In a world where ensuring domestic security is paramount, the DSF-100 form plays a crucial role for businesses operating within New Jersey's borders. Mandated by the New Jersey Department of the Treasury Division of Taxation, this form is specifically designed for documenting and submitting the Domestic Security Fee returns associated with vehicle rental agreements. The DSF-100 not only serves as a financial instrument but also as a gesture towards contributing to state efforts in enhancing security measures. For the reporting period starting August 1, 2002, and ending September 30, 2002, the form outlines a detailed process for calculating the fees due from vehicle rental agreements, both short-term (28 days or less) and those extending beyond this duration. Importantly, it sets a due date for submission, which for this period is October 31, 2002, emphasizing the need for timely compliance. With options to file online or by phone, it offers flexibility to taxpayers, ensuring that fulfilling civic duties is as straightforward as possible. Additionally, the form includes sections for calculating penalties and interest for late filings, underscoring the importance of adhering to deadlines. Through the DSF-100, New Jersey not only safeguards its financial interests but also reinforces its commitment to maintaining public safety, making it an essential document for vehicle rental businesses in the state.

| Question | Answer |

|---|---|

| Form Name | Form Dsf 100 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | dsf100 nj dsf 100 form |

STATE OF NEW JERSEY |

|

9/02 |

DEPARTMENT OF THE TREASURY |

|

DIVISION OF TAXATION |

NEW JERSEY DOMESTIC SECURITY FEE RETURN

For the period beginning August 1, 2002 and ending September 30, 2002

This return is due no later than October 31, 2002

File the

or

File By Phone: Call

NEW JERSEY TAXPAYER IDENTIFICATION NUMBER

TAXPAYER NAME

TAXPAYER ADDRESS

CITY

STATE

ZIP CODE

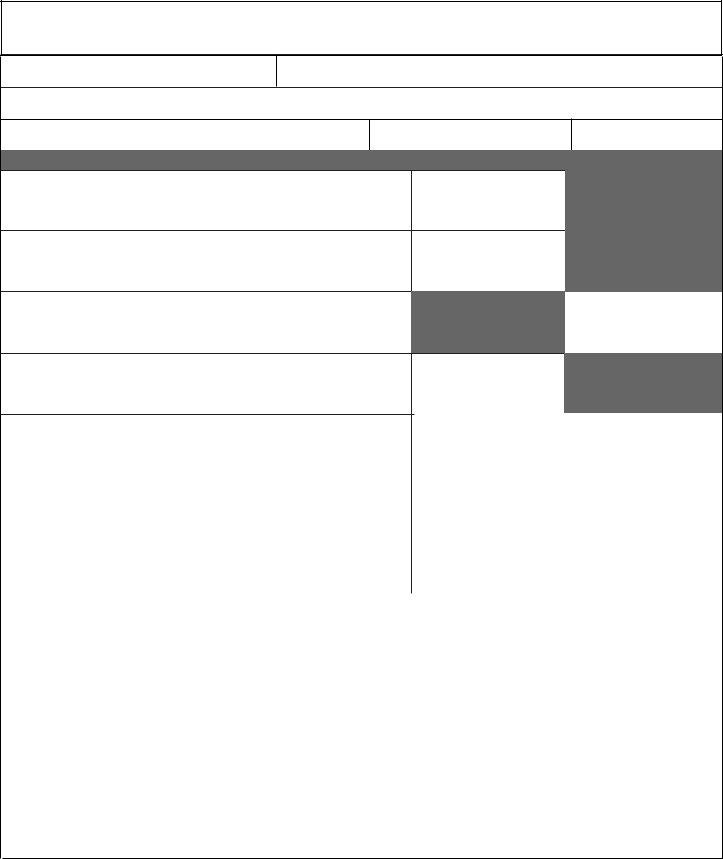

1.Number of Vehicle Rental Agreements of 28 days or less completed during the quarterly period.

2.Number of Rental Fee Days represented in the agreements from Line 1.

