We used the top software engineers to design our PDF editor. This application will assist you to complete the form ct 3 document effortlessly and won't take up a great deal of your time. This easy instruction will allow you to start out.

Step 1: Select the button "Get form here" to access it.

Step 2: The form editing page is presently available. Include text or enhance current details.

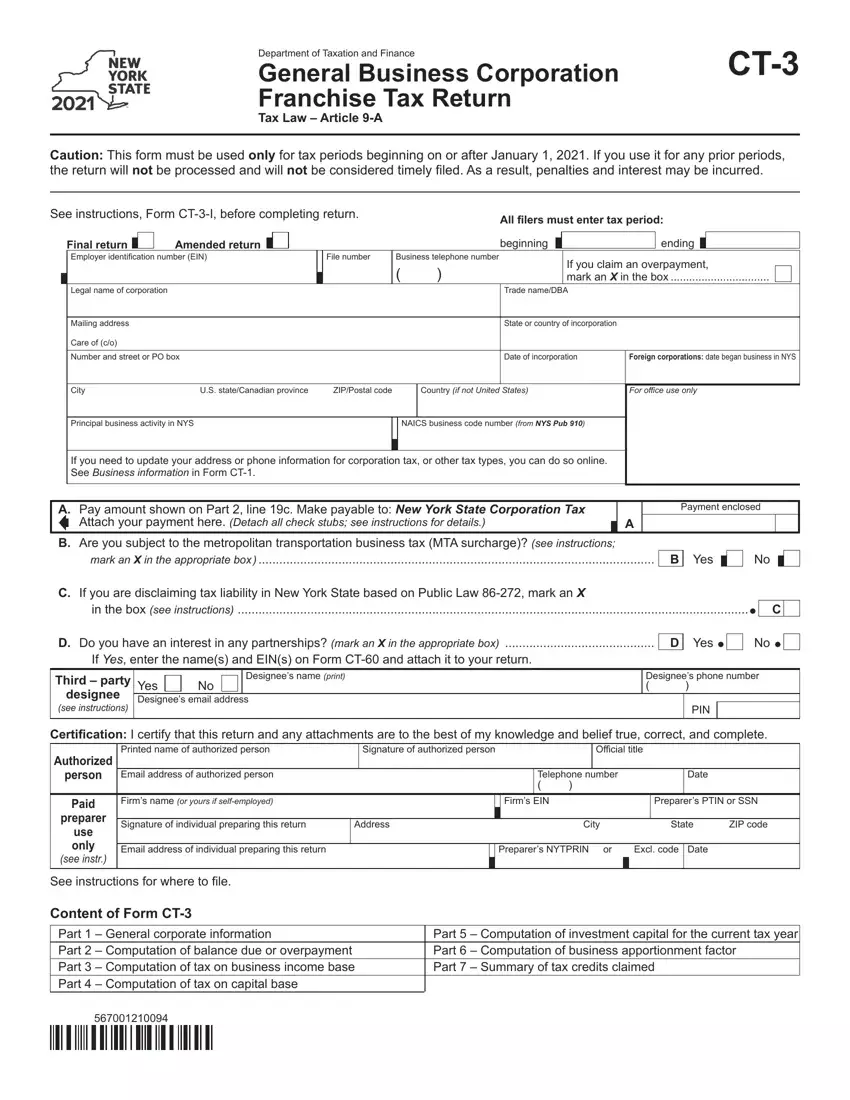

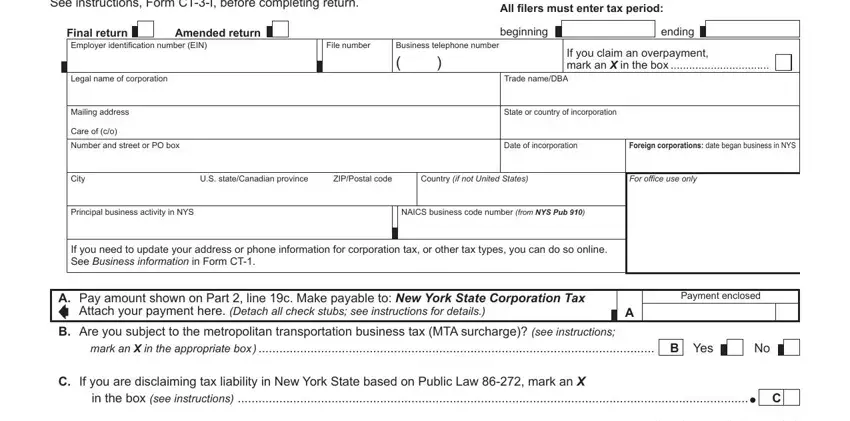

