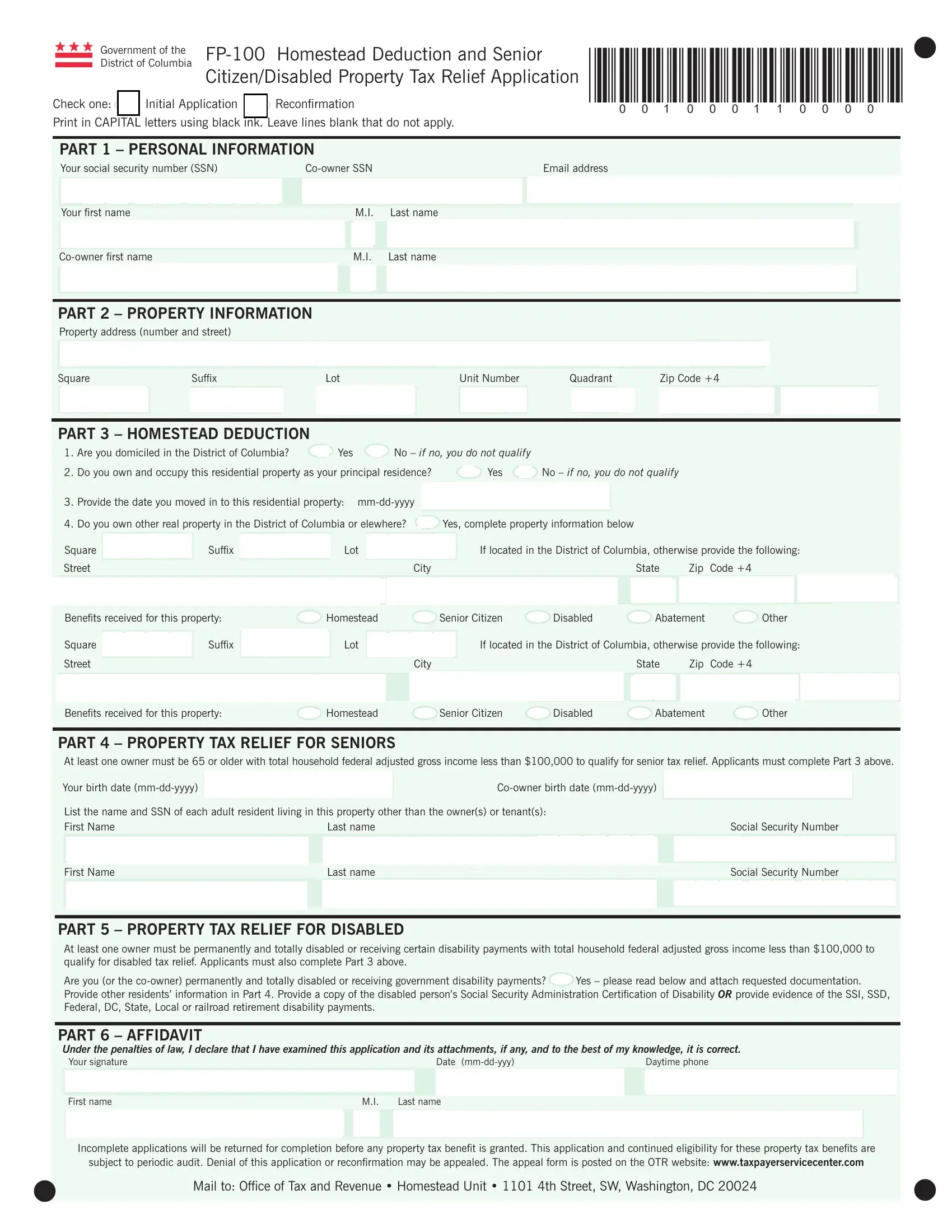

Dealing with PDF documents online is always easy with this PDF tool. Anyone can fill in Form Fp 100 here and use several other functions available. FormsPal is aimed at giving you the perfect experience with our tool by regularly presenting new capabilities and enhancements. Our editor is now a lot more helpful as the result of the newest updates! At this point, filling out PDF documents is simpler and faster than before. To get the process started, consider these basic steps:

Step 1: First, open the editor by pressing the "Get Form Button" above on this site.

