|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

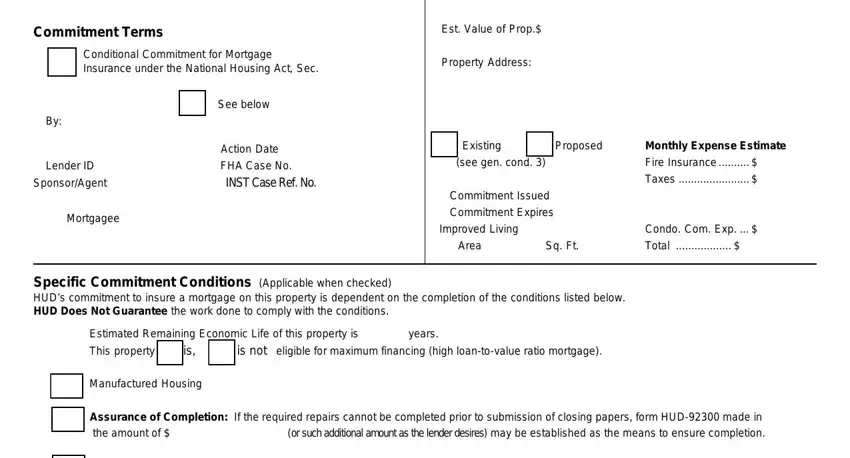

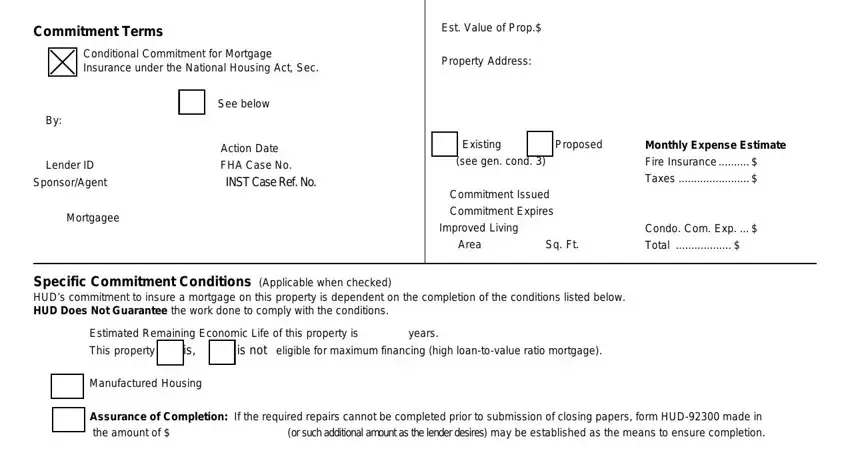

Specific Commitment Conditions (Applicable when indicated on the front |

|

mandated form, that the house and other structures within the legal |

|

|

of this form) |

|

|

|

|

|

|

|

|

|

boundaries of the property indicate no evidence of active termite |

|

B. Proposed Construction: |

|

The builder or mortgagee must notify the |

|

infestation. |

|

|

|

|

|

|

|

|

|

|

|

|

|

L. |

Code Enforcement: |

The lender shall submit a statement from the |

|

|

assigned Fee Inspector as appropriate (see items 11, 12, and 13 |

|

|

below). |

|

|

|

|

|

|

|

|

|

public authority that the property meets local code requirements. |

|

C. |

Warranty: Form HUD-92544 is required on all new construction and |

M. Repairs: The lender shall notify the original appraiser upon completion |

|

|

shall be executed between the builder and the purchaser. |

|

|

|

of required repairs, unless otherwise instructed. |

|

|

|

|

D. |

Section 223: This commitment is issued pursuant to Section 223(e). |

N. Lender's Certificate of Completion: |

The lender |

shall furnish a |

|

E. |

Health Authority Approval: Submit local health authority approval |

|

certificate that required repairs have been examined and were satisfac- |

|

|

torily completed. |

|

|

|

|

|

|

|

|

|

|

|

(on a form or letter) indicating the individual water supply and/or |

|

|

|

|

|

|

|

|

|

|

|

|

O. Manufacturers Warranties |

must |

be |

provided to |

the homebuyer |

|

|

sewage disposal system is acceptable. |

|

|

|

|

|

F. |

Reserved. |

|

|

|

|

|

|

|

|

covering heating/cooling systems, hot water heaters, ranges, etc. |

|

|

|

|

|

|

|

|

P. |

Initial Inspection (2 working days) is requested before the “beginning |

|

G. |

Prefabricator’s Certificate: The Lender shall provide a prefabrication |

|

|

of construction” with forms in place. |

|

|

|

|

|

|

certificate as required by the related engineering bulletin. |

|

|

|

|

|

|

|

|

|

|

|

Q. Frame Inspection (1 working day) is requested when the building is |

|

H. |

Termite Control (Proposed Construction): If soil poisioning is used, |

|

|

enclosed and framing, plumbing, heating, electrical, and insulation is |

|

|

the builder shall complete form HUD-NPCA-99-A, Termite Soil Treat- |

|

|

|

|

complete and visible. |

|

|

|

|

|

|

|

|

|

|

ment Guarantee, and transmit a copy to HUD or the Direct Endorse- |

|

|

|

|

|

|

|

|

|

|

|

R. Final Inspection is requested when construction is completed and the |

|

|

ment Underwriter. The Mortgagee will deliver the original and a copy |

|

|

to the mortgagor at closing. |

|

|

|

|

|

property ready for occupancy. |

|

|

|

|

|

|

I. |

Flood Insurance Requirement: This property is located in a special |

S. Insulation Certificate must be posted in a conspicuous location in the |

|

|

flood hazard area and must be covered by flood insurance in accor- |

|

dwelling. |

|

|

|

|

|

|

|

|

|

|

|

|

|

dance with HUD regulation 24 CFR 203.16a. |

|

|

|

T. The Insured Protection Plan Warranty Agreementshall be executed |

|

J. |

Carpet Identification: |

(as listed in Certified |

Products |

Directory) |

|

between the builder and the homebuyer. |

|

|

|

|

U. The lender shall furnish a certificate of occupancy or letter of accep- |

|

|

Manufacturer recommended maintenance program must be provided |

|

|

|

tance from the local building authority. |

|

|

|

|

|

|

to the homebuyer. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

K. |

Termite Control: (Existing Construction) A recognized termite control |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

operator shall furnish certification using form NPMA-33, or State- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

