or schedules showing the same information shown on Federal Form 1120S, Form 4797.

(c)Lines 22(a) to 30: Include all items of income and expense which pass through to the individual shareholders as reported on the Federal Schedule K. Be sure to report lines 26, 27 and 28 as deductions.

Charitable contributions are limited to 10% of taxable income for New Jersey purposes and should be stated separately on line 30.

Built-in gains must be reported on line 23(d) as a gross amount exclusive of any net effects of taxes paid by the corporation.

(d)Line 32: Include any interest income that was not taxable for Federal Income Tax purposes, and was not included in total income reported on line 31, Schedule A.

(e)Line 33: Enter the total taxes paid or accrued to the United States, a possession or territory of the United States, a state, a political subdivision thereof, or the District of Columbia, on or measured by profits or income, business presence or business activity, or any sales and use tax paid by a utility vendor, taken as a deduction in Schedule A and reflected in line 31. Refer to Instruction 22.

(f)Line 34: Any tax paid by the corporation on behalf of any shareholder should not have been deducted as an expense on Schedule A. However, if the corporation expensed such taxes on Schedule A, these taxes must be included in line 34.

(g)Line 35: Enter the depreciation and other adjustments from Schedule S. (See Instruction 34).

(h)Line 36(a): DEDUCTION FOR FOREIGN TAXES PAID,

WITHHELD, OR DEEMED PAID: Taxes actually paid to or withheld by a foreign country and claimed as a credit on the

Federal Income Tax Return may be deducted only to the extent that the related income is included in entire net income on line

41.Any such taxes appearing as a deduction in arriving at line 31, entire net income before special deductions or net operating loss deduction, must be adjusted to the extent that they relate to dividends excluded from line 41.

The portion of any Section 78 gross-up included in dividend income on line 23(b), Schedule A, that is not excluded from entire net income on line 41, may be treated as a deduction for foreign taxes.

Lines 36(b) and (c): Use these lines to report amounts of (1) adjustments not otherwise specifically provided for and (2) gross income, less deductions and expenses in connection therewith, from sources outside the United States, not included in Federal taxable income and (3) the net effect of the elimination of non-operational and non-unitary partnership income and expenses from line 36, Schedule O, Part I. Attach separate riders explaining fully such items.

(i)Line 38: A net operating loss for a taxable year may be carried forward as a net operating loss deduction to a succeeding year. An S corporation may carry forward losses generated as a C corporation prior to its New Jersey S election. A net operating loss is the excess of allowable deductions over gross income used in computing entire net income. Neither a net operating loss deduction nor the dividend exclusion is an allowable deduction in computing a net operating loss. The statute authorizes a carryover of the deduction for seven years. Schedule A-1 must be completed if the net operating loss deduction is taken. See instruction 15.

(j)Line 40: Dividends from all sources must be included in Schedule A. However, an exclusion from entire net income for certain dividend income may be taken as indicated in Schedule R. Taxpayer may not include money market fund income as part of the dividend exclusion.

(k)Line 41: If line 41 is a negative amount, DO NOT SUBTRACT line 42 from line 41. The loss on line 41 should be carried to line 43. The income on line 42 should be multiplied by line 44 and carried to line 45.

(l)Line 42: Must reflect the income used as a basis in determining the Federal tax payable by the corporation as reported on the Federal Form 1120S, such as certain built-in gains, net passive income, etc. Built-in gains must be reported on line 23(d) as a gross amount exclusive of any net effects of taxes paid by the corporation.

(m)RIGHT OF DIRECTOR TO CORRECT DISTORTIONS OF NET INCOME: The Director is authorized to adjust and redetermine items of gross receipts and expenses as may be necessary to make a fair and reasonable determination of tax payable under the Corporation Business Tax Act. For details regarding the conditions under which this authority may be exercised, refer to regulation N.J.A.C. 18:7-5.10.

15.SCHEDULE A-1 - NET OPERATING LOSS DEDUCTION AND CARRYOVER: Complete this schedule only if a net operating loss has been carried forward from a previous tax year and claimed as a deduction on the current year’s return. An S corporation may carry forward losses generated as a C corporation prior to its New Jersey S election. Use lines 1 through 7, columns 1 through 4 to compute the net operating loss from a previous tax year or years. Determine the amount of the net operating loss by adding back to the loss reported on Schedule A, line 31 (CBT- 100S) or Schedule A, line 28 (CBT-100) all New Jersey adjustments except for the dividend exclusion for that tax year. The amount of a net operating loss allowed to be taken as a deduction in the current tax year is limited to the amount of income reported on line 37 of Schedule A for that tax year. Use lines 8 through 14 in columns 1 and 4 to report for each year a net operating loss deduction is taken, the amount of the previous year’s net operating loss used to offset entire net income before the dividend exclusion. The net amount reported on line 15 represents the unused net operating loss carryover available for future use. If space is insufficient due to the filing of more than one tax return for the same tax year, attach a rider to report the required information.

16.SCHEDULE A-2 - COST OF GOODS SOLD: The amounts reported on this schedule must be the same as the amounts reported on the taxpayer’s Federal income tax return.

17.SCHEDULE A-3 - SUMMARY OF TAX CREDITS: This schedule must be completed if one or more tax credits are claimed for the current tax period. The total on line 10 must equal the amount reported on page 1, line 10. Refer to Instruction 37 for tax credit information.

18.SCHEDULE B - BALANCE SHEET: Every taxpayer must complete this schedule. The amounts reported must be the same as the year end figures shown on the taxpayer’s books.

19.SCHEDULE C - RECONCILIATION OF INCOME PER BOOKS WITH INCOME PER RETURN: Every corporation must complete this schedule.

20.SCHEDULE E - GENERAL INFORMATION: All taxpayers must answer all questions on this schedule. In addition, riders must be submitted where necessary in answering the questions.

21.SCHEDULE F - CORPORATE OFFICERS GENERAL INFORMATION AND COMPENSATION: All applicable information should be provided for each corporate officer regardless of whether or not compensation was received.

22.SCHEDULE H - TAXES: Itemize all taxes which were in any way deducted in arriving at taxable net income, whether reflected at line 2 (Cost of goods sold and/or operations), line 12 (Taxes), line 19 and/or 28 (Other deductions) or anywhere on Schedule A. Also refer to instruction 14(e).

23.OPTIONAL COPIES OF SCHEDULES A: Any taxpayer who files a Federal Form 1120S with the Internal Revenue Service may submit copies of page 1 in lieu of completing lines 1 to 21 of Schedule A. Such copies or reproductions must be facsimiles of the complete schedules; they must be of good legibility and on paper of substantially the same weight and texture, and of a quality at least as good as that used in the official form, CBT-100S. They must also be of the same size as that of the official schedules, both as to the overall dimensions of the paper and the image reproduced thereon.

Separate pages must be fastened together in proper order and must be attached to the return form. The taxpayer’s full name and identifying number must be typed or printed on each reproduced page or copy.

24.SCHEDULE J PART I - GENERAL INSTRUCTIONS REGARDING ALLOCATION OF ADJUSTED ENTIRE NET INCOME:

(a)WHO IS PERMITTED TO ALLOCATE: No domestic or foreign corporation is permitted to allocate less than 100% of its adjusted entire net income to New Jersey, unless, during the period covered by the return, it actually maintained a regular place of business outside of New Jersey other than a statutory office.

(b)DEFINITION OF REGULAR PLACE OF BUSINESS: A “regular place of business” is any bona fide office (other than a statutory office), factory, warehouse, or other space of the taxpayer which is regularly MAINTAINED, OCCUPIED and USED by the taxpayer in carrying on its business and in which one or more regular employees are in attendance. To maintain a place of business, the taxpayer must either own or rent the premises. That cost must be borne directly by the the taxpayer and not by some related entity or person.