If you want to obtain the document, type in the data the software will require you to for each of the appropriate parts:

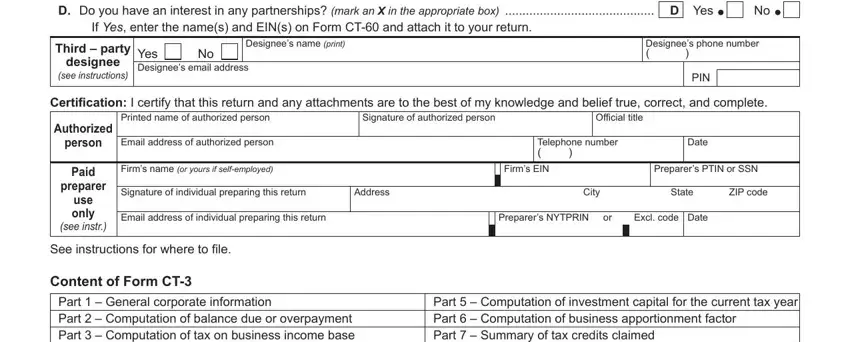

Write down the data in D Do you have an interest in any, If Yes enter the names and EINs on, Third party designee see, Yes Designees email address, Designees name print, Designees phone number, PIN, Certification I certify that this, Printed name of authorized person, Signature of authorized person, Official title, Authorized person, Paid preparer use only see instr, Email address of authorized person, and Telephone number.

