We were building our PDF editor with the prospect of making it as fast to use as it can be. Therefore the process of filling out the fsps report will likely to be simple carry out the following steps:

Step 1: The following page includes an orange button stating "Get Form Now". Hit it.

Step 2: At the moment you are on the document editing page. You may enhance and add content to the file, highlight words and phrases, cross or check specific words, insert images, put a signature on it, get rid of needless fields, or take them out altogether.

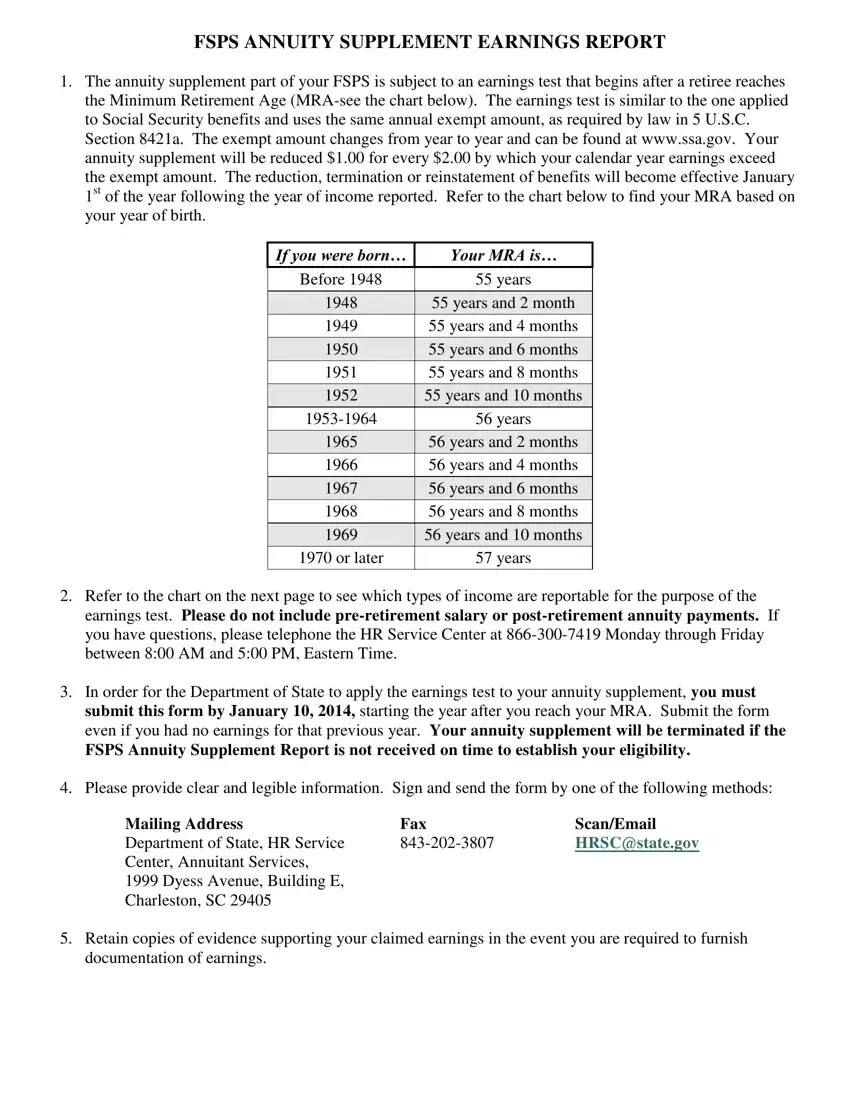

Type in the content requested by the platform to fill in the form.

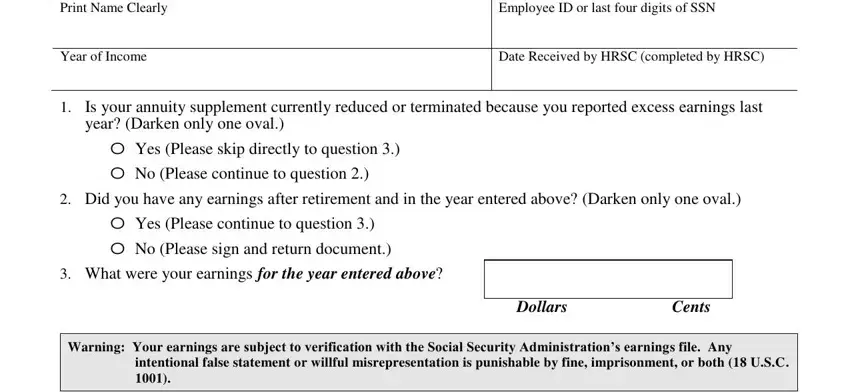

In the field Print Name Clearly, Year of Income, Employee ID or last four digits of, Date Received by HRSC completed by, Is your annuity supplement, year Darken only one oval, O Yes Please skip directly to, Did you have any earnings after, O Yes Please continue to question, Dollars Cents, Warning Your earnings are subject, and intentional false statement or write down the data that the program requests you to do.

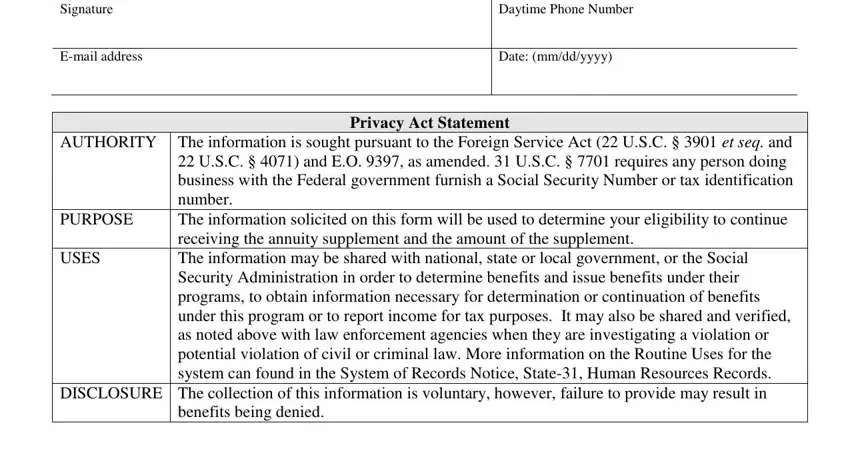

Mention the main information in Signature, Email address, Daytime Phone Number, Date mmddyyyy, PURPOSE, Privacy Act Statement AUTHORITY, USES, and benefits being denied area.

Step 3: After you have clicked the Done button, your form will be available for transfer to any device or email you identify.

Step 4: Ensure that you avoid possible problems by creating a minimum of a pair of copies of the file.