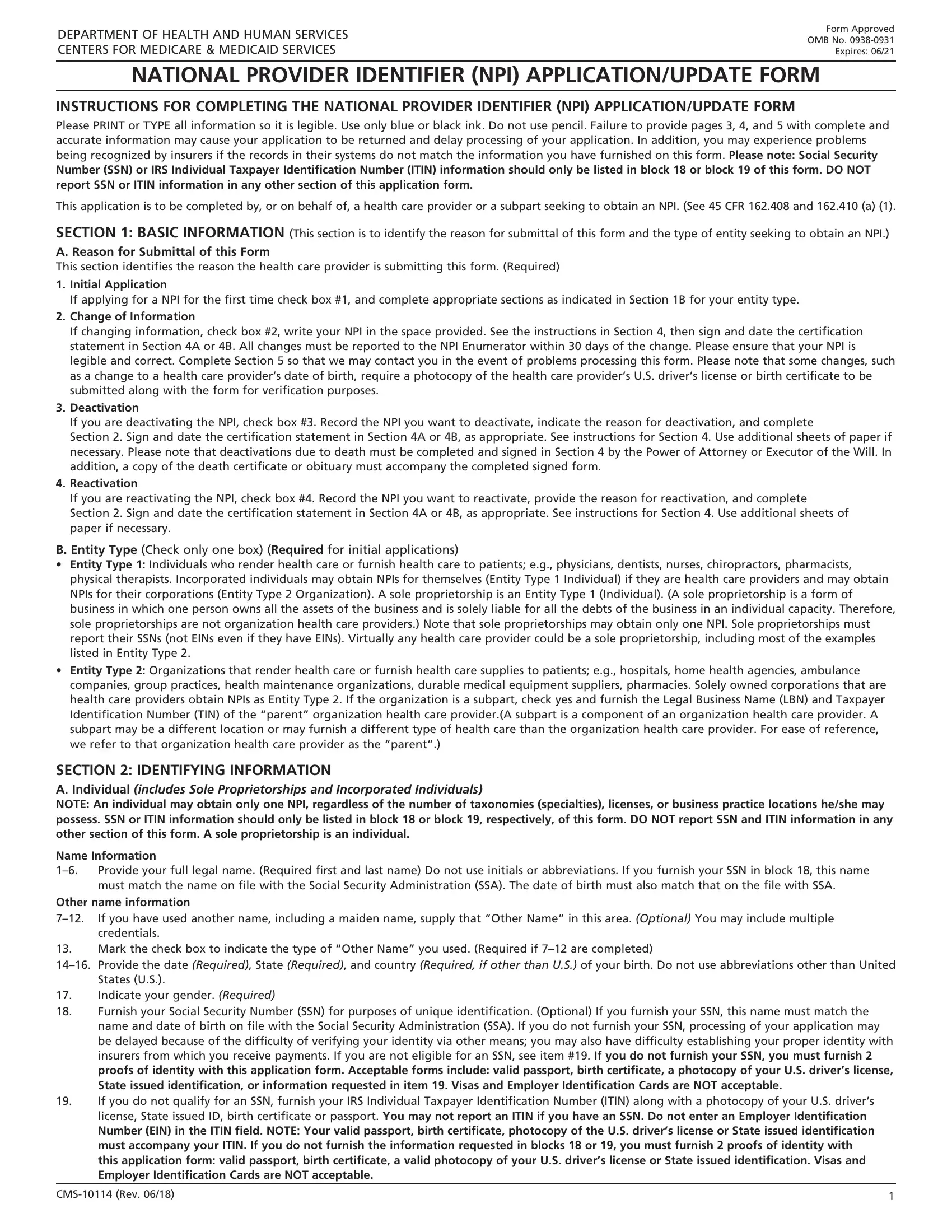

NATIONAL PROVIDER IDENTIFIER (NPI) APPLICATION/UPDATE FORM

INSTRUCTIONS FOR COMPLETING THE NATIONAL PROVIDER IDENTIFIER (NPI) APPLICATION/UPDATE FORM

Please PRINT or TYPE all information so it is legible. Use only blue or black ink. Do not use pencil. Failure to provide pages 3, 4, and 5 with complete and accurate information may cause your application to be returned and delay processing of your application. In addition, you may experience problems being recognized by insurers if the records in their systems do not match the information you have furnished on this form. Please note: Social Security

Number (SSN) or IRS Individual Taxpayer Identification Number (ITIN) information should only be listed in block 18 or block 19 of this form. DO NOT report SSN or ITIN information in any other section of this application form.

