Whether you are a business involved in the marine industry or deal with pollutants subject to taxes in Florida, understanding the DR-309660 form is crucial for optimizing your financial strategies. The Florida Department of Revenue provides this form as an Application for Pollutants Tax Refund, a critical document for any entity looking to reclaim funds from the state. Designed with specificity for pollutants tax recovery, the form meticulously guides applicants through a process requiring detailed information on pollutants exported or consumed in a manner that merits a tax refund. Scheduled to be filed quarterly, this form demands careful attention to the complete provision of applicant identification, tax details, and the precise calculation of refunds sought, along with a substantiating inventory and export details. Not only does it cover petroleum products and solvents but also extends to motor oils, lubricants, and ammonia-containing products, offering a substantial breadth of tax refund opportunities. Moreover, the document underscores the importance of punctuality, documentation, and the potential implications of submission errors. With its comprehensive structure, the DR-309660 form embodies the bridge between stringent regulatory mandates and the financial recuperation available to businesses within Florida’s pollutant management framework.

| Question | Answer |

|---|---|

| Form Name | Form Dr 309660 |

| Form Length | 6 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 30 sec |

| Other names | dr309660 florida department of revenue power of attorney form |

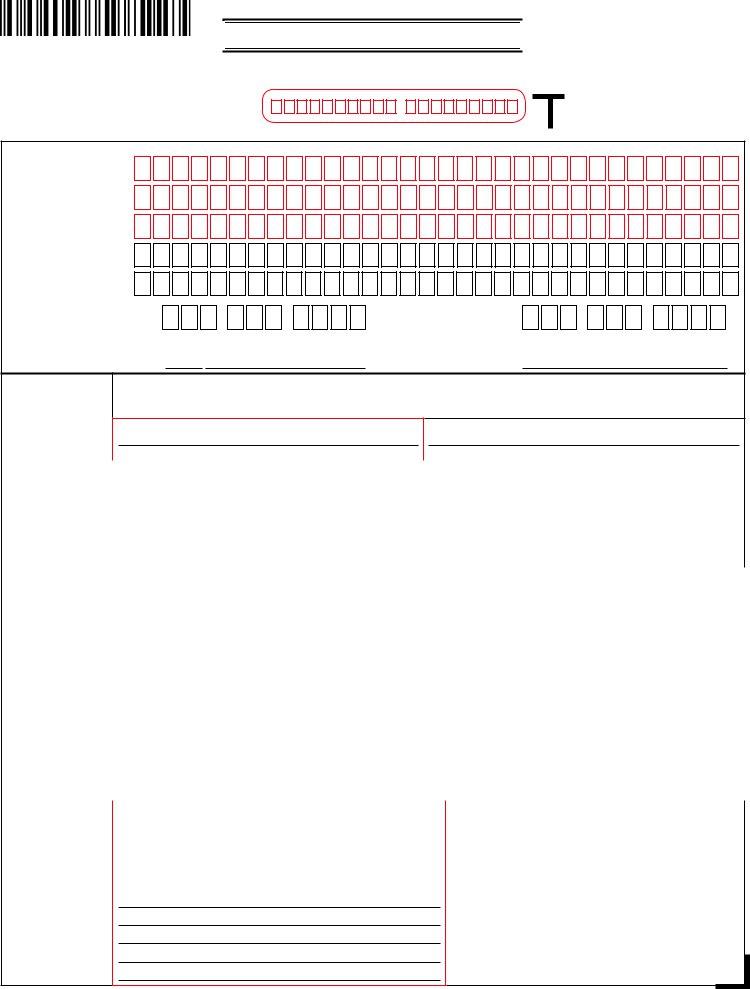

Florida Department of Revenue

Application for Pollutants Tax Refund

R. 01/11

Rule

Florida Administrative Code

Effective 01/11

Complete Parts 1 through 6 and attach appropriate documentation. Type or print clearly. Your refund application will be rejected if red boxes are not completed in full.

|

Handwritten Example |

|

|

Typed Example |

||||||

0 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

0123456789 |

|

|

|

|

|

|

|

|

Use black ink. |

||

Mail application to: Refund Subprocess

Florida Department of Revenue PO Box 6490

Tallahassee FL

Part 1 Fill in

Name of applicant: |

|

|

Mailing street address: |

|

|

Mailing city, state, ZIP: |

|

|

Location street address: |

|

|

Location city, state, ZIP: |

|

|

Business telephone number |

|

|

(include area code): |

|

|

Fax number (include area |

|

|

code optional): |

( |

) |

|

–

–

Home telephone number (include area code):

–

–

Part 2

Sign and date this form.

