This PDF editor was designed with the purpose of allowing it to be as simple and easy-to-use as it can be. These actions can make filling up the ct 5 4 easy and fast.

Step 1: Get the button "Get Form Here" and then click it.

Step 2: At this point, you are on the form editing page. You can add text, edit present information, highlight specific words or phrases, put crosses or checks, insert images, sign the file, erase unwanted fields, etc.

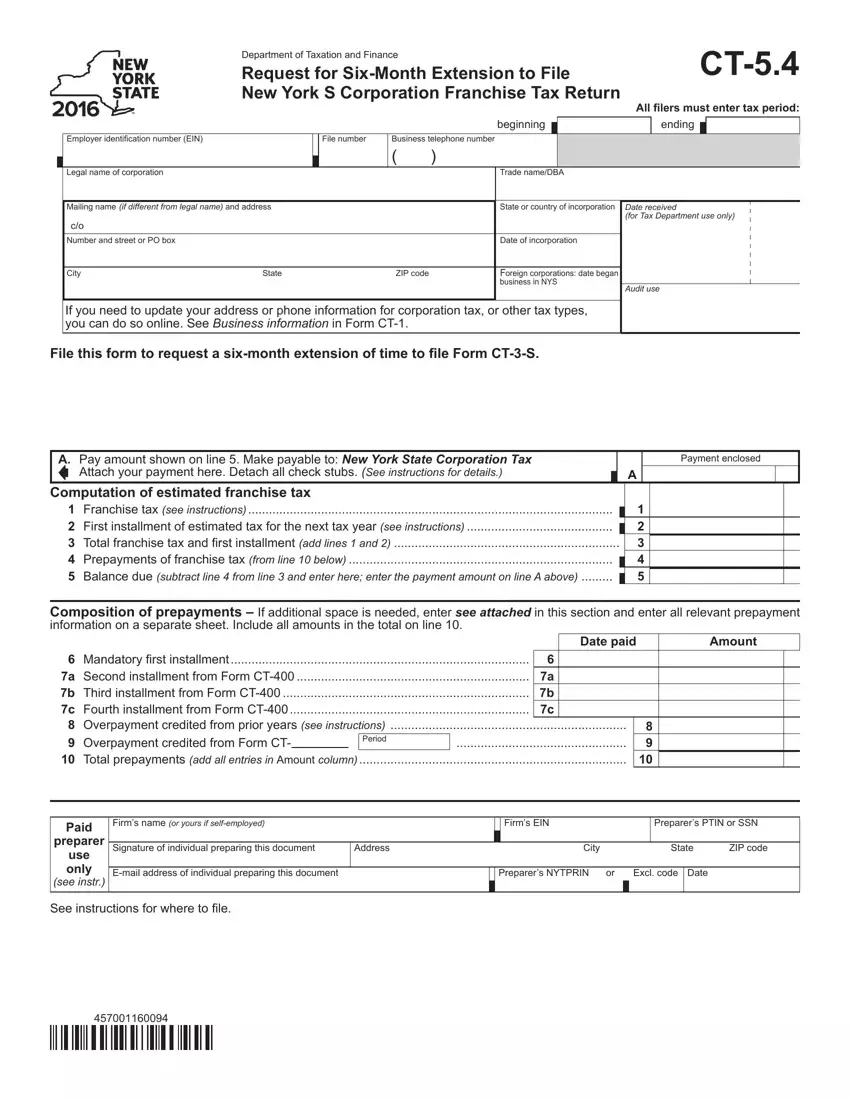

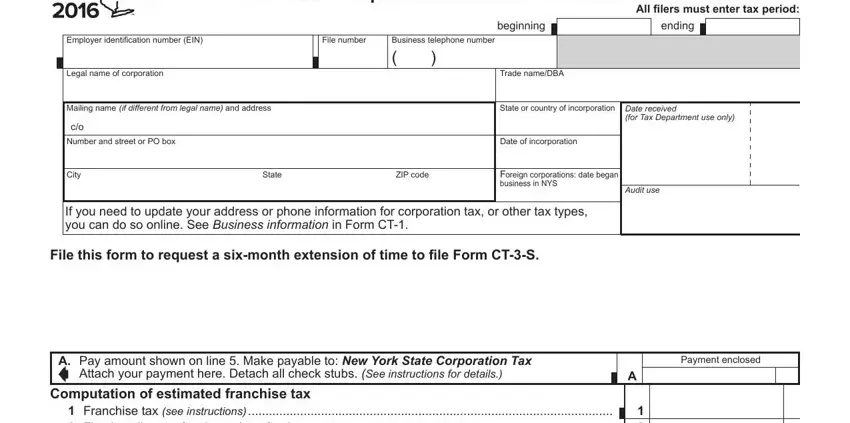

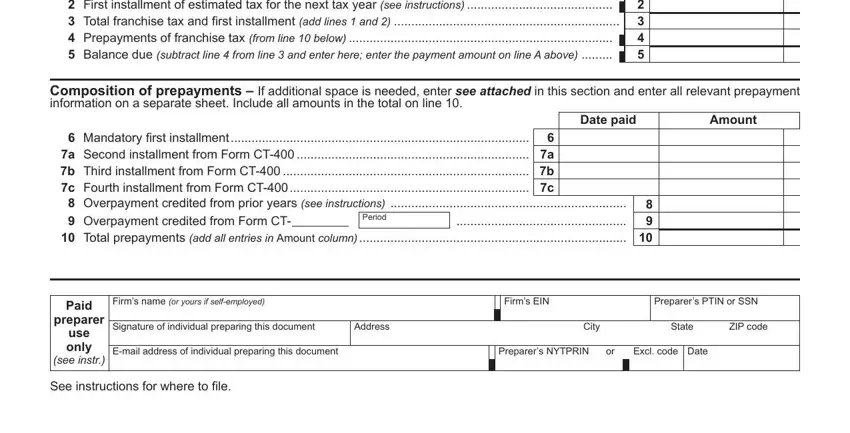

Fill in the ct 5 4 PDF and type in the information for each and every section:

Include the demanded details in the Computation, of, estimated, franchise, tax Date, paid Amount, Mandatory, i, rst, installment Period, Paid, preparer, use, only see, in, str Firms, name, or, yours, if, self, employed Firms, E, IN Preparer, sPT, IN, or, S, SN Address, City, and State segment.

Step 3: Press "Done". Now you can export your PDF form.

Step 4: Try to create as many duplicates of the form as possible to keep away from future troubles.