This application is to be completed by, or on behalf of, a health care provider or a subpart seeking to obtain an NPI. (See 45 CFR 162.408 and 162.410 (a) (1).

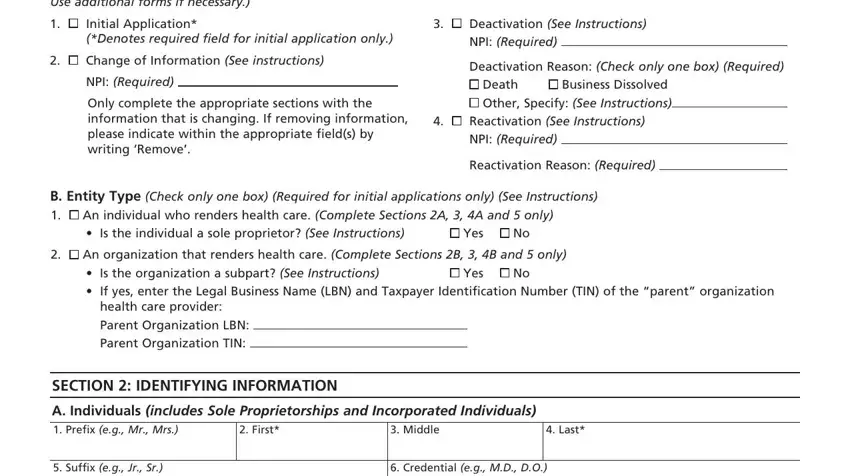

SECTION 1: BASIC INFORMATION (This section is to identify the reason for submittal of this form and the type of entity seeking to obtain an NPI.)

A. Reason for Submittal of this Form

This section identifies the reason the health care provider is submitting this form. (Required)

1.Initial Application

If applying for a NPI for the first time check box #1, and complete appropriate sections as indicated in Section 1B for your entity type.

2.Change of Information

If changing information, check box #2, write your NPI in the space provided. See the instructions in Section 4, then sign and date the certification statement in Section 4A or 4B. All changes must be reported to the NPI Enumerator within 30 days of the change. Please ensure that your NPI is legible and correct. Complete Section 5 so that we may contact you in the event of problems processing this form. Please note that some changes, such as a change to a health care provider’s date of birth, require a photocopy of the health care provider’s U.S. driver’s license or birth certificate to be submitted along with the form for verification purposes.

3.Deactivation

If you are deactivating the NPI, check box #3. Record the NPI you want to deactivate, indicate the reason for deactivation, and complete

Section 2. Sign and date the certification statement in Section 4A or 4B, as appropriate. See instructions for Section 4. Use additional sheets of paper if necessary. Please note that deactivations due to death must be completed and signed in Section 4 by the Power of Attorney or Executor of the Will. In addition, a copy of the death certificate or obituary must accompany the completed signed form.

4.Reactivation

If you are reactivating the NPI, check box #4. Record the NPI you want to reactivate, provide the reason for reactivation, and complete Section 2. Sign and date the certification statement in Section 4A or 4B, as appropriate. See instructions for Section 4. Use additional sheets of paper if necessary.

B. Entity Type (Check only one box) (Required for initial applications)

•Entity Type 1: Individuals who render health care or furnish health care to patients; e.g., physicians, dentists, nurses, chiropractors, pharmacists, physical therapists. Incorporated individuals may obtain NPIs for themselves (Entity Type 1 Individual) if they are health care providers and may obtain NPIs for their corporations (Entity Type 2 Organization). A sole proprietorship is an Entity Type 1 (Individual). (A sole proprietorship is a form of business in which one person owns all the assets of the business and is solely liable for all the debts of the business in an individual capacity. Therefore, sole proprietorships are not organization health care providers.) Note that sole proprietorships may obtain only one NPI. Sole proprietorships must report their SSNs (not EINs even if they have EINs). Virtually any health care provider could be a sole proprietorship, including most of the examples listed in Entity Type 2.

