With the help of the online PDF editor by FormsPal, you'll be able to complete or alter illinois qualifying education expenses right here and now. Our tool is continually evolving to present the best user experience achievable, and that is because of our commitment to continuous development and listening closely to comments from users. It merely requires just a few basic steps:

Step 1: First of all, access the pdf editor by clicking the "Get Form Button" at the top of this webpage.

Step 2: When you launch the tool, you'll see the form made ready to be filled out. Aside from filling out different blanks, you could also perform other sorts of things with the form, specifically putting on any text, changing the original textual content, adding graphics, affixing your signature to the document, and more.

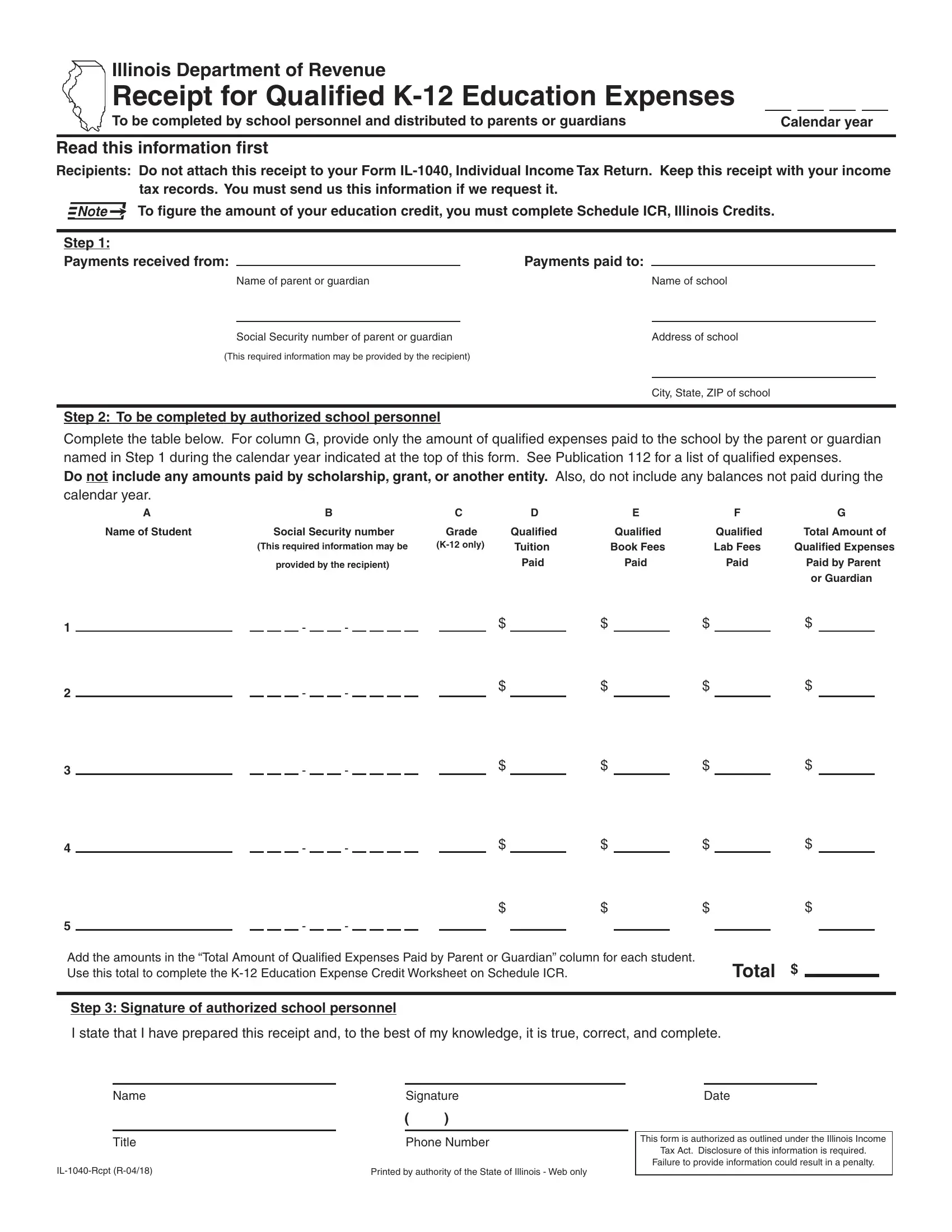

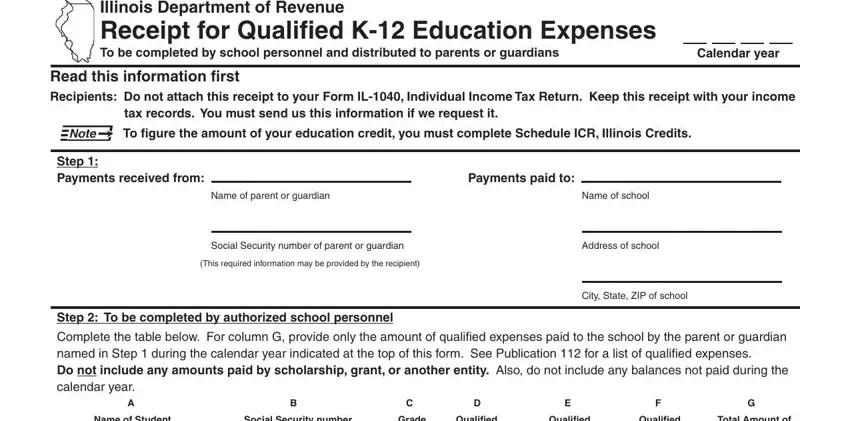

To be able to fill out this PDF document, ensure that you type in the right details in each field:

1. Start filling out your illinois qualifying education expenses with a number of major blank fields. Note all of the necessary information and make sure nothing is omitted!

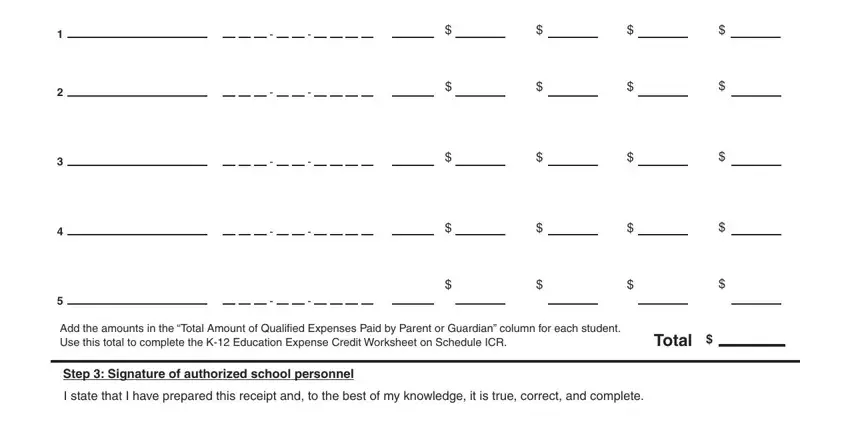

2. Your next part would be to fill in these particular fields: Add the amounts in the Total, Total, Step Signature of authorized, and I state that I have prepared this.

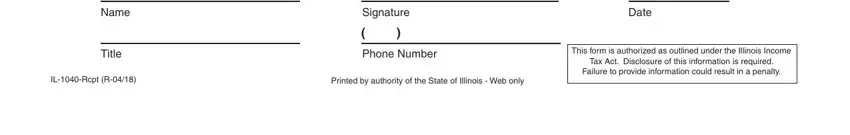

3. This next segment will be about Name, Title, Signature, Phone Number, ILRcpt R, Printed by authority of the State, Date, This form is authorized as, and Tax Act Disclosure of this - fill in all of these blanks.

You can certainly get it wrong when filling in the Phone Number, and so make sure you look again before you'll send it in.

Step 3: Reread everything you've typed into the blanks and then click on the "Done" button. Join FormsPal right now and instantly get illinois qualifying education expenses, available for download. All modifications made by you are saved , so that you can change the form further anytime. Here at FormsPal, we do everything we can to ensure that all of your information is maintained secure.