The PDF editor makes it simple to complete the dtf 803 dmv form ny document. You will be able to obtain the file without delay by using these basic steps.

Step 1: Choose the button "Get form here" to open it.

Step 2: You're now allowed to enhance dtf 803 dmv form ny. You have plenty of options with our multifunctional toolbar - it's possible to add, eliminate, or modify the content material, highlight its certain elements, and perform many other commands.

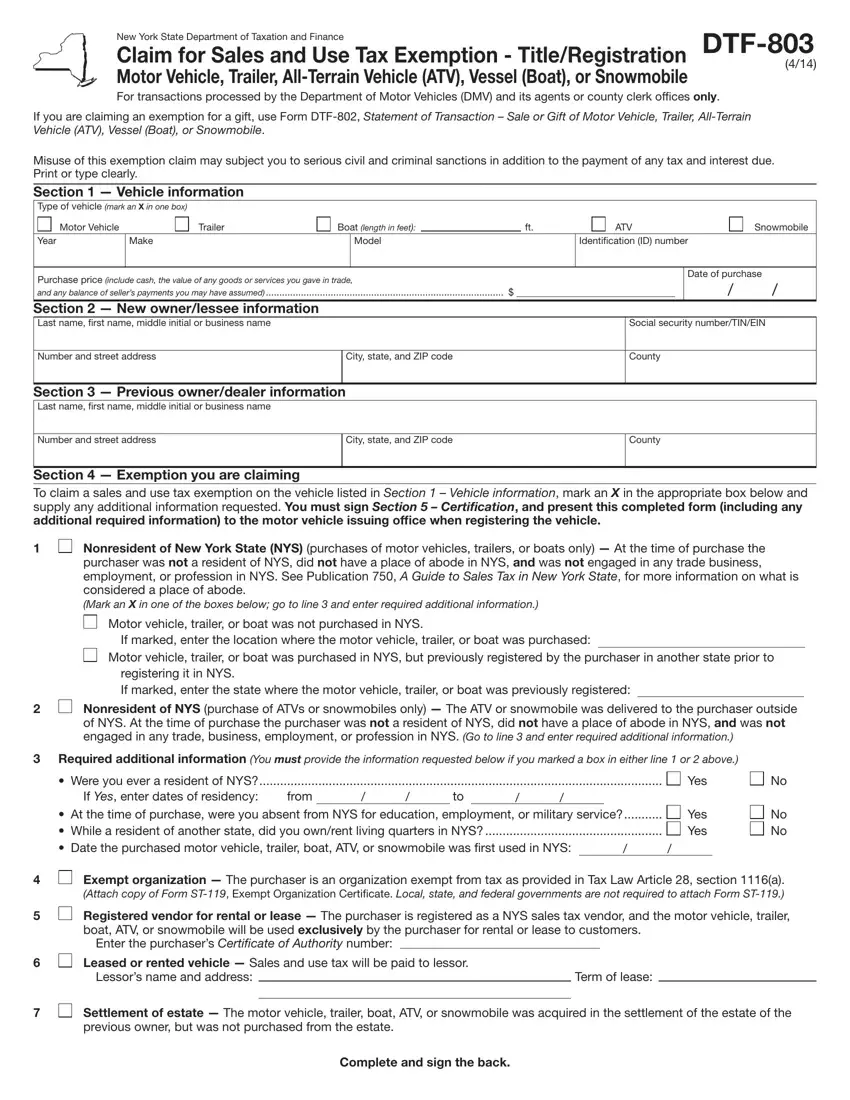

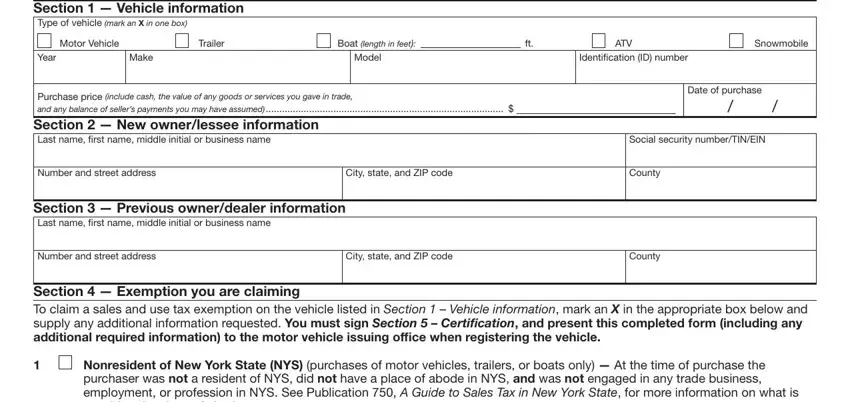

Provide the requested material in each one segment to prepare the PDF dtf 803 dmv form ny