•Entity Type 2: Organizations that render health care or furnish health care supplies to patients; e.g., hospitals, home health agencies, ambulance companies, group practices, health maintenance organizations, durable medical equipment suppliers, pharmacies. Solely owned corporations that are health care providers obtain NPIs as Entity Type 2. If the organization is a subpart, check yes and furnish the Legal Business Name (LBN) and Taxpayer Identification Number (TIN) of the “parent” organization health care provider.(A subpart is a component of an organization health care provider. A subpart may be a different location or may furnish a different type of health care than the organization health care provider. For ease of reference, we refer to that organization health care provider as the “parent”.)

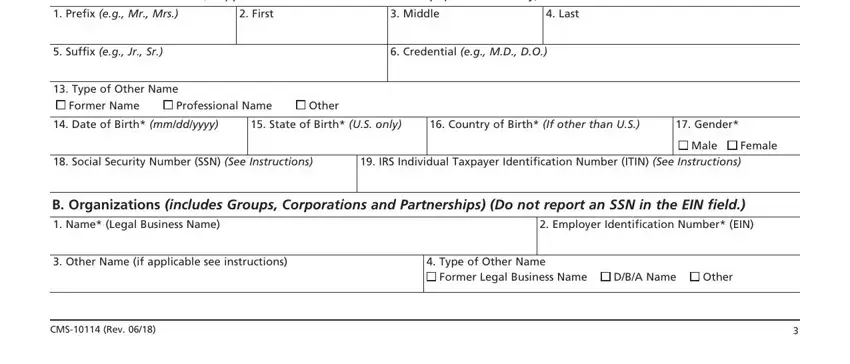

SECTION 2: IDENTIFYING INFORMATION

A. Individual (includes Sole Proprietorships and Incorporated Individuals)

NOTE: An individual may obtain only one NPI, regardless of the number of taxonomies (specialties), licenses, or business practice locations he/she may possess. SSN or ITIN information should only be listed in block 18 or block 19, respectively, of this form. DO NOT report SSN and ITIN information in any other section of this form. A sole proprietorship is an individual.

Name Information

1–6. Provide your full legal name. (Required first and last name) Do not use initials or abbreviations. If you furnish your SSN in block 18, this name must match the name on file with the Social Security Administration (SSA). The date of birth must also match that on the file with SSA.

Other name information

7–12. If you have used another name, including a maiden name, supply that “Other Name” in this area. (Optional) You may include multiple credentials.

13.Mark the check box to indicate the type of “Other Name” you used. (Required if 7–12 are completed)

14–16. Provide the date (Required), State (Required), and country (Required, if other than U.S.) of your birth. Do not use abbreviations other than United States (U.S.).

17.Indicate your gender. (Required)

18.Furnish your Social Security Number (SSN) for purposes of unique identification. (Optional) If you furnish your SSN, this name must match the name and date of birth on file with the Social Security Administration (SSA). If you do not furnish your SSN, processing of your application may be delayed because of the difficulty of verifying your identity via other means; you may also have difficulty establishing your proper identity with insurers from which you receive payments. If you are not eligible for an SSN, see item #19. If you do not furnish your SSN, you must furnish 2 proofs of identity with this application form. Acceptable forms include: valid passport, birth certificate, a photocopy of your U.S. driver’s license, State issued identification, or information requested in item 19. Visas and Employer Identification Cards are NOT acceptable.

19.If you do not qualify for an SSN, furnish your IRS Individual Taxpayer Identification Number (ITIN) along with a photocopy of your U.S. driver’s license, State issued ID, birth certificate or passport. You may not report an ITIN if you have an SSN. Do not enter an Employer Identification

Number (EIN) in the ITIN field. NOTE: Your valid passport, birth certificate, photocopy of the U.S. driver’s license or State issued identification must accompany your ITIN. If you do not furnish the information requested in blocks 18 or 19, you must furnish 2 proofs of identity with this application form: valid passport, birth certificate, a valid photocopy of your U.S. driver’s license or State issued identification. Visas and Employer Identification Cards are NOT acceptable.