It's simple to fill out the Form Cs 22 Alabama empty lines. Our PDF editor will make it virtually effortless to complete almost any PDF. Down the page are the basic four steps you'll want to consider:

Step 1: Select the button "Get Form Here".

Step 2: So, you can start modifying the Form Cs 22 Alabama. Our multifunctional toolbar is readily available - add, delete, alter, highlight, and conduct other commands with the content in the form.

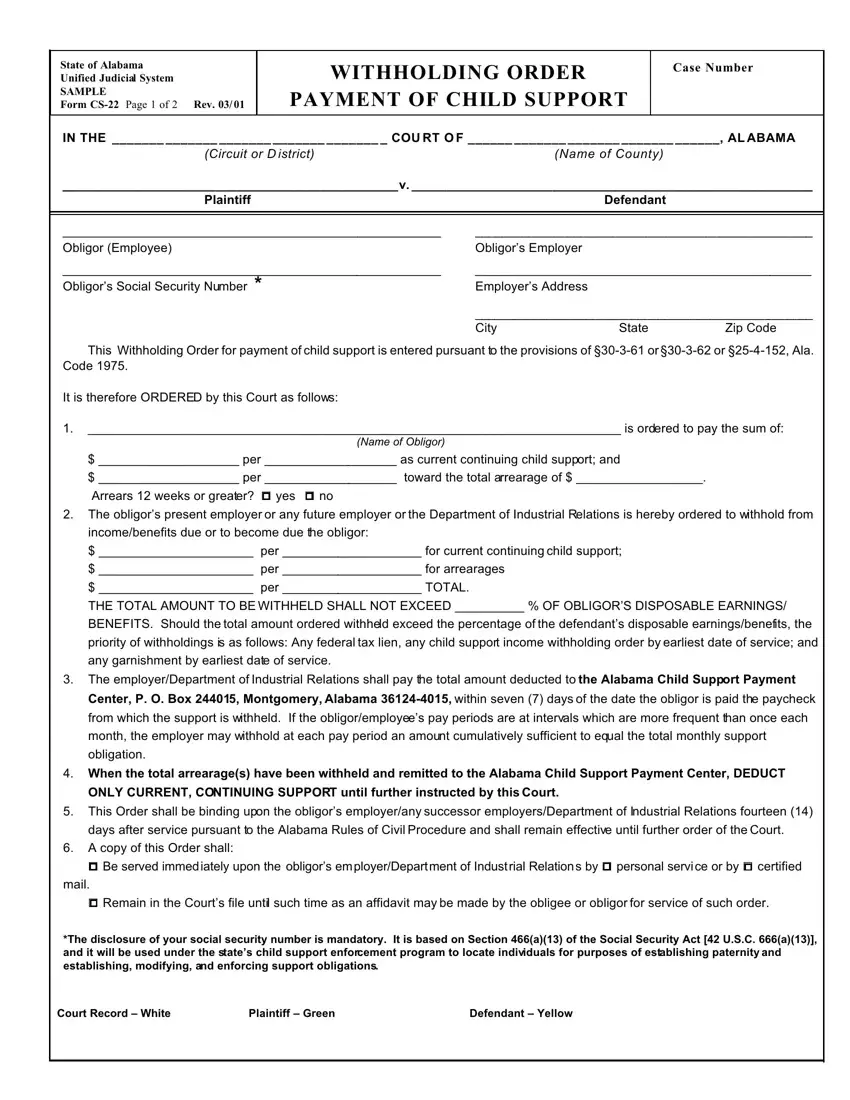

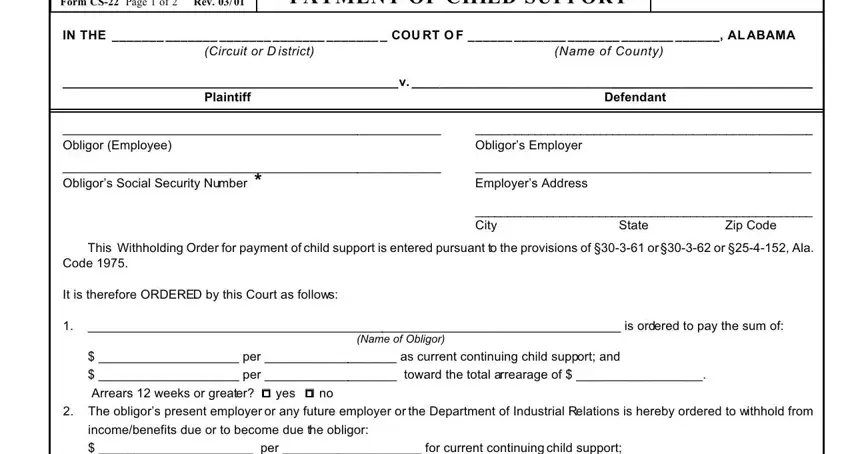

Provide the appropriate material in each one area to complete the PDF Form Cs 22 Alabama

