Using the online tool for PDF editing by FormsPal, you'll be able to fill out or modify 3911 taxpayer statement refund form right here. Our development team is always working to develop the editor and help it become much better for users with its handy functions. Uncover an ceaselessly progressive experience now - take a look at and uncover new possibilities as you go! All it takes is a couple of basic steps:

Step 1: Open the form inside our editor by clicking the "Get Form Button" in the top area of this webpage.

Step 2: As you open the PDF editor, you will see the document ready to be completed. Apart from filling in different fields, you may as well do many other things with the file, such as putting on custom text, changing the initial textual content, inserting illustrations or photos, affixing your signature to the form, and a lot more.

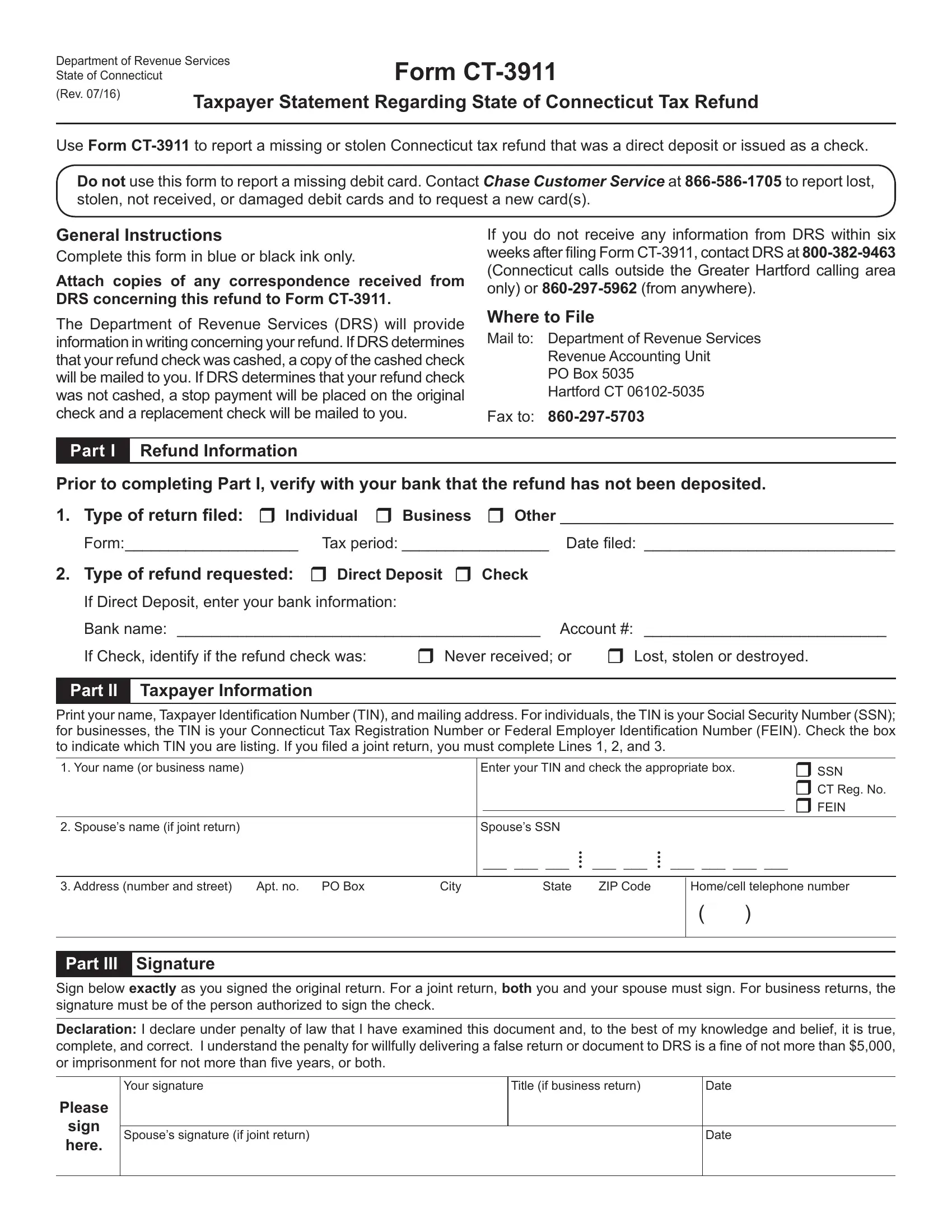

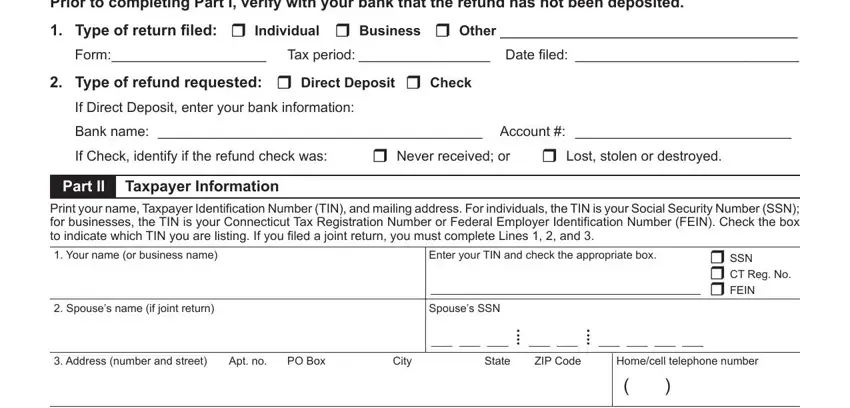

When it comes to blanks of this particular form, this is what you should do:

1. It is recommended to fill out the 3911 taxpayer statement refund form properly, therefore be attentive while working with the sections containing these fields:

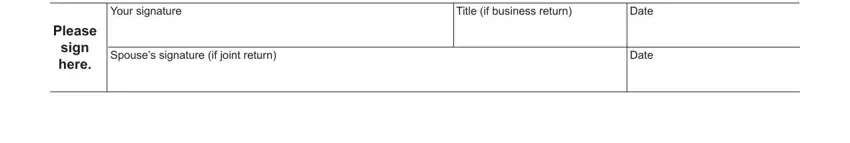

2. After finishing the previous section, go to the next stage and fill in the necessary details in all these blanks - Your signature, Title if business return, Date, Please, sign here, Spouses signature if joint return, and Date.

You can potentially make errors when filling in the Date, therefore ensure that you take another look prior to deciding to submit it.

Step 3: After you have looked over the information you filled in, press "Done" to complete your FormsPal process. Join FormsPal right now and immediately use 3911 taxpayer statement refund form, prepared for download. All modifications you make are kept , helping you to change the file at a later point as required. FormsPal is dedicated to the personal privacy of our users; we ensure that all personal information processed by our editor stays protected.