|

|

|

RESET |

|

|

|

|

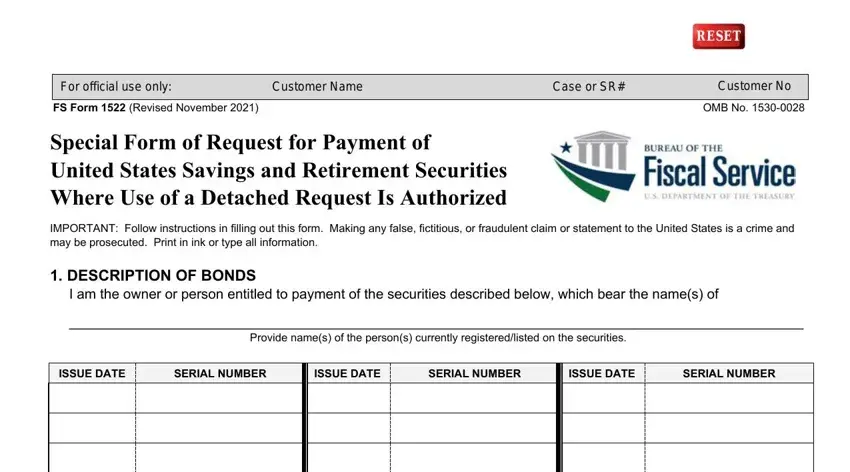

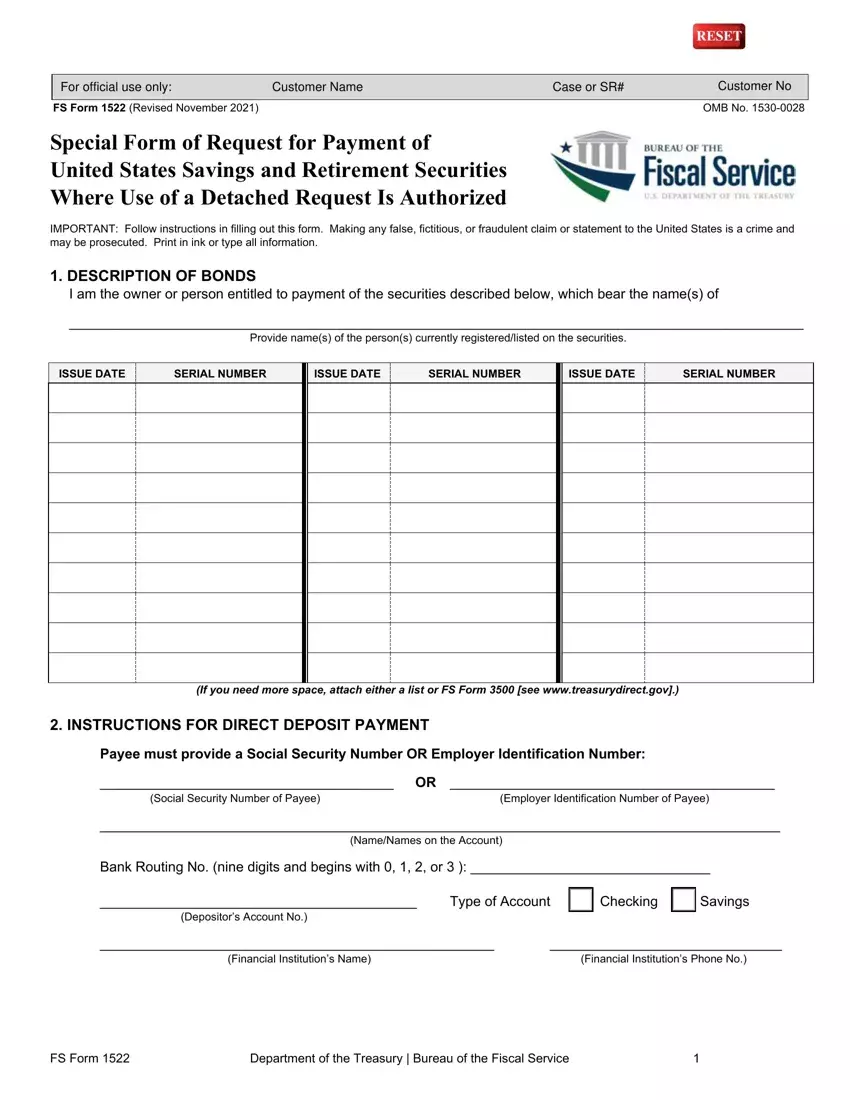

For official use only: |

Customer Name |

Case or SR# |

Customer No |

|

|

|

|

FS Form 1522 (Revised November 2021) |

|

|

OMB No. 1530-0028 |

Special Form of Request for Payment of

United States Savings and Retirement Securities

Where Use of a Detached Request Is Authorized

IMPORTANT: Follow instructions in filling out this form. Making any false, fictitious, or fraudulent claim or statement to the United States is a crime and may be prosecuted. Print in ink or type all information.