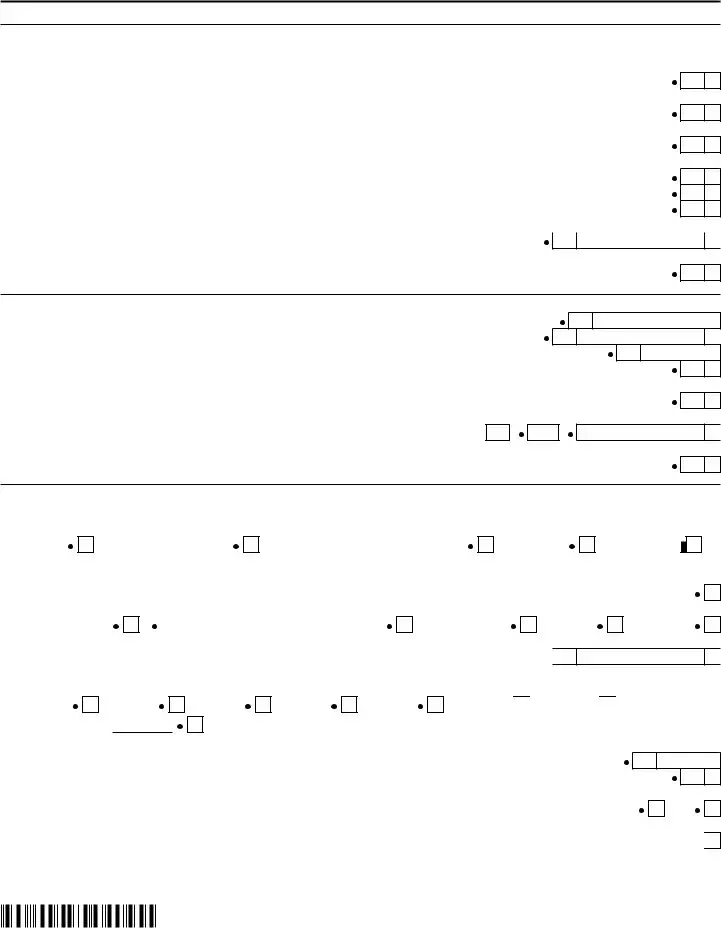

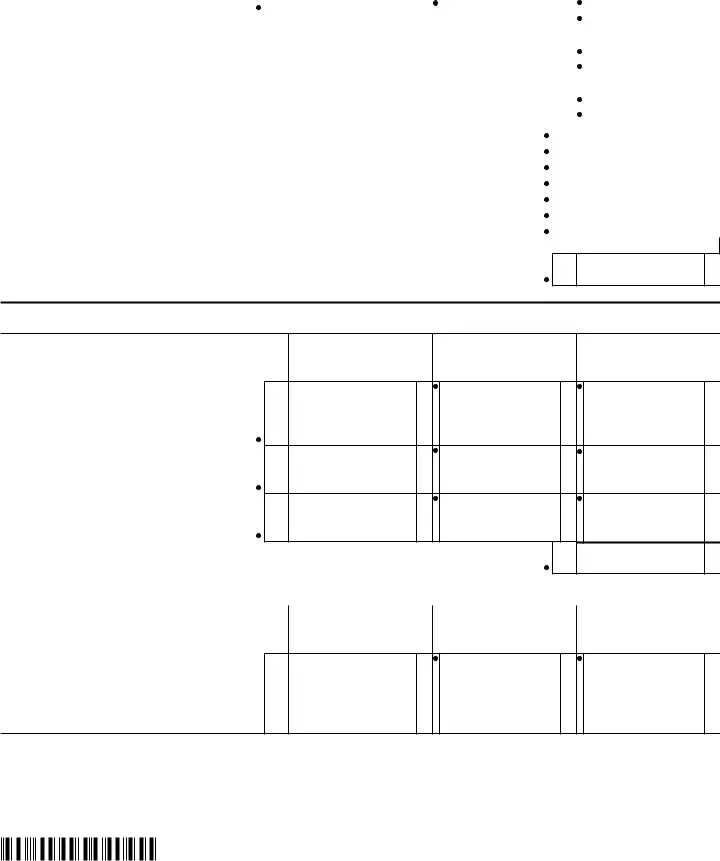

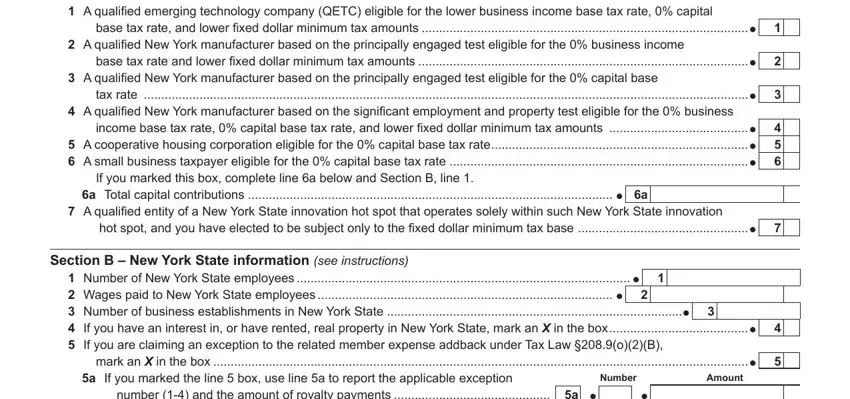

Provide the significant data in the Part General corporate, A qualified emerging technology, base tax rate and lower fixed, A qualified New York manufacturer, tax rate, A qualified New York manufacturer, income base tax rate capital base, If you marked this box complete, a Total capital contributions, A qualified entity of a New York, hot spot and you have elected to, Section B New York State, Number of New York State, mark an X in the box, and a If you marked the line box use part.

