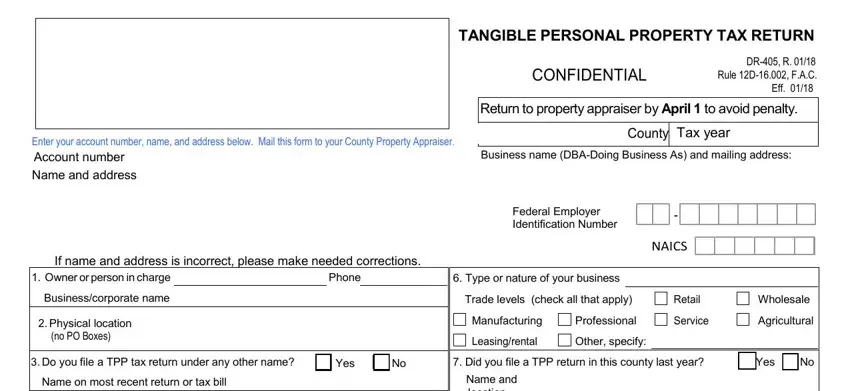

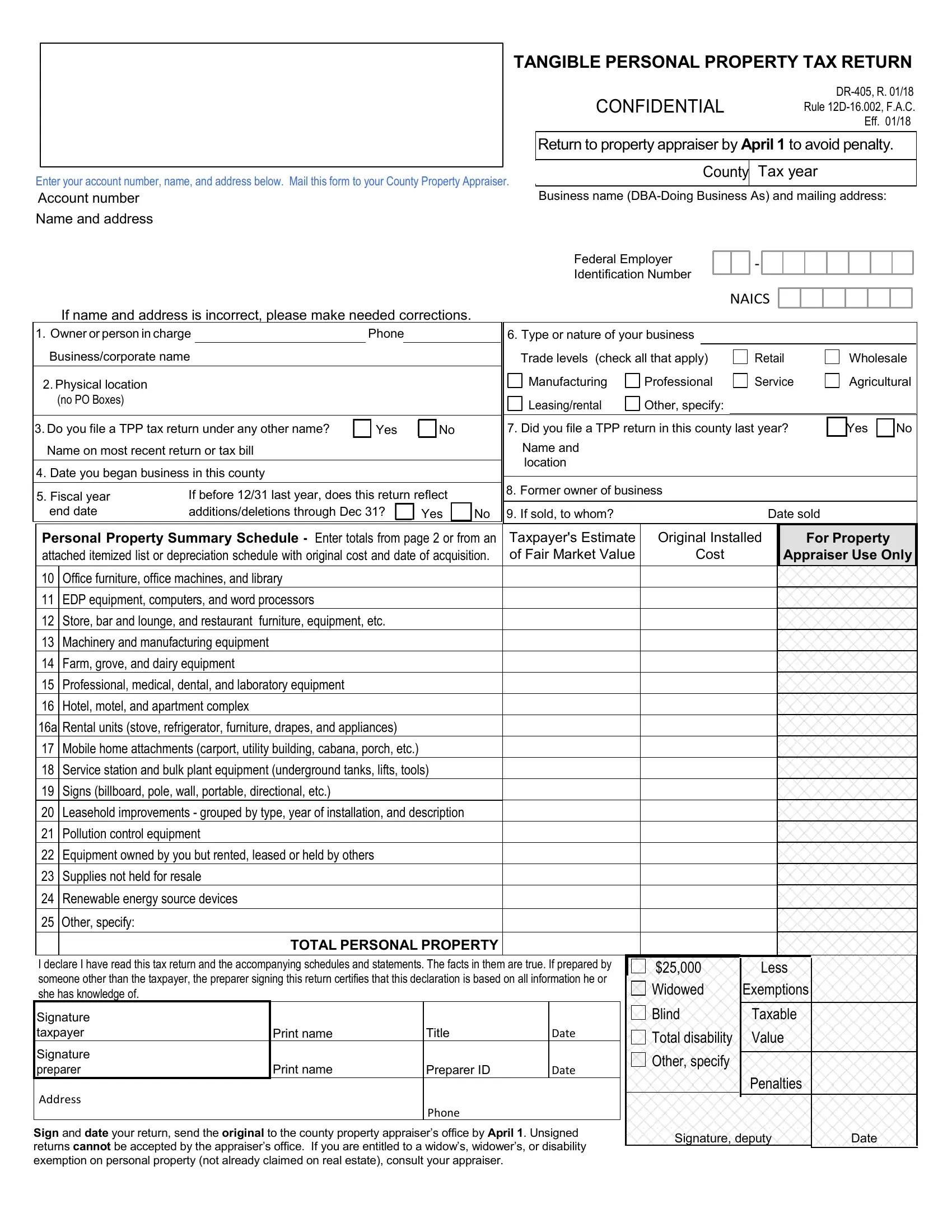

TANGIBLE PERSONAL PROPERTY TAX RETURN

DR-405, R. 01/18

Rule 12D-16.002, F.A.C.

Eff. 01/18

Enter your account number, name, and address below. Mail this form to your County Property Appraiser.

Account number

Name and address

Return to property appraiser by April 1 to avoid penalty.

County Tax year

Business name (DBA-Doing Business As) and mailing address:

Federal Employer |

|

|

- |

|

|

|

|

|

|

|

Identification Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If name and address is incorrect, please make needed corrections.

1. Owner or person in charge |

|

Phone |

|

|

|

|

|

Business/corporate name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. Physical location |

|

|

|

|

|

|

|

|

|

|

|

|

|

(no PO Boxes) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. Do you file a TPP tax return under any other name? |

|

|

Yes |

|

No |

|

|

|

|

|

|

|

Name on most recent return or tax bill |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

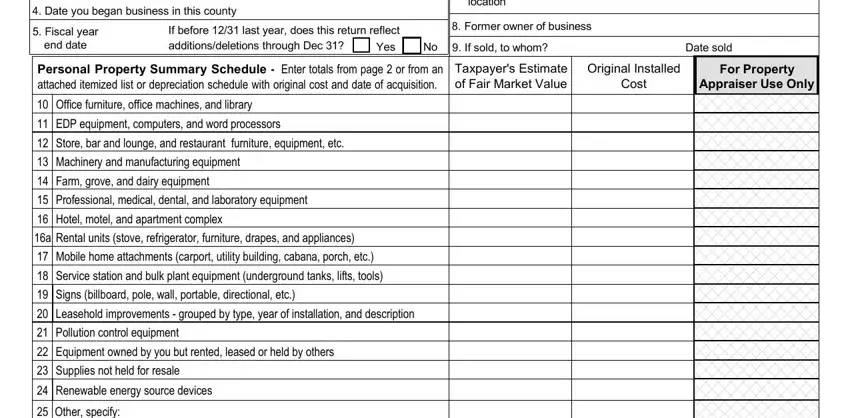

4. Date you began business in this county |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. Fiscal year |

If before 12/31 last year, does this return reflect |

|

|

end date |

additions/deletions through Dec 31? |

|

|

|

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. Type or nature of your business |

|

|

|

|

|

|

|

|

|

|

Trade levels (check all that apply) |

