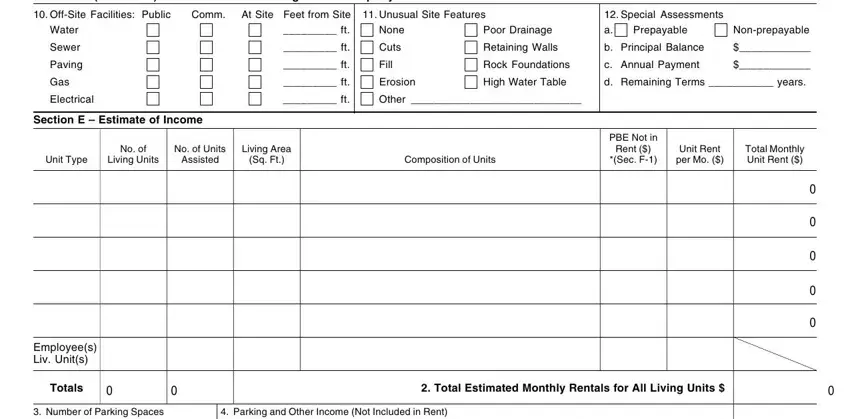

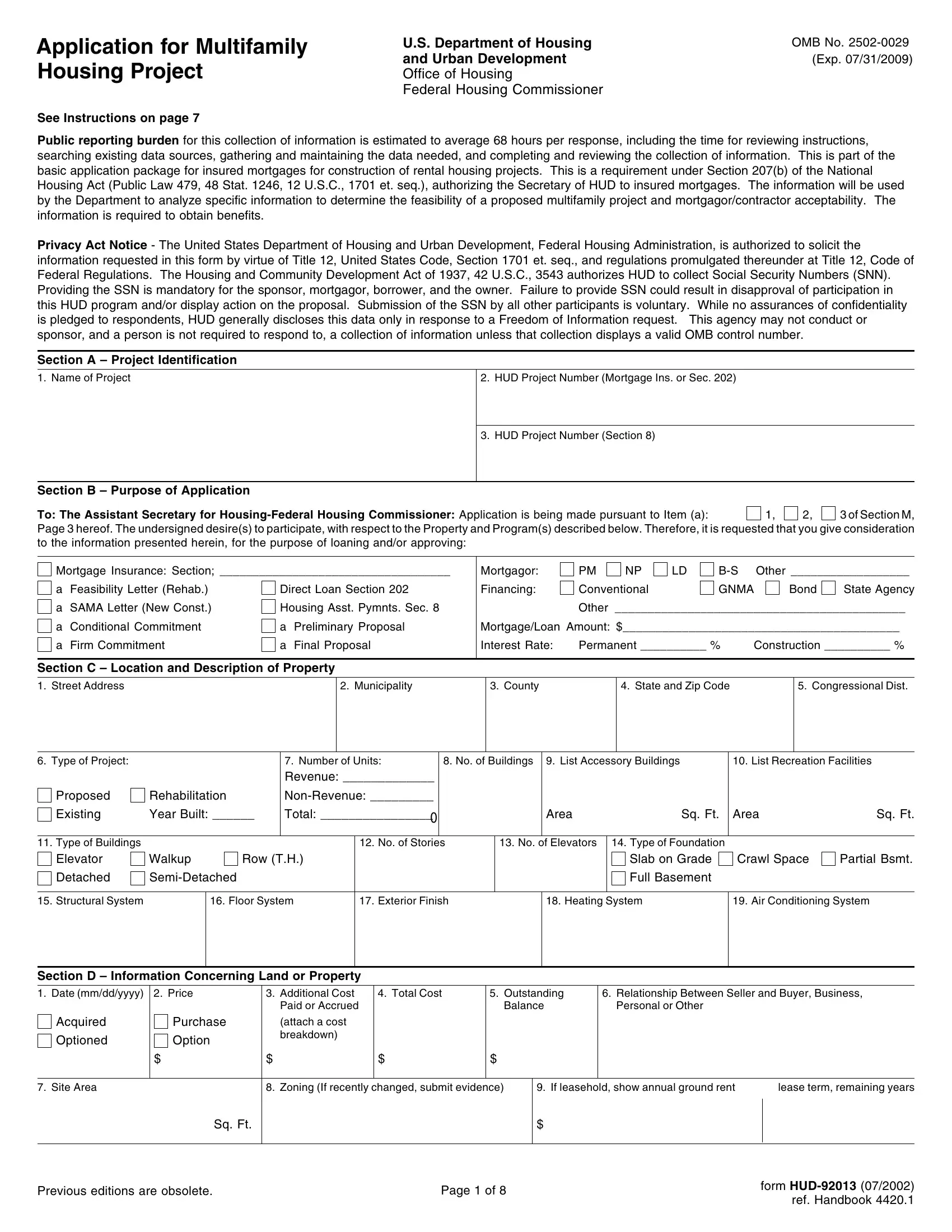

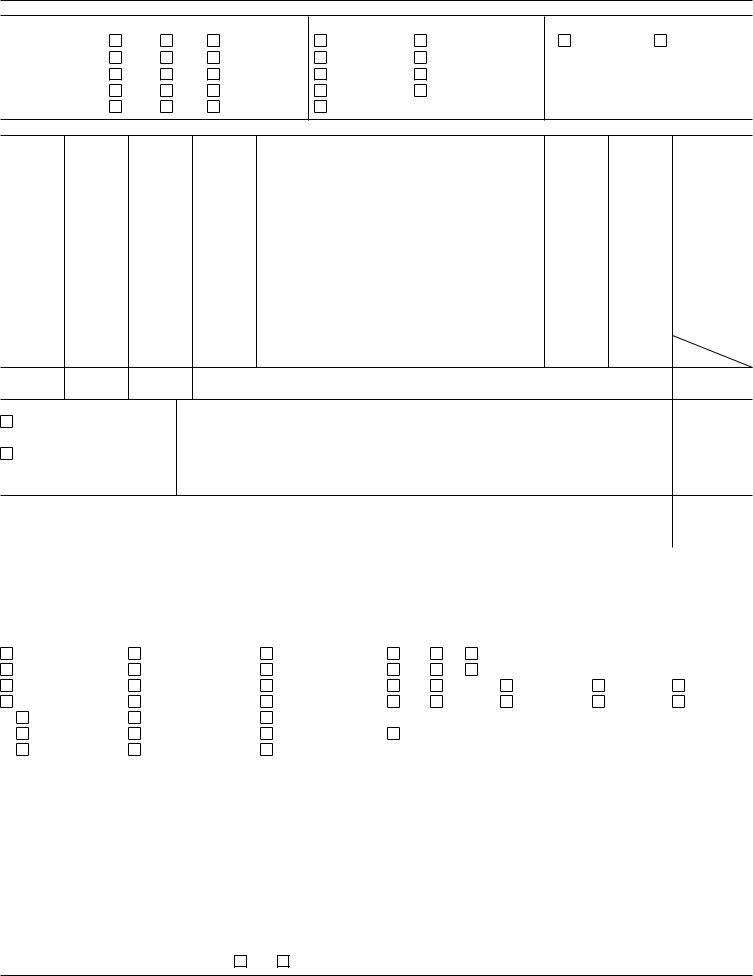

Total Monthly Unit Rent is the Unit Rent Per Month ($) times the No. of Living Units of that type and represents the Gross Income that can be anticipated for those units.

Employee(s) Living Unit(s) – List the number of employee living units for which rental income will not be received, the square foot area of each unit, and its unit composition. Employee living units must be included in the total units for the project, since they affect project operating expense estimates.

