In the realm of real estate transactions in Colorado, the DR 1083 form serves a critical role by detailing the regulations regarding the conveyance of a Colorado Real Property Interest. This document, structured and dispensed by the Colorado Department of Revenue, is a definitive source for individuals or entities navigating the complexities of real estate sales within the state boundaries. At its core, the form gathers comprehensive information about the transferor, including personal details and specifics pertaining to the property being sold, such as the type of property, date of closing, address or legal description, selling price, and details related to the Colorado tax withheld. Notably, the DR 1083 form embodies certain statutory requirements, particularly focusing on sales exceeding $100,000 by nonresidents, which are subject to withholding tax, aiming to pre-collect anticipated Colorado income tax on gains from such sales. This form, alongside DR 1079 if applicable, needs to be filed with the Colorado Department of Revenue within a specified timeframe following the property's closing date, emphasizing its significance in ensuring tax compliance and the smooth execution of property transfer processes. Fulfilling these obligations correctly can avert potential penalties, underscoring the form's paramount importance in Colorado's real estate proceedings.

| Question | Answer |

|---|---|

| Form Name | Form Dr 1083 Colorado |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | form 1083, transferor, herebyaffirmthatIam, 1083 form |

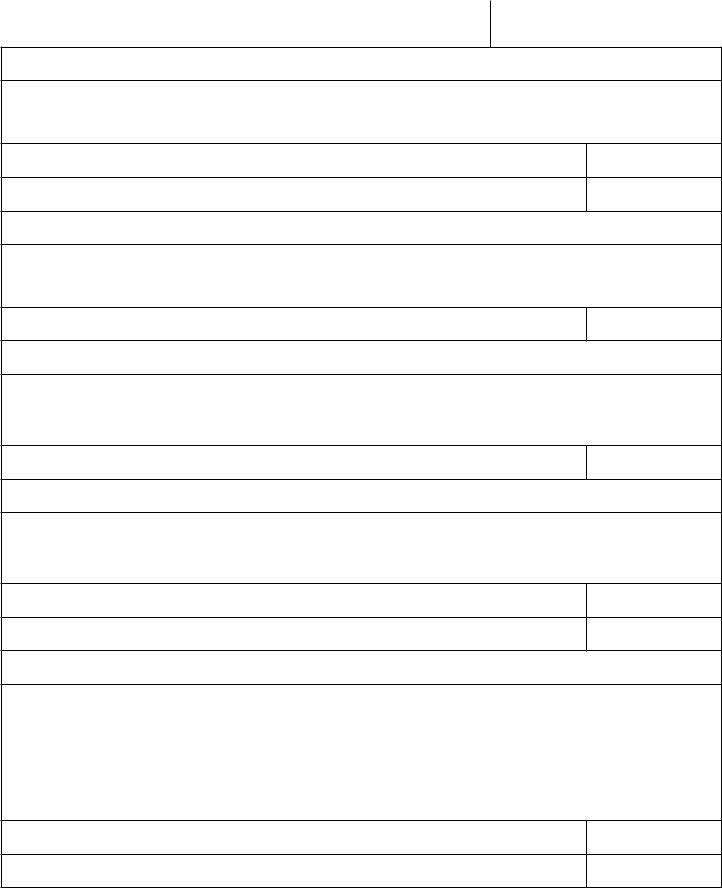

DR 1083 (10/17/13)

COLORADO DEPARTMENT OF REVENUE

Denver, CO

WWW. TAXCOLORADO.COM

*141083==19999*

Information with Respect to a Conveyance

of a Colorado Real Property Interest

1. Transferor's Last Name |

|

|

|

|

|

First Name |

|

|

|

|

Middle Initial |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

City |

|

State |

|

Zip |

||

|

|

|

|

|

|

|

|

|

|

|

|

||

Spouse's Last Name (if applicable) |

|

|

|

|

|

First Name |

|

|

|

|

Middle Initial |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

City |

|

State |

|

Zip |

||

|

|

|

|

|

|

|

|

|

|

|

|

||

2. Transferor is (check one): |

|

|

|

|

|

|

If other, please specify: |

|

|

|

|||

|

Individual |

Estate |

Corporation |

Trust |

Other (specify) |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

||||

3. |

SSN |

|

|

Colorado Account Number |

4. FEIN |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|||||

5. |

Type of property sold |

|

|

|

|

|

|

6.Date of closing (MM/DD/YY) |

|||||

|

|

|

|

|

|

|

|

|

|

||||

7. |

Address or legal description of property sold |

|

|

|

City |

|

State |

|

Zip |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

Selling price of the property |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