(c)ALLOCATION PERCENTAGES: In computing the allocation factor in Schedule J, division must be carried to six decimal places, e.g., .123456.

(d)ELECTION TO ALLOCATE: If the taxpayer is entitled to allocate, the election should be made with the filing of the Corporation Business Tax return regardless of the amount of income reported on line 41 of Schedule A. Schedule J must be completed to validate the election.

(e)Only the receipts, property and payroll expenses attributable to operational activity are to be used in computing the allocation factor denominators.

25.SCHEDULE J PART II - AVERAGE VALUES: Average value is generally computed on a quarterly basis where the taxpayer’s accounting practice permits such computation. At the option of the taxpayer or the State, a more frequent basis (monthly, weekly or daily) may be used. Where the taxpayer’s accounting practice does not permit computation of average value on a quarterly or more frequent basis, semi-annual or annual frequency may be used only where no distortion of average value results. If any basis other than quarterly is used, state the basis and reasons for use thereof on rider.

The average values of real and tangible personal property owned which are used in determining the property fraction of the allocation factor are based on book value. The numerator and denominator must take into account accumulated depreciation deferred for net income purposes where the taxpayer accounts for its property on its books on a Federal income tax basis. Rented or leased property is valued at eight times its annual rent, including any amounts (such as taxes) paid or accrued in addition to or in lieu of rent during the period covered by the return. All other property which is used by the taxpayer but is neither owned, rented or leased, should be valued at book value, however, if no such book value exists, the market value of the property should be used.

26.SCHEDULE J PART III - COMPUTATION OF ALLOCATION FACTOR: This schedule may be omitted if the taxpayer does not maintain a regular place of business outside this State other than a statutory office, in which case the tax law requires the allocation factor to be 100%.

(a)However, if the allocation factor is 100% but the taxpayer in fact pays tax to another state based on or measured by income which is included on Schedule A of this return, it may compute a reduction in its N.J. Corporation Business Tax under certain conditions. Refer to N.J.A.C. 18:7-8.3 for eligibility and the method of computing such reduction. A copy of this regulation can be obtained from the Taxpayer Forms Service which can be contacted by following the instructions on the bottom of page 13. The credit for taxes paid to other jurisdictions may be claimed on Page 1, line 8. New Jersey S corporations which claim this credit must advise each shareholder of this information so that they may properly complete their New Jersey Gross Income Tax return.

(b)LINE 1 - PROPERTY FRACTION: For general information regarding method of valuation in arriving at average values, see instruction 25. Tangible personal property is within New Jersey if and so long as it is physically situated or located here. Property of the taxpayer held in New Jersey by an agent, consignee or factor is (and property held outside New Jersey by an agent, consignee or factor is not) situated or located within New Jersey. Property, while in transit from a point outside New Jersey to a point in New Jersey or vice versa does not have a fixed situs either within or outside the State and, therefore, will not be deemed to be “situated” or “located” either within or outside New Jersey and accordingly the average value of such property should be omitted from both the numerator and the denominator of the property fraction. Ships, aircraft, satellites used in the communications industry, and other mobile or movable property are subject to the specific rules defined in N.J.A.C. 18:7-8.4.

(c)LINE 2(a) - RECEIPTS FRACTION: Receipts from sales of tangible personal property are allocated to New Jersey where the goods are shipped to points within New Jersey.

Receipts from the sale of goods are allocable to New Jersey if shipped to a New Jersey or a non-New Jersey customer where possession is transferred in New Jersey. Receipts from the sale

of goods shipped to a taxpayer from outside of New Jersey to a New Jersey customer by a common carrier are allocable to New Jersey. Receipts from the sale of goods shipped from outside of New Jersey to a New Jersey location where the goods are picked up by a common carrier and transported to a customer outside of New Jersey are not allocable to New Jersey.

Receipts from the following are allocable to New Jersey; services performed in New Jersey; rentals from property situated in New Jersey; royalties from the use in New Jersey of patents or copyrights; all other business receipts earned in New Jersey.

(d)LINES 2(e) and 2(g)

(1)RECEIPTS FROM SALES OF CAPITAL ASSETS: Receipts from sales of capital assets (property not held by the taxpayer for sale to customers in the regular course of business), either within or outside New Jersey, should be included in the numerator and the denominator based upon the net gain recognized and not upon gross selling prices. Where the taxpayer’s business is the buying and selling of real estate or the buying and selling of such securities for trading purposes, gross receipts from the sale of such assets should be included in the numerator and the denominator of the receipts fraction.

(2)DIVIDEND INCOME: The amount of dividends excluded from entire net income at line 40, Schedule A, must not be included in the numerator or denominator of the receipts fraction.

(e)Lines 2(h) and 2(i) - The percentage of receipts in New Jersey should be entered on both lines 2(h) and 2(i) to effect a double- weighted receipts fraction in the computation of the allocation factor.

(f)LINE 3 - PAYROLL FRACTION: In general, a taxpayer reporting to the Division of Employment Security in the New Jersey Department of Labor will allocate to New Jersey all wages, salaries and other personal service compensation, etc., reportable to that Division, including the portions thereof, in individual cases, in excess of taxable wages. All executive salaries are includible in both the numerator and denominator. See N.J.S.A. 54:10A-7 for the definition of wages, salaries and other personal services compensation allocable to New Jersey.

(g)ALLOCATION FACTOR - GENERAL: The allocation factor is computed by adding together the percentages shown at lines 1(c), 2(h), 2(i) and 3(c) of Schedule J, Part III for the period covered by the return, and dividing the total of the percentages by four (4). However, if the property or payroll fraction is missing, the remaining percentages are added and the sum is divided by three. If the receipts fraction is missing, the other two percentages are added and the sum is divided by two. If two of the fractions are missing, the remaining percentage may be used as the allocation factor. A fraction is not missing merely because its numerator is zero, but is missing if its denominator is zero.

If there is a declaration of nonoperational income, expenses, or assets from Schedule O, those items attributable to the non- operational activity should be excluded from the denominator of all three fractions of the allocation factor.

27.SCHEDULE K - SHAREHOLDERS’ SHARES OF INCOME, DEDUCTIONS, ETC.

(a)PART I

Line 1 - Enter the total number of shareholders as of the closing date of this return.

Line 2 - Enter the total number of nonresident shareholders included on line 1 above.

Lines 3(a) and (b) - Enter the total number of nonconsenting shareholders included on line 1 and the percentage of stock owned as of the closing date of this return.

(b)PART II

Lines 2(a) - (l) - Enter the amounts of income or loss as reported on the corresponding lines of your Federal Form 1120S, Schedule K.

Lines 4(a) - (d) Additions

(a)Enter any State and municipal interest income that was not included in line 3. Do not include interest received or credited from obligations of the State of New Jersey or any of its political subdivisions.

(b)Enter the total taxes paid or accrued to the United States, a state, a political subdivision thereof, or the District of Columbia on or measured by profits or income, or business presence or business activity, including income taxes paid or accrued by the corporation on behalf of, or in satisfaction of the liabilities of, the shareholders of the corporation, taken as a deduction on the CBT-100S, Schedule A and reflected in line 3, Part II of Schedule K.

(c)Enter all interest on indebtedness incurred or continued, expenses paid and incurred to purchase, carry, manage or conserve, and expenses of collection of the income or gain from obligations the income or gain from which is deductible pursuant to N.J.S.A. 54A:6-14 and 6-14.1, and reflected in line 3, Part II of Schedule K.

