Reset Form

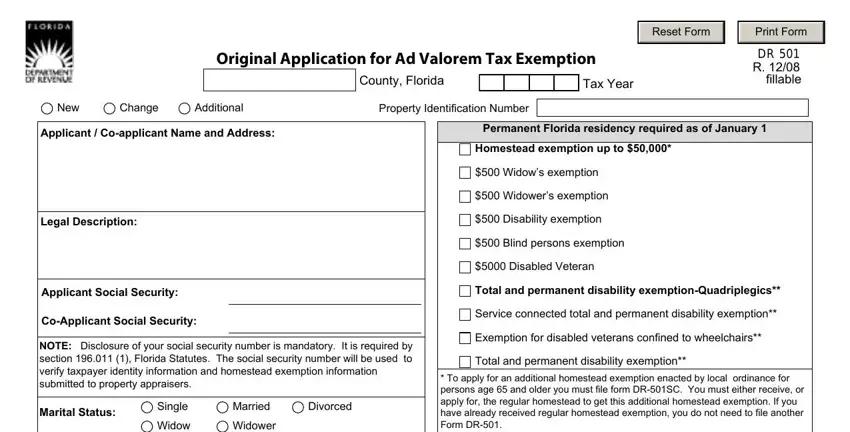

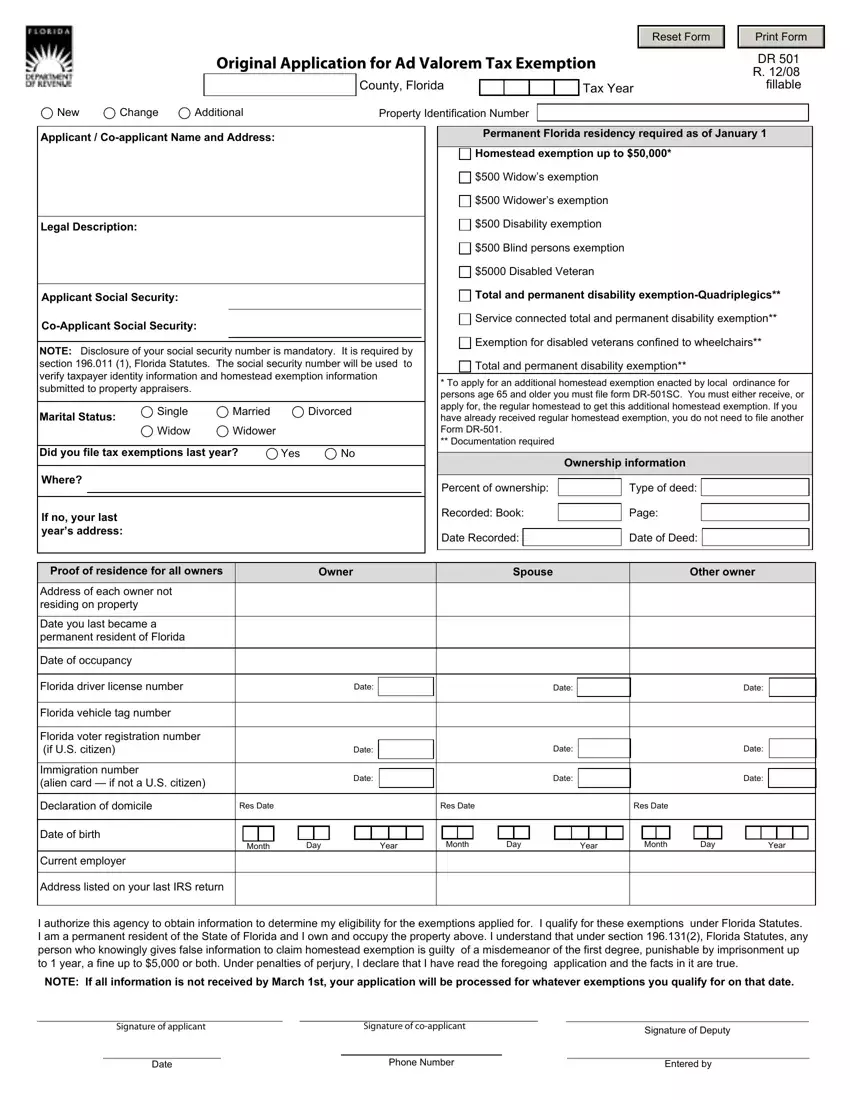

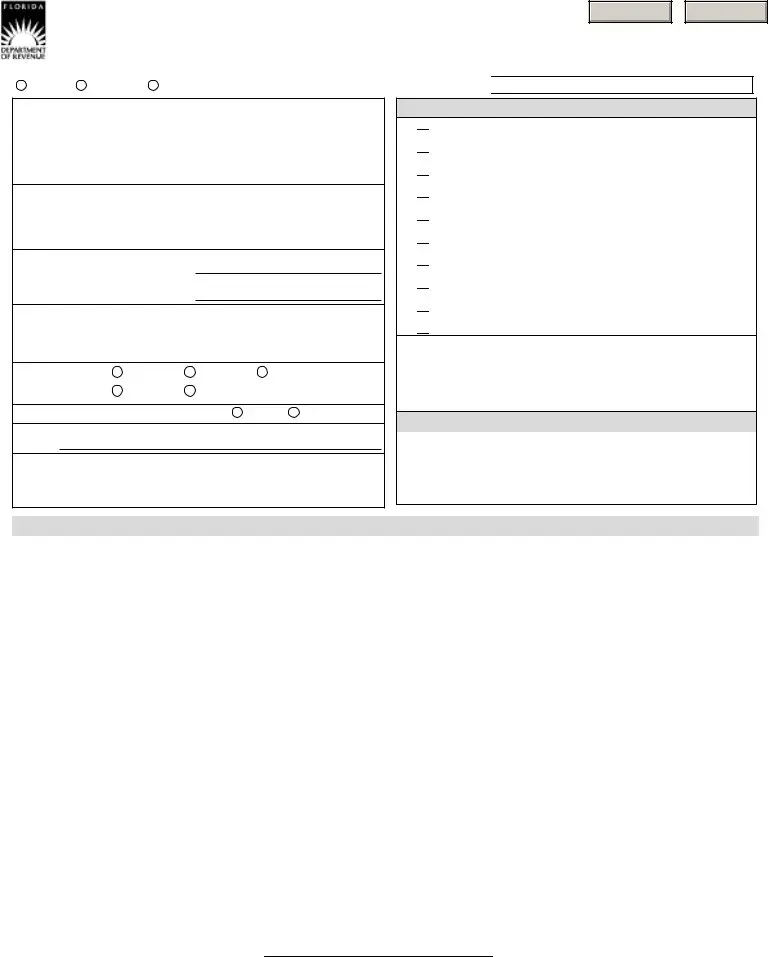

Original Application for Ad Valorem Tax Exemption

|

|

|

|

County, Florida |

|

|

|

|

|

Tax Year |

|

|

|

|

|

|

|

|

|

New |

Change |

Additional |

Property Identification Number |

|

|

|

|

|

|

Print Form

DR 501

R.12/08 fillable

Applicant / Co-applicant Name and Address:

Legal Description:

Applicant Social Security:

Co-Applicant Social Security:

NOTE: Disclosure of your social security number is mandatory. It is required by section 196.011 (1), Florida Statutes. The social security number will be used to verify taxpayer identity information and homestead exemption information submitted to property appraisers.

Marital Status: |

Single |

Married |

|

Divorced |

Widow |

Widower |

|

|

|

|

|

Did you file tax exemptions last year? |

Yes |

No |

Where? |

|

|

|

|

If no, your last year’s address:

Permanent Florida residency required as of January 1  Homestead exemption up to $50,000*

Homestead exemption up to $50,000*

$500 Widow’s exemption

$500 Widow’s exemption

$500 Widower’s exemption

$500 Widower’s exemption

$500 Disability exemption

$500 Disability exemption

$500 Blind persons exemption

$500 Blind persons exemption  $5000 Disabled Veteran

$5000 Disabled Veteran