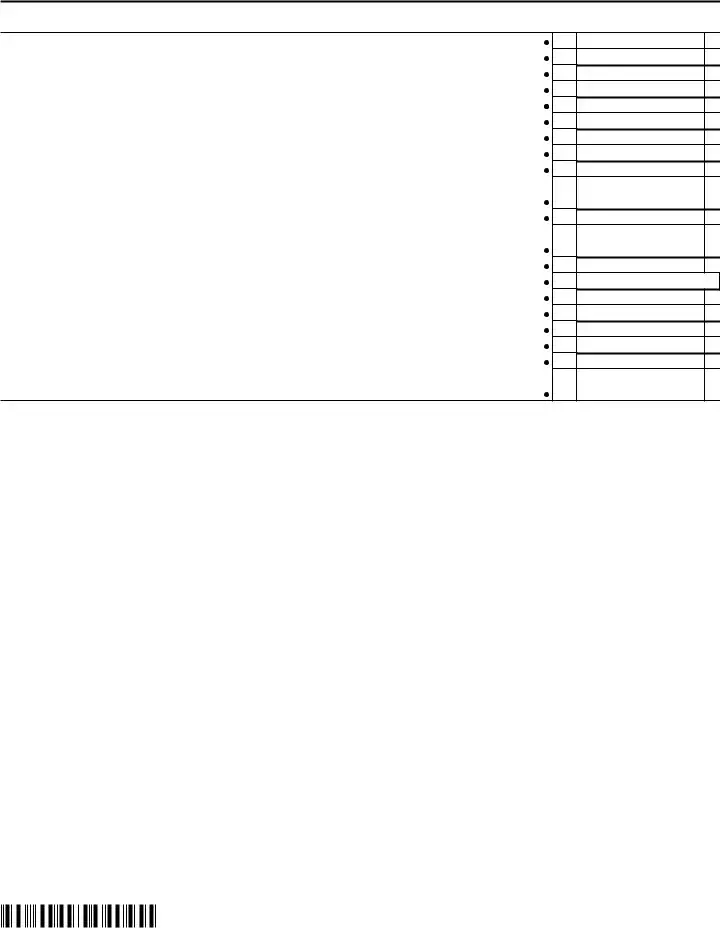

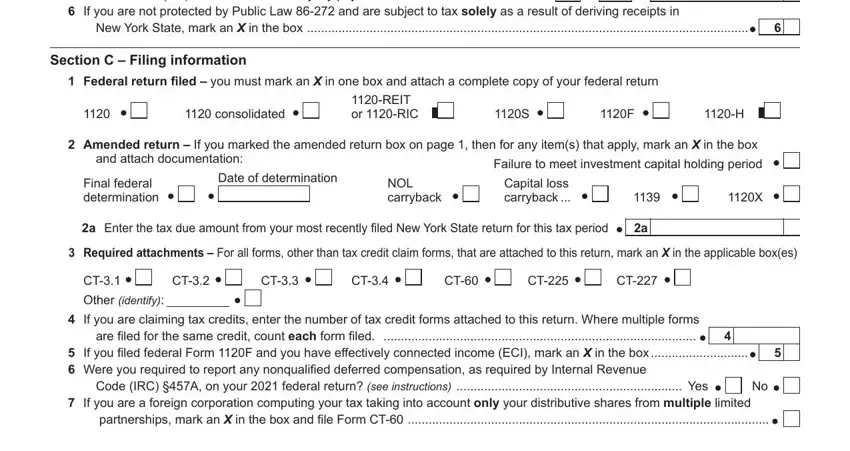

As part of section number and the amount of royalty, If you are not protected by, New York State mark an X in the, Section C Filing information, Federal return filed you must, consolidated, REIT or RIC, Amended return If you marked the, and attach documentation, Final federal determination, Date of determination, NOL carryback, Capital loss carryback, a Enter the tax due amount from, and Required attachments For all, specify the rights and responsibilities.