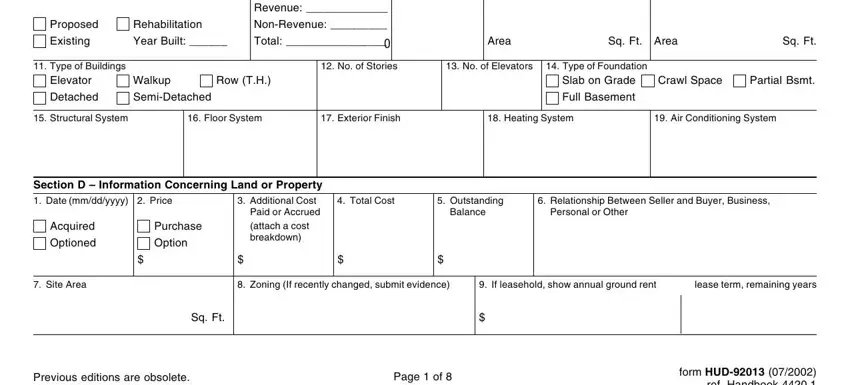

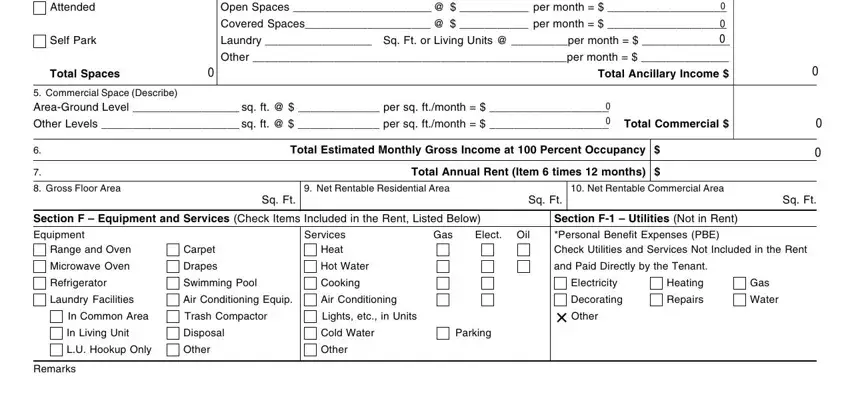

Item 8—At SAMA or feasibility stage insert the estimated gross floor area which is the sum of all floor areas of headroom height within the exterior walls. When completing a request for Conditional or Firm Commitment, insert the gross floor area computed from the plans.

Items 9 and 10 – Net Rentable Residential Area/Net Rentable Commercial Area is the sum of all living/commercial areas within the exterior walls, measured from the interior faces of the exterior walls, corridor walls, and partitions separating the area from other living or commercial areas. Existing comparable structures should be used as a guide by the sponsor in making these estimates at SAMA stage. At the Conditional or Firm Commitment stages, these areas should be calculated from the floor plans.

Section G – Estimate of Replacement Cost

Line 1—Unusual Land Improvements – Enter cost for unusual site preparation such as pilings, retaining walls, fill, etc.

Line 2—Other Land Improvements – Enter cost of other land improvements such as on-site utilities, landscape work, drives and walks.

Line 10—General Requirements – See Uniform System for Construction Specifications, Data Filing and Cost Accounting. Pages 1.3 and 1.4.

Line 21—Enter the estimated cost per gross square foot of building area (Line 20 divided by Item 8 of Section E, page 1).

Line 22—Enter the estimated period that will be reflected in the construction contract. The construction time plus the two months equals the total estimated “construction period”.

Line 23—Interest is the amount estimated to accrue during the anticipated construction period. It is computed on one-half of the loan amount for new construction and one-half of "as is" value for substantial rehabilitation.

Line 24—Taxes which accrue during the construction are estimated and included as the tax amount.

Line 25—Insurance includes fire, windstorm, extended coverage, liability, and other risks customarily insured against in the community. It does not include workmen's compensation, or public liability insurance, which are included in the cost estimate.

(Note: Lines 23, 26 through 31, and 39 are not applicable to Section 202 Capital Advance applications.)

Line 26—HUD/FHA mortgage insurance premium is the amount to be earned during the estimated construction period. The amount should be computed on the requested loan amount at 1/2 of 1% per year or fraction of a year. If the estimated construction period exceeds one year, the premium will be based on a two-year period.

Line 27—HUD/FHA examination fee is computed at $3 per $1000 of the requested loan amount.

Line 28—HUD/FHA inspection fee is computed at $5 per $1000 of the requested loan amount when the project involves new construction, and on the estimated cost of rehabilitation when the project involves the rehabilitation of an existing structure.

Line 29—Financing fee is computed at a maximum of 2% on the loan amount. It is an initial service charge. This fee is not to be confused with discounts.

Line 30—Enter FNMA/GNMA fee here. HUD Field Office personnel will advise interested sponsors and mortgagees of the current maximum allowable rate for this fee and the conditions pursuant to which such fee may be included.

