When working in the online editor for PDFs by FormsPal, you'll be able to fill in or edit Form Cift 620 right here and now. In order to make our tool better and less complicated to work with, we continuously work on new features, considering suggestions from our users. Starting is effortless! Everything you need to do is stick to the following simple steps directly below:

Step 1: First, open the editor by clicking the "Get Form Button" at the top of this site.

Step 2: The editor will give you the opportunity to customize the majority of PDF forms in many different ways. Transform it with any text, correct existing content, and place in a signature - all at your convenience!

It is simple to finish the document with this detailed guide! This is what you want to do:

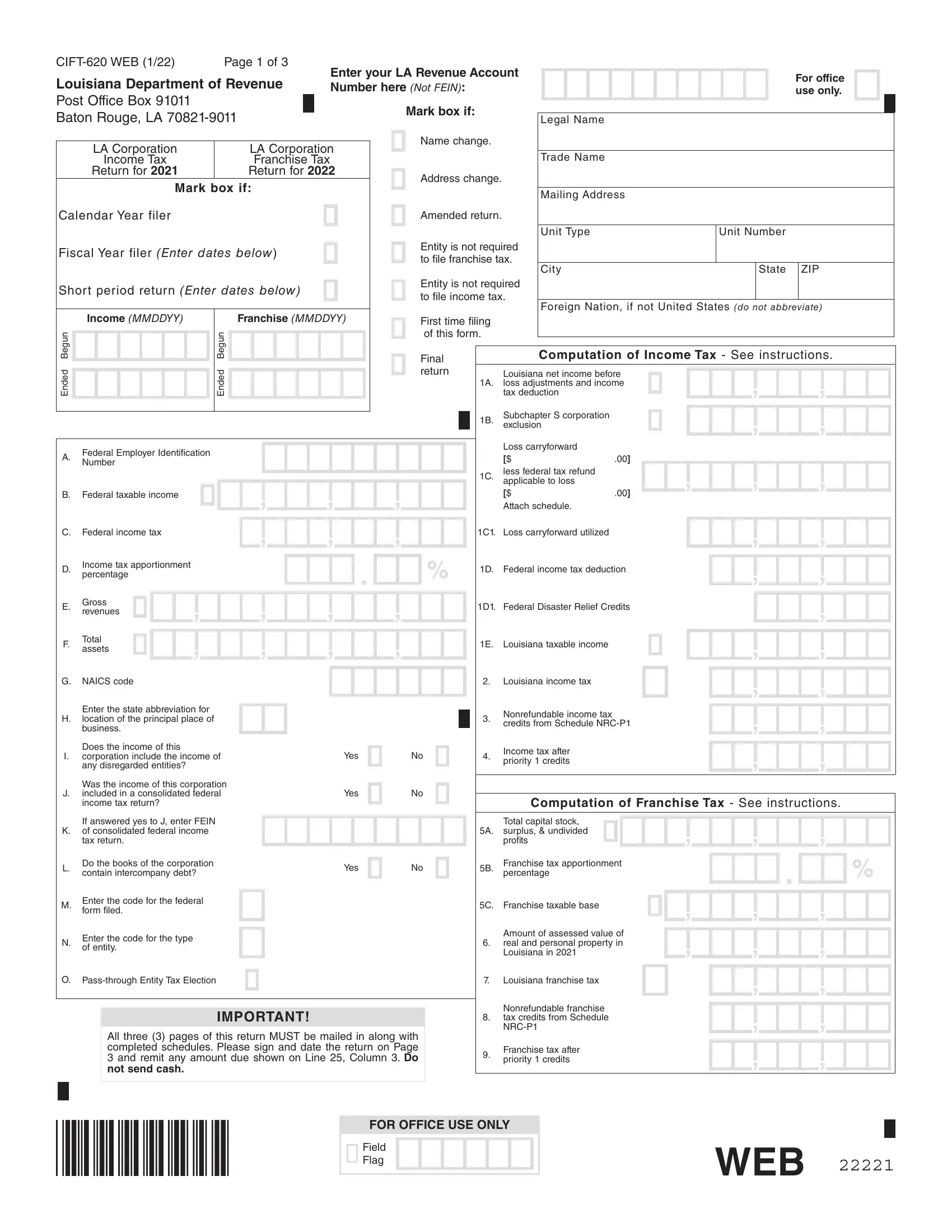

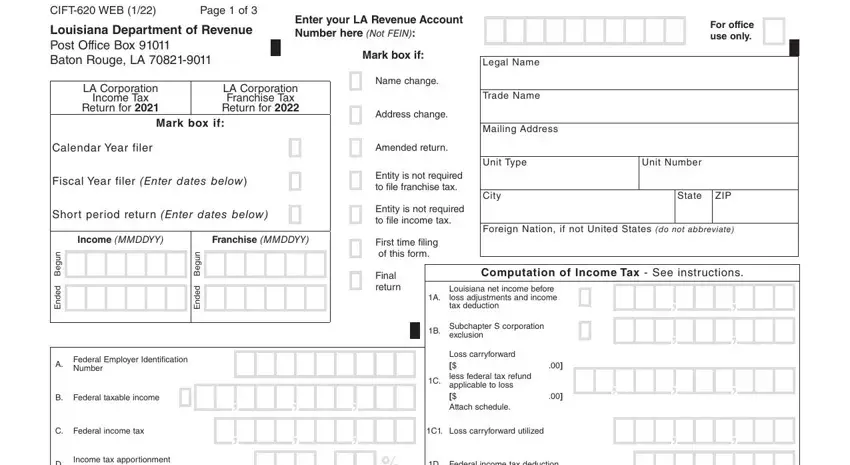

1. It is recommended to complete the Form Cift 620 correctly, hence be attentive when working with the parts that contain these specific blanks:

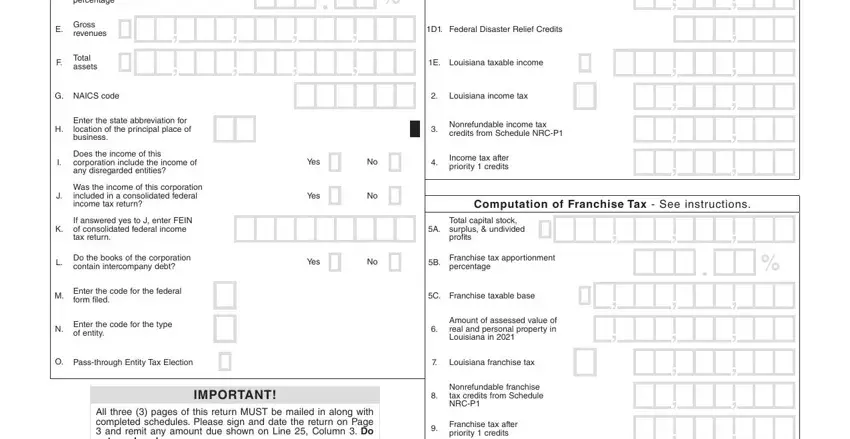

2. Right after completing the last section, head on to the subsequent step and enter the necessary particulars in these blank fields - Income tax apportionment percentage, Gross revenues, Total assets, D Federal income tax deduction, D Federal Disaster Relief Credits, E Louisiana taxable income, G NAICS code, Louisiana income tax, Enter the state abbreviation for, Does the income of this, Was the income of this corporation, If answered yes to J enter FEIN of, Do the books of the corporation, Enter the code for the federal, and Enter the code for the type of.

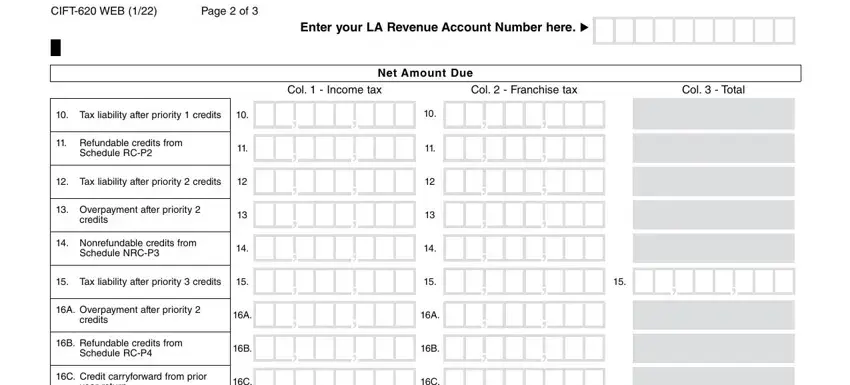

3. This next section will be about CIFT WEB, Page of, Enter your LA Revenue Account, Net Amount Due, Col Income tax, Col Franchise tax, Col Total, Tax liability after priority, Refundable credits from, Schedule RCP, Tax liability after priority, Overpayment after priority, credits, Nonrefundable credits from, and Schedule NRCP - complete every one of these blank fields.

People frequently make mistakes when filling in Overpayment after priority in this section. Ensure you review everything you enter right here.

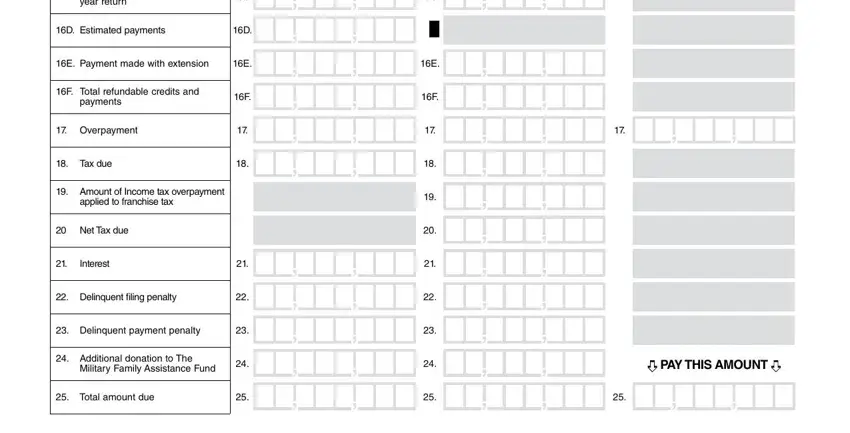

4. Filling out year return, D Estimated payments, E Payment made with extension, F Total refundable credits and, payments, Overpayment, Tax due, Amount of Income tax overpayment, applied to franchise tax, Net Tax due, Interest, Delinquent filing penalty, Delinquent payment penalty, Additional donation to The, and Military Family Assistance Fund is vital in the next section - make certain that you take your time and be attentive with each and every field!

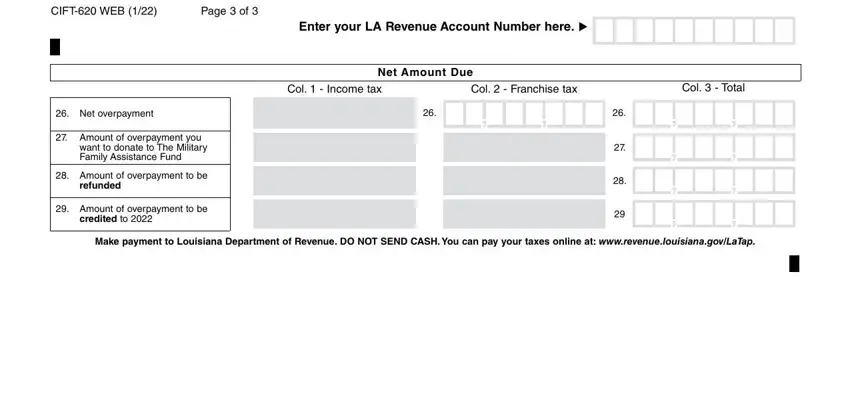

5. As a final point, the following last segment is precisely what you have to complete prior to finalizing the form. The blank fields in question include the following: CIFT WEB, Page of, Enter your LA Revenue Account, Net Amount Due, Col Income tax, Col Franchise tax, Col Total, Net overpayment, Amount of overpayment you, want to donate to The Military, Amount of overpayment to be, refunded, Amount of overpayment to be, credited to, and Make payment to Louisiana.

Step 3: Always make sure that your information is correct and then click on "Done" to complete the task. Go for a free trial account with us and obtain direct access to Form Cift 620 - downloadable, emailable, and editable from your personal account. FormsPal offers safe form completion without personal data record-keeping or any kind of sharing. Be assured that your data is secure with us!