You could complete Form Dr8453 Colorado easily using our online PDF tool. Our development team is always working to develop the editor and enable it to be much easier for users with its handy functions. Enjoy an ever-improving experience today! Getting underway is simple! All you should do is take the next simple steps down below:

Step 1: Hit the "Get Form" button above. It's going to open our pdf tool so you could start filling out your form.

Step 2: As you open the file editor, you will get the form ready to be filled out. Besides filling out various fields, you could also do other things with the Document, namely writing custom words, modifying the initial textual content, adding images, signing the form, and a lot more.

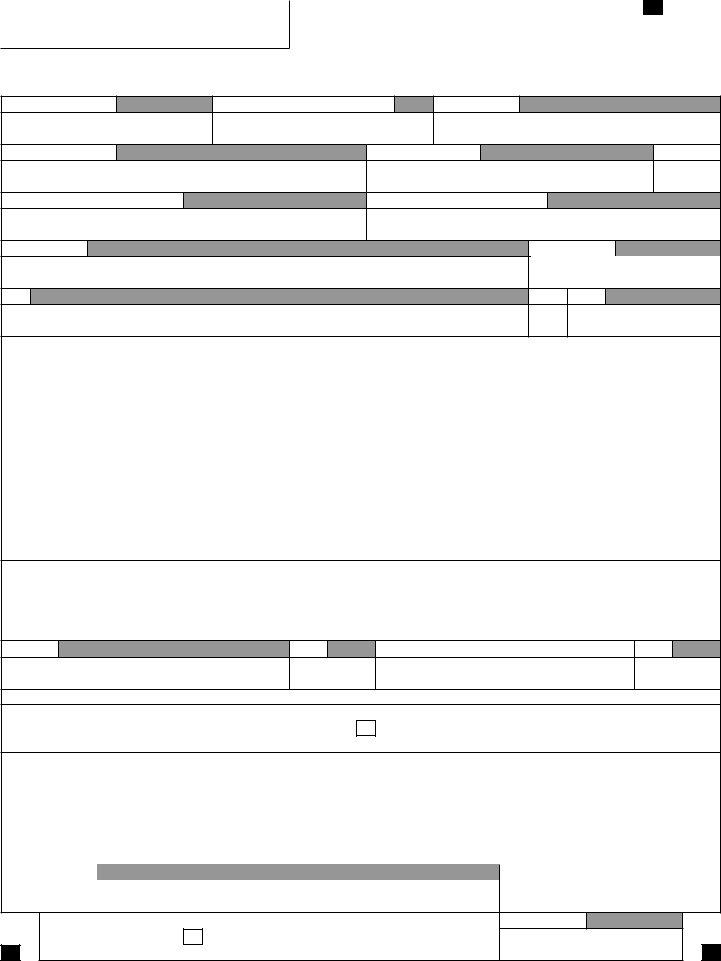

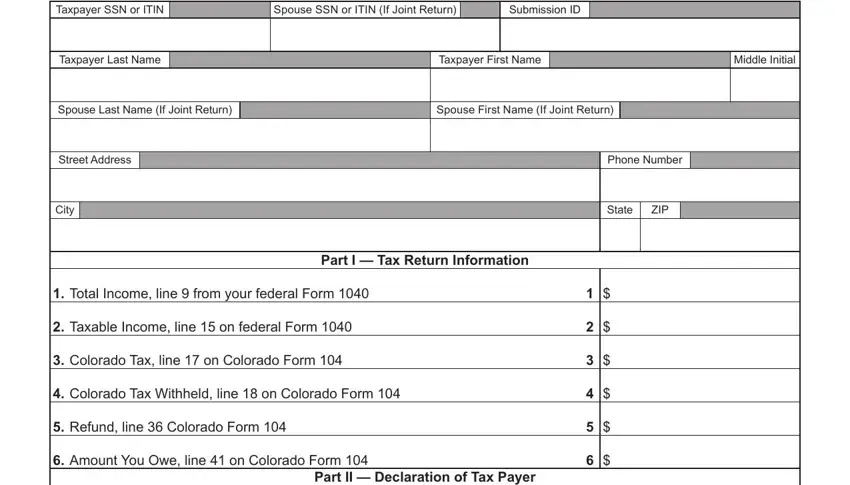

With regards to the blank fields of this precise document, this is what you need to know:

1. To start off, when filling out the Form Dr8453 Colorado, beging with the page that contains the following blank fields:

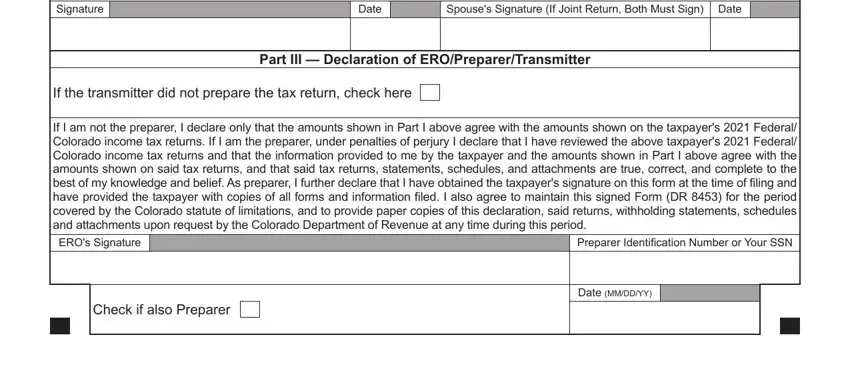

2. After this section is complete, you're ready to insert the required specifics in Signature, Date, Spouses Signature If Joint Return, If the transmitter did not prepare, Part III Declaration of, If I am not the preparer I declare, EROs Signature, Preparer Identification Number or, Check if also Preparer, and Date MMDDYY so you can progress to the third stage.

Many people often get some things wrong while completing Check if also Preparer in this section. You need to reread what you type in here.

Step 3: Prior to getting to the next stage, you should make sure that all blanks were filled in right. As soon as you are satisfied with it, press “Done." Sign up with FormsPal now and immediately get access to Form Dr8453 Colorado, ready for downloading. Every last change made is handily kept , allowing you to customize the file at a later time if needed. At FormsPal, we do our utmost to be sure that your information is maintained secure.