|

Retail |

|

|

Wholesale |

|

|

|

|

|

|

Manufacturing |

|

Professional |

|

Service |

|

|

Agricultural |

|

|

|

|

|

|

|

|

Leasing/rental |

|

Other, specify: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. Did you file a TPP return in this county last year? |

|

|

|

|

No |

|

|

Yes |

|

|

|

Name and |

|

|

|

|

|

|

|

|

|

|

|

|

|

location |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. Former owner of business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. If sold, to whom? |

|

|

|

|

Date sold |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Personal Property Summary Schedule - Enter totals from page 2 or from an |

Taxpayer's Estimate |

Original Installed |

For Property |

attached itemized list or depreciation schedule with original cost and date of acquisition. |

of Fair Market Value |

Cost |

Appraiser Use Only |

10 |

Office furniture, office machines, and library |

|

|

|

|

11 |

EDP equipment, computers, and word processors |

|

|

|

|

12 |

Store, bar and lounge, and restaurant furniture, equipment, etc. |

|

|

|

|

13 |

Machinery and manufacturing equipment |

|

|

|

|

14 |

Farm, grove, and dairy equipment |

|

|

|

|

15 |

Professional, medical, dental, and laboratory equipment |

|

|

|

|

16 |

Hotel, motel, and apartment complex |

|

|

|

|

16a Rental units (stove, refrigerator, furniture, drapes, and appliances)

17Mobile home attachments (carport, utility building, cabana, porch, etc.)

18Service station and bulk plant equipment (underground tanks, lifts, tools)

19Signs (billboard, pole, wall, portable, directional, etc.)

20Leasehold improvements - grouped by type, year of installation, and description

21Pollution control equipment

22Equipment owned by you but rented, leased or held by others

23Supplies not held for resale

24 Renewable energy source devices

25Other, specify:

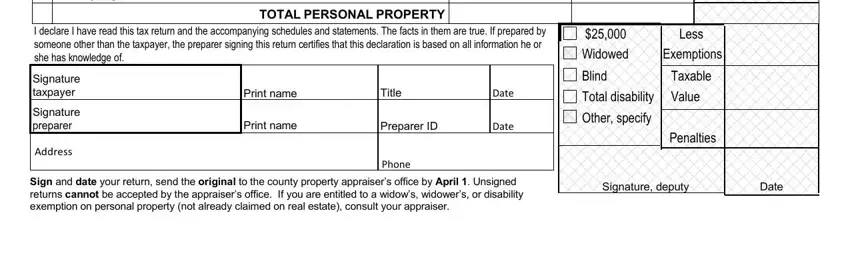

TOTAL PERSONAL PROPERTY

|

I declare I have read this tax return and the accompanying schedules and statements. The facts in them are true. If prepared by |

$25,000 |

Less |

|

|

someone other than the taxpayer, the preparer signing this return certifies that this declaration is based on all information he or |

Widowed |

Exemptions |

|

|

she has knowledge of. |

|

|

|

|

|

|

Signature |

|

|

|

|

Blind |

Taxable |

|

|

taxpayer |

Print name |

Title |

DATE |

|

Total disability |

Value |

|

|

Signature |

|

|

|

|

|

|

|

|

|

|

Other, specify |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

preparer |

Print name |

Preparer ID |

DATE |

|

|

|

|

|

|

Penalties |

|

|

ADDRESS |

|

PHONE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sign and date your return, send the original to the county property appraiser’s office by April 1. Unsigned |

|

|

|

|

Signature, deputy |

Date |

|

returns cannot be accepted by the appraiser’s office. If you are entitled to a widow’s, widower’s, or disability |

|

|

|

|

|

|

|

|

|

exemption on personal property (not already claimed on real estate), consult your appraiser. |

