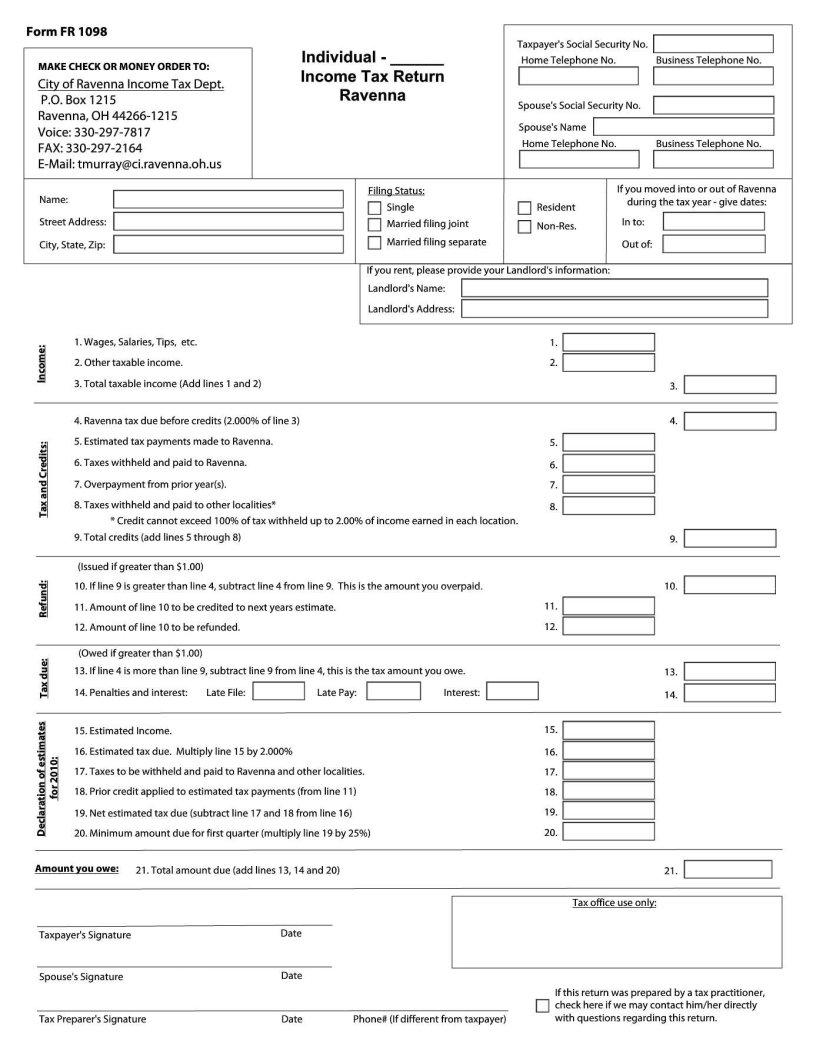

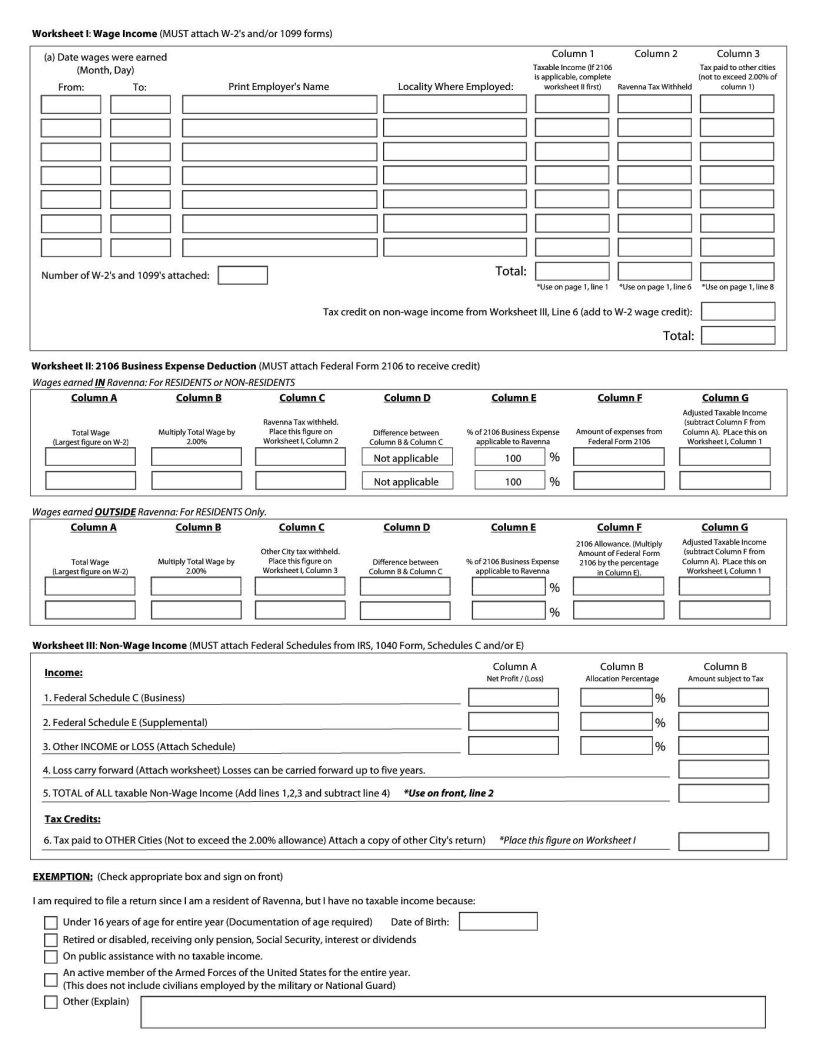

The complexities of tax documentation and compliance can often seem daunting, particularly when navigating the myriad forms required by the IRS. Among these, the FR 1098 form plays a crucial role for individuals and businesses alike, assisting in the accurate reporting of certain financial transactions within a given tax year. This form, while not widely discussed outside of professional circles, is pivotal in ensuring that taxpayers receive rightful deductions and credits, thereby influencing their overall tax liability. Its importance cannot be overstated, as it directly impacts the financial health of taxpayers, necessitating a thorough understanding of its purpose, the types of transactions it covers, eligibility criteria, and the potential repercussions of errors or omissions. Handling the FR 1098 form correctly is not just about compliance; it's about maximizing financial benefits that can significantly affect one’s financial standing. Therefore, a closer look at this form unveils the intricate ways in which it interacts with broader financial and tax reporting structures, illustrating the importance of due diligence and accuracy in tax preparation endeavors.

| Question | Answer |

|---|---|

| Form Name | Form Fr 1098 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | city of ravenna ohio taxes, how to tax ravenna, united way vita tax preparation ravenna ohio, tmurrayci |