1. DESCRIPTION OF BONDS

I am the owner or person entitled to payment of the securities described below, which bear the name(s) of

_______________________________________________________________________________________________

Provide name(s) of the person(s) currently registered/listed on the securities.

(If you need more space, attach either a list or FS Form 3500 [see www.treasurydirect.gov].)

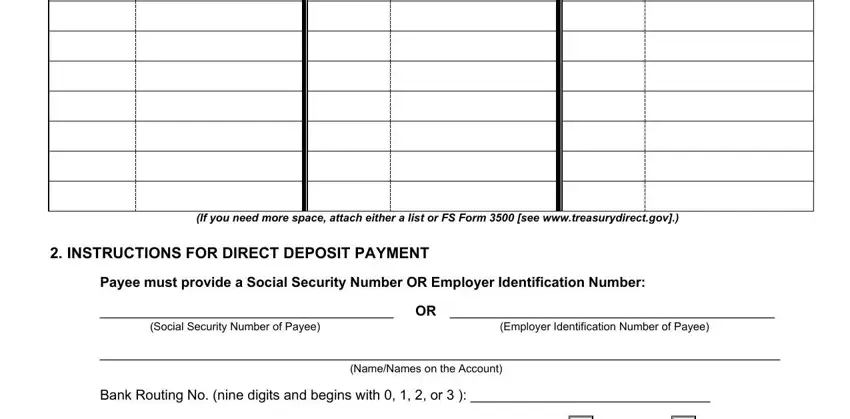

2. INSTRUCTIONS FOR DIRECT DEPOSIT PAYMENT

Payee must provide a Social Security Number OR Employer Identification Number:

______________________________________ |

OR __________________________________________ |

(Social Security Number of Payee) |

(Employer Identification Number of Payee) |

________________________________________________________________________________________

(Name/Names on the Account)

Bank Routing No. (nine digits and begins with 0, 1, 2, or 3 ): _______________________________

_________________________________________ |

Type of Account |

(Depositor’s Account No.)

___________________________________________________ |

______________________________ |

(Financial Institution’s Name) |

(Financial Institution’s Phone No.) |

FS Form 1522 |

Department of the Treasury | Bureau of the Fiscal Service |

1 |

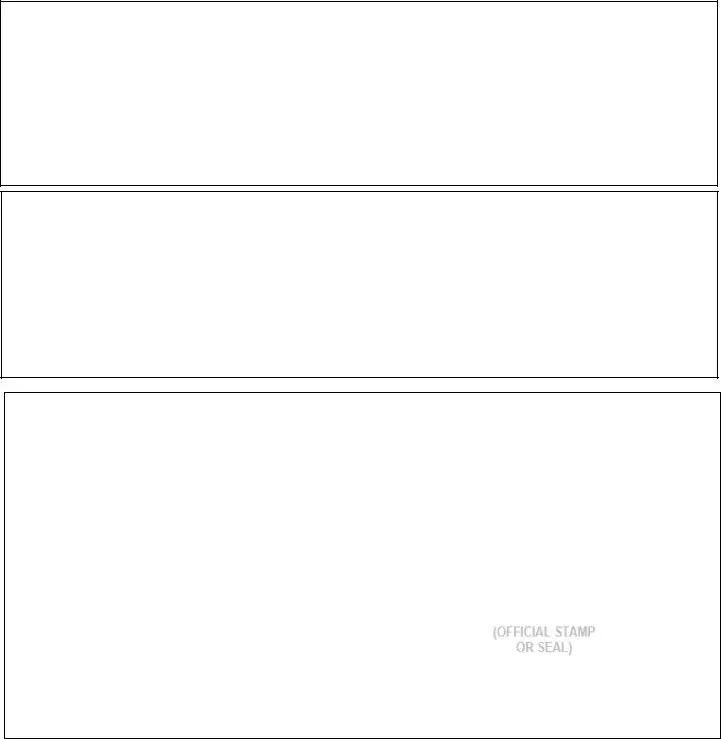

3. SIGNATURE

Under penalties of perjury, I certify that:

1.The number shown on this form is my correct Taxpayer Identification Number (or I am waiting for a number to be issued to me); and

2.I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding; and

3.I am a U.S. person (including a U.S. resident alien).

NOTE: You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return.