(d)Enter any losses reflected in line 3 that are not deductible for Gross Income Tax pursuant to N.J.S.A. 54A:6-14 and 6- 14.1, i.e. losses from exempt Federal obligations and/or obligations of the State of New Jersey or its political subdivisions.

Lines 6(a) - (e) Subtractions

(a)Enter any interest income reflected in line 3 that is not subject to Gross Income Tax pursuant to N.J.S.A. 54A:6-14 and 6-14.1, i.e. interest income on exempt Federal obligations.

(b)Enter any gains reflected in line 3 that are not subject to New Jersey Gross Income Tax pursuant to N.J.S.A. 54A:6-14 and 6-14.1, i.e. gains or losses from exempt Federal obligations and/or obligations of the State of New Jersey or its political subdivisions.

(c)IRS Section 179 expenses from Federal Schedule K.

(d)50% of meals and entertainment expenses not deductible for Federal purposes.

(e)Other subtractions -

(1)Expenses to generate Federal tax exempt income that is taxable for New Jersey Gross Income Tax purposes. Attach schedule.

(c)PART III

Line 1 (a) - If you have completed Schedule O - Nonoperational Activity, enter the amount reported on Part I, line 34, of Schedule O. If you have not completed Schedule O, enter zero on this line. If the nonoperational income has already been deducted from line 1 via adjustments made in Part II, make no adjustments on this line.

Line 5 - If you have completed Schedule O - Nonoperational

Activity, enter the amount reported on Part III, line 31, column C, Total Allocated New Jersey Portion. If you have not completed Schedule O, enter a zero on this line.

(d)PART IV

Distributions for New Jersey tax purposes should be made in the same manner as for Federal tax purposes following the rules listed in Sections 1368 and 1371 of the Internal Revenue Code.

(e)PART IV-A

ANALYSIS OF NEW JERSEY ACCUMULATED ADJUSTMENTS ACCOUNT (AAA) - This account reflects New Jersey S corporation earnings after a New Jersey S corporation election has been filed and approved.

NOTE: If applicable, the allocation percentage from Schedule K, Part III, line 3 should be used for all allocated amounts indicated below.

1.Column A includes:

Resident - All items of income, loss, reduction or distribution regardless of where it is generated (include both allocated and non-allocated amounts).

Nonresident - Items of income, loss, reduction or distribution generated from New Jersey sources (include allocated amounts only).

2.Column B includes: Resident - No items.

Nonresident - Items of income, loss, reduction or distribution generated from non-New Jersey sources (include non-allocated amounts only).

Line 1 - Enter the prior year ending balance of the New Jersey Accumulated Adjustments Account (AAA). For the first year of the New Jersey S corporation election, the beginning balance of the New Jersey AAA account will be zero.

Line 2 - Enter the net pro rata share of allocated and non- allocated S corporation income or loss for resident shareholders and the net pro rata share of allocated S corporation income for nonresident shareholders.

Line 3 - Enter the total of the allocated and non-allocated tax- exempt income or loss for resident shareholders and the allocated tax-exempt income or loss for nonresident shareholders.

Line 4 - Enter the total of the allocated and non-allocated other reduction(s) for resident shareholders and the allocated other reduction(s) for nonresident shareholders. Other reductions include charitable contributions made by the S corporation, taxes based on income paid by the S corporation (the taxes added back on Schedule K, Part II, line 4b), health or life insurance paid by the S corporation, fines and penalties paid by the S corporation, club dues paid by the S corporation, and any foreign taxes paid by the S corporation. Also, other reductions should include any other adjustments for expenses which are nondeductible for federal income tax purposes in determining income but must be taken into consideration in calculating the ending balance of AAA in the year the expenses are incurred or paid, and are not already included in Schedule K, Part II. Provide a Schedule detailing other reductions.

Line 5 - Enter the total of lines 1, 2, 3 and 4.

Line 6 - Enter the total of the allocated and non-allocated distribution(s) for the resident shareholder and the allocated distribution(s) for the nonresident shareholder. Federal rules governing distributions must be followed.

(f)PART IV-B

NEW JERSEY EARNINGS AND PROFITS ACCOUNT - This account reflects New Jersey C corporation earnings prior to any New Jersey S corporation election.

Line 1 - Enter the beginning balance of the New Jersey E & P account. For the first year of the New Jersey S corporation election, the beginning balance of the earnings and profits account will be the retained earnings of the corporation prior to the New Jersey S election. If the retained earnings of the corporation prior to the New Jersey S election is a negative amount, enter ZERO.

Line 2 - Enter any additions or adjustments that must be made for Federal income tax purposes.

Line 3 - Enter any dividends paid during the tax year from the earnings and profits account. Refer to instruction 27(e), line 6.

(g)PARTS V, VI and VII

Complete Parts V, VI and VII including shareholders’ full names and social security numbers. List ALL shareholders in the S corporation receiving either a Federal or New Jersey K-1. Report all distributions issued to shareholders during the reporting period whether in cash or property. If additional space is required, attach separate schedules in the exact format for the additional shareholders.

1.PART V - For resident shareholders, indicate their pro rata share of S corporation income from all sources.

2.PART VI - For consenting non-resident shareholders, indicate the income/loss allocated to New Jersey in column

(C)and the income/loss not allocated to New Jersey in column (D).

3.PART VII - For nonconsenting non-resident shareholders, indicate the income/loss allocated to New Jersey in column

(C)and the income/loss not allocated to New Jersey in column (D). Enter on page 1, lines 16 and 17 of the CBT- 100S, the totals reported from Part VII, column (C), the income allocated to New Jersey, and column (F), Gross Income Tax Paid, respectively. If the income allocated to New Jersey is a loss, enter a zero (0) on lines 16 and 17 on page 1 of the CBT-100S.

28.SCHEDULE N - NEXUS - IMMUNE ACTIVITY DECLA- RATION: Foreign corporations that claim their income is immune from taxation pursuant to Public Law 86-272, 15 U.S.C. § 381 et seq., must complete Schedule N and file it with the CBT-100S. This schedule may be obtained from the Taxpayer Forms Service which can be contacted by following the instructions on the bottom of page 13.

29.SCHEDULE O - NONOPERATIONAL ACTIVITY: Corporations that claim to have nonoperational activity, nonoperational assets or non-unitary partnership investments must complete Schedule O and file it with the CBT-100S. This schedule may be obtained from the Taxpayer Forms Service which can be contacted by following the instructions on the bottom of page 13. Complete lines 4(a) and 4(b) on page 1 only if a completed Schedule O is attached to the return.

30.SCHEDULE P - SUBSIDIARY INVESTMENT ANALYSIS: Itemize the investment in each subsidiary company, showing the name of each subsidiary, the percentage of interest held in each company, the individual book value included in the balance sheet for each subsidiary investment and the amount of dividends received from each subsidiary which is included in gross income on Schedule A. Do not include advances or other receivables due to

subsidiaries in the book value reported at Column 3.

31.SCHEDULE P-1 - PARTNERSHIP INVESTMENT ANALYSIS: Itemize the investment in each partnership, limited liability company and any other entity which is treated for Federal tax purposes as a partnership. List the name, the date and state where organized, and the Federal Identification number for each partnership. Also, check the type of ownership (general or limited), the tax accounting method used to reflect your share of partnership activity on this return (flow through method or separate accounting) and whether or not the partnership has nexus in New Jersey. Attach a copy of Schedule NJ-K-1 from form NJ-1065 if the partnership is filing in New Jersey, or the Federal Schedule K-1 if not. Any one member limited liability company should be included on this

schedule. Corporations who claim that their partnership investments are non-unitary and therefore are utilizing the Separate Tax Accounting Method must complete Schedule O to report this activity and compute the appropriate amount of tax.

32. SCHEDULE Q - QUALIFIED SUBCHAPTER S

SUBSIDIARIES (QSSS): All Federal S Corporations which are treated federally as a Qualified Subchapter S Subsidiary (QSSS) will be recognized accordingly by New Jersey. However, to qualify as a New Jersey QSSS, a copy of Federal Form 966 and a New Jersey Form CBT-2553 signed by a corporate officer in which the corporate parent shareholder consents to taxation by New Jersey must be submitted. The Corporation Business Tax return of the New Jersey QSSS will reflect a $200 minimum tax liability. The assets, liabilities, income and expenses will be treated as those of the parent corporation. Failure to file either a Federal Form 966 or a New Jersey Form CBT-2553 with the corporate parents consent to taxation by New Jersey will result in the denial of New Jersey QSSS status and subject the entity to taxation in New Jersey as a C corporation. A New Jersey QSSS, is required to annually file page 1 and Schedule Q of the Corporation Business Tax return and Form CAR-100, the Corporation Business Tax Payment and Annual Report form.

33.SCHEDULE R - DIVIDEND EXCLUSION: Taxpayers may exclude from entire net income 100% of dividends from qualified subsidiaries, if such dividends were included in the taxpayer’s gross income on Schedule A. A qualified subsidiary is defined as ownership by the taxpayer of at least 80 percent of the total combined voting power of all classes of stock entitled to vote and at least 80 percent of the total number of shares of all other classes of stock, except non-voting stock which is limited and preferred as to dividends. With respect to other dividends, the exclusion shall be limited to 50% of such dividends included in the taxpayer’s gross income on Schedule A. Taxpayers shall not include money market fund income as part of the dividend exclusion.

34.SCHEDULE S - DEPRECIATION AND SAFE HARBOR LEASING: All taxpayers except for gas, electric, and gas and electric utilities (who must complete Schedule S, Part III) must complete this schedule and must submit a copy of a completed Federal Depreciation Schedule, Form 4562 even if it is not required for Federal purposes. Schedule S provides for adjustments to depreciation and certain safe harbor leasing transactions.

SCHEDULE S - PART I Line 10 Additions:

(a)Add any depreciation or cost recovery (ACRS and MACRS) which was deducted in arriving at Federal taxable income on recovery property placed in service on or after January 1, 1981 and prior to taxpayers’ accounting periods beginning on and after July 7, 1993.

(b)Add distributive share of ACRS and MACRS from a

partnership.

(c)Add any interest, amortization or transactional costs, rent, or any other deduction which was claimed in arriving at Federal taxable income as a result of a “safe harbor leasing” election made under Section 168(f)(8) of the Federal Internal Revenue Code; provided, however, any such amount with respect to a qualified mass commuting vehicle pursuant to the Federal Internal Revenue Code Section 168(f)(8)(D)(v) need not be added back to net income.

Line 11 Deductions:

(a)Deduct depreciation on property placed in service after 1980 and prior to taxpayers’ fiscal or calendar accounting periods beginning on and after July 7, 1993 on which ACRS and MACRS has been disallowed under 10(a) of this instruction using any method, life and salvage value which would have been allowable under the Federal Internal Revenue Code at December 31, 1980 but using the Federal basis for depreciation on the date the property was placed in service.

(b)Deduct recomputed depreciation attributable to distributive share of recovery property from a partnership.

(c)Deduct any item of income included in arriving at Federal taxable income solely as a result of a “safe harbor leasing” election made under Section 168(f)(8) of the Federal Internal Revenue Code provided, however, that any such income which relates to a qualified mass commuting vehicle pursuant to Federal Internal Revenue Code Section 168(f)(8)(D)(v) cannot be deducted from net income.

(d)Where the user/lessee of qualified lease property which is precluded from claiming a deduction for rent under 10(c) of this instruction would have been entitled to cost recovery on property which is subject to such “safe harbor lease” election in the absence of that election, it may claim depreciation on the property in accordance with 11(a) of this instruction.

(e)Gain or loss on property sold or exchanged is the amount properly to be recognized in the determination of Federal taxable income. However, on the physical disposal of recovery property, whether on not a gain or loss is properly to be recognized under the Federal Internal Revenue Code, there shall be allowed as a deduction any excess, or there must be restored as an item of income, any deficiency of depreciation disallowed at line 10(a) over related depreciation claimed on that property at line 11(a). A statutory merger or consolidation shall not constitute a disposal of recovery property.

NOTE: Uncoupling is not required for property placed into service during accounting periods beginning on or after July 7, 1993.

SCHEDULE S - PART III

All gas, electric and gas, and electric utilities must complete this schedule in order to compute their New Jersey depreciation allowable for the single asset account which is comprised of all depreciable property placed in service prior to January 1, 1998. The basis of this asset account will be the total Federal depreciable basis as of December 31, 1997 plus the excess of the book depreciable basis over the Federal tax basis as of December 31, 1997. This basis will be reduced yearly by the Federal basis of these assets sold, retired or disposed of from January 1, 1998 to date.

35.SCHEDULE NJ-K-1 - SHAREHOLDER’S SHARE OF INCOME / LOSS: A copy of each shareholder’s Schedule NJ-K-1 must be attached to the CBT-100S. A copy of each NJ-K-1 must be kept as part of the corporation’s records, and a separate copy must be supplied to each individual shareholder on or before the date on

which the CBT-100S is to be filed. The instructions for this schedule can be found on the reverse side of the form.

36.FORM NJ-1040-SC - PAYMENT ON BEHALF OF NON- CONSENTING SHAREHOLDERS: A copy of each NJ-1040-SC filed by the corporation on behalf of any nonconsenting shareholder must be attached to the CBT-100S. A copy must be retained by the corporation as part of its records, and a copy must also be supplied to the shareholder on whose behalf the NJ-1040-SC was filed on or before the due date of the CBT-100S. The instructions for this form can be found on the reverse side of the form.

37.TAX CREDITS: (Refer to instruction 17)

(a)NEW JOBS INVESTMENT TAX CREDIT: This tax credit is available for investment in new or expanded business facilities that create new jobs in New Jersey. The investment must create at least 5 new jobs (50 for large businesses), with a median annual compensation of $30,700 for tax years beginning in 1998 and $31,050 for tax years beginning in 1999. New investment is not eligible for the credit unless the average value of all real and tangible personal property in this State has increased over the prior year.

The facilities must have been purchased from an unrelated party during or after the taxpayer’s accounting period beginning on or after July 7, 1993, the effective date of this legislation. It must be employed by the taxpayer in a taxable activity and must not have been in use during the 90 day period prior to purchase. Investments which qualify for the Manufacturing Equipment and Employment Investment Tax Credit cannot also qualify for this credit.

A new employee means a New Jersey resident, hired to fill a regular, permanent position in this State which did not exist prior to the qualified investment, and would not exist but for the qualified investment. The employee must be unrelated to the taxpayer and must not have been employed by the taxpayer during the six months prior to the date the investment was placed in service or use.

The taxpayer cannot claim a credit for a number of new employees that exceeds either the increase in the taxpayer’s average employment for the tax year, or one-half of the taxpayer’s average employment for the year. Also, individuals counted in determining the New Jobs Factor must not be ones for whom the taxpayer is allowed an Urban Enterprise Zone or Urban Development Project Employees Tax Credit.

A small business taxpayer in 1999 means a taxpayer with an annual payroll of not more than $2,304,150 and annual gross receipts of not more than $6,910,050.