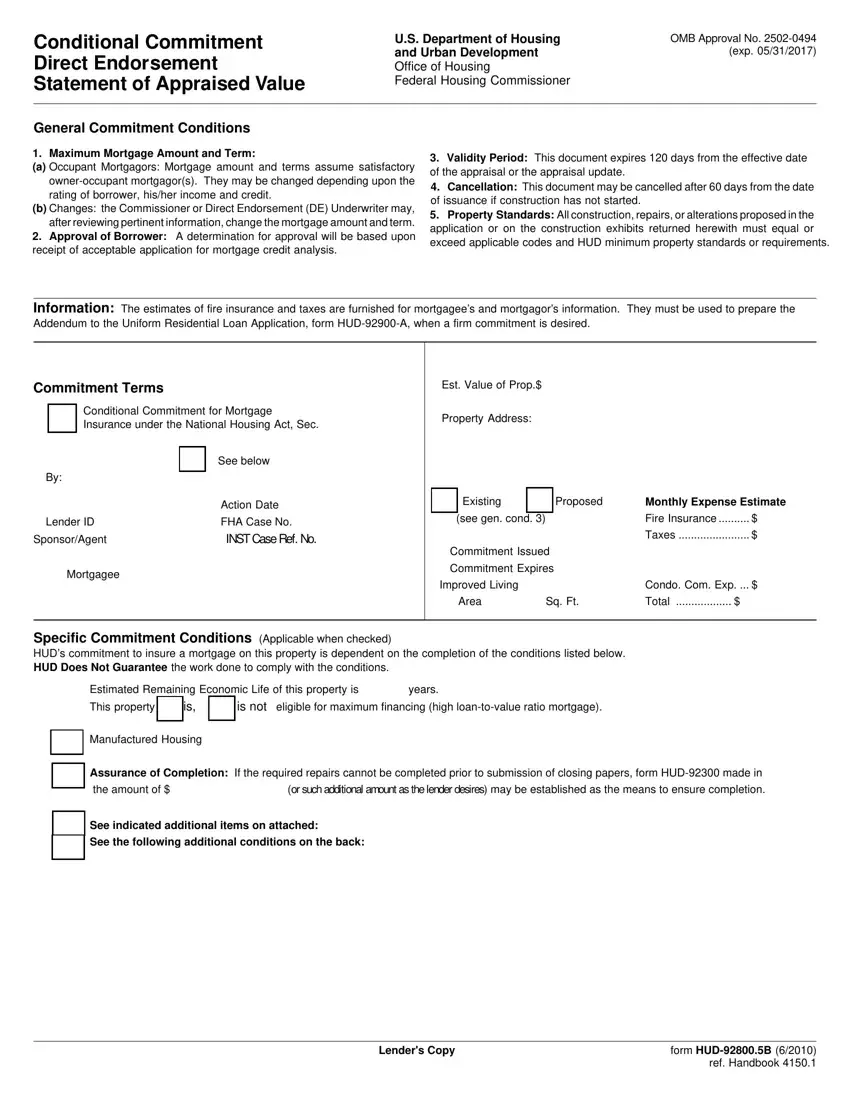

AdvicetoHomebuyers If your application was processed by a Direct |

Estimated Monthly Expenses: |

These are costs associated |

with |

homeowner- |

|

Endorsement (DE) lender, you should first contact them for assistance before |

ship which HUD believes the home-owners will have to pay when living in the |

|

calling HUD. |

|

|

|

|

|

|

|

property. |

Two examples of “estimated monthly expenses” are fire insurance and |

|

Prepaid Items: |

These are charges that normally will be paid at closing and are |

taxes, which are |

paid |

to |

your |

lender each |

month as part of |

your |

mortgage |

|

payment. |

These |

are |

put |

into |

your |

escrow |

account. |

|

|

|

|

recurring in |

nature. They include |

such items as |

funds for |

real estate |

taxes |

and |

|

|

|

|

OtherCostsofHomeownership: |

Utilities |

are usually |

paid |

monthly to |

|

hazard |

insurance. |

The amount |

of these items |

will vary |

depending |

upon |

the |

|

whomever provides the service. Also, you should save a certain amount |

|

closing |

date. |

No |

estimate is provided with this |

statement. |

|

|

|

|

|

each month to cover repair and maintenance costs which will come up while |

|

Escrow Account: This is a special account that your lender will keep on |

|

you own your home. |

|

|

|

|

|

|

|

|

|

|

your behalf to save the necessary funds to pay certain future bills. Your |

|

|

|

|

|

|

|

|

|

|

Late Payments: If you do not pay your mortgage payment within 15 days |

|

mortgage payment will include, in addition to an amount for interest and |

|

from the 1st day of the month, you can be charged a penalty. This may be |

|

principal, amounts to cover such items as property taxes, hazard insur- |

|

4 cents for each dollar of your payment. |

|

|

|

|

|

ance, and, for certain FHA programs, the mortgage insurance premium. |

|

|

|

|

|

New Construction: After |

specifications |

are |

accepted by |

HUD |