Total and permanent disability exemption-Quadriplegics**

Total and permanent disability exemption-Quadriplegics**

Service connected total and permanent disability exemption**

Service connected total and permanent disability exemption**  Exemption for disabled veterans confined to wheelchairs**

Exemption for disabled veterans confined to wheelchairs**

Total and permanent disability exemption**

Total and permanent disability exemption**

*To apply for an additional homestead exemption enacted by local ordinance for persons age 65 and older you must file form DR-501SC. You must either receive, or apply for, the regular homestead to get this additional homestead exemption. If you have already received regular homestead exemption, you do not need to file another Form DR-501.

**Documentation required

|

|

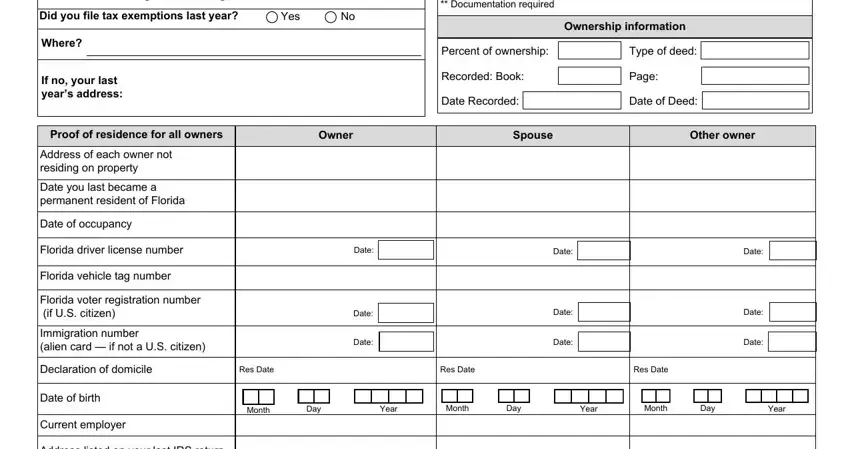

Ownership information |

|

|

|

|

|

|

|

|

Percent of ownership: |

|

Type of deed: |

|

|

|

|

|

|

|

|

|

Recorded: Book: |

|

Page: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date Recorded: |

|

|

Date of Deed: |

|

|

Proof of residence for all owners |

|

|

|

|

|

Owner |

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse |

|

|

|

|

|

|

|

|

|

|

|

Other owner |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of each owner not |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

