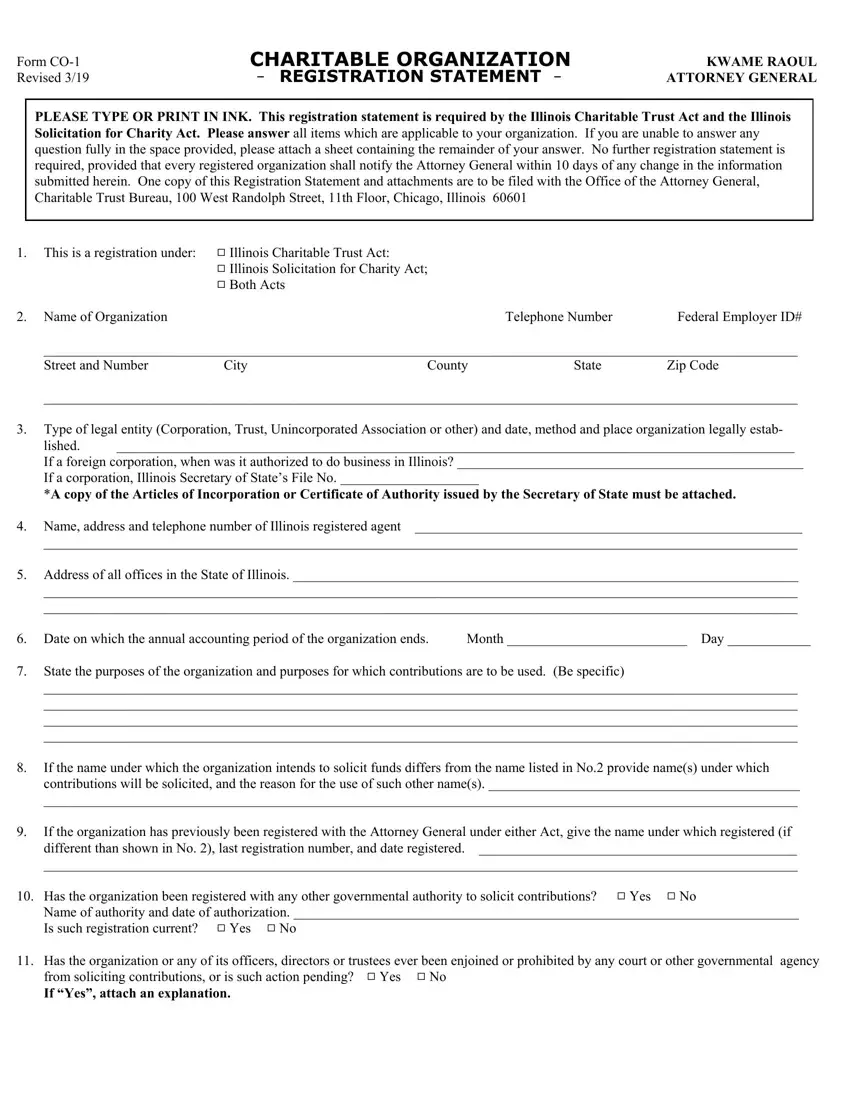

PLEASE TYPE OR PRINT IN INK. This registration statement is required by the Illinois Charitable Trust Act and the Illinois Solicitation for Charity Act. Please answer all items which are applicable to your organization. If you are unable to answer any question fully in the space provided, please attach a sheet containing the remainder of your answer. No further registration statement is required, provided that every registered organization shall notify the Attorney General within 10 days of any change in the information submitted herein. One copy of this Registration Statement and attachments are to be filed with the Office of the Attorney General, Charitable Trust Bureau, 100 West Randolph Street, 11th Floor, Chicago, Illinois 60601