To claim this credit, the taxpayer must complete Form 304 and attach it to the tax return. This form and related information may be obtained from the Taxpayer Forms Service which can be contacted by following the instructions on the bottom of page 13.

(b)URBAN ENTERPRISE ZONE TAX CREDITS: A taxpayer which has been designated as a “qualified business” as defined in the New Jersey Urban Enterprise Zones Act, N.J.S.A. 52:27H- 60 et seq., may qualify for either an employee tax credit or an investment tax credit. To be eligible, the taxpayer must have been certified as a qualified business by the Urban Enterprise Zones Authority. Certification is renewable annually. The urban

enterprise zones are located in Asbury Park, Bridgeton, Camden,

Carteret, East Orange, Elizabeth, Guttenberg, Hillside, Irvington, Jersey City, Kearny, Lakewood, Long Branch, Millville, Mount Holly, Newark, North Bergen, Orange, Passaic, Paterson, Pemberton Township, Perth Amboy, Phillipsburg,

Plainfield, Pleasantville, Trenton, Union City, Vineland and West New York. Further information can be obtained from the New Jersey Urban Enterprise Zones Authority, Department of Commerce and Economic Development, PO Box 829, Trenton, New Jersey 08625-0829, phone (609) 292- 1912.

The forms required to validate the employee tax credit (Form

300)and the investment tax credit (Form 301) are available from the Taxpayer Forms Service which can be contacted by following the instructions on the bottom of page 13. Specific information on these tax credits can be obtained from the Tax Services Branch, phone (609) 292-5994.

(1)Employees Tax Credit: This credit is available to a taxpayer who was certified as a qualified business in the preceding tax year as well as the current tax year. Qualifying employees must have been hired after certification and must have worked six consecutive months in the tax year following the tax year in which employment began. To claim the credit, a completed Form 300 must be attached to the tax return.

(2)Investment Tax Credit: A qualified business which is not entitled to an employees tax credit may be entitled to the investment tax credit. This credit is only available to an employer with less than 50 employees. The investment must be at least $5,000 if there are 10 or fewer employees, and increases by $500 for each additional employee. To qualify for the credit, the investment must be approved by the Urban Enterprise Zones Authority. A completed Form 301 must be attached to the tax return to validate the investment tax credit claim.

(c)REDEVELOPMENT AUTHORITY PROJECT TAX CREDIT : Any taxpayer who is actively engaged in the conduct of business at a location within a project as defined in N.J.S.A. 55: 19-1 et seq., and whose business at that location consists primarily of manufacturing or other business that is not retail sales or warehousing oriented, may be entitled to claim the Redevelopment Authority Project Tax Credit. This credit is allowed in the tax year next following the tax year of qualification. To claim the credit, the taxpayer must complete Form 302 and attach it to the return. This form and related information may be obtained from the Taxpayer Forms Service which can be contacted by following the instructions on the bottom of page 13. Inquiries regarding the projects should be directed to the New Jersey Redevelopment Authority, PO Box 834, Trenton, New Jersey 08625-0834, phone (609) 292-3732.

(d)RECYCLING EQUIPMENT TAX CREDIT: A taxpayer who purchased qualified recycling equipment on or after October 1, 1987 and who received a certification for this equipment from the Commissioner of the Department of Environmental Protection may be eligible to claim the Recycling Equipment Tax Credit. The recycling equipment must have been used exclusively within New Jersey, except for vehicles which must have been used primarily within New Jersey.

The legislation governing this tax credit expired on December 31, 1996, however, any unused credits claimed prior to January 1, 1997, can be taken on the current tax return subject to the limitations set forth on Form 303.

To claim this credit, the taxpayer must complete Form 303 and attach it to the tax return. This form and related information may be obtained from the Taxpayer Forms

Service which can be contacted by following the instructions on the bottom of page 13.

(e) MANUFACTURING |

EQUIPMENT |

AND |

EMPLOYMENT INVESTMENT TAX |

CREDIT: |

Investments in qualified manufacturing equipment made in tax years beginning on or after January 1, 1994 may be eligible for the Manufacturing Equipment and Employment Investment Tax Credit. Such investment has the benefit of allowing a tax credit computation for the tax year in which the investment was made as well as each of the following two tax years. The tax credit computation for the first year is based on the cost of the qualified manufacturing equipment placed in service in New Jersey during that tax year. The computations for the two following tax years are based on the average increase in New Jersey residents employed in New Jersey subject to a limitation based on the cost of the investment made in the first year.

The manufacturing equipment portion is limited to 2% of the investment credit base of qualified equipment placed in service in the tax year, up to a maximum allowed credit for the tax year of $1,000,000. The employment investment portion is valid for each of the two tax years next succeeding the tax year for which the manufacturing equipment credit is allowed, but is limited to 3% of the investment credit base, not to exceed a maximum allowable amount for each of the two tax years of $1,000 multiplied by the increase in the average number of qualified employees.

To claim this credit, the taxpayer must complete Form 305 and attach it to the tax return. This form and related information may be obtained from the Taxpayer Forms Service which can be contacted by following the instructions on the bottom of page 13.

(f)RESEARCH AND DEVELOPMENT TAX CREDIT: A taxpayer who has performed qualified research activities in New Jersey may be eligible to claim the Research and Development Tax Credit. A credit for increased research activities is allowed based on qualified expenditures made in taxable years beginning on and after January 1, 1994. It provides a credit of 10% of the excess qualified research expenses over a base amount plus 10% of the basic research payments.

Qualified research is limited to scientific experimentation or engineering activities designed to aid in the development of a new or improved product, process, technique, formula, invention, or computer software programs held for sale, lease, or license, or used by the taxpayer in a trade or business. For in-house research expenses (see Section 41(b)(2) of the Internal Revenue Code), this trade or business requirement will be met if the taxpayer’s principal purpose for conducting the research is to use the results of the research in the active conduct of a future trade or business (see Section 41(b)(4) of the Internal Revenue Code).

An S corporation is allowed to claim a credit in connection with increasing research activities to the extent of its New Jersey corporation tax liability. Pass through of this credit to shareholders is not permitted. To claim this credit, the taxpayer must complete Form 306 and attach it to the tax return. This form and related information may be obtained from the Taxpayer Forms Service which can be contacted by following the instructions on the bottom of page 13.

(g)SMART MOVES FOR BUSINESS PROGRAMS TAX CREDIT (FORMERLY THE EMPLOYER TRIP

REDUCTION PLAN - RIDE SHARE TAX CREDIT): A taxpayer who has registered with the New Jersey Department of Transportation and who has an authorized report/plan to provide commuter transportation benefits may claim a tax credit based on the direct expenditures attributed to the plan.

The credit may be taken for expenditures attributed to authorized plans approved after January 1, 1994. Taxpayers subject to more than one tax for which the credit can be applied must prorate the credit amount available based on the amount that each liability has to the total of the liabilities in the reporting period.

The ride share credit is equal to 10% of the cost of commuter transportation benefits provided during the reporting period. The maximum calculation equals the per employee limit multiplied by the number of participating employees. The per employee limit is adjusted annually in proportion to the consumer price index.

To claim this credit, the taxpayer must complete Form 307 and attach it to the tax return. This form and related information may be obtained from the Taxpayer Forms Service which can be contacted by following the instructions on the bottom of page 13.