|

|

|

|

|

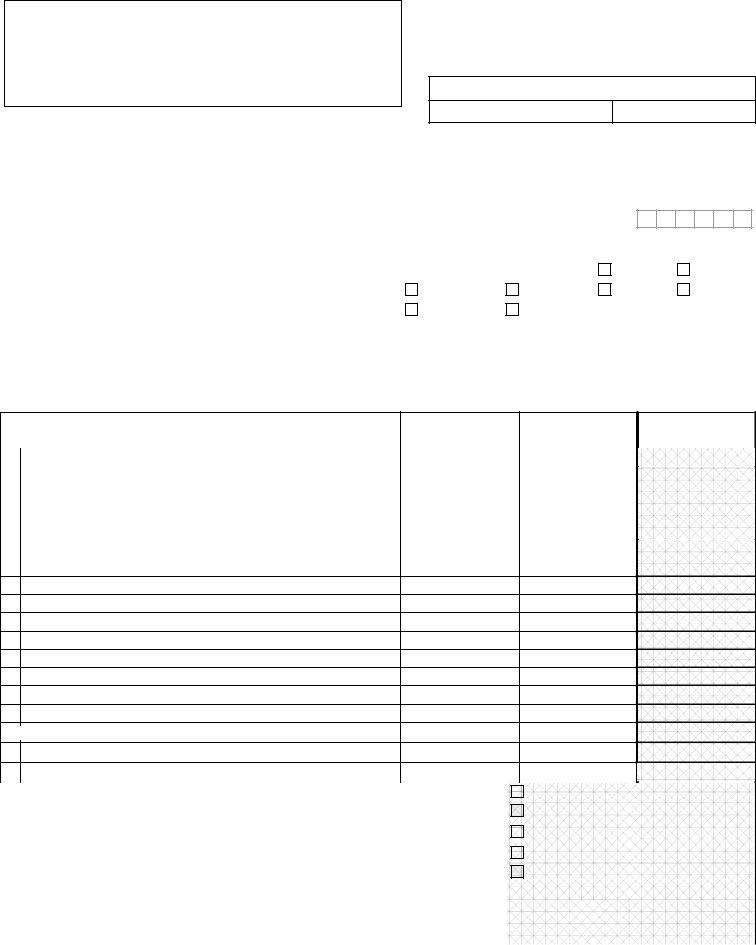

Complete this form if you own property used for commercial purposes that is not included in the assessed value of your business' real property. This may include office furniture, computers, tools, supplies, machines, and leaseholdimprovements. Return this to your propertyappraiser's office byApril 1. Keep a copyfor your records.

Report your summary totals on page 1. Use page 2 or an attached, itemized list with original cost and date acquired for each item to provide the details for each category. Contact your local property appraiser if you have questions.

If you ask, the property appraiser will give you an extension for 30 days and may grant an additional 15 days. You must ask for the extension in time for the property appraiser to consider the request and act on it before April 1.

Each return is eligible for an exemption up to $25,000. By filing a DR-405 on time you automatically apply for the exemption. If you do not file on time, Florida Law provides for the loss of the $25,000 exemption.

WHAT TO REPORT

Include on your return:

1.Tangible Personal Property. Goods, chattels, and other articles of value (except certain vehicles) that can be manually possessed and whose chief value is intrinsic to the article itself.

2.Inventory held for lease. Examples: equipment, furniture, or fixtures after their first lease or rental.

3.Equipment on some vehicles. Examples: power cranes,aircompressors,andotherequipmentused primarily as a tool rather than a hauling vehicle.

4.Property personally owned, but used in the business.

5.Fully depreciated items, whether written off or not. Report at original installed cost.

Do not include:

1.Intangible Personal Property. Examples: money, all evidences of debt owed to the taxpayer, all evidence of ownership in a corporation.

2.Household Goods. Examples: wearing apparel, appliances, furniture, and other items ordinarily found in the home and used for the comfort of the owner and his family, and not used for commercial purposes.

3.Most automobiles, trucks, and other licensed vehicles. See 3 above.

4.Inventory that is for sale as part of your business. Items commonly referred to as goods, wares, and merchandise that are held for sale. Also, inventory

is construction and agricultural equipment weighing 1,000 pounds or more that is returned to a dealership under a rent-to-purchase option and held for sale to customers in the ordinary course of business. See section 192.001(11)(c), Florida Statutes.

LOCATION OF PERSONAL PROPERTY

Report all property located in this county on January

1.You must file a single return for each site in the county where you transact business. If you have freestanding property at multiple sites other than where you transact business, file a separate, but single, return for all such property located in the county.

Examples of freestanding property at multiple sites include vending and amusement machines, LP/ propane tanks, utility and cable company property, billboards, leased equipment, and similar property not customarily located in the offices, stores, or plants of the owner, but is placed throughout the county.

PENALTIES

Failure to file - 25% of the total tax levied against the property for each year that no return is filed

Filing late - 5% of the total tax levied against the property covered by that return for each year, each month, and part of a month, that a return is late, but not more than 25% of the total tax

Unlisted property -15% of the tax attributable to the omitted property

RELATED FLORIDA TAX LAWS

§192.042, F.S. - Assessment date: Jan 1 §193.052, F.S. - Filing requirement §193.062, F.S. - Filing date: April 1 §193.063, F.S. - Extensions for filing §193.072, F.S. - Penalties

§193.074, F.S. - Confidentiality §195.027(4), F.S.- Return Requirements §196.183, F.S. - $25,000 Exemption