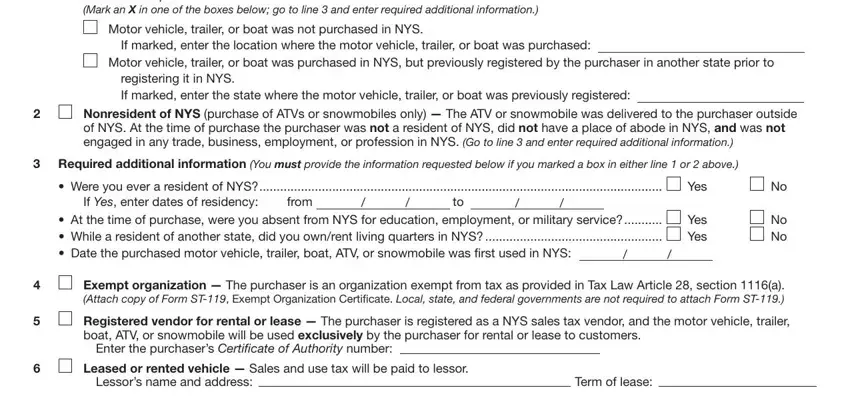

Jot down the details in the Nonresident of New York State NYS, Motor vehicle trailer or boat was, If marked enter the location where, Motor vehicle trailer or boat was, registering it in NYS If marked, Nonresident of NYS purchase of, Required additional information, If Yes enter dates of residency, Were you ever a resident of NYS, from, Yes, Yes Yes, No No, Exempt organization The purchaser, and Registered vendor for rental or field.

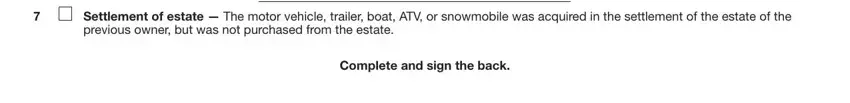

The application will demand you to give particular necessary particulars to easily fill in the area Settlement of estate The motor, previous owner but was not, and Complete and sign the back.