(h)SMALL NEW JERSEY-BASED HIGH-TECHNOLOGY BUSINESS INVESTMENT TAX CREDIT: A taxpayer may claim a tax credit in an amount equal to 10% of the qualified investment made by the taxpayer during the tax year in a small- New Jersey-based high-technology business. The maximum allowable credit for each tax year is $500,000 for each qualified investment made by the taxpayer. The small high-technology business must employ less than 225 employees, of which 75% must have jobs in New Jersey. The small high-technology business must conduct pilot scale manufacturing or qualified research in New Jersey in the fields of advanced computing, advanced materials, biotechnology, electronic device technology, environmental technology, and medical device technology.

To claim this credit, the taxpayer must complete Form 308 and attach it to the tax return., This form and related information may be obtained from the Taxpayer Forms Service which can be contacted by following the instructions on the bottom of page 13.

(i)NEIGHBORHOOD AND BUSINESS CHILD CARE TAX CREDIT: A taxpayer that is a member of a small-medium business child care consortium for the three-year demonstration program in accordance with section 4 of P.L. 1999,c.108, may claim a tax credit in an amount equal to 15% of the taxpayer’s expenditures made during the privilege period for child care center physical plant or facilities. The expenditure may be for a child care center owned and operated by the consortium or by a contracted sponsoring organization. This expenditure must be made on or after the designation of the consortium and before the expiration of the demonstration program.

Also, a taxpayer may claim a tax credit in an amount equal to 10% of the taxpayer’s contribution made during the privilege period to a sponsor of a neighborhood-based child care center that was awarded a program grant. To qualify, the contribution must be made on or after the awarding of the grant and before the expiration of the demonstration program.

To claim this credit, the taxpayer must complete Form 309 and attach it to the tax return. This form and related information may be obtained from the Taxpayer Forms Service which can be contacted by following the instructions on the bottom of page 13.

38.INSTALLMENT PAYMENTS: Taxpayers are required to make installment payments of estimated tax. The requirement for making these payments is based on the amount of the total tax liability shown on the most recent return.

(a)If the 1999 Total Tax Liability is $500 or more, the taxpayer must make installment payments towards 2000. These payments are to be made on form CBT-150 and are due on or before the 15th day of the 4th, 6th, 9th and 12th months of the tax year. Details for making these payments can be found in the CBT-150 instruction booklet.

(b)If the 1999 Total Tax Liability is less than $500, installment payments may be made as indicated in (a) above OR in lieu of making installment payments, the taxpayer may make a payment of 50% of the 1999 total tax liability. For taxpayers who qualify and wish to take advantage of this option, enter on line 12, 50% of the amount on line 11. This will become part of the payment to be made with the 1999 return and installment payments will not be required. This payment should be claimed as a credit when filing the 2000 return.

39.PAYMENTS AND CREDITS: Credit for the total amount of the payments and credits listed below should be taken on page 1, line 14:

(a)Include installment tax payments made with the form CBT-150 as well as any payment made on line 14 of the 1998 CBT-100 or line 12 of the 1998 CBT-100S.

(b)Include the payment, if any, that was remitted with the tentative return, form CBT-200-T.

(c)Include any overpayment from the preceding tax return which the taxpayer elected to have credited to the current year’s tax. Do not include any amount of the overpayment which the taxpayer elected to have refunded.

(d)Include any payments remitted electronically through the Electronic Funds Transfer Program.

40.LINE 18 -DELINQUENT FILING AND/OR TAX PAYMENT- COMPUTATION OF PENALTY AND INTEREST:

Late Filing Penalty - 5% per month or fraction thereof of the total tax liability not to exceed 25% of such tax liability. Also, a penalty of $100 for each month the return is delinquent may be imposed. For return periods beginning on or after January 1, 1999, late filing penalty is calculated at 5% per month or fraction thereof of the amount of underpayment not to exceed 25% of that underpayment, except if no return has been filed within 30 days of the date on which the first notice of delinquency in filing the return was sent, the penalty shall accrue at 5% per month or fraction thereof of the total tax liability not to exceed 25% of such tax liability.

Late Payment Penalty - 5% of the balance of Corporation Business Tax and/or Gross Income Tax due paid after the due date for filing the return may be imposed.

Interest - The annual interest rate is 3% above the average predominant prime rate. Interest is imposed each month or fraction thereof on the unpaid balance of Corporation Business Tax and/or Gross Income Tax from the original due date to the date of payment. At the end of each calendar year, any tax, penalties and interest remaining due will become part of the balance on which interest will be charged. The interest rates assessed by the Division of Taxation are published in the quarterly issues of the New Jersey State Tax News. To obtain a copy, refer to the instructions at the bottom of page 13.

NOTE: The average predominant prime rate is the rate as determined by the Board of Governors of the Federal Reserve System, quoted by commercial banks to large businesses on

December 1st of the calendar year immediately preceding the calendar year in which payment was due or as redetermined by the Director in accordance with N.J.S.A. 54:48-2.

Civil Fraud - If any part of an assessment is due to civil fraud, there shall be added to the tax an amount equal to 50% of the assessment in accordance with N.J.S.A. 54:49-9.1

41.LINE 19 - UNDERPAYMENT OF ESTIMATED TAX: The form CBT-160 must be used by taxpayers to determine whether an underpayment exists in any of the installment payment periods or if the corporation is subject to an interest charge, and if so, the amount of interest. If the taxpayer qualifies for any of the exceptions to the imposition of interest for any of the installment payments, Part II must be completed and should be filed with the taxpayer’s return, form CBT-100S, as evidence of such exception. The CBT-160 must be attached to the return and any interest due entered on Line 19, Page 1 of the form CBT-100S.

42.AMENDED RETURNS: To amend CBT-100S returns, use the CBT-100S form for the appropriate tax year and write “AMENDED RETURN” clearly on the front page of the form. Refer to instruction 1 for the mailing address.