§ 837.06, F.S. - False Official Statements

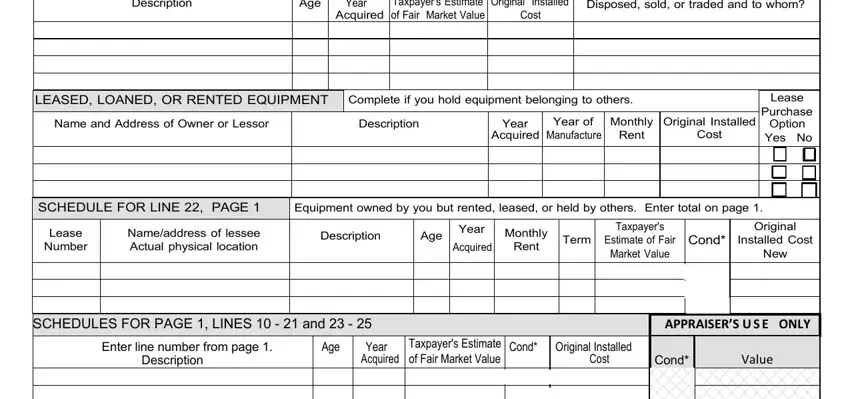

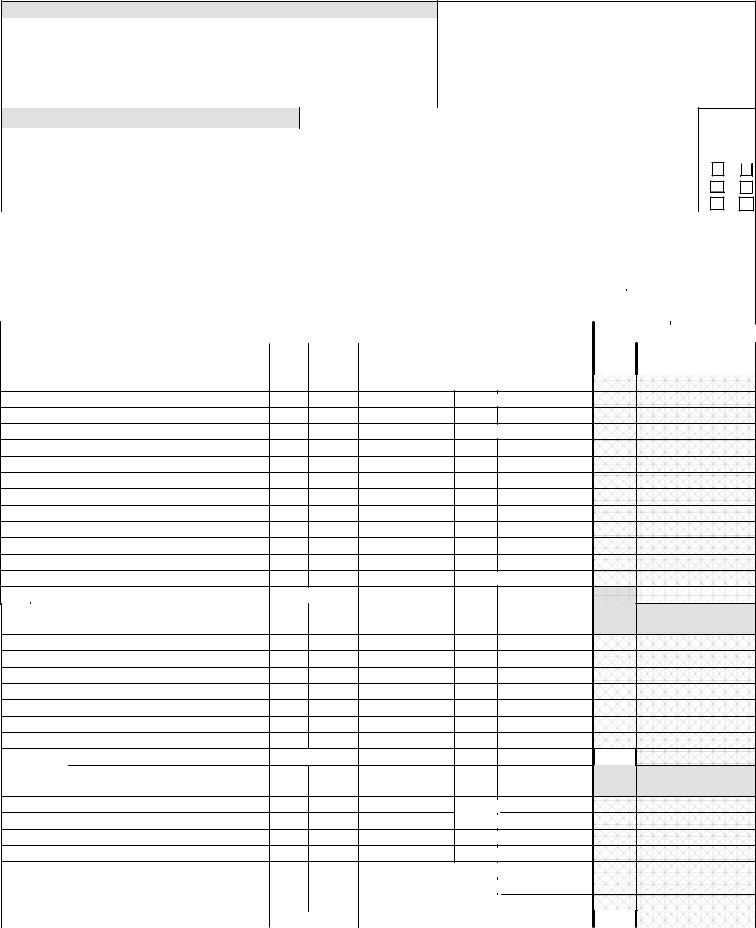

See line and column instructions on page 4.

DR-405, R. 01/18, Page 4

LINE INSTRUCTIONS

Within each section, group your assets by year of acquisition. List each item of property separately except for “classes” of personal property. A class is a group of items substantially similar in function, use, and age.

Line 14 - Farm, Grove, and Dairy Equipment

List all types of agricultural equipment you owned on January 1. Describe property by type, manufacturer, model number, and year acquired. Examples: bulldozers, draglines, mowers, balers, tractors, all types of dairy equipment, pumps, irrigation pipe - show feet of main line and sprinklers, hand and power sprayers, heaters, discs, fertilizer distributors.

Line 16 and 16a - Hotel, Motel, Apartment and Rental Units (Household Goods)

List all household goods. Examples: furniture, appliances, and equipment used in rental or other commercial property. Both residents and nonresidents must report if a house, condo, apartment, etc. is rented at any time during the year.

