When you desire to fill out Form Ha 1152 U3, there's no need to install any sort of software - just use our PDF tool. To retain our tool on the forefront of practicality, we aim to integrate user-driven features and enhancements regularly. We're always happy to get suggestions - play a vital role in revolutionizing how you work with PDF docs. For anyone who is looking to get started, here's what it will take:

Step 1: Hit the "Get Form" button above on this webpage to access our PDF tool.

Step 2: This tool provides you with the opportunity to customize the majority of PDF documents in a variety of ways. Modify it by writing personalized text, adjust what is originally in the file, and include a signature - all within the reach of a couple of mouse clicks!

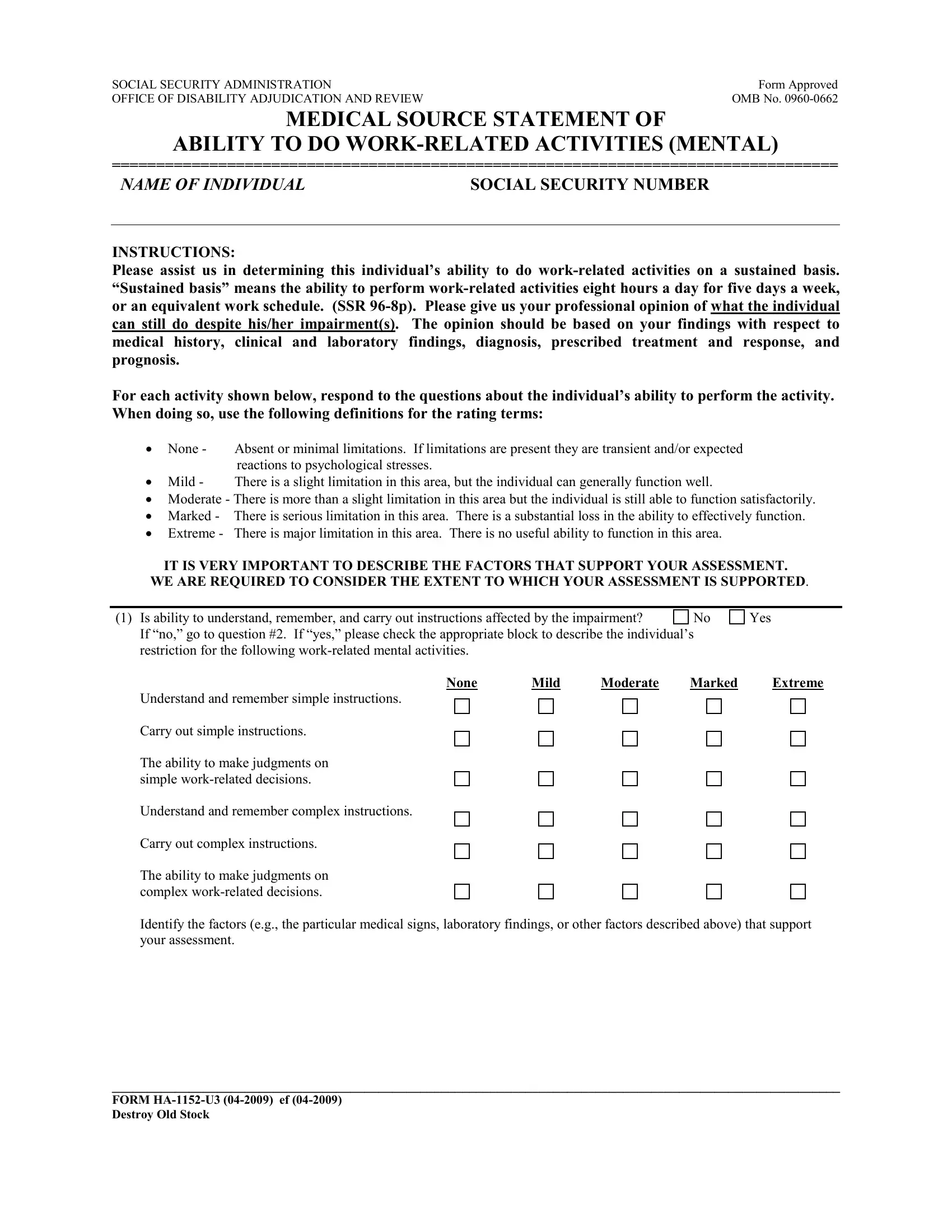

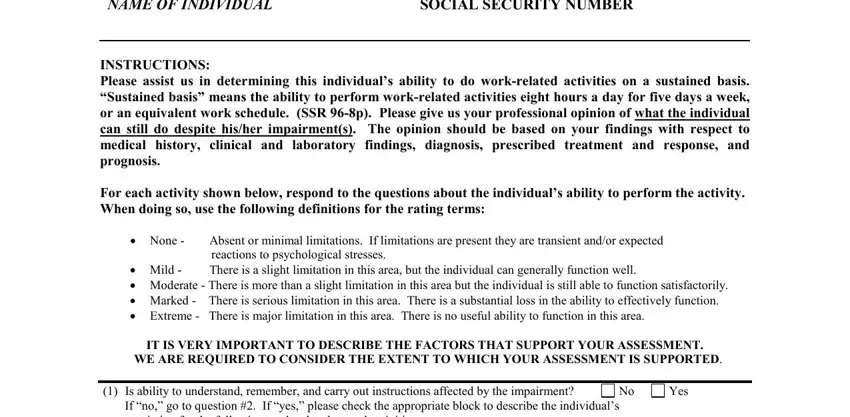

When it comes to fields of this precise form, this is what you should do:

1. First, once completing the Form Ha 1152 U3, start with the form section that contains the next fields:

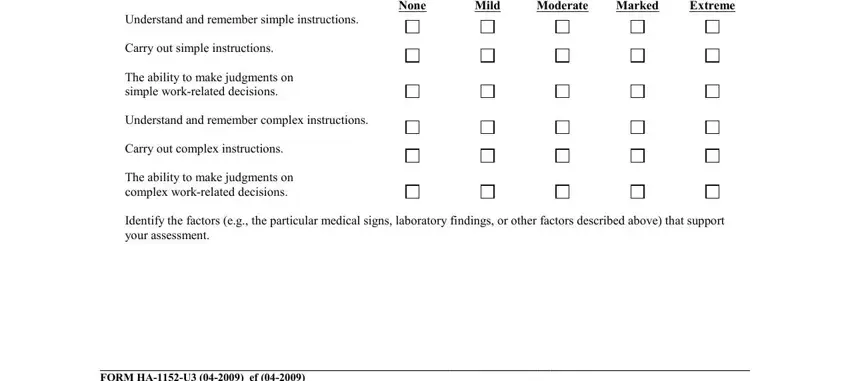

2. After completing this section, go on to the subsequent stage and fill in the necessary details in all these fields - None, Mild, Moderate, Marked, Extreme, Understand and remember simple, Carry out simple instructions, The ability to make judgments on, Understand and remember complex, Carry out complex instructions, The ability to make judgments on, Identify the factors eg the, and FORM HAU ef Destroy Old Stock.