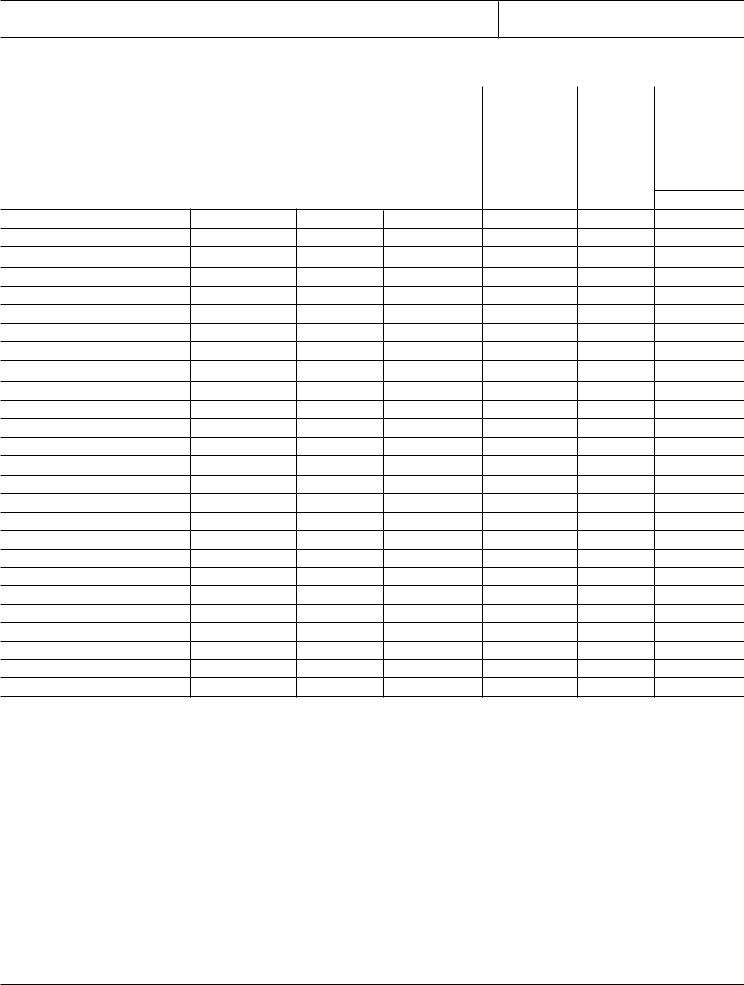

LIST OF CBT-100S SCHEDULES, FORMS AND INSTRUCTIONS

Page 1 |

Computation of Tax |

Schedule A |

Computation of Entire Net Income |

Schedule A-1 |

Net Operating Loss Deduction and Carryover |

Schedule A-2 |

Cost of Goods Sold |

Schedule A-3 |

Summary of Tax Credits |

Schedule B |

Balance Sheet |

Schedule C |

Reconciliation of Income Per Books with Income Per Return |

Schedule E |

General Information |

Schedule F |

Corporate Officers - General Information and Compensation |

Schedule H |

Taxes |

Schedule J |

General Information for Allocating Taxpayers, Average Values, |

|

Computation of Allocation Factor |

Schedule K |

Shareholders’ Shares of Income, Deductions, Etc. |

Schedule N * |

Nexus - Immune Activity Declaration |

Schedule NJ-K-1 |

Shareholder’s Share of Income/Loss |

Schedule O * |

Nonoperational Activity |

Schedule P |

Subsidiary Investment Analysis |

Schedule P-1 |

Partnership Investment Analysis |

Schedule Q |

Qualified Subchapter S Subsidiaries (QSSS) |

Schedule R |

Dividend Exclusion |

Schedule S |

Depreciation and Safe Harbor Leasing |

Form NJ-1040-SC |

Payment on Behalf of Nonconsenting Shareholders |

Form NJ-1080-C * |

Gross Income Tax - Nonresident Composite Return |

Form 300 * |

Urban Enterprise Zone Employees Tax Credit and Credit Carry Forward |

Form 301 * |

Urban Enterprise Zone Investment Tax Credit and Credit Carry Forward |

Form 302 and 302-A * |

Redevelopment Authority Project Tax Credit and Credit Carry Forward |

Form 303 * |

Recycling Equipment Tax Credit |

Form 304 and 304-A * |

New Jobs Investment Tax Credit |

Form 305 and 305-A * |

Manufacturing Equipment and Employment Investment Tax Credit |

Form 306 and 306-A * |

Research and Development Tax Credit |

Form 307 and 307-A * |

Smart Moves for Business Programs Tax Credit |

Form 308 and 308-A * |

Small New Jersey-Based High-Technology Business Investment |

|

Tax Credit |

Form 309 and 309-A * |

Neighborhood and Business Child Care Tax Credit |

* Must be requested from the Division’s Taxpayer Forms Service.

TAX FORMS AND INFORMATION

Requests for forms should be addressed to the New Jersey Division of Taxation, Taxpayer Forms Service, PO Box 269, Trenton, NJ 08646-0269. To listen to prerecorded information or to order forms and publications, dial 1-800-323-4400 from touch-tone phones within New Jersey, or 609-826-4400 from touch-tone phones anywhere. Requests to receive the New Jersey State Tax News must be made in writing to the New Jersey Division of Taxation, Office of Communication, PO Box 281, Trenton, NJ 08646-0281. If you wish to speak to a Division representative, contact the Division of Taxation’s Call Center at 609-292-6400.

Many State tax forms and publications are available by fax and/or through the World Wide Web. Call NJ TaxFax at 609-826-4500 from your fax machine’s phone, or access the Division’s home page via your computer’s modem at: http://www.state.nj.us/treasury/taxation/

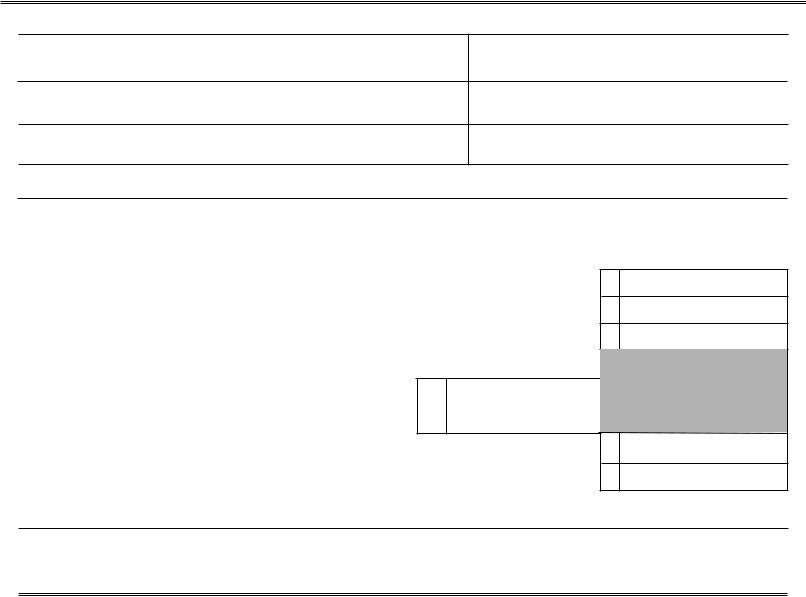

|

CBT-200-T |

State of New Jersey |

|

10-99, R-21 |

|

|

|

|

DIVISION OF TAXATION |

TENTATIVE RETURN AND APPLICATION FOR EXTENSION OF TIME TO FILE

The New Jersey Corporation Business Tax Return (Form CBT-100) or

The New Jersey S Corporation Business Tax Return (Form CBT-100S)

For Taxable Years Ending on and After July 31, 1999

(See instructions on reverse side. Type or print the requested information.)

For accounting period beginning ____________________, ___________ and ending ____________________, ___________