Line 31—AMPO is the Allowance to Make Project Operational and is computed at 2% of the maximum Mortgage insurance amount. It is allowable in cases involving nonprofit mortgagors (not including cooperative mortgagors).

Line 33—Title and Recording Expenses – This is the cost typically incurred for these items, by mortgagor, in connection with a mortgage transaction. This cost generally includes such items as recording fees, mortgage and stamp taxes, cost of survey, and title insurance including all title work involved between initial and final endorsement.

Lines 35, 36 and 37—Legal, Organizational and Cost Certification Audit Fee

–This estimate is to be based upon the typical cost usually incurred for these services in the area where the project is to be located. These items must be recorded separately.

Line 39—Builder's and Sponsor's Profit and Risk Allowance – This is based on total estimated cost of on-site utilities, landscape work, structures, general over-head expenses, architect's fees, carrying charges, financing, legal, organization and audit expenses. It is allowable in 220, 221(d) (3) Limited Distribution or profit-motivated, 221(d)(4), and 231 profit-motivated projects. It is in lieu of, and not in addition to, builder's profit.

Line 40—Consultant's Fee, if any, enter amount to be charged the non-profit sponsor by a qualified consultant.

Line 41—Supplemental Management Fund for subsidized living units only – Allowance must not exceed $100 per assisted unit, excluding non-revenue producing units, if any.

Line 42—Contingency Reserve – An amount allowable for rehabilitation projects only, not to exceed 10% of the sum of Line 11 in Section G.

Line 46—Land (Estimated Market Price of Site) – Enter sponsor's estimate of market price of site including off-site costs. If site was purchased from public body, for a specific re-use, enter purchase price plus holding cost and any other cost that the purchaser is required to pay, pursuant to specific conditions of the contract of sale. For Rehabilitation interline the “As Is” Value of Property.

Section I – Estimate of Annual Expense

Line 13—Other – Reflect expense not specifically listed, such as, project secur-ity. Contract Security if provided should include contract guard service, performed either part or full-time, in connection with project operation. If security services are performed by staff employees, their salaries are included under Line 12, Payroll expense.

In housing for the Elderly, Line 23, will include only the expenses resulting from supplying tenants with shelter and utilities included in the rent. Separate income and expense budgets for supplying tenants with non-shelter services must be shown on Form HUD-92013-E, supplement to this application and used with all Elderly/Handicapped Housing proposals.

Section J – Total Settlement Requirements

Line 2—Enter amount required to clear title to site. If land is to be acquired, the unpaid balance of the purchase price shall be entered. If leasehold, or land owned free and clear of encumbrances, enter “none.” Indebtedness against land must be supported by options, purchase agreements, pay-off balances, etc.

Line 3—Enter the sum of “Development Cost” and “Land Indebtedness.”

Line 4—Enter principal amount of mortgage requested.

Line 6—Enter the amount required to meet operating and debt service expense from project completion until such time as income is adequate to provide a self- sustaining operation.

Line 7—Enter discount to be paid for placement of the permanent mortgage as well as any discount required by the construction lender.

Line 8—Enter the maximum interest yield cost.

Line 9—Enter 2 percent of the mortgage amount requested. No entry is required for nonprofit mortgagors.

Line 10—Enter one-half of one percent (0.5%) of the total loan requested or $10,000, whichever is the lesser.

Line 11—Enter the cost of required improvements beyond property lines, such as streets and utilities, etc., which will not be installed at public or utility company expense.

Line 12—Enter relocation expenses in excess of amount allowed in replace- ment cost.

Line 13—Other – Enter any and all cost not identified elsewhere.

Line 15—Enter principal(s) cash contribution.

Line 16—Identify fees waived or deferred during construction or paid by means other than cash, i.e., BSPRA, builder's profit; identify grants/loans and the respective amounts.

Section K--Principal Participants

Items 1 through 6--For individuals, enter last name, first name, middle initial. When entering business names, avoid using abbreviations if possible. Follow the instructions for Item 1 in Section C when entering address information. The Social Security Number (SSN) is applicable for all individuals and the Employer Identification Number (EIN) for all businesses. Providing the SSN is mandatory for the sponsor, mortgagor, borrower, and the owner. Providing the SSN for all other participants is voluntary.