With the online editor for PDFs by FormsPal, you can fill out or edit deductions here. The editor is continually improved by our team, getting useful functions and growing to be even more convenient. With just a couple of basic steps, you are able to begin your PDF editing:

Step 1: Firstly, open the pdf editor by pressing the "Get Form Button" above on this site.

Step 2: After you access the online editor, you'll notice the document prepared to be filled out. Aside from filling in various fields, you may as well perform some other things with the form, specifically writing custom textual content, modifying the initial textual content, adding images, signing the form, and much more.

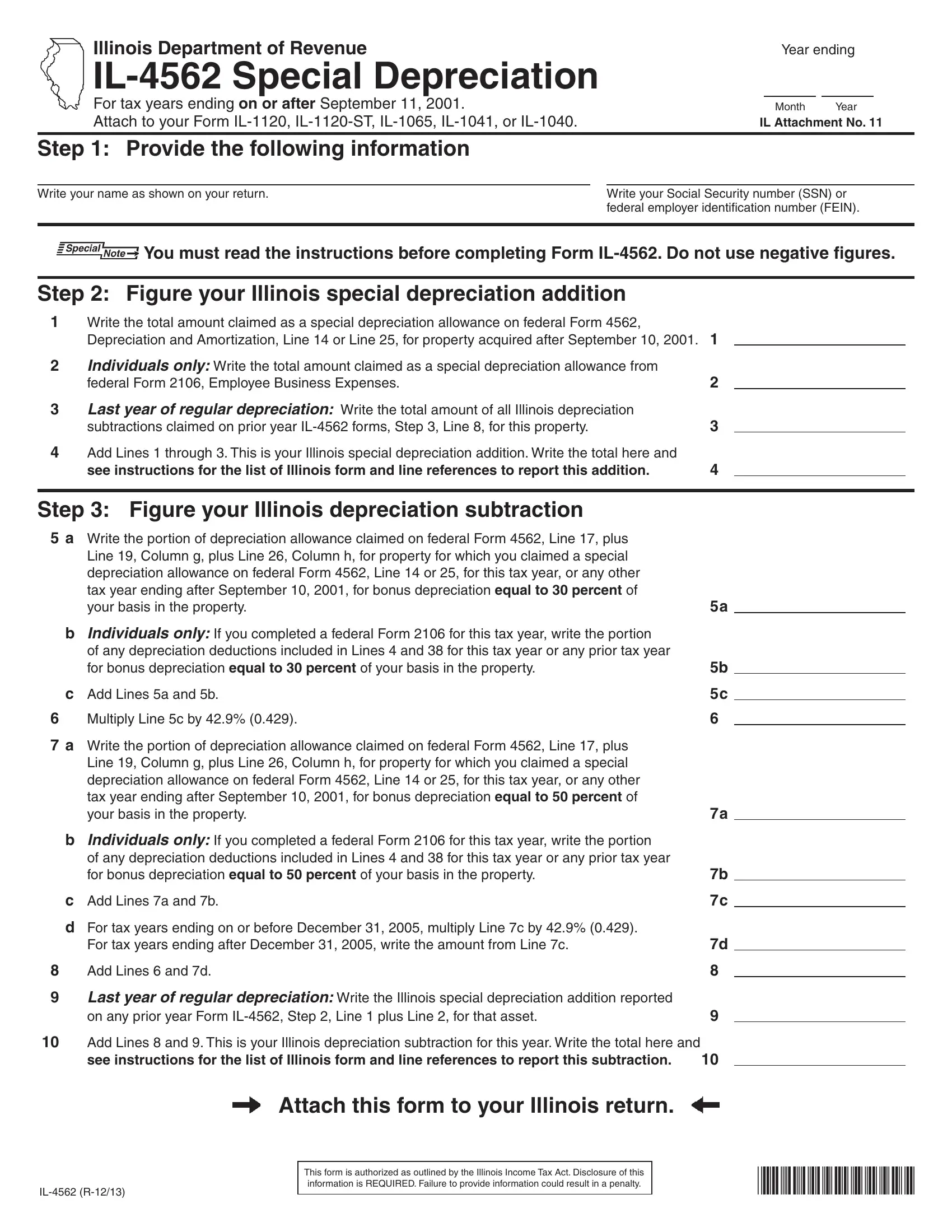

With regards to the blanks of this precise form, this is what you need to do:

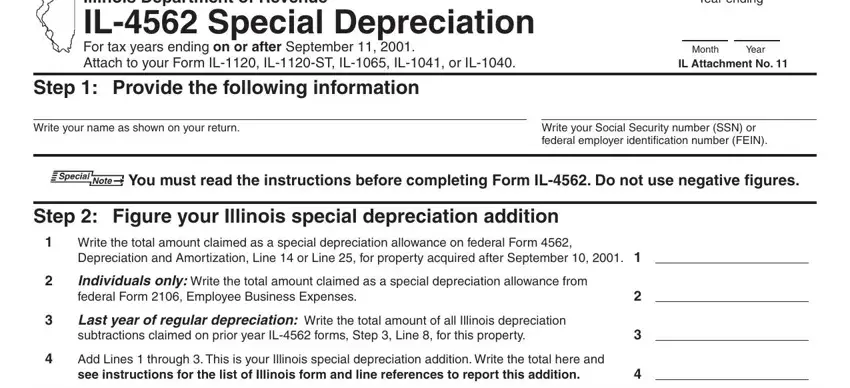

1. Firstly, when filling out the deductions, beging with the section containing next blank fields:

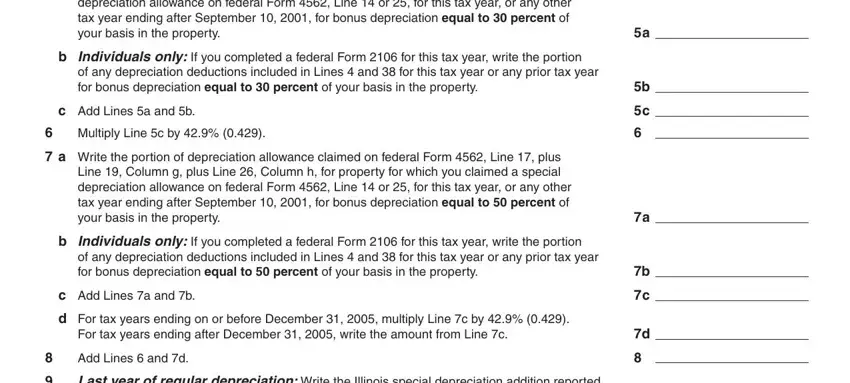

2. Once this segment is finished, you have to put in the needed specifics in Step Figure your Illinois, b Individuals only If you, of any depreciation deductions, c Add Lines a and b, Multiply Line c by, a Write the portion of, b Individuals only If you, of any depreciation deductions, c Add Lines a and b, d For tax years ending on or, For tax years ending after, Add Lines and d, and Last year of regular depreciation so you're able to move on further.

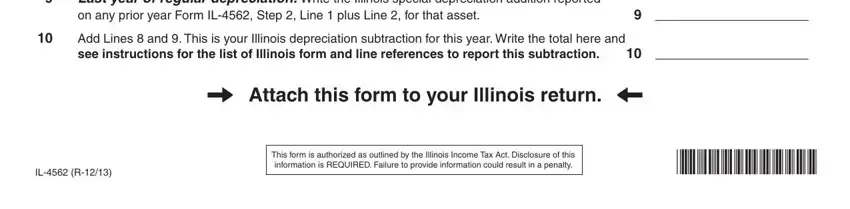

3. The next part is considered fairly simple, Last year of regular depreciation, on any prior year Form IL Step, Add Lines and This is your, see instructions for the list of, Attach this form to your Illinois, IL R, and This form is authorized as - all these empty fields must be completed here.

Be very attentive while completing Add Lines and This is your and see instructions for the list of, because this is the part in which a lot of people make errors.

Step 3: When you've looked once again at the details in the fields, press "Done" to complete your FormsPal process. After starting a7-day free trial account with us, you'll be able to download deductions or email it promptly. The form will also be available through your personal account with your each change. FormsPal guarantees safe form editor devoid of personal data record-keeping or distributing. Feel at ease knowing that your data is safe with us!