9. |

Selling price of this transferor's interest |

|

|

|

|

|

$ |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

||||

10. If Colorado tax was withheld, check this box |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||

11. Amount of tax withheld |

|

|

|

|

|

|

|

$ |

|

|

|

||

|

|

|

|

|

|

|

|||||||

12. If withholding is not made, give reason (check one): |

|

|

|

|

|

||||||||

|

a. Afirmation of Colorado residency signed |

|

|

|

|

|

|

|

|

|

|||

|

b. Afirmation of permanent place of business signed |

|

|

|

|

|

|

||||||

|

c. Afirmation of principal residence signed |

|

|

|

|

|

|

|

|

|

|||

|

d. Afirmation of partnership signed |

|

|

|

|

|

|

|

|

|

|||

|

e. Afirmation of no tax reasonably estimated to be due to no gain on sale signed |

|

|

|

|||||||||

|

f. No net proceeds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

13. Title Insurance Company |

|

|

|

|

|

|

|

Phone Number |

|||||

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Address |

|

|

|

|

City |

|

|

State |

|

Zip |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

File this form together with DR 1079, if applicable, within 30 days of the closing date with the

Colorado Department of Revenue

Denver, CO

*141083==29999*

Afirmation of Colorado Residency

I (we) hereby afirm that I am (we are) the transferor(s) or the iduciary of the transferor of the property described on this

DR 1083 and that as of the date of closing I am (we are) or the estate or the trust is a resident of the State of Colorado.

Signed under the penalty of perjury

Signature of transferor or iduciary

Date (MM/DD/YY)

Spouse's signature (if applicable)

Date (MM/DD/YY)

Afirmation of Permanent Place of Business

I hereby afirm that the transferor of the property described on this DR 1083 is a corporation which maintains a

permanent place of business in Colorado.

Signed under the penalty of perjury.

Signature of corporate oficer

Date (MM/DD/YY)

Afirmation of Sale by Partnership

I hereby afirm that the transfer of property described on this DR 1083 was sold by an organization deined as a partnership under section 761(a) of the Internal Revenue Code and required to ile an annual federal partnership return

of income under section 6031(a) of the Internal Revenue Code.

Signed under the penalty of perjury.

Signature of general partner

Date (MM/DD/YY)

Afirmation of Principal Residence

I hereby afirm that I am (we are) the transferor(s) of the property described on this DR 1083 and immediately prior to the

transfer it was my (our) principal residence which could qualify for the exclusion of gain provision of section 121 of the Internal Revenue Code.

Signed under the penalty of perjury.

Signature of transferor

Date (MM/DD/YY)

Spouse's signature if applicable

Date (MM/DD/YY)

Afirmation of No Reasonably Estimated Tax to be Due

I hereby afirm that I am (we are) the transferor(s) or an oficer of the

the transfer.

Please understand before you sign this afirmation that nonresidents of Colorado are subject to Colorado tax on gains from the sale of Colorado real estate to the extent such gains are included in federal taxable income.

Signed under the penalty of perjury.

Signature of transferor, oficer or iduciary

Date (MM/DD/YY)

Spouse's signature if applicable

Date (MM/DD/YY)

Instructions for DR 1083

In general. With certain exceptions, sales of Colorado real property valued of $100,000 of more, and are made by nonresidents of Colorado, are subject to a withholding tax in anticipation of the Colorado income tax that will be due on the gain from the sale.

A transferor who is an individual, estate, or trust will be subject to the withholding tax if either the federal Form

disbursement of the funds resulting from the transaction shows a

A corporate transferor will be subject to the withholding tax if immediately after the transfer of the title to the Colorado real property interest, it has no permanent place of business in Colorado. A corporation will be deemed to have a permanent place of business in Colorado if it is a

Colorado domestic corporation, if it is qualiied by law to

transact business in Colorado, or if it maintains and staffs a permanent ofice in Colorado.

Amount of withholding. The withholding shall be made by the title insurance company or its authorized agent

or any attorney, bank, savings and loan association,

savings bank, corporation, partnership, association, joint stock company, trust, unincorporated organization or any

combination thereof acting separately or in concert that provides closing and settlement services. The amount to be withheld shall be the lesser of: (a) two percent of the selling price of the property interest or, (b) the net proceeds that would otherwise be due to the transferor as shown on the settlement statement.

"Closing and settlement services" means providing services for the beneit of all necessary parties in

connection with the sale, leasing, encumbering, mortgaging, creating a secured interest in and to the real property, and the receipt and disbursement of money in connection with any sale, lease, encumbrance, mortgage, or deed of trust.