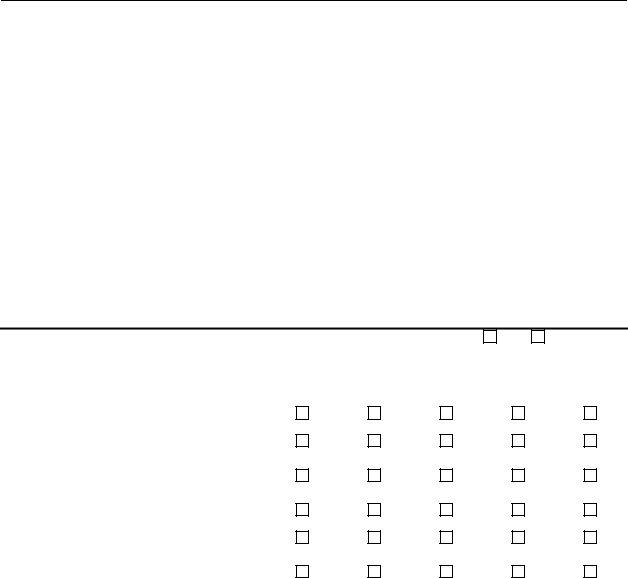

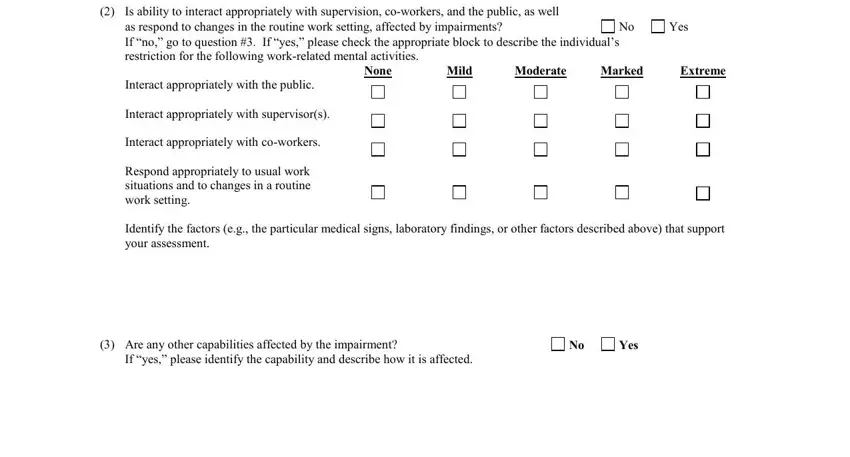

3. This next stage is normally simple - fill in every one of the fields in Is ability to interact, as respond to changes in the, Yes, None, Mild, Moderate, Marked, Extreme, Interact appropriately with the, Interact appropriately with, Interact appropriately with, Respond appropriately to usual, Identify the factors eg the, Are any other capabilities, and Yes in order to finish this process.

People who use this form often make errors while completing Interact appropriately with the in this part. Remember to read again whatever you enter right here.

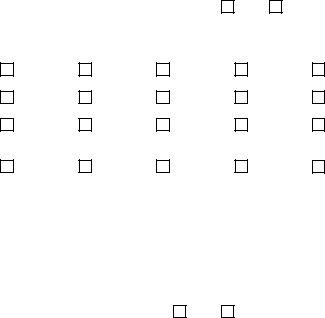

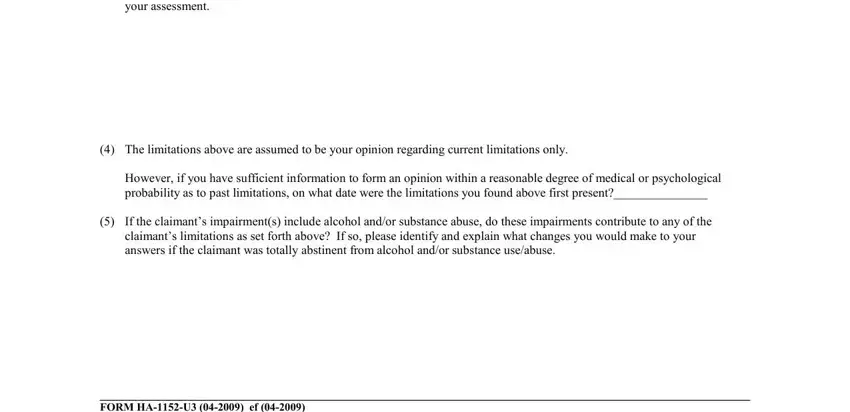

4. This next section requires some additional information. Ensure you complete all the necessary fields - Identify the factors eg the, The limitations above are assumed, However if you have sufficient, If the claimants impairments, claimants limitations as set forth, and FORM HAU ef Destroy Old Stock - to proceed further in your process!

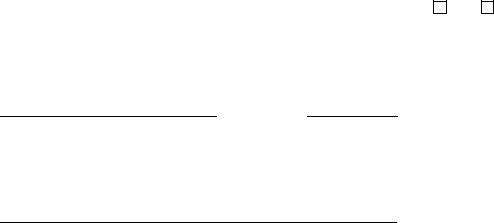

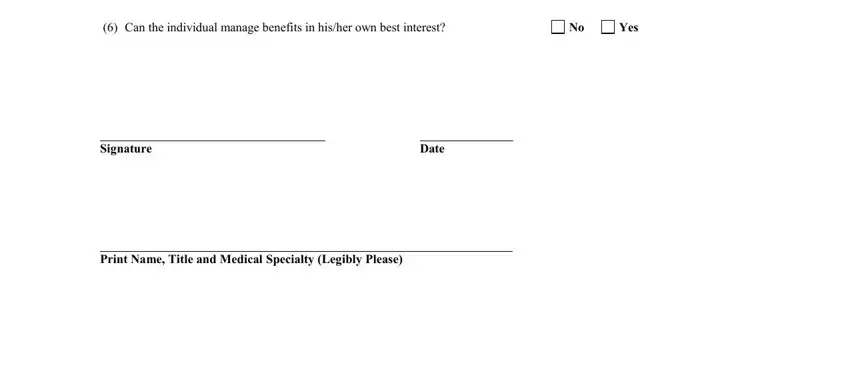

5. To wrap up your document, this particular section includes some extra blanks. Filling in Date, Yes, and Can the individual manage should conclude the process and you can be done in a short time!

Step 3: Immediately after double-checking the entries, press "Done" and you are good to go! Try a 7-day free trial subscription at FormsPal and gain immediate access to Form Ha 1152 U3 - download, email, or change inside your FormsPal account. Whenever you work with FormsPal, you can fill out documents without having to get worried about database leaks or entries being distributed. Our protected software makes sure that your private information is stored safe.