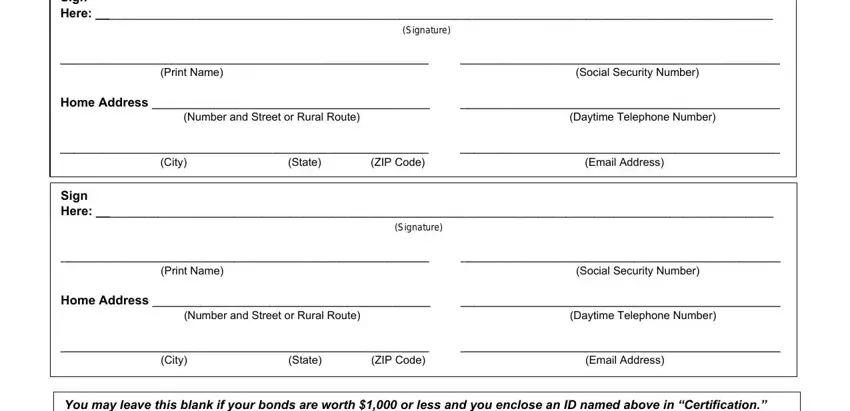

Certification. If the current redemption value (see Instructions) of your bonds totals $1,000 or less, your signature need not be certified; you may simply sign the form and enclose a current copy of your driver’s license, passport, state ID, or military ID. If the current redemption value of your bonds totals more than $1,000, sign this form in the presence of a notary or certifying officer.

Complete in ink. If required (see “Certification” above), sign in the presence of a notary or certifying officer.

Sign

Here: __________________________________________________________________________________________________

(Signature)

_____________________________________________________ |

______________________________________________ |

(Print Name) |

|

|

(Social Security Number) |

Home Address ________________________________________ |

______________________________________________ |

(Number and Street or Rural Route) |

|

(Daytime Telephone Number) |

_____________________________________________________ |

______________________________________________ |

(City) |

(State) |

(ZIP Code) |

(Email Address) |

Sign

Here: __________________________________________________________________________________________________

(Signature)

_____________________________________________________ |

______________________________________________ |

(Print Name) |

|

|

(Social Security Number) |

Home Address ________________________________________ |

______________________________________________ |

(Number and Street or Rural Route) |

|

(Daytime Telephone Number) |

_____________________________________________________ |

______________________________________________ |

(City) |

(State) |

(ZIP Code) |

(Email Address) |

You may leave this blank if your bonds are worth $1,000 or less and you enclose an ID named above in “Certification.”

Instructions to Notary or Certifying Officer: 1. Name(s) of the person(s) who appeared and date of appearance MUST be completed. 2. If a Medallion stamp is used, an original signature is required. 3. Person(s) must sign in your presence.

I CERTIFY that ________________________________________________________________________ , whose identity(ies)

(Names of Persons Who Appeared)

is/are known or proven to me, personally appeared before me this _______________ day of _______________ |

__________ |

(Month) |

(Year) |

at ___________________________________________________ and signed this form. |

|

(City, State) |

|

________________________________________________________ |

|

(Signature and Title of Notary or Certifying Officer) |

|

________________________________________________________ |

|

(Name of Financial Institution) |

|

________________________________________________________ |

|

(Address) |

|

________________________________________________________ |

|

(City, State, ZIP code) |

|

FS Form 1522 |

Department of the Treasury | Bureau of the Fiscal Service |

2 |

You may leave this blank if your bonds are worth $1,000 or less and you enclose an ID named above in “Certification.”

Instructions to Notary or Certifying Officer: 1. Name(s) of the person(s) who appeared and date of appearance MUST be completed. 2. If a Medallion stamp is used, an original signature is required. 3. Person(s) must sign in your presence.

I CERTIFY that ________________________________________________________________________ , whose identity(ies)

(Names of Persons Who Appeared)

is/are known or proven to me, personally appeared before me this _______________ day of _______________ |

__________ |

(Month) |

(Year) |

at ___________________________________________________ and signed this form. |

|

(City, State) |

|

________________________________________________________ |

|

(Signature and Title of Notary or Certifying Officer) |

|

________________________________________________________ |

|

(Name of Financial Institution) |

|

________________________________________________________ |

|

(Address) |

|

________________________________________________________ |

|

(City, State, ZIP code) |

|

INSTRUCTIONS

USE OF FORM – Use this form to request payment of United States Savings Bonds, Savings Notes, Retirement Plan Bonds, and Individual Retirement Bonds.

WHO MAY COMPLETE – This form may be completed by the owner, coowner, surviving beneficiary, or legal representative of the estate of a deceased or incompetent owner, persons entitled to the estate of a deceased registrant, or such other persons who may be entitled to payment under the regulations governing United States Savings Bonds. A minor may sign this form if, in the opinion of the notary or certifying officer, he or she is of sufficient competency to understand the nature of the transaction. An incompetent person may not sign this form.