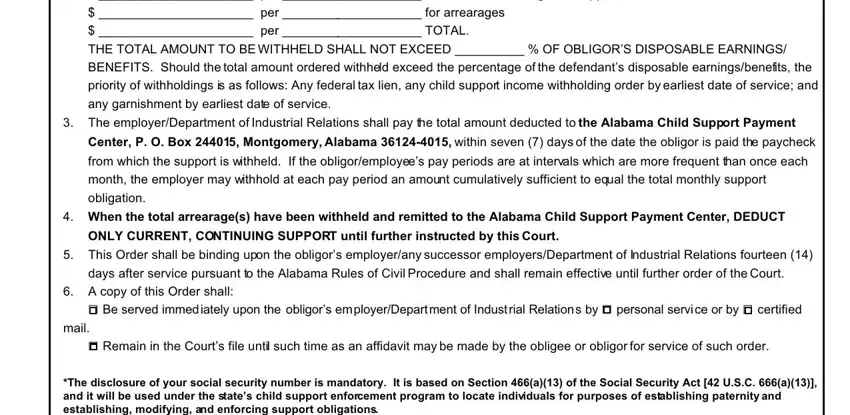

Inside the section incomebenefits due or to become, The employerDepartment of, Center P O Box Montgomery Alabama, from which the support is withheld, When the total arrearages have, ONLY CURRENT CONTINUING SUPPORT, This Order shall be binding upon, A copy of this Order shall, G Be served immed iately upon the, mail, G Remain in the Courts file until, and The disclosure of your social provide the details that the system requests you to do.

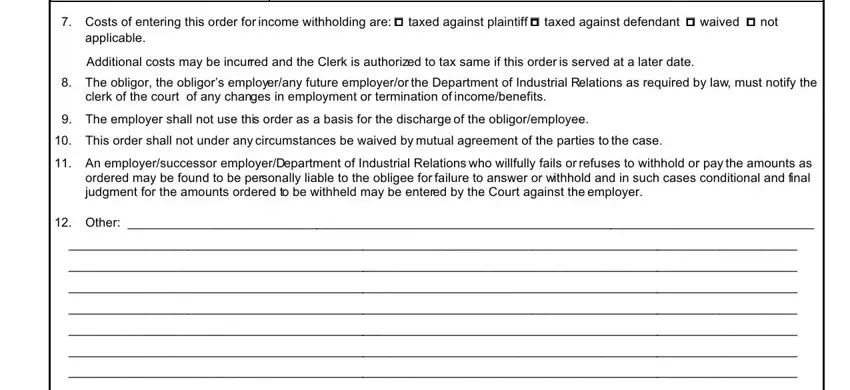

Jot down the necessary data when you find yourself on the Costs of entering this order for, applicable, Additional costs may be incurred, The obligor the obligors, clerk of the court of any changes, The employer shall not use this, This order shall not under any, An employersuccessor, and Other part.

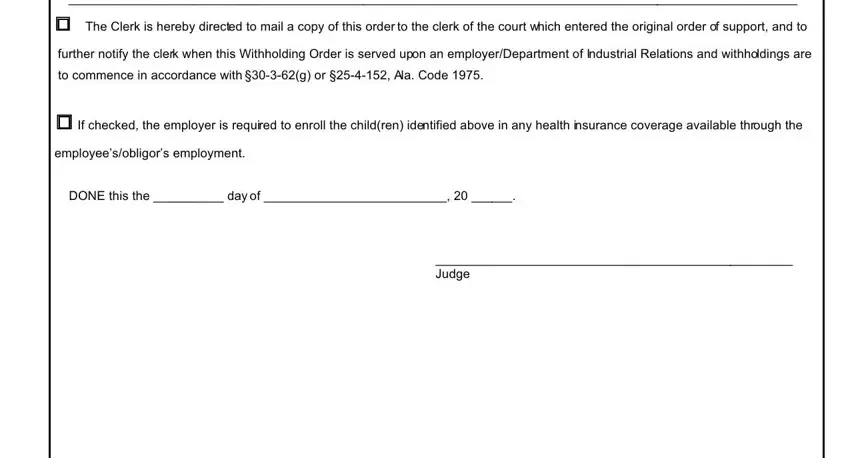

You have to specify the rights and obligations of the sides within the G The Clerk is hereby directed to, further notify the clerk when this, to commence in accordance with g, G If checked the employer is, employeesobligors employment, DONE this the day of, and Judge field.

Step 3: After you select the Done button, the finalized document is simply exportable to each of your gadgets. Or alternatively, it is possible to deliver it using mail.

Step 4: You can also make duplicates of your document toremain away from all of the potential future problems. You need not worry, we do not publish or record your details.