3. Multiply Line 2 by $2.00. Enter result here. |

$ |

.00 |

|

4.Number of Vehicle Rental Agreements greater than 28 days completed during the quarterly period.

5. |

Multiply Line 4 by $56.00 (fee limit per agreement, if agreement |

|

$ |

.00 |

|

|

|

greater than 28 days). Enter result here. |

|

|

|||

|

|

|

|

|

||

|

|

|

|

|

|

|

6. |

Penalty and Interest (see instructions). |

|

$ |

.00 |

|

|

|

|

|

|

|

|

|

7. |

Total Amount Due - Add Lines 3, 5, and 6. Enter result here. |

|

$ |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Make your check payable to “State of New Jersey - Domestic Security Fee”

Mail this return and payment to: |

State of New Jersey |

|

Division of Taxation |

|

Revenue Processing Center |

|

PO Box 643 |

|

Trenton, NJ |

|

|

|

|

I verify and/or affirm that all information on this return is correct. I am aware that if any of the foregoing information provided by me is knowingly false, I am subject to punishment.

______________________________________________________________________________________________________________________

SignatureTitleDate

______________________________________________________________________________________________________________________

Print Name |

Telephone # |

Instructions for Completing the

Line 1. Enter the Number of Vehicle Rental Agreements of 28 days or less, which were completed during the quarter. Enter (0) if zero. A Vehicle Rental Agreement means any agreement or invoice for the rental of a motor vehicle such as a passenger automobile, truck, van, tractor or semitrailer that is rented without a driver and designed for use in the transportation of persons or property on the public roadways, other than for transportation of commercial freight. The term includes motor vehicle rentals/loaner transactions which are between rental companies. If any consideration is paid, or might have to be paid, by the renter for expenses, such as, but not limited to, insurance coverage, damage waiver, or excess mileage, the agreement/transaction is to be treated as a rental for purposes of the Domestic Security Fee.

Line 2. Enter the Number of Rental Fee Days represented in the agreements of 28 days or less from Line 1. Enter

(0)if zero. A Rental Fee Day is a "Rental day" on which a $2.00 fee is charged and means midnight to midnight or a

Line 3. Multiply Line 2 by $2.00 and enter result. The Rental Fee is $2.00 per day with a

Line 4. Enter the Number of Vehicle Rental Agreements greater than 28 days which were completed during the quarter. Enter (0) if zero. See the definition of a “Vehicle Rental Agreement” in the Line 1 instructions.

Line 5. Multiply Line 4 by $56.00 (fee limit per agreement, if agreement greater than 28 days) and enter result. Enter

(0) if zero.

Line 6. Enter any Penalty and Interest you calculate as due and payable. Enter (0) if zero. If you do not make an entry, the Division of Taxation will make the calculation for you and mail you a Statement of Account including a balance due. Failure to file a New Jersey Domestic Security Fee Return by the due date and/or failure to make remittance for the fee due by said date will result in penalty and interest charges as follows:

Penalty Charges:

1.Late Filing Penalty - 5% per month or fraction thereof of the balance of fee liability due at original return due date not to exceed 25% of such fee liability.

2.Late Payment Penalty - 5% of the balance of the fee due paid late may be imposed.

Interest Charges:

The annual interest rate is 3% above the average predominant prime rate. Interest is imposed each month or fraction thereof on the unpaid balance of the fee from the original due date to the date of payment. At the end of each calendar year and fee, penalties and interest remaining due will become part of the balance on which interest will be charged.

NOTE: The average predominant prime rate is the rate as determined by the Board of Governors of the Federal Reserve System, quoted by commercial banks to large businesses on December 1st of the calendar year immediately preceding the calendar year in which the payment was due or as determined by the Director in accordance with R.S.

Collection Fee: In addition, if your Domestic Security Fee bill is sent to our collection agency, a referral cost recovery fee of 10% of the Domestic Security Fee may be added to your liability. If a certificate of debt is issued for your outstanding liability, a fee for the cost of collection may also be imposed.

Line 7. - Total Amount Due. Add Lines 3, 5, and 6 and enter result. Enter (0) if zero.