Dealing with PDF files online is definitely simple with this PDF editor. Anyone can fill out Form Es 40 here and try out many other functions available. In order to make our tool better and simpler to work with, we continuously work on new features, considering feedback coming from our users. To get started on your journey, consider these simple steps:

Step 1: First, access the tool by clicking the "Get Form Button" above on this page.

Step 2: This editor helps you modify your PDF in a range of ways. Modify it by including any text, adjust existing content, and place in a signature - all close at hand!

Filling out this PDF demands care for details. Ensure that every blank field is done properly.

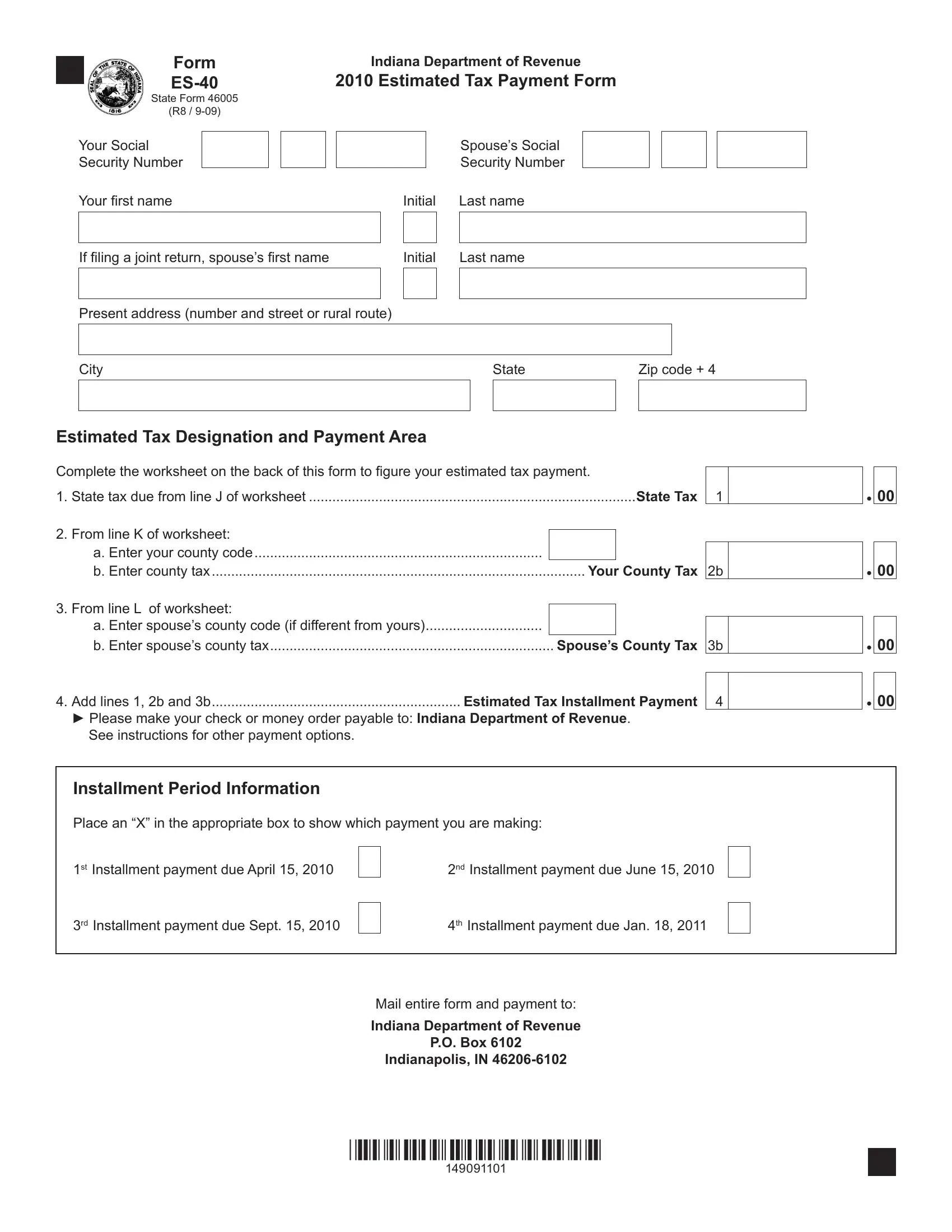

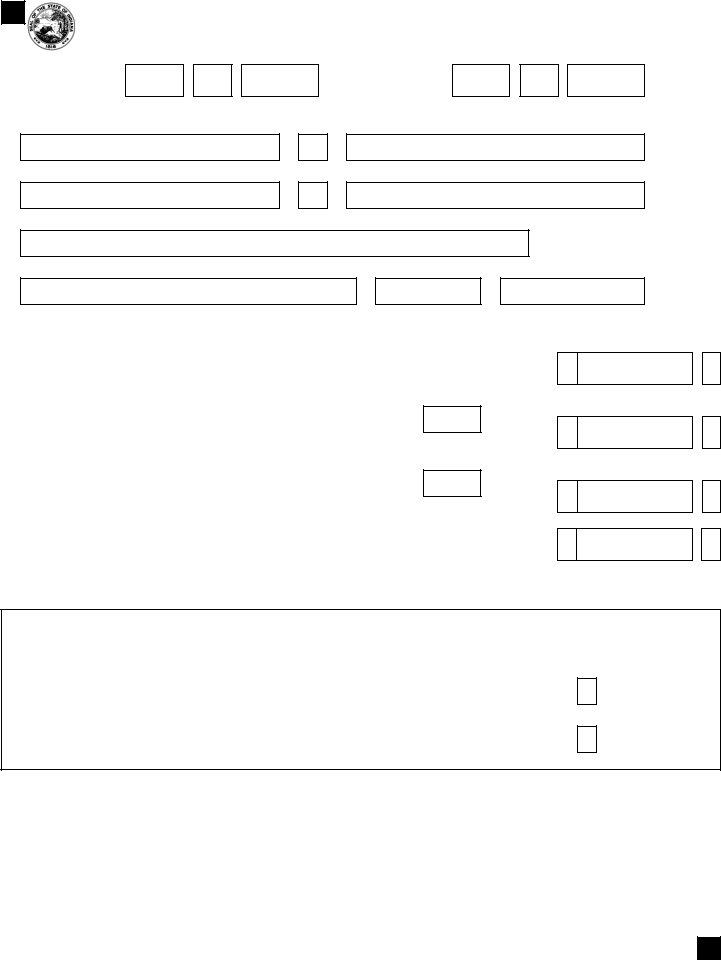

1. Start completing your Form Es 40 with a group of necessary blank fields. Gather all the information you need and ensure not a single thing missed!