Under penalty of perjury, I swear or afirm that this application, including supporting documentation, has been examined by me and is true and correct for the period stated and is made in good faith according to Chapter 206, Florida Statutes (F.S.), and the regulations issued under authority thereof.

Signature of applicant/representative:

Date:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Print name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

Important - A Florida Department of Revenue Power of Attorney (Form |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

refund request is submitted by the applicant’s representative. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

Representative’s phone number: |

|

|

|

|

|

|

|

|

|

|

|

|

– |

|

|

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

Part 3 |

$ |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Enter amount of refund. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 4 |

Identiication number of applicant: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||

|

Provide the |

Federal employer identiication number: |

|

|

Fuel tax license number: |

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

identiication number |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

under which the tax |

|

|

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

was paid. If you do not |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

have a federal employer |

Business partner number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

identiication number, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

provide your social |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

security number. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Enter the period shown |

Period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

on the tax return(s) |

|

|

|

|

|

|

|

|

|

M |

|

|

|

M |

|

|

|

D |

|

D |

Y Y |

|

|

M M |

|

|

|

D D |

|

|

Y Y |

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

used to report the tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and/or when it was |

Paid |

|

|

|

|

|

|

|

|

/ |

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

to |

|

|

|

|

|

|

/ |

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

paid. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

M M |

|

|

|

D D |

Y Y |

|

|

M M |

|

|

|

D D |

|

|

Y Y |

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||

|

Part 6 |

Reasons for this refund (additional sheets may be added): |

|

|

|

|

|

|

FOR DOR USE ONLY |

|

|

DOC TYPE 76 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Clarify and speed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REFUND |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

up your refund claim |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

by providing a brief |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Approval Amount $ _________________________________ |

||||||||||||||||||||||

|

explanation. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date ____________________________________________ |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Approved by______________________________________ |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

Review |

Refund Amount $ __________________________________ |

Date ____________________________________________ |

Approved by ______________________________________ |

|

Florida Department of Revenue |

|

|

|

|

|

|

|

Application for Pollutants Tax Refund |

|

|

|

|

|

R. 01/11 |

|

|

|

|

|

|

Page 2 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Coastal Protection |

Water Quality |

Inland Protection |

||||

Schedule A. |

|

|

|

|

|

|

|

1.Beginning Inventory (Must agree with closing inventory from prior quarter)

2.Purchases (From completed Schedule 1 – Schedule of Purchases)

3.Ending inventory (Use this igure for beginning inventory on next claim)

4.Barrels consumed ( Add Lines 1 and 2. Subtract Line 3)

5.Barrels not eligible for refund

6.Barrels claimed for refund (Line 4 minus Line 5 )

7. Refund (Line 6 multiplied by the rate per barrel) |

$ |

$ |

$ |

Schedule B. |

|

|

|

8.Beginning Inventory (Must agree with closing inventory from prior quarter)

9.Purchases (From Schedule 1- Schedule of Purchases)

10.Ending inventory (Use this igure for beginning inventory on next claim)

11.Gallons consumed ( Add Lines 8 plus 9. Subtract Line 10)

12.Gallons not eligible for refund

13.Gallons claimed for refund (Line 11 minus Line 12)

14. Refund (Line 13 multiplied by rate per gallon) |

$ |

$ |

$ |

Schedule C.

15.Beginning Inventory (Must agree with closing inventory from prior quarter)

16.Purchases (From Schedule 1- Schedule of Purchases)

17.Ending inventory (Use this igure for beginning inventory on next claim)

18.Barrels consumed ( Add Lines 15 plus 16. Subtract Line 17)

19.Barrels not eligible for refund

20.Barrels claimed for refund (Line 18 minus Line 19)

21. Refund (Line 20 multiplied by rate per barrel) |

$ |

$ |

$ |

Schedule D. Solvents |

|

|

|

22.Beginning Inventory (Must agree with closing inventory from prior quarter)

23.Purchases (From Schedule

24.Ending inventory (Use this igure for beginning inventory on next claim)

25.Gallons consumed ( Add Lines 22 plus 23. Subtract Line 24)

26.Gallons not eligible for refund

27.Gallons claimed for refund (Line 25 minus Line 26)

28. |

Refund (Line 27 multiplied by rate per gallon) |

$ |

$ |

$ |

|

|

|

|

|

|

|

29. |

Total net refund requested (Add Lines 7 plus 14 plus 21 and Line 28) |

$ |

|

|

|

30. |

Less refund processing fee |

$ |

|

|

|

31. |

Net refund due (Line 30 minus Line 31) |

$ |

|

|

|