Our finest computer programmers have worked collectively to get the PDF editor which you can begin using. This particular app makes it easy to prepare Form E2A documentation quickly and with ease. This is certainly all you have to undertake.

Step 1: Initially, hit the orange button "Get Form Now".

Step 2: After you access our Form E2A editing page, there'll be all the actions it is possible to undertake about your template in the upper menu.

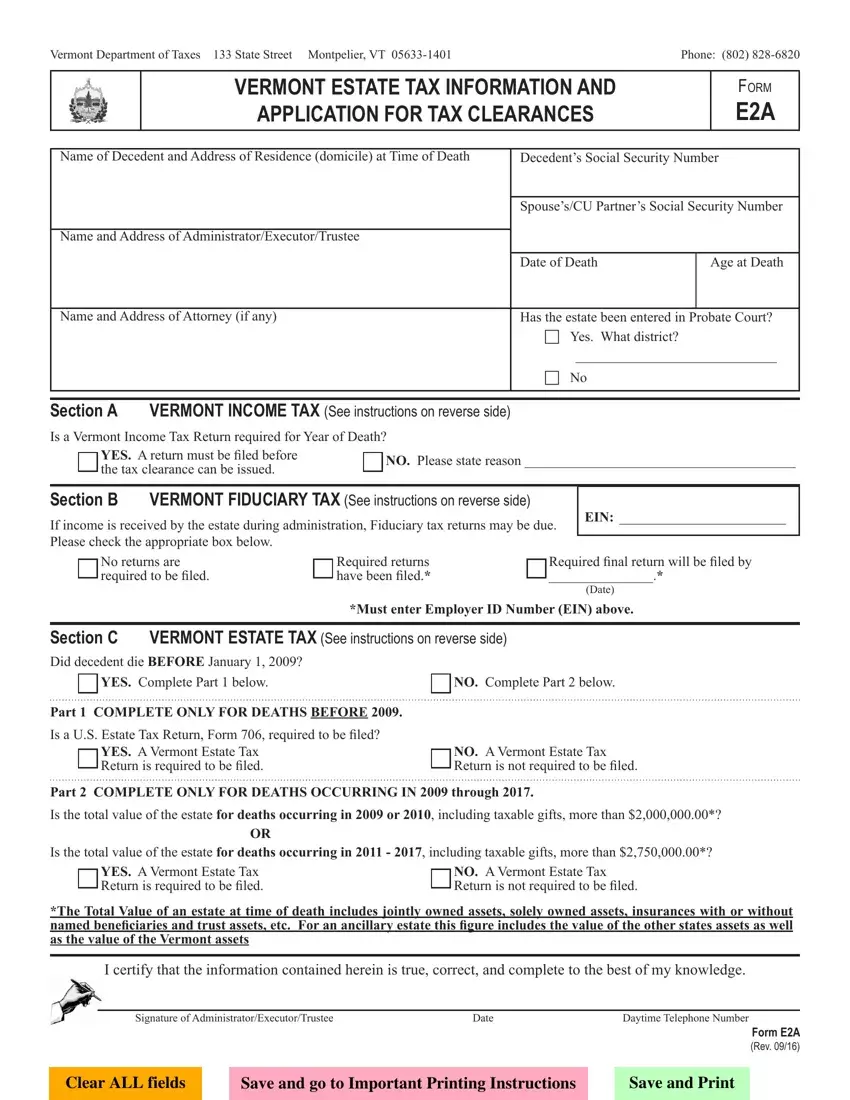

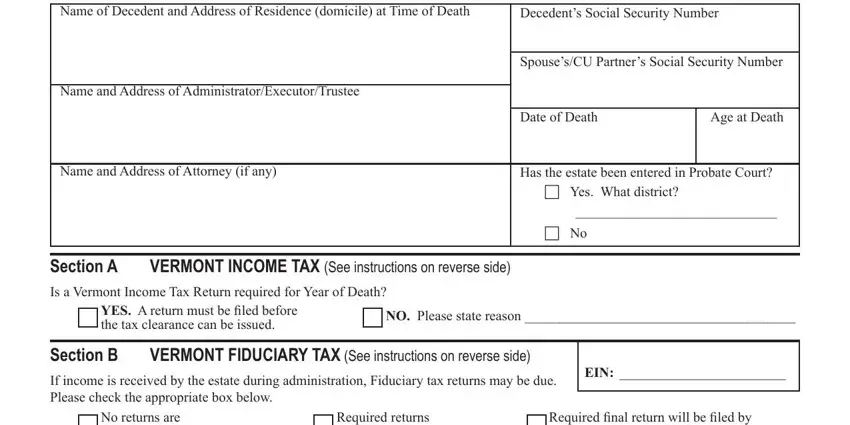

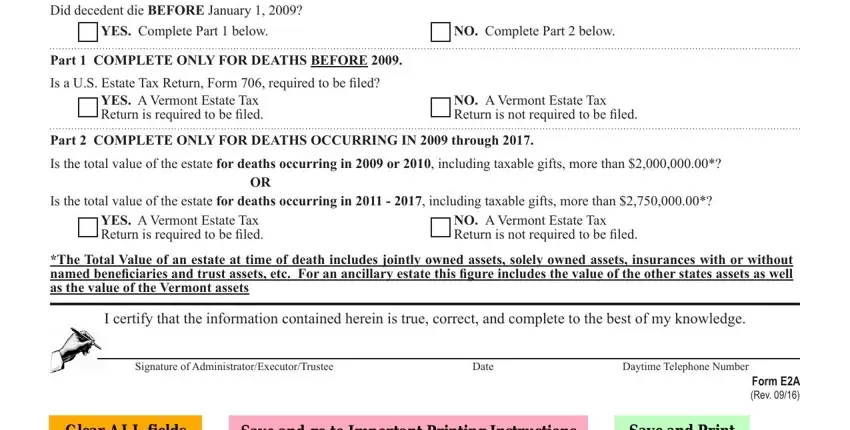

In order to fill in the Form E2A PDF, enter the information for all of the segments:

The system will need you to complete the Section C Did decedent die BEFORE, YES Complete Part below, NO Complete Part below, Part COMPLETE ONLY FOR DEATHS, Is a US Estate Tax Return Form, YES A Vermont Estate Tax Return is, NO A Vermont Estate Tax Return is, Part COMPLETE ONLY FOR DEATHS, Is the total value of the estate, Is the total value of the estate, YES A Vermont Estate Tax Return is, NO A Vermont Estate Tax Return is, The Total Value of an estate at, I certify that the information, and Signature of field.

Step 3: Select the "Done" button. Next, you can export the PDF file - save it to your device or deliver it through email.

Step 4: Create duplicates of the file. This is going to prevent forthcoming worries. We don't see or display your information, as a consequence you can be confident it is secure.