Use the correct form

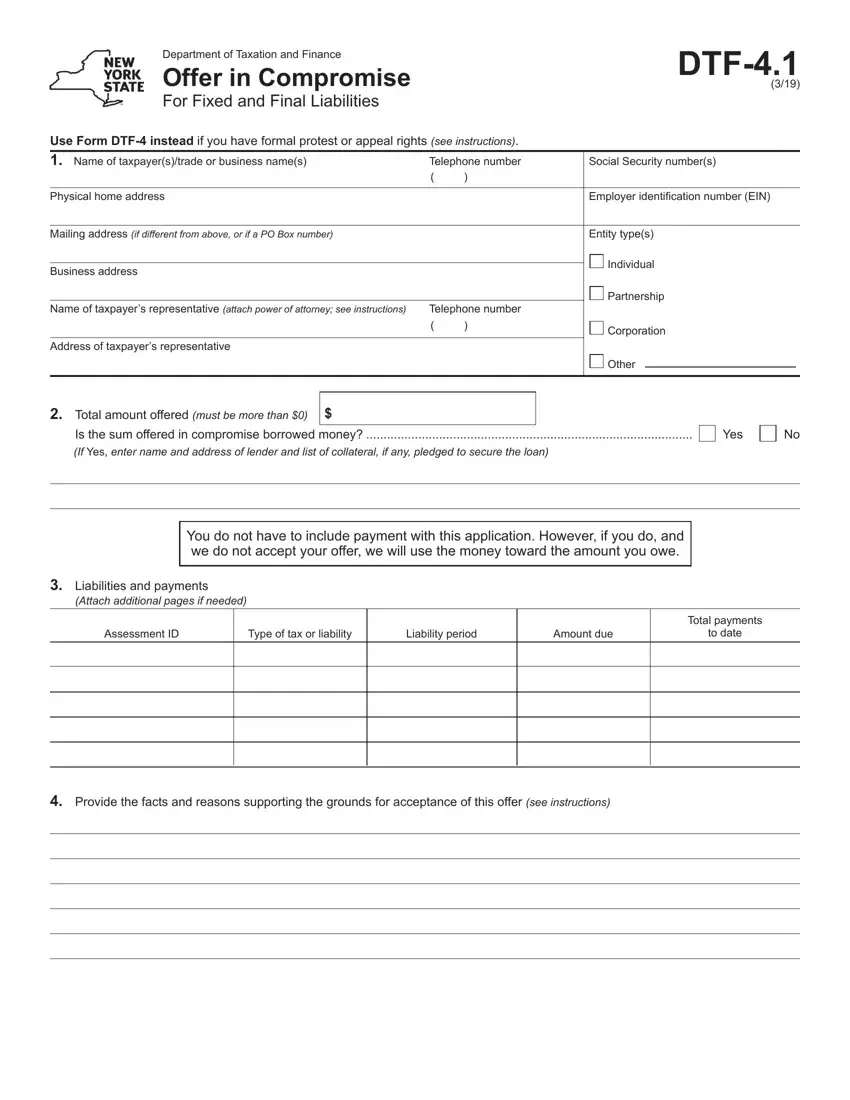

•Use Form DTF-4.1, Offer in Compromise: For Fixed and Final Liabilities, to submit your request to compromise liabilities, where you do not have any formal protest or appeal rights.

You do not have these rights if you:

•owe tax, interest, or penalties due to: a math or clerical error on a return, a change the IRS made to your federal return, or your failure to pay on time the tax that you reported due on your return, or

•received a Statement of Proposed Audit Changes.

Your liabilities are fixed and final, and may be established by a valid warrant.

•Use Form DTF-4, Offer in Compromise: For Liabilities Not Fixed and Final, and Subject to Administrative Review, where you still have formal protest or appeal rights.

Considerations for using Form DTF-4.1

You must be in compliance with all paying and filing requirements for periods not included in your offer. This includes estimated payments, tax deposits, and similar requirements.

Generally, we may consider offers in compromise from the following taxpayers:

•individuals and businesses discharged from bankruptcy

•individuals and businesses that are insolvent (liabilities, including tax liabilities, exceed the fair market value of assets)

•individuals (not businesses) for whom paying the debt in full would cause undue economic hardship

Submitting Form DTF-4.1 does not automatically suspend collection of a warrant, nor does it suspend the time for you to take any action about an assessment.

Also, submitting Form DTF-4.1 does not affect the interest and penalties that continue to accrue on your liabilities. Interest is due at the rate set by the Tax Law, from the date of the notice or agreement until we receive full payment.

We may require a written collateral agreement or other security, to protect the Tax Department’s interest.

Generally, a taxpayer may make only one offer in compromise for a particular liability for a particular period.

Basis for compromise

To be eligible, you must show that you have been discharged in bankruptcy, you are insolvent, or (for individuals only) that collection in full would cause you undue economic hardship. You are considered insolvent if all your liabilities (including your tax debt) exceed the fair market value of your assets.

Undue economic hardship generally means that you are unable to pay reasonable basic living expenses, which are those providing for the health, welfare, and production of income for your family. We use IRS standards to help determine allowable living expenses.