Line 17 - Mobile Home Attachments

For each type of mobile home attachment (awnings, carports, patio roofs, trailer covers, screened porches or rooms, cabanas, open porches, utility rooms, etc.), enter the number of items you owned on January 1, the year of purchase, the size (length X width), and the original installed cost.

Line 20 - Leasehold Improvements, Physical Modifications to Leased Property

If you have made any improvements, including modifications and additions, to property that you leased, list the original cost of the improvements. Group them by type and year of installation. Examples: slat walls, carpeting, paneling, shelving, cabinets. Attach an itemized list or depreciation schedule of the individual improvements.

Line 22 - Owned by you but rented to another

Enter any equipment you own that is on a loan, rental, or lease basis to others.

Line 23 - Supplies

Enter the average cost of supplies that are on hand. Include expensed supplies, such as stationery and janitorial

supplies, linens, and silverware, which you may not have recorded separately on your books.

Include items you carry in your inventory account but do not meet the definition of “inventory” subject to exemption.

Line 24 - Renewable Energy Source Devices

List all renewable energy source devices as defined in section 193.624, Florida Statutes. Section 196.182, F.S., provides an exemption to renewable energy source devices considered tangible personal property. The exemption is granted based on a percentage of value, when the devices are installed, and what type of property the devices are installed on.

COLUMN INSTRUCTIONS

List all items of furniture, fixtures, all machinery, equipment, supplies, and certain types of equipment attached to mobile

homes. For each item, you must report your estimate of the current fair market value and condition of the item (good, average, poor). Enter all expensed items at original installed cost. Do not use “various” or “same as last year” in any of

the columns. These are not adequate responses and may subject you to penalties for failure to file.

Taxpayer's Estimate of Fair Market Value

You must report the taxpayer's estimate of fair market value of the property in the columns labeled "Taxpayer's Estimate of Fair Market Value." The amount reported is your estimate of the current fair market value of the property.

Original Installed Cost

Report 100% of the original total cost of the property in the columns labeled "Original Installed Cost." This cost includes sales tax, transportation, handling, and installation charges, if incurred. Enter only unadjusted figures in "Original Installed Cost" columns.

The original cost must include the total original installed cost of your equipment, before any allowance for depreciation. Include sales tax, freight- in, handling, and installation costs. If you deducted a trade-in from the invoice price, enter the invoice price. Add back investment credits taken for federal income tax if you deducted those from the original cost.

Include all fully depreciated items at original cost, whether written off or not.

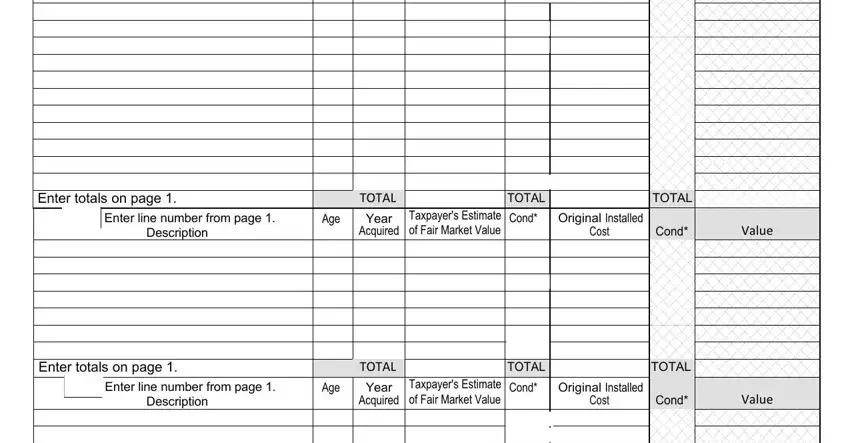

Assets Physically Removed

If you physically removed assets last year, complete the columns in the first section of page 2. If you sold, traded, or gave property to another business or person, include the name in the last column.

Leased, Loaned, and Rented Equipment

If you borrowed, rented, or leased equipment from others, enter the name and address of the owner or lessor in the second section of page 2. Include a description of the equipment, year you acquired it, year of manufacture (if known), the monthly rent, the amount it would have originally cost had you bought it new, and indicate if you have an option to buy the equipment at the end of the term.