Step 2: With this state-of-the-art PDF editor, it is possible to do more than simply fill out blank fields. Express yourself and make your docs look sublime with custom text put in, or fine-tune the original content to perfection - all comes with the capability to incorporate stunning photos and sign the document off.

Completing this form generally requires attention to detail. Make sure all mandatory blanks are done correctly.

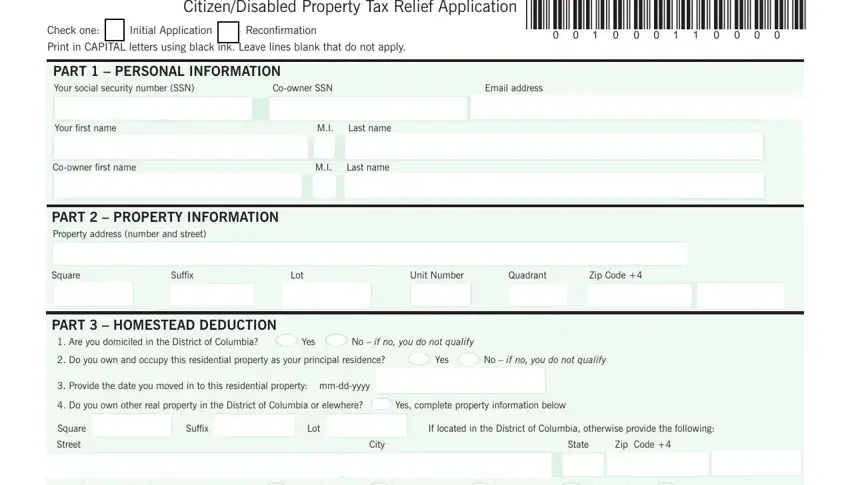

1. While completing the Form Fp 100, be certain to complete all of the essential fields in their relevant section. It will help to hasten the process, allowing for your details to be processed without delay and appropriately.

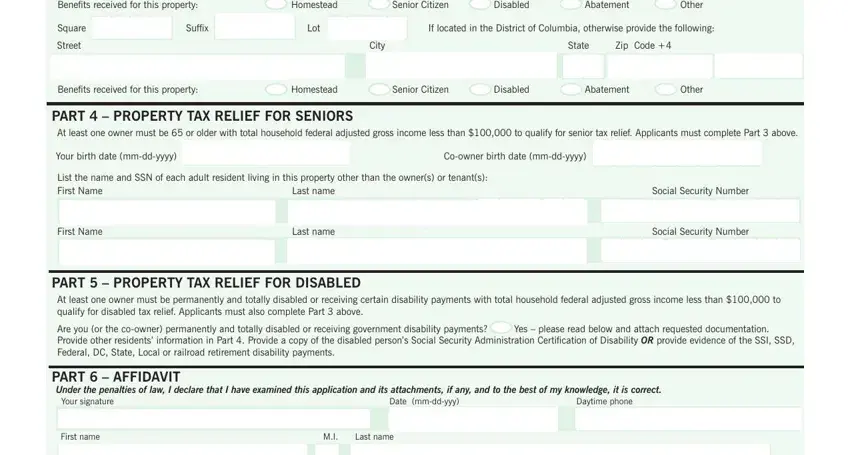

2. Your next stage is usually to fill in all of the following blanks: Benefits received for this property, Homestead, Senior Citizen, Disabled, Abatement, Other, Square, Street, Suffix, Lot If located in the District of, City, State, Zip Code, Benefits received for this property, and Homestead.

Be very attentive when filling out Square and Homestead, because this is the section in which many people make errors.

Step 3: Ensure that the details are accurate and then click "Done" to complete the process. Sign up with us today and instantly use Form Fp 100, prepared for downloading. Each and every modification made is conveniently saved , which means you can modify the form at a later point if needed. We do not share or sell any details you enter while completing documents at our website.