Our leading web programmers worked hard to set-up the PDF editor we are excited to deliver to you. The software helps you shortly create x 941x and will save you valuable time. Simply comply with the following instruction.

Step 1: Find the button "Get Form Here" and click it.

Step 2: You can find all of the options that you can use on the document after you've accessed the x 941x editing page.

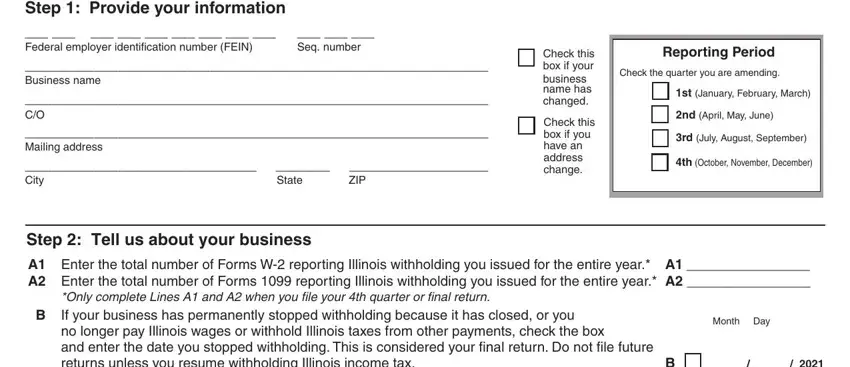

For each area, fill in the data requested by the program.

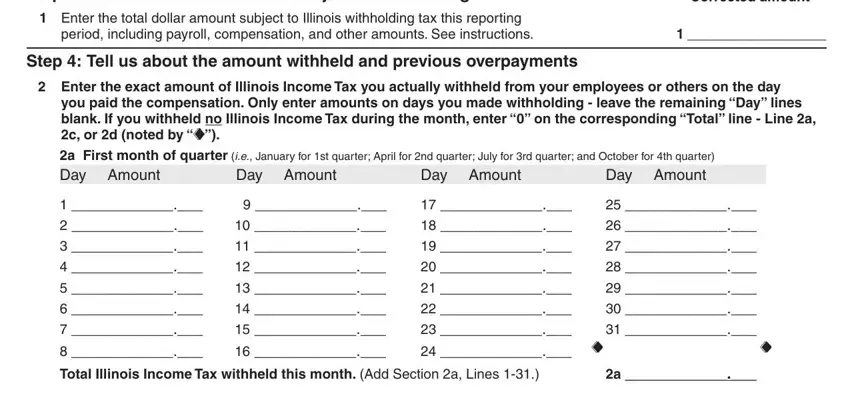

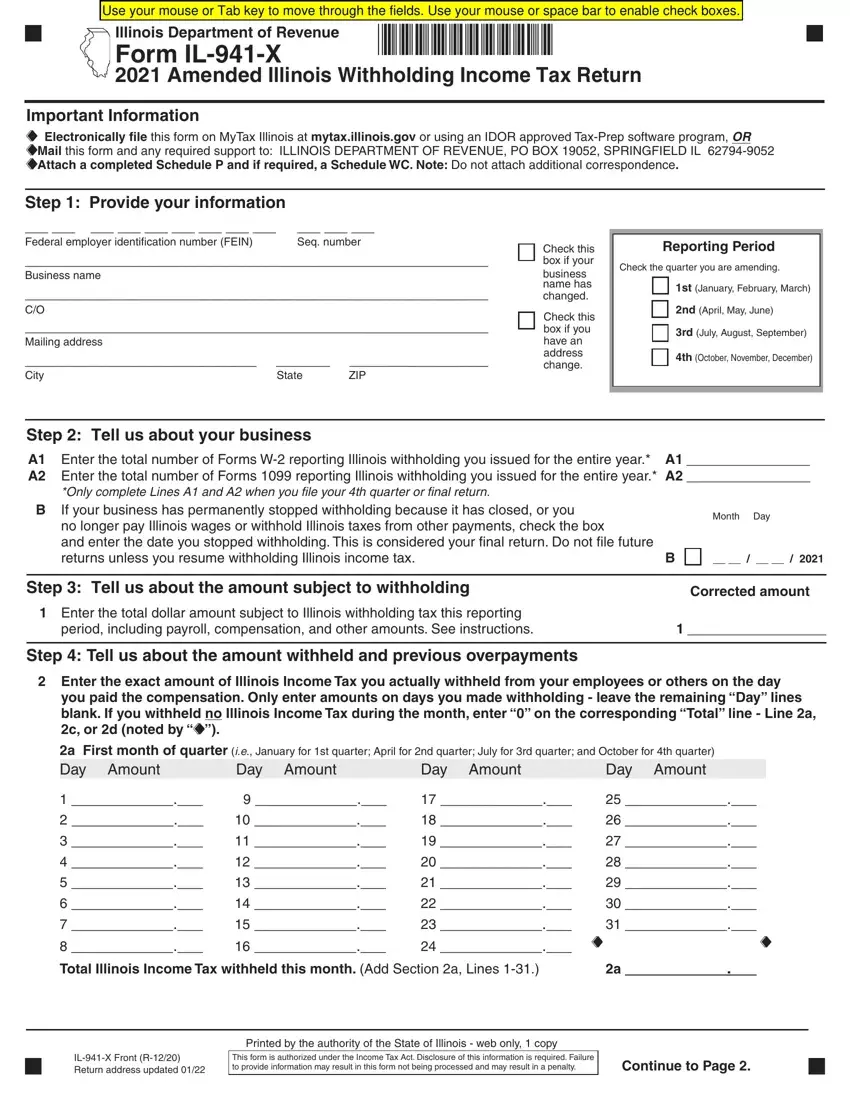

Inside the section Step Tell us about the amount, Enter the total dollar amount, period including payroll, Step Tell us about the amount, Corrected amount, Enter the exact amount of, you paid the compensation Only, a First month of quarter ie, and Total Illinois enter the particulars that the program demands you to do.