Corporation Name

Mailing Address

Federal Employer Identification Number

NJ Corporation Number

State and Date of Incorporation

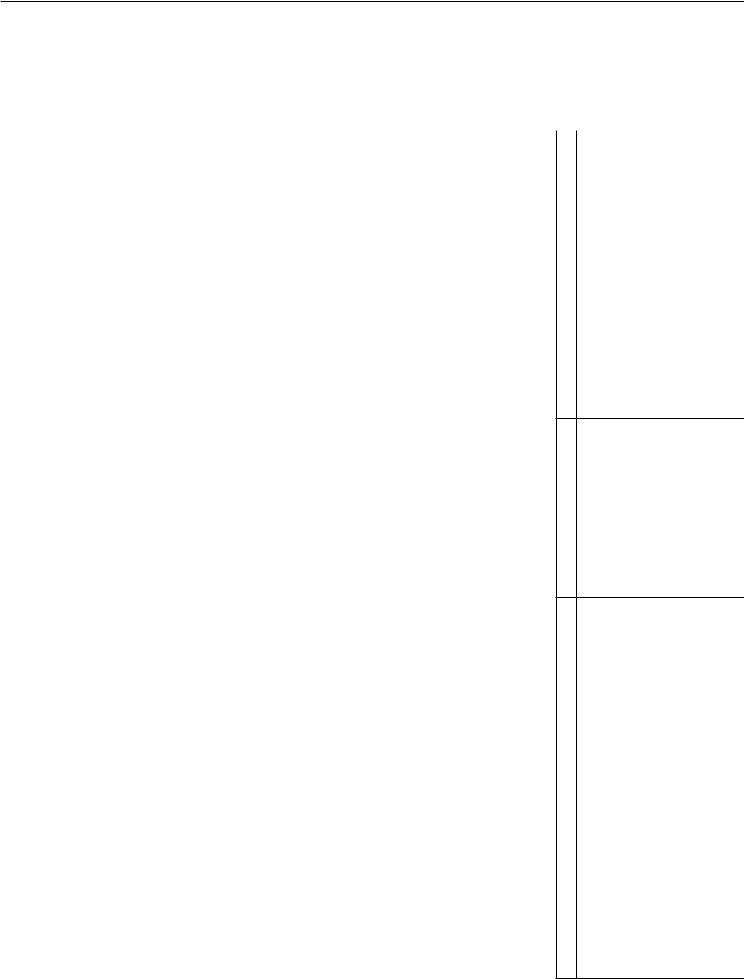

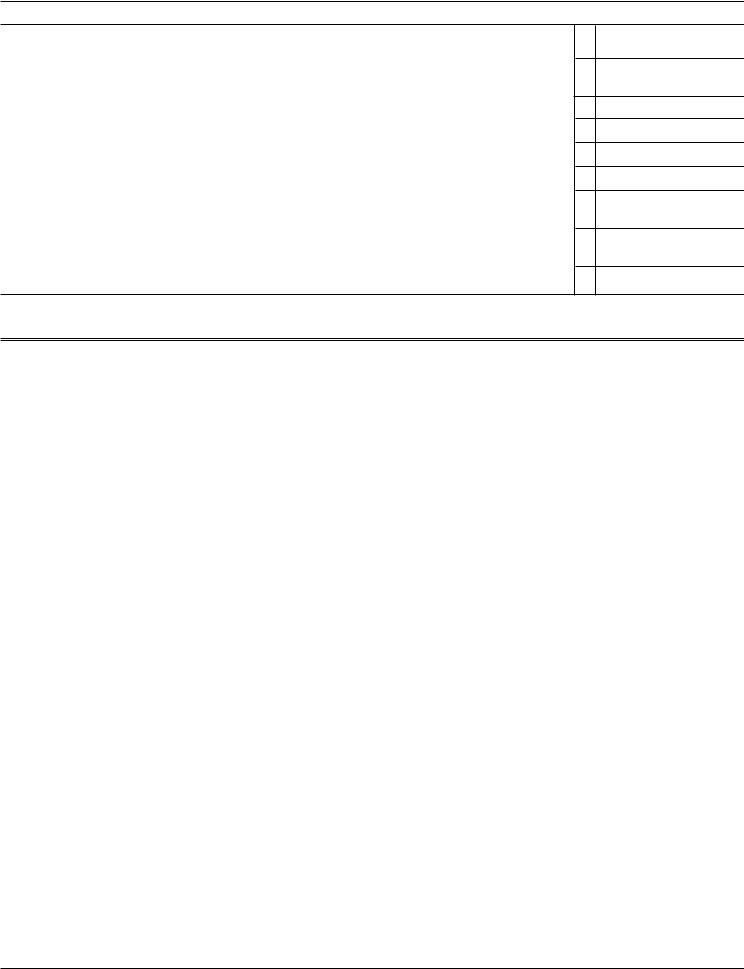

APPLICATION IS HEREBY MADE FOR AN AUTOMATIC EXTENSION OF SIX (6) MONTHS FOR FILING THE COMPLETED

RETURN OF THE ABOVE CORPORATION UNDER THE CORPORATION BUSINESS TAX ACT (N.J.S.A. 54:10A-1 et seq.)

Remittance to cover the full amount of the net balance due, as per computation below, must accompany this application.

No extension will be granted in the absence of such remittance.

COMPUTATION OF TENTATIVE TAX

1.Total Tentative Tax for Current Period

IMPORTANT: See Instruction 5 regarding minimum tax requirements. . . . . . . . . . . . . . . . . . . . . . .

2.Installment Payment (See Instruction 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.Combined Total (Line 1 plus Line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.Credits:

(a)Installments Paid

|

(Including payment on prior year’s return, if any) |

4(a) |

|

(b) Overpayment Claimed as a Credit |

|

|

4(b) |

|

(From prior period) |

Total Credits (Add Lines (a) and (b)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Net Balance Remitted Herewith (Line 3 minus Line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

WARNING: Penalties may be assessed for underestimation of tax. See Instruction 7 on reverse side.

Remittance should be made payable to “State of New Jersey” and forwarded with this return to:

Division of Taxation - Corporation Tax, Revenue Processing Center, PO Box 666, Trenton, NJ 08646-0666

SIGNATURE AND VERIFICATION

I declare under the penalties of perjury that I have been authorized by the above-named corporation to make this application and that to the best of my knowledge and belief the statements made herein are true and correct.

___________________________________________________________________________________________________________________________

(Date)(Signature of Duly Authorized Officer of Taxpayer)(Title)

___________________________________________________________________________________________________________________________

(Date)(Tax Preparer’s Signature)(Address)(Preparer’s I.D. Number)

___________________________________________________________________________________________________________________________

(Name of Tax Preparer’s Employer) |

(Address) |

(Employer’s I.D. Number) |

CBT-200-T |

Page 2 |

(Rev. 10-99, R-21) |

|

INSTRUCTIONS

1.AUTOMATIC EXTENSION - Where a tentative return and tax payment are timely and properly filed, it is the policy of the Division of Taxation to grant an automatic extension of six (6) months for filing the CBT-100 or the CBT-100S. The return must include the computation of the tax liabilities on Lines 1 through 3 and must be submitted with payment of the total amount due reflected at Line 5. The application must be postmarked on or before the original due date of the tax return.

2.MAXIMUM EXTENSION - The extended period may not exceed six (6) months from the original due date of the return. Therefore, there will be no additional extensions beyond this automatic extension.

3.Request for extension of time for filing a return must be signed by an officer of the corporation, an accountant authorized to prepare this return, or any duly authorized agent of the taxpayer. Tax preparers who fail to sign the return and provide their assigned tax identification number shall be liable for a $25 penalty for each such failure. If the tax preparer is not self- employed, the name of the tax preparer’s employer and the employer’s tax identification number should also be provided.

4.Where a request for extension is duly made, it will be granted by the Division. Approved extensions will not be confirmed in writing. If your request for extension is denied, this application will be returned with the reason for the denial stated hereon.

5.MINIMUM TAX: The minimum tax requirement for all periods is $200 for both domestic and foreign Corporations. The minimum tax cannot be prorated. Zero (0) returns are not permitted.

6.INSTALLMENT PAYMENT - Any taxpayer with a tax liability of less than $500 at Line 1, may make a payment of 50 percent of Line 1 in lieu of making the installment payments otherwise required.

7.PENALTIES AND INTEREST

a.Interest - The annual interest rate is 3% above the average predominant prime rate. Interest is imposed each month or fraction thereof on the unpaid balance of tax from the original due date to the date of payment. At the end of each calendar year, any tax, penalties and interest remaining due will become part of the balance on which interest will be charged.

NOTE: The average predominant prime rate is the rate as determined by the Board of Governors of the Federal Reserve System, quoted by commercial banks to large businesses on December 1st of the calendar year immediately preceding the calendar year in which payment was due or as redetermined by the Director in accordance with N.J.S.A. 54:48-2.

b.Insufficiency Penalty - If the amount paid with the Tentative Return, Form CBT-200-T, is less than 90% of the tax liability computed on Form CBT-100 or CBT-100S, or in the case of a taxpayer whose preceding return covered a full 12 month period, is less than the amount of the tax computed at the rates applicable to the current accounting year, the taxpayer may be liable for a penalty of 5% per month or fraction thereof on the amount of underpayment from the original due date to the date of actual payment.