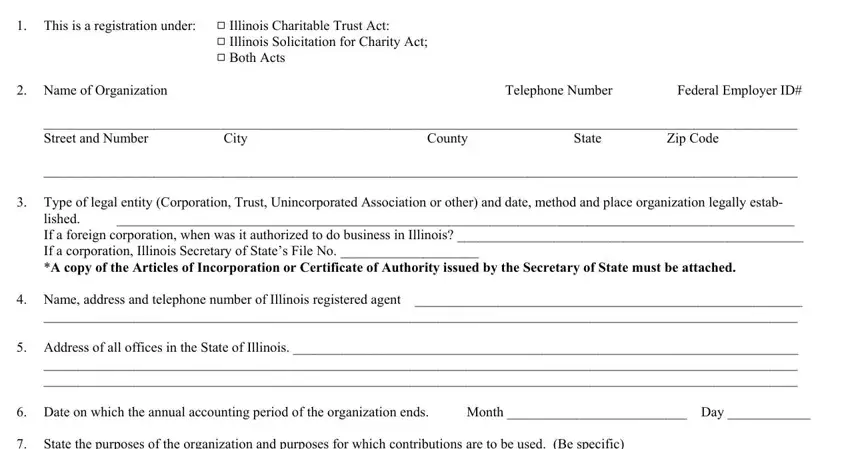

1.This is a registration under: 9 Illinois Charitable Trust Act:

9 Illinois Solicitation for Charity Act;

9 Both Acts

2. Name of OrganizationTelephone Number Federal Employer ID#

_____________________________________________________________________________________________________________

Street and Number CityCountyState Zip Code

_____________________________________________________________________________________________________________

3.Type of legal entity (Corporation, Trust, Unincorporated Association or other) and date, method and place organization legally estab- lished. __________________________________________________________________________________________________

If a foreign corporation, when was it authorized to do business in Illinois? __________________________________________________

If a corporation, Illinois Secretary of State’s File No. ____________________

*A copy of the Articles of Incorporation or Certificate of Authority issued by the Secretary of State must be attached.

4. Name, address and telephone number of Illinois registered agent ________________________________________________________

_____________________________________________________________________________________________________________

5.Address of all offices in the State of Illinois. _________________________________________________________________________

_____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________

6. Date on which the annual accounting period of the organization ends. |

Month __________________________ Day ____________ |

7.State the purposes of the organization and purposes for which contributions are to be used. (Be specific)

_____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________

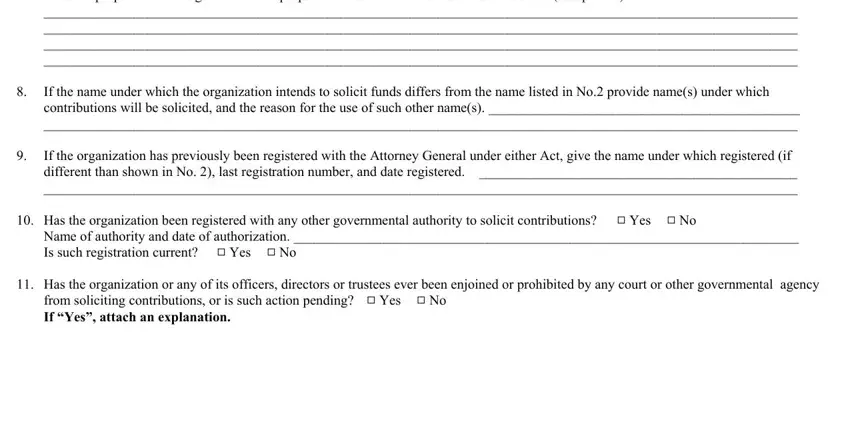

8.If the name under which the organization intends to solicit funds differs from the name listed in No.2 provide name(s) under which contributions will be solicited, and the reason for the use of such other name(s). _____________________________________________

_____________________________________________________________________________________________________________

9.If the organization has previously been registered with the Attorney General under either Act, give the name under which registered (if different than shown in No. 2), last registration number, and date registered. ______________________________________________

_____________________________________________________________________________________________________________

10. |

Has the organization been registered with any other governmental authority to solicit contributions? 9 Yes 9 No |

|

Name of authority and date of authorization. _________________________________________________________________________ |

|

Is such registration current? 9 Yes 9 No |

11. |

Has the organization or any of its officers, directors or trustees ever been enjoined or prohibited by any court or other governmental agency |

|

from soliciting contributions, or is such action pending? 9 Yes 9 No |

If “Yes”, attach an explanation.