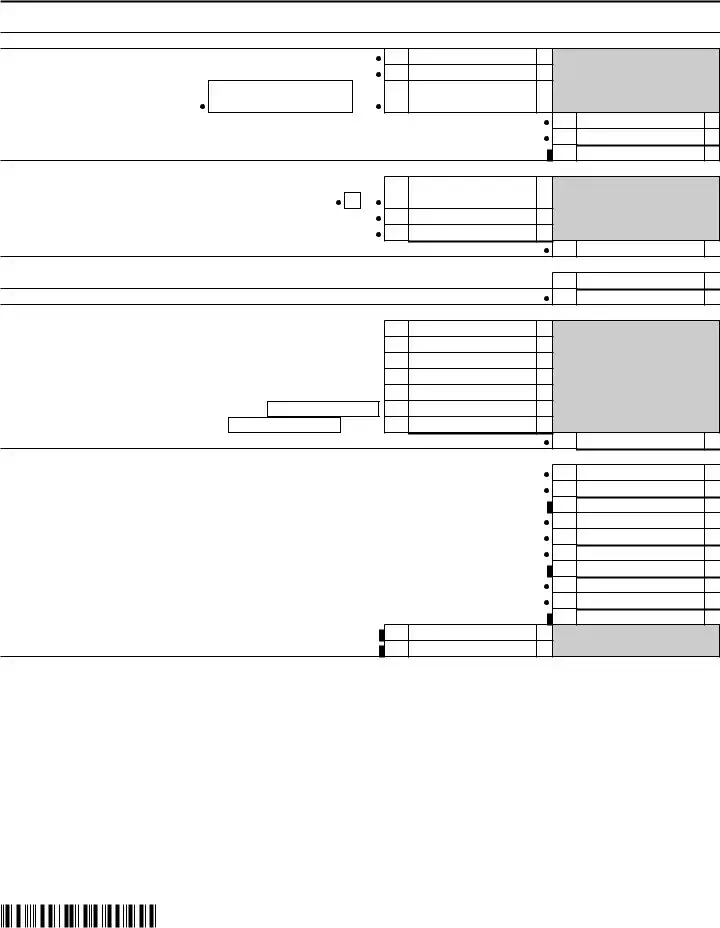

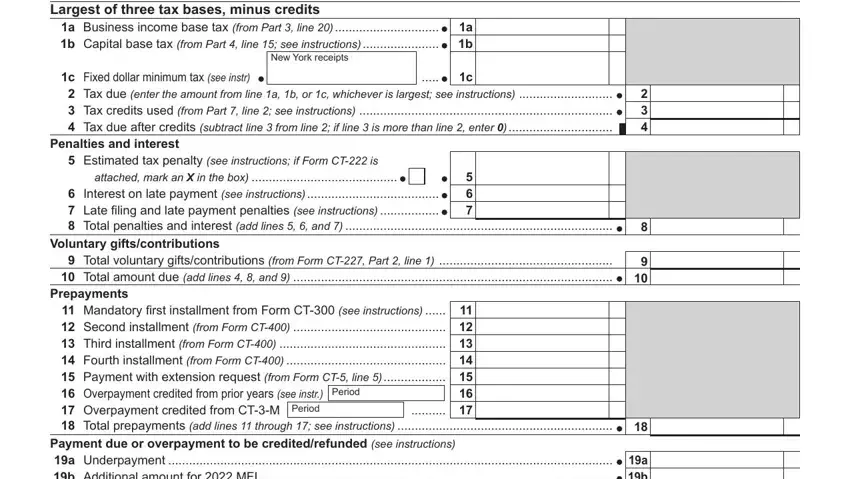

End by checking the following sections and completing them as required: Largest of three tax bases minus, a b, New York receipts, c Fixed dollar minimum tax see, Tax due enter the amount from, Penalties and interest, Estimated tax penalty see, attached mark an X in the box, Interest on late payment see, Voluntary giftscontributions, and Total voluntary.

Step 3: Press the "Done" button. It's now possible to upload the PDF form to your device. Aside from that, it is possible to deliver it through electronic mail.

Step 4: Come up with at least two or three copies of the document to remain away from any sort of potential difficulties.