COMPLETION OF FORM – Print clearly in ink or type all information requested.

ITEM 1.DESCRIPTION OF BONDS – Provide the name(s) of the person(s) shown in the inscription of the bonds for which payment is requested. Describe the bonds by issue date and serial number.

ITEM 2.INSTRUCTIONS FOR DIRECT DEPOSIT PAYMENT

The payee's Taxpayer Identification Number must be provided. Furnish the Social Security Number if the payee is an individual. If an estate, trust, or other entity is involved and IRS has assigned an Employer Identification Number, provide that number. Furnish the name(s) on the account, the account number, the type of account, and the financial institution's name, the routing/transit number which identifies the institution, and the institution's phone number. You may need to contact the financial institution to obtain the routing number.

Please verify account information for accuracy and legibility to avoid a delay in deposit.

ITEM 3. SIGNATURE

The person(s) requesting payment of the bonds must sign the form in ink, print his or her name, and provide his or her address, daytime telephone number, and if applicable, e-mail address. If the name of a person requesting payment has been changed by marriage or in any other legal manner from the name in the inscription of the bonds, the signature to the request for payment must show both names and the manner in which the change was made; for example, "Miss Mary T. Jones now by marriage Mrs. Mary T. Smith.”

FS Form 1522 |

Department of the Treasury | Bureau of the Fiscal Service |

3 |

CERTIFICATION – To find the current redemption value of savings bonds of Series EE, Series E, or Series I, or of savings notes, use the Savings Bond Calculator at TreasuryDirect.gov.

If the current redemption value of your bonds totals $1,000 or less, your signature need not be certified. Rather, when you sign the form, you may verify your identity by enclosing a current copy of your driver’s license, passport, state ID, or military ID.

If the current redemption value of your bonds totals more than $1,000, each person whose signature is required must appear before and establish identification to the satisfaction of a notary or authorized certifying officer. The signatures to the form must be signed in the presence of the notary or officer. The notary or certifying officer must affix the seal or stamp which is used when certifying requests for payment. Authorized certifying officers are available at financial institutions, including credit unions, in the United States. Examples of acceptable seals and stamps:

•The seal or stamp of a notary

•A financial institution’s official seal or stamp, including: Signature Guaranteed seal or stamp; Endorsement Guaranteed seal or stamp; Corporate seal or stamp (a corporate resolution isn’t required); or Issuing or paying agent seal or stamp (including name, location, and four-digit identification number or nine-digit routing number)

•The seal or stamp of Treasury-recognized Signature Guarantee Programs or other Treasury-approved Medallion Programs

WHERE TO SEND – Unless otherwise instructed, send this form and the bonds, as well as any other appropriate forms, evidence, or identification records, to the address below. Legal evidence or documentation you submit cannot be returned.

Treasury Retail Securities Services, P.O. Box 9150, Minneapolis, MN 55480-9150

(Phone: 844-284-2676--toll free.)

NOTICE UNDER THE PRIVACY AND PAPERWORK REDUCTION ACTS

The collection of the information you are requested to provide on this form is authorized by 31 U.S.C. CH. 31 relating to the public debt of the United States. The furnishing of a Social Security Number, if requested, is also required by Section 6109 of the Internal Revenue Code (26 U.S.C. 6109).

The purpose of requesting the information is to enable the Bureau of the Fiscal Service and its agents to issue securities, process transactions, make payments, identify owners and their accounts, and provide reports to the Internal Revenue Service. Furnishing the information is voluntary; however, without the information, the Fiscal Service may be unable to process transactions.

Information concerning securities holdings and transactions is considered confidential under Treasury regulations (31 CFR, Part 323) and the Privacy Act. This information may be disclosed to a law enforcement agency for investigation purposes; courts and counsel for litigation purposes; others entitled to distribution or payment; agents and contractors to administer the public debt; agencies or entities for debt collection or to obtain current addresses for payment; agencies through approved computer matches; Congressional offices in response to an inquiry by the individual to whom the record pertains; as otherwise authorized by law or regulation.

We estimate it will take you about 15 minutes to complete this form. However, you are not required to provide information requested unless a valid OMB control number is displayed on the form. Any comments or suggestions regarding this form should be sent to the Bureau of the Fiscal Service, Forms Management Officer, Parkersburg, WV 26106-1328. DO NOT SEND completed form to the above

address; send to the address shown in "WHERE TO SEND" above.

FS Form 1522 |

Department of the Treasury | Bureau of the Fiscal Service |

4 |