or a direct |

|

These charges are collected in advance so that your lender will have |

|

endorsement lender, the builder is required to warrant that the house substan- |

|

enough money in the account to apply the charge when it comes due. |

|

tially conforms to approved plans and specifications. This warranty is for 1 year |

|

Generally, 1/12 of the next year’s estimated charges will be the amount |

|

following the date on which title is transferred to the original buyer or the date on |

|

collected with each of your monthly mortgage payments. Bear in mind that |

|

which the house was first lived in, which ever happens first. If, during the |

|

in most communities taxes and other operating costs are increasing. The |

|

warranty |

period, |

you notice |

defects for |

which you believe the builder is |

|

estimates should give some idea of what you can expect the costs to be at |

|

responsible, ask him in writing to fix them. If he does not fix them, write your |

|

the beginning. |

In some areas the estimate of taxes may also include |

|

lender or HUD. Include your FHA case number. If inspection shows the builder |

|

charges such as sewer charges, garbage collection fee, water rates, etc. |

|

to be at fault, your lender or HUD will try to persuade him to fix the defect. If |

|

Mortgage Insurance Premium: |

The amount for insuring your mortgage. |

|

he does not, you may be able to obtain legal relief under the builder’s warranty. |

|

The premium may be in the form of an upfront charge and/or a monthly |

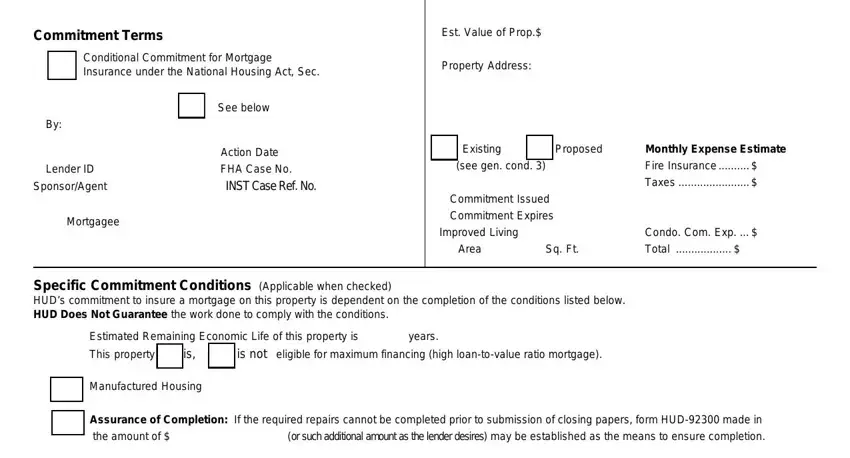

Manufactured Housing

Manufactured Housing

See the following additional conditions on the back:

See the following additional conditions on the back:

Manufactured Housing

Manufactured Housing

See the following additional conditions on the back:

See the following additional conditions on the back:

Manufactured Housing

Manufactured Housing

See the following additional conditions on the back:

See the following additional conditions on the back: