It is possible to complete the et85 form using this PDF editor. These actions will enable you to easily prepare your document.

Step 1: Select the orange button "Get Form Here" on the page.

Step 2: After you've entered the et85 edit page, you will notice all functions it is possible to undertake regarding your template in the top menu.

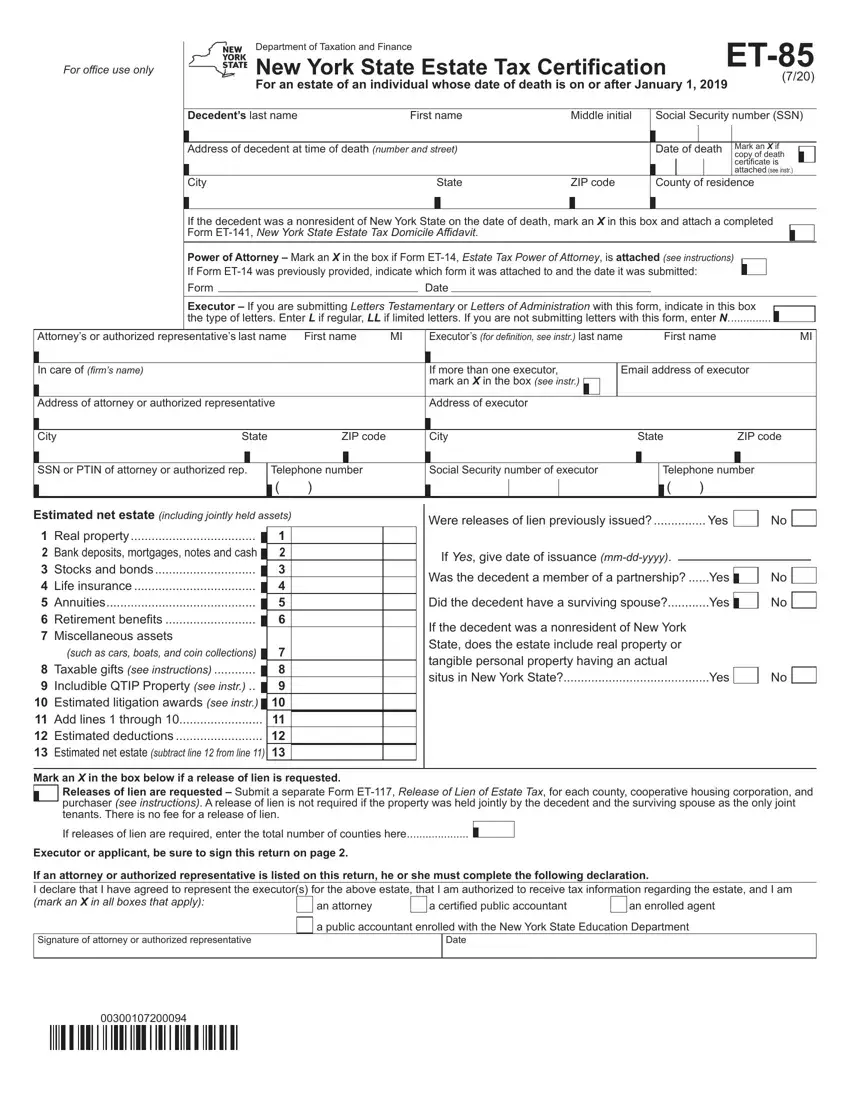

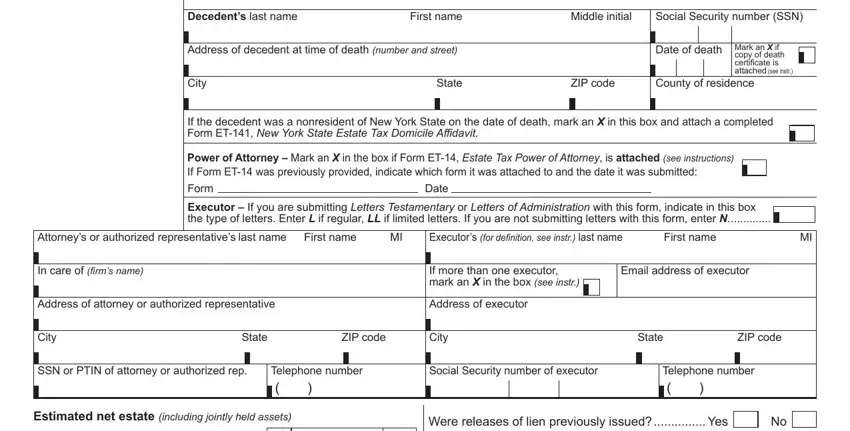

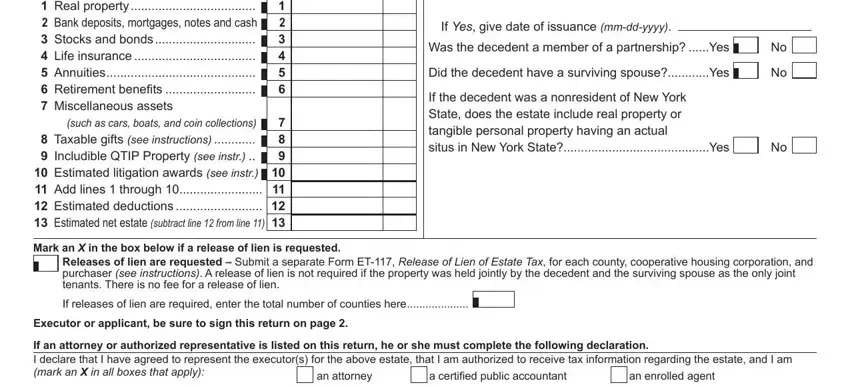

All of these parts are contained in the PDF document you will be completing.

Indicate the details in If, Yes, give, date, of, issuance, mm, dd, yyyy NoNo, a, certified, public, accountant and an, enrolled, agent

In the Date part, highlight the valuable information.

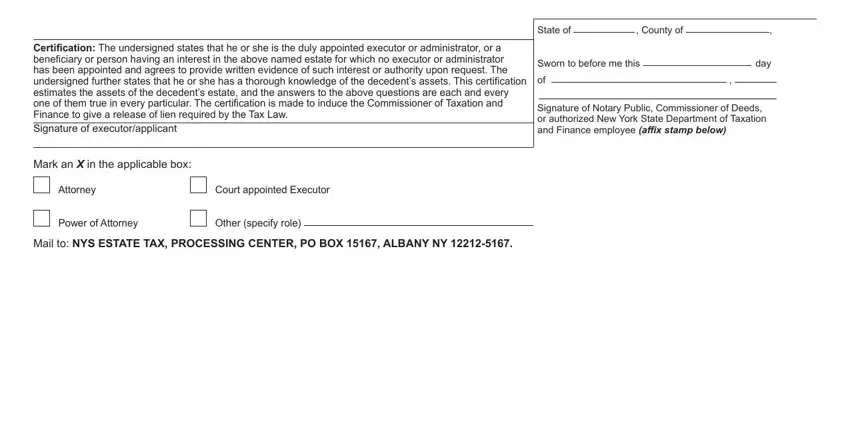

The State, of County, of Sworn, to, before, me, this, of day, Mark, an, X, in, the, applicable, box Attorney, Court, appointed, Executor Power, of, Attorney and Other, specify, role space is where all parties can describe their rights and responsibilities.

Step 3: If you're done, click the "Done" button to upload the PDF file.

Step 4: Generate a duplicate of every single file. It may save you time and allow you to stay clear of challenges in the long run. By the way, your information is not revealed or analyzed by us.