This PDF editor was designed to be as simple as possible. While you adhere to the next steps, the procedure for completing the dwc83 form document will be trouble-free.

Step 1: You can click the orange "Get Form Now" button at the top of the following website page.

Step 2: Once you've accessed the dwc83 form editing page you can discover all the functions you'll be able to conduct with regards to your document at the top menu.

Fill out the dwc83 form PDF by typing in the data meant for each individual part.

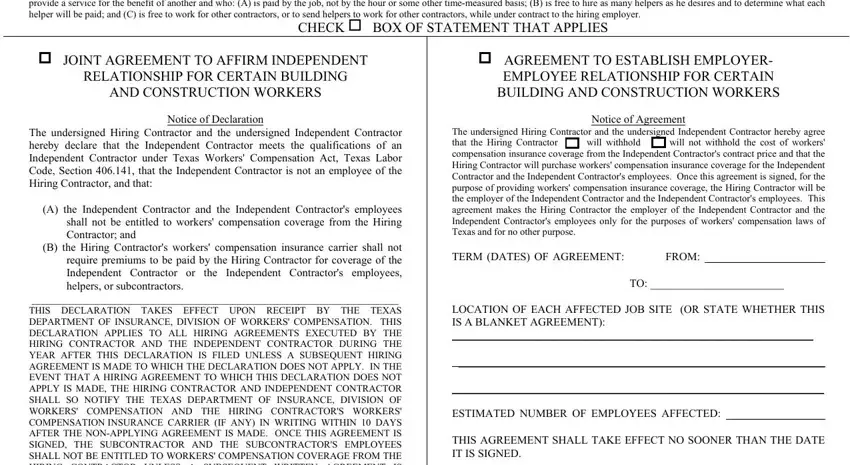

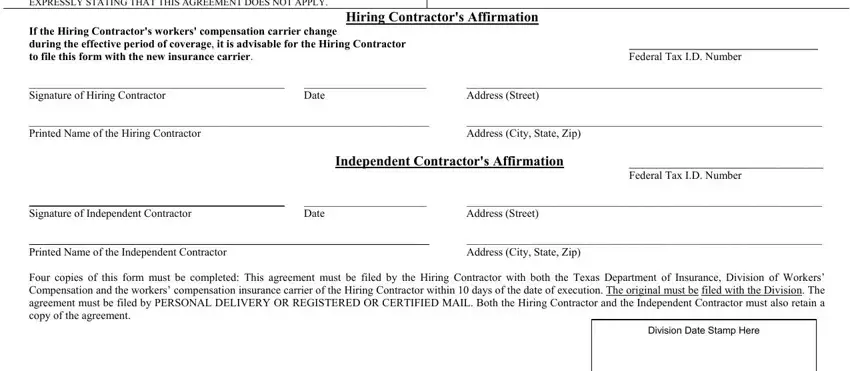

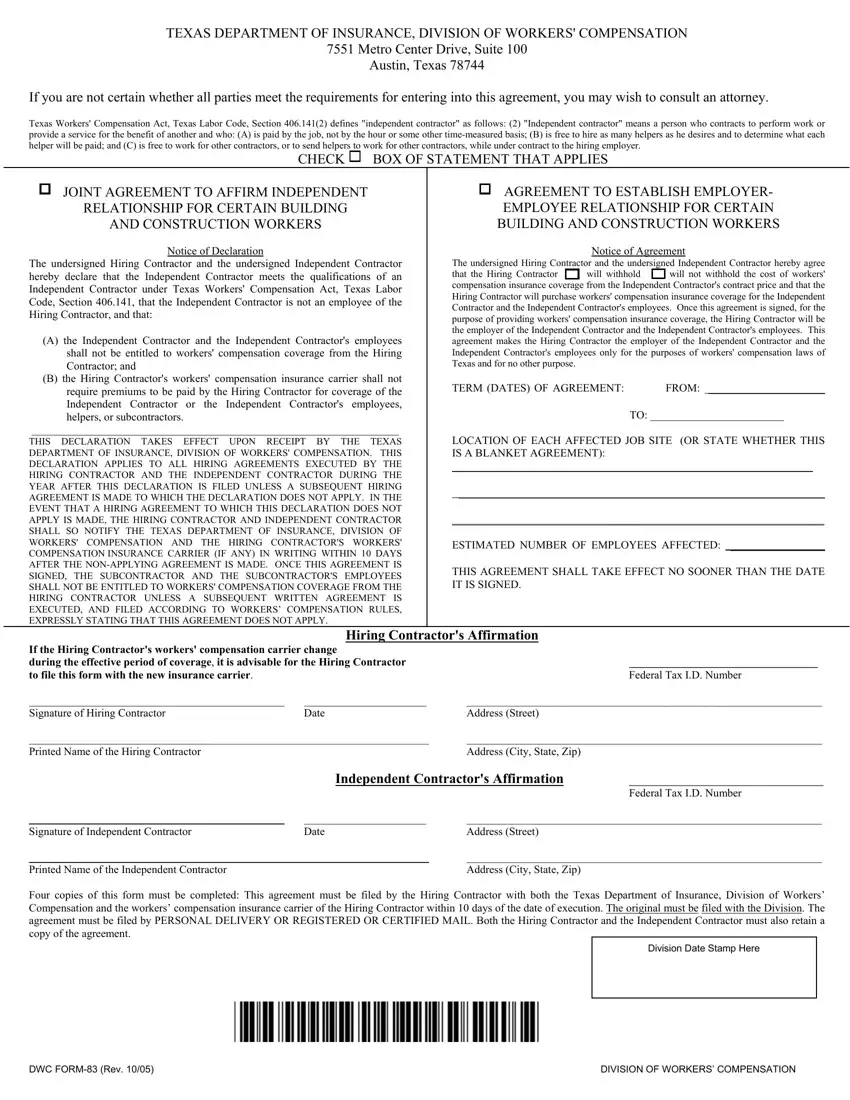

Write down the information in THIS DECLARATION TAKES EFFECT, If the Hiring Contractors workers, Hiring Contractors Affirmation, Federal Tax ID Number, Signature of Hiring Contractor, Date, Address Street, Printed Name of the Hiring, Address City State Zip, Independent Contractors Affirmation, Federal Tax ID Number, Signature of Independent, Date, Address Street, and Printed Name of the Independent.

Step 3: If you're done, hit the "Done" button to transfer the PDF document.

Step 4: In order to avoid any sort of difficulties in the future, you should create as a minimum a couple of duplicates of your file.

BOX OF STATEMENT THAT APPLIES

BOX OF STATEMENT THAT APPLIES

AGREEMENT TO ESTABLISH EMPLOYER- EMPLOYEE RELATIONSHIP FOR CERTAIN BUILDING AND CONSTRUCTION WORKERS

AGREEMENT TO ESTABLISH EMPLOYER- EMPLOYEE RELATIONSHIP FOR CERTAIN BUILDING AND CONSTRUCTION WORKERS

will withhold

will withhold

will not withhold the cost of workers' compensation insurance coverage from the Independent Contractor's contract price and that the Hiring Contractor will purchase workers' compensation insurance coverage for the Independent Contractor and the Independent Contractor's employees. Once this agreement is signed, for the purpose of providing workers' compensation insurance coverage, the Hiring Contractor will be the employer of the Independent Contractor and the Independent Contractor's employees. This agreement makes the Hiring Contractor the employer of the Independent Contractor and the Independent Contractor's employees only for the purposes of workers' compensation laws of Texas and for no other purpose.

will not withhold the cost of workers' compensation insurance coverage from the Independent Contractor's contract price and that the Hiring Contractor will purchase workers' compensation insurance coverage for the Independent Contractor and the Independent Contractor's employees. Once this agreement is signed, for the purpose of providing workers' compensation insurance coverage, the Hiring Contractor will be the employer of the Independent Contractor and the Independent Contractor's employees. This agreement makes the Hiring Contractor the employer of the Independent Contractor and the Independent Contractor's employees only for the purposes of workers' compensation laws of Texas and for no other purpose.