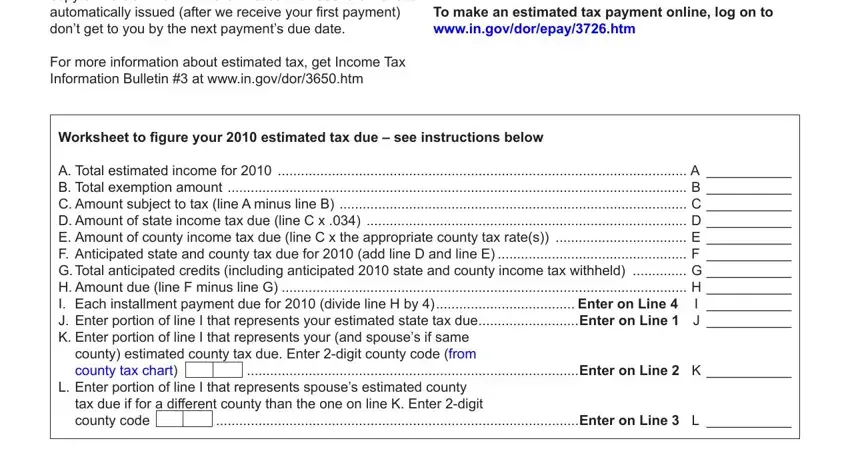

2. Given that the last part is done, you're ready to insert the needed details in Line E Multiply amount on line C, and Lines J K and L If you are paying in order to progress further.

Lots of people frequently make errors when completing Line E Multiply amount on line C in this area. You should definitely read twice whatever you enter here.

Step 3: Before finalizing your file, ensure that all blank fields were filled out right. As soon as you believe it is all good, click on “Done." Find the Form Es 40 when you join for a free trial. Easily use the pdf form inside your FormsPal cabinet, with any modifications and adjustments conveniently saved! If you use FormsPal, you can easily fill out forms without the need to worry about personal information incidents or entries getting distributed. Our secure software ensures that your private details are stored safe.