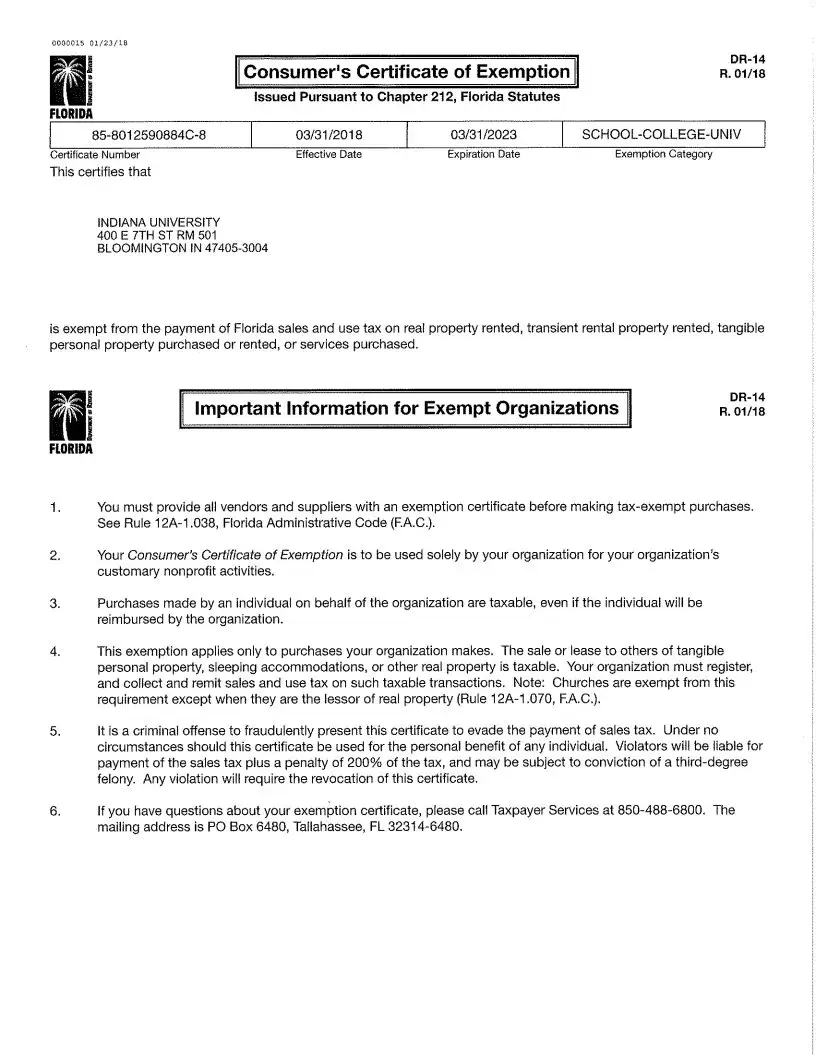

Navigating the intricacies of tax exemptions for educational institutions can often feel like a complex puzzle. At the heart of this puzzle for Indiana University lies the Florida Certificate of Exemption, known as Form DR-14, a crucial piece for ensuring the university's purchases are done in a financially savvy and compliant manner. This special document, rooted in the provisions of section 212.08(7) of the Florida Statutes (F.S.), empowers the university to acquire tangible personal property or taxable services without the burden of sales tax. However, to harness this benefit correctly, specific conditions must be met, including the stipulation that Indiana University must act as the direct purchaser and payer, ensuring purchases are directly invoiced and paid for by the university itself, whether by check or credit card. Furthermore, every acquisition made under this exemption must solely benefit the university and be integral to its work and exempt purposes, definitively stating that personal benefits for officers, members, or employees are off limits. Guiding vendors through this process involves providing them with a copy of the DR-14 form, essentially a bridge between strict legal requirements and the university's ambitions to further its educational goals financially and efficiently.

| Question | Answer |

|---|---|

| Form Name | Form Dr14 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | state of florida dr 14, florida tax exempt form dr 14, form dr 14, dr 14 form |

FLORIDA CERTIFICATE OF EXEMPTION (DR‐ 14)

***For internal Indiana University use only***

NOTE: According to Florida section 212.08(7), Florida Statutes (F.S.), Indiana University is authorized to make purchases and leases for its exclusive use without paying sales tax. The University must issue the attached certificate to vendors when purchasing tangible personal property or taxable services to qualify for the exemption.

Indiana University must be the direct purchaser and payer of record. Purchases must be made in the following manner:

o Are directly invoiced and charged to Indiana University, and o Are directly paid by Indiana University via

check,

credit card

All purchases made using Form DR‐14 must benefit the University only. The form may not be used for the benefit of any officer, member, or employee of Indiana University.

The purchases must be made for use in carrying on the work of the organization and directly related to the University’s exempt purpose.

INSTRUCTIONS:

Provide a copy of the Florida Consumer's Certificate of Exemption to vendors