Exceptions to Withholding. Withholding shall not be made when:

the selling price of the property is not more than $100,000;

or

the transferor is an individual, estate, or trust and both the Form

disbursement of funds show a Colorado address for the transferor;

or

the transferee is a bank or corporate beneiciary under a mortgage or beneiciary under deed of trust,

and the Colorado real property is acquired in judicial nonjudicial foreclosure or by deed in lieu of foreclosure;

or

the transferor is a corporation incorporated under Colorado law or currently registered with the

Secretary of State's Ofice as authorized to transact

business in Colorado;

or

the title insurance company or the person providing

the closing and settlement services, in good faith, relies upon a written afirmation executed by the

transferor, certifying under the penalty of perjury one of the following:

that the transferor, if a corporation, has a permanent place of business in Colorado;

that the transferor is a partnership as deined

in section 761(a) of the Internal Revenue

Code required to ile an annual federal return

of income under section 6031(a) of the Internal Revenue Code;

that the Colorado real property being conveyed is the principal residence of the transferor which could qualify for the exclusion of gain provisions of section 121 of the Internal Revenue Code;

that the transferor will not owe Colorado income tax reasonably estimated to be due

from the inclusion of the actual gain required to be recognized on the transaction in the gross

income of the transferor.

Normally Colorado tax will be due on any transaction upon which gain will be recognized for federal income tax purposes. Gain will normally be recognized for federal income tax

purposes any time the selling price of the property exceeds the total of the taxpayer's adjusted basis in the property, plus the expenses incurred in the sale of the property. The taxpayer's adjusted basis of the property will normally be the taxpayer's total investment in the property, minus any depreciation thereon he has previously claimed for federal income tax purposes.

Partnership as Transferor. Sales of real property interests by organizations recognized as partnerships for federal income tax purposes and required to ile annual federal

partnership returns of income will not be subject to the

Colorado withholding tax. This exception will not apply to joint ownerships of property which are not recognized as

partnerships for federal income tax purposes. The sale of property jointly owned by a husband and wife, for example, is a sale by two individuals, not a sale by a partnership, and not exempt from withholding tax.

Completion of DR 1083. DR 1083 must be completed and submitted to the Department of Revenue with respect to sales of Colorado real property if Colorado tax was withheld

from the net proceeds from the sale, or if Colorado tax would have been withheld but for the signing of an afirmation by

the transferor.

Information. Forms and additional information are available through the Tax Information Index at WWW.TAXCOLORADO.COM or call (303)

Line 1. Enter the name and address of the transferor.

In the case of multiple transferors of the same real property, a separate DR 1083 must be iled

for each transferor except that if the transferors are husband and wife at the time of closing who held the property as joint tenants, tenants by the entirety, tenants in common, or as community property, and they are both subject to withholding or both exempt from withholding, treat them as a single transferor and list both of their names on line 1. Do not list husband and wife as one transferor if they do not choose to be listed as one transferor. Use the same address as is used

on the federal FORM

available.

Line 3. If both husband and wife are listed on line 1, show both Social Security Numbers on line 3.

Line 5. Type of property sold would be residential, rental, commercial, unimproved land, farm, etc.

Line 6. Address or legal description would be the same as shown on federal FORM

Line 7. Date of closing would be the same as shown on Form

Line 8. Selling price of the property is the contract sales price. Selling price means the sum of:

•the cash paid or to be paid but not including interest;

•the fair market value of other property transferred or to be transferred; and

•the outstanding amount of any liability assumed by the transferee to which the Colorado real property interest is subject immediately before and after the transfer.

Line 9. Selling price of the transferor's interest is that part of the selling price entered on line 8 apportioned to the ownership interest of the transferor for whom the DR 1083 is being prepared. For example, if the property was owned 60% by Smith and 40% by Jones and the property was sold for $150,000, theDR1083beingpreparedforJoneswouldshow $150,000online8and$60,000online9.Notethat it is the amount on line 8 that determines whether or not the $100,000 withholding tax threshold is met, not the amount entered on line 9, but the withholding is to be computed on the amount on line 9 if it is smaller than the amount on line 8.

Line 10 If Colorado tax is withheld on the transaction, check the box on line 10 and show the amount withheld on line 11.

Line 11 If Colorado tax is being withheld on the transfer, thetitleinsurancecompanyorthepersonproviding theclosingandsettlementservicesmustcomplete DR 1079 which is the form used to transmit the tax withheld to the Colorado Department of Revenue.

Line 12. If Colorado tax is not withheld on the transaction, check appropriate box on line 12.

Due date and penalty. The title insurance company or other

person providing the closing and settlement services must ile DR 1083, together with DR 1079 if Colorado tax was

withheld on the transfer, with the Colorado Department of Revenue within 30 days of the closing date of the transaction.

Any title insurance company or its authorized agent which is required to withhold any amount pursuant to

property interests) and fails to do so shall be liable for the greater of ive hundred dollars or ten percent of the amount required to be withheld, not to exceed

dollars.