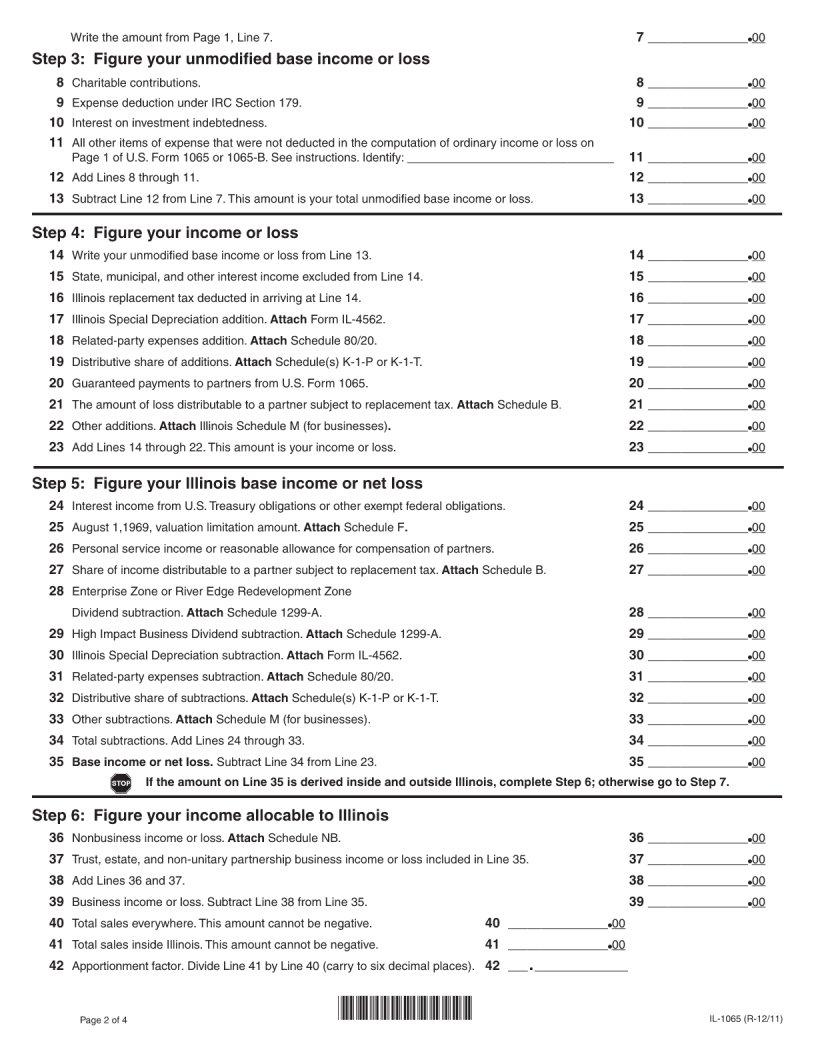

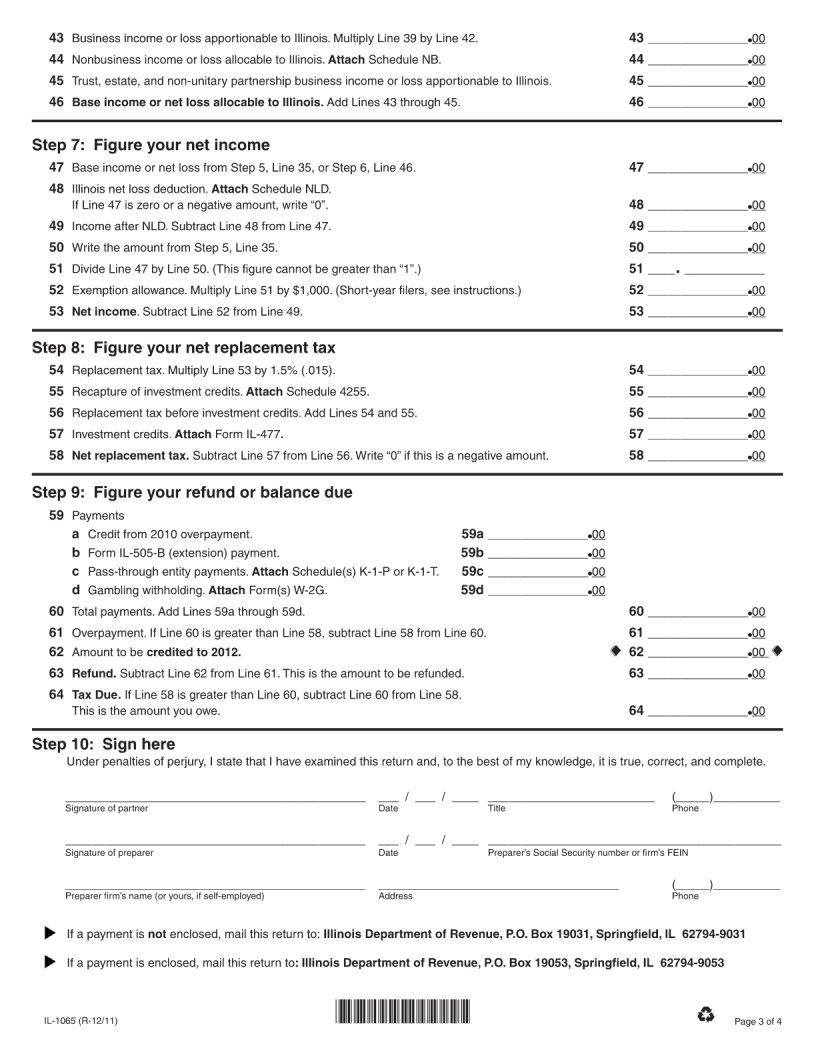

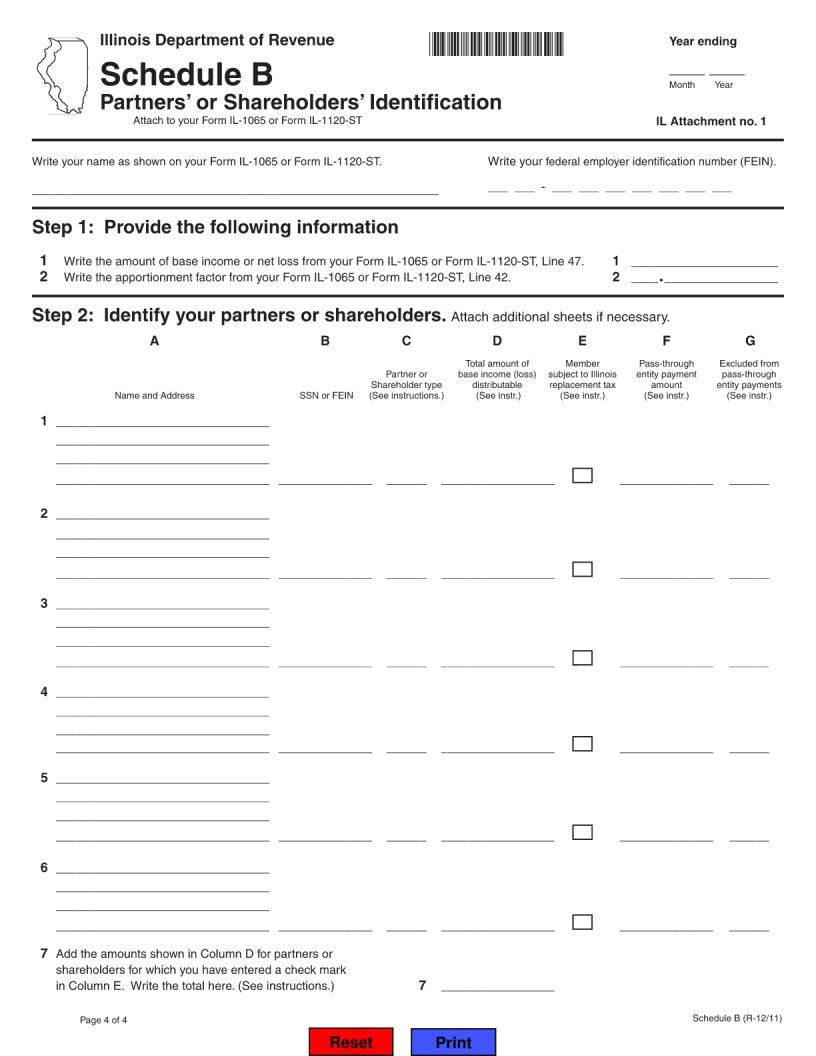

Businesses operating within Illinois and structured as partnerships find the IL 1065 form crucial in reporting their income, deductions, gains, losses, and more to the Illinois Department of Revenue. This comprehensive form ensures that partnerships distribute their financial information accurately, adhering to state tax obligations. Designed to maintain transparency and facilitate the equitable division of tax responsibilities among partners, it plays a pivotal role in the financial year-end closing. While the form outlines clear guidelines for declaring various income streams and tax-deductible expenses, it also serves as a tool for partnerships to calculate their share of state income, thereby determining individual tax liabilities. Additionally, the IL 1065 form assists in reconciling the amount of tax owed to the state with payments previously made, aiding in the efficient management of partnership resources. With the complexity of tax laws and regulations, the form acts as a navigational aid for partnerships to comply with Illinois tax codes, ensuring that all financial activities are duly reported and taxed accordingly.

| Question | Answer |

|---|---|

| Form Name | Form Il 1065 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | unitary, preparer, form il 1065, subtractions |