residing on property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date you last became a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

permanent resident of Florida |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of occupancy |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Florida driver license number |

|

|

|

|

|

|

|

Date: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: |

|

|

|

|

|

|

|

|

|

|

|

|

Date: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Florida vehicle tag number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Florida voter registration number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(if U.S. citizen) |

|

|

|

|

|

|

|

Date: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: |

|

|

|

|

|

|

|

|

|

|

|

Date: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Immigration number |

|

|

|

|

|

|

|

Date: |

|

|

|

|

|

|

|

|

|

|

|

|

Date: |

|

|

|

|

|

|

|

|

|

|

|

Date: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(alien card — if not a U.S. citizen) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Declaration of domicile |

Res Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

Res Date |

|

|

|

|

|

|

|

|

|

|

Res Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of birth |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

|

Day |

|

|

|

|

|

Year |

|

|

|

Month |

|

Day |

|

|

|

|

Year |

|

|

Month |

|

|

Day |

|

|

|

Year |

|

Current employer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address listed on your last IRS return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

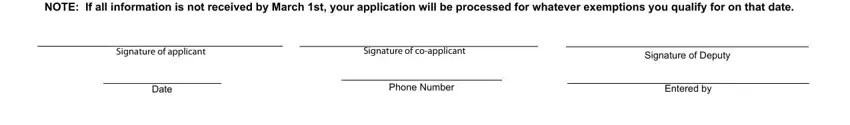

I authorize this agency to obtain information to determine my eligibility for the exemptions applied for. I qualify for these exemptions |

under Florida Statutes. |

I am a permanent resident of the State of Florida and I own and occupy the property above. I understand that under section 196.131(2), Florida Statutes, any person who knowingly gives false information to claim homestead exemption is guilty of a misdemeanor of the first degree, punishable by imprisonment up to 1 year, a fine up to $5,000 or both. Under penalties of perjury, I declare that I have read the foregoing application and the facts in it are true.

NOTE: If all information is not received by March 1st, your application will be processed for whatever exemptions you qualify for on that date.

|

Signature of applicant |

|

Signature of co-applicant |

|

Signature of Deputy |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone Number |

|

|

|

Date |

|

Entered by |

This application must be filed with the property appraiser by March 1st

The information contained in this application will be provided to the Department of Revenue and the Department and/or property appraisers are authorized to provide this information to any state in which the applicant has previously resided, pursuant to Section 196.121, Florida Statutes. Social security numbers will remain confidential pursuant to sections 193.114(5), and 193.074, Florida Statutes.

Notice: A tax lien can be imposed on your property.

Section 196.161 (1) provides:

(1)(a) “When the estate of any person is being probated or administered in another state under an allegation that such person was a resident of that state and the estate of such person contains real property situate in this state upon which homestead exemption has been allowed pursuant to s. 196.031 for any year or years within 10 years immediately prior to the death of the deceased, then within 3 years after the death of such person the property appraiser of the county where the real property is located shall, upon knowledge of such fact, record a notice of tax lien against the property among the public records of that county, and the property shall be subject to the payment of all taxes exempt thereunder, a penalty of 50 percent of the unpaid taxes for each year, plus 15 percent interest per year, unless the circuit court having jurisdiction over the ancillary administration in this state, determines that the decedent was a permanent resident of this state during the year or years an exemption was allowed, whereupon the lien shall not be filed or, if filed, shall be canceled of record by the property appraiser of the county where the real estate is located. (b) In addition, upon determination by the property appraiser that for any year or years within the prior 10 years a person who was not entitled to a homestead exemption was granted a homestead exemption from ad valorem taxes, it shall be the duty of the property appraiser making such determination to serve upon the owner a notice of intent to record in the public records of the county a notice of tax lien against any property owned by that person in the county, and such property shall be identified in the notice of tax lien. Such property which is situated in this state shall be subject to the taxes exempted thereby, plus a penalty of 50 percent of the unpaid taxes for each year and 15 percent interest per annum. However, if a homestead exemption

is improperly granted as a result of a clerical mistake or omission by the property appraiser, the person improperly receiving the exemption shall not be assessed penalty and interest. Before any such lien may be filed, the owner so notified must be given 30 days to pay the taxes, penalties, and interest.

Homestead exemption up to $50,000*

Homestead exemption up to $50,000* $500 Widow’s exemption

$500 Widow’s exemption $500 Widower’s exemption

$500 Widower’s exemption $500 Disability exemption

$500 Disability exemption $500 Blind persons exemption

$500 Blind persons exemption  $5000 Disabled Veteran

$5000 Disabled Veteran Total and permanent disability

Total and permanent disability  Service connected total and permanent disability exemption**

Service connected total and permanent disability exemption**  Exemption for disabled veterans confined to wheelchairs**

Exemption for disabled veterans confined to wheelchairs** Total and permanent disability exemption**

Total and permanent disability exemption**