We also consider other factors, including the taxpayer’s age, employment status, and employment history; any inability to earn income because of long-term illness, medical condition, or disability; and any obligation to dependents.

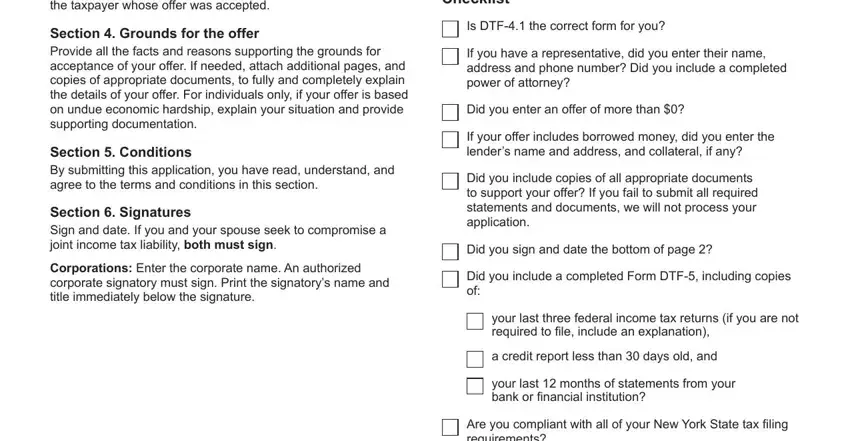

All offers must include:

•a completed Form DTF-5, Statement of Financial Condition (available at www.tax.ny.gov), including copies of:

•your last three federal income tax returns,

•a credit report less than 30 days old, and

•your last 12 months of statements from your bank or financial institution.

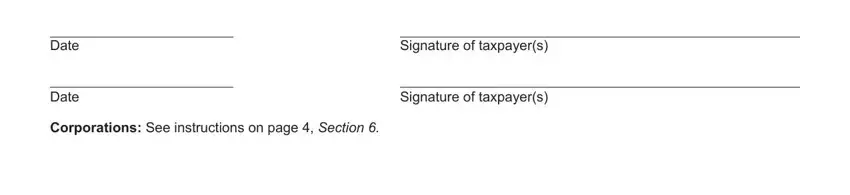

If we accept your offer

If the Tax Department accepts your offer, and you satisfy all the terms of the offer (for example, you paid in full the offer and complied with the terms of any collateral agreement), we will eliminate the remaining balance of your liabilities included in this offer, satisfying any warrants.

Taxpayer’s representative

If you have a representative, you must include a completed power of attorney. We recommend POA-1, Power of Attorney, available at www.tax.ny.gov. If you use another power of attorney, it must include the same information as the POA-1.

Estates

When Form DTF-4.1 is submitted by an estate fiduciary (executor or administrator), the fiduciary must submit a copy of the appropriate court appointment (for example, letters testamentary or letters of administration) or, if there is no court appointment, appropriate documents as requested by the Tax Department. If the offer in compromise will be handled by the fiduciary’s duly authorized representative, and the representative will sign on page 2 on behalf of the fiduciary, the fiduciary must also submit a completed power of attorney along with the appropriate documents. We recommend Form ET-14, Estate Tax Power of Attorney. If you use another power of attorney form, it must include the same information as the ET-14.

Specific instructions

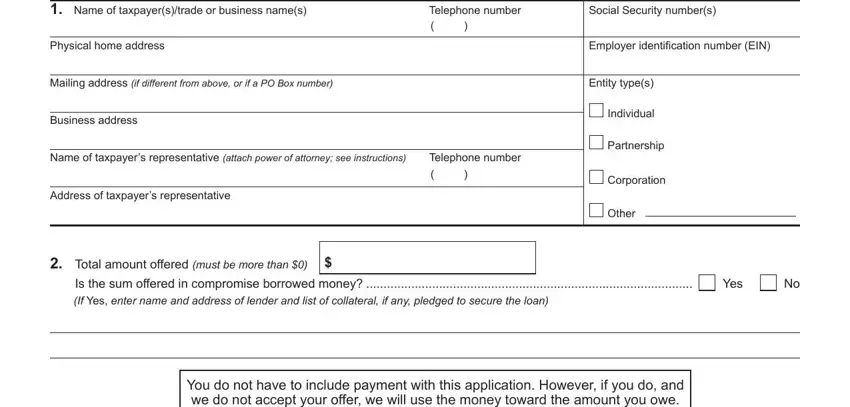

Section 1. Taxpayer information

Enter the full name and phone number of the taxpayer(s). If the taxpayer is a business, enter the name of the business or its trade name (or both). If this is a joint income tax liability, both spouses may submit one application and enter both names. However, for any other type of joint liability, such as a partnership, each must submit separate DTF-4.1 forms.

Enter the taxpayer’s Social Security number, or, for a business, the EIN.

Enter the taxpayer’s physical home address, mailing address if different or a PO Box, and business address (if applicable).

Mark an X in a box to indicate entity type(s). If Other, fill in the blank.

If the taxpayer has a representative, enter the name, phone number, and address of the representative, and attach a completed power of attorney.

Section 2. Amount offered

Enter the total amount you intend to offer. You must offer more than $0, and you cannot include any amounts previously paid or collected against the liabilities.