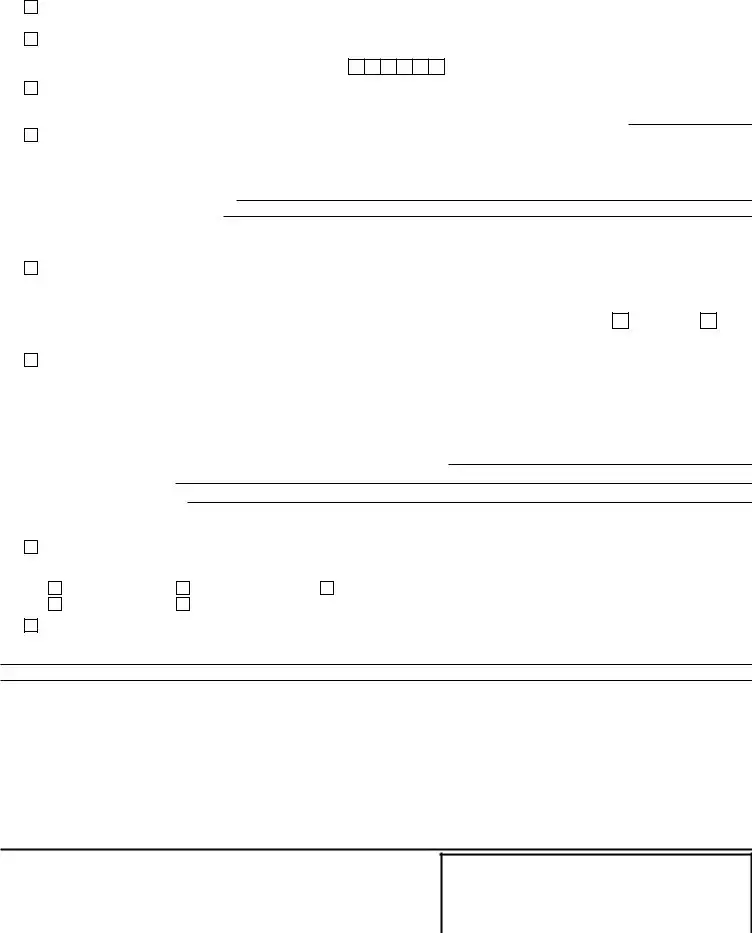

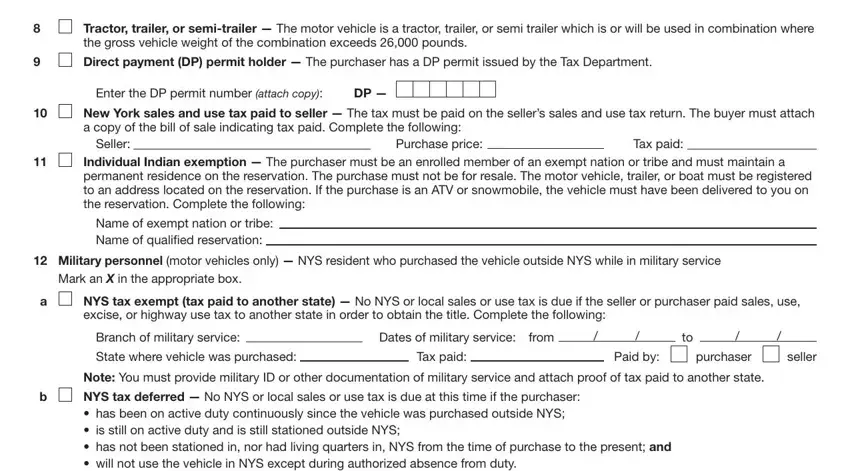

The Tractor trailer or semitrailer, the gross vehicle weight of the, Direct payment DP permit holder, Enter the DP permit number attach, New York sales and use tax paid to, a copy of the bill of sale, Seller, Purchase price, Tax paid, Individual Indian exemption The, Name of exempt nation or tribe, Military personnel motor vehicles, Mark an X in the appropriate box, NYS tax exempt tax paid to another, and excise or highway use tax to area needs to be used to provide the rights or obligations of both sides.

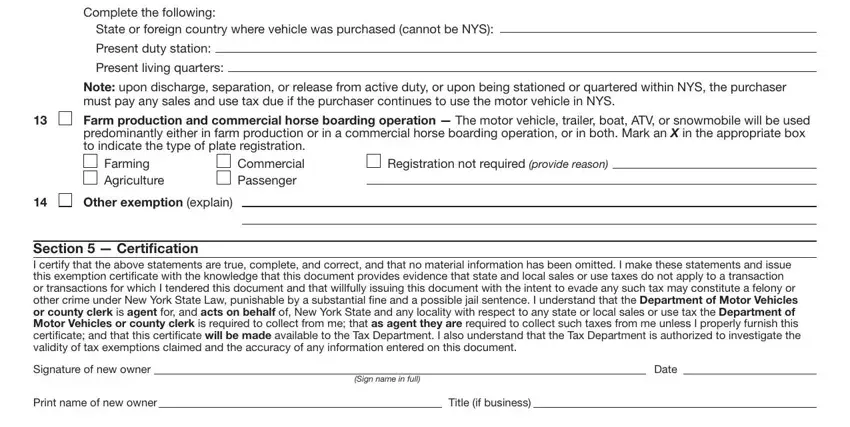

End by looking at the following sections and filling them in correspondingly: NYS tax deferred No NYS or local, Complete the following State or, Present duty station, Present living quarters, Note upon discharge separation or, Farm production and commercial, Registration not required provide, Farming Agriculture, Other exemption explain, Section Certification I certify, Signature of new owner, Print name of new owner, Sign name in full, Title if business, and Date.

Step 3: Press the "Done" button. Now it's possible to transfer your PDF document to your device. Additionally, it is possible to deliver it by means of electronic mail.

Step 4: To avoid any specific concerns in the long run, try to have minimally two or three duplicates of your document.