You could work with ftb 3538 effortlessly in our PDFinity® editor. FormsPal professional team is always working to develop the editor and make it even easier for people with its many features. Discover an constantly revolutionary experience today - check out and find out new opportunities along the way! Getting underway is easy! All you have to do is stick to the next simple steps down below:

Step 1: Hit the "Get Form" button above on this page to access our editor.

Step 2: The tool will allow you to modify the majority of PDF forms in various ways. Improve it by writing personalized text, correct what is originally in the PDF, and put in a signature - all manageable within minutes!

It really is simple to finish the form using this helpful guide! Here is what you must do:

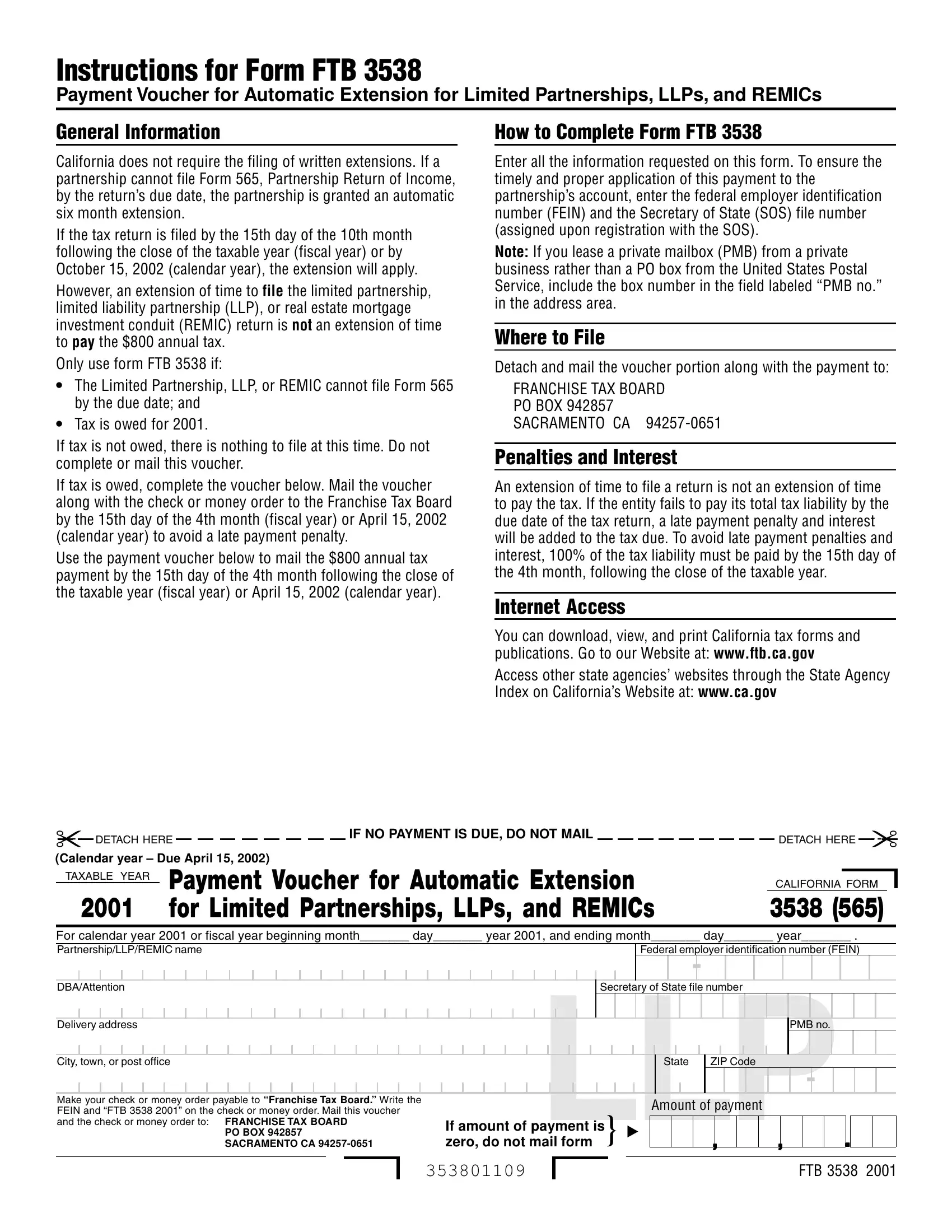

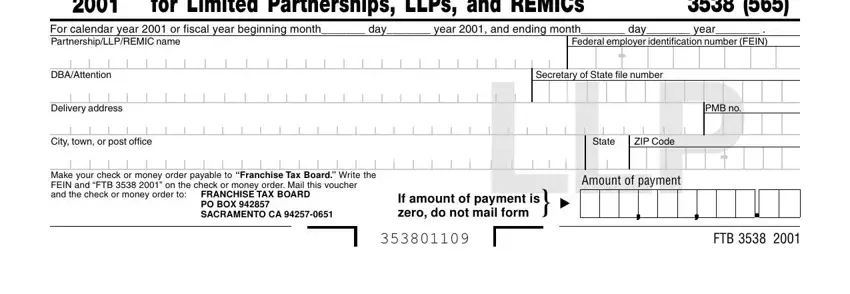

1. To begin with, once completing the ftb 3538, start with the part that features the next blanks:

Step 3: Reread the information you've typed into the blank fields and press the "Done" button. After getting a7-day free trial account with us, it will be possible to download ftb 3538 or email it right off. The document will also be readily accessible via your personal account page with all of your adjustments. When using FormsPal, it is simple to fill out forms without the need to be concerned about personal data leaks or records being distributed. Our secure platform helps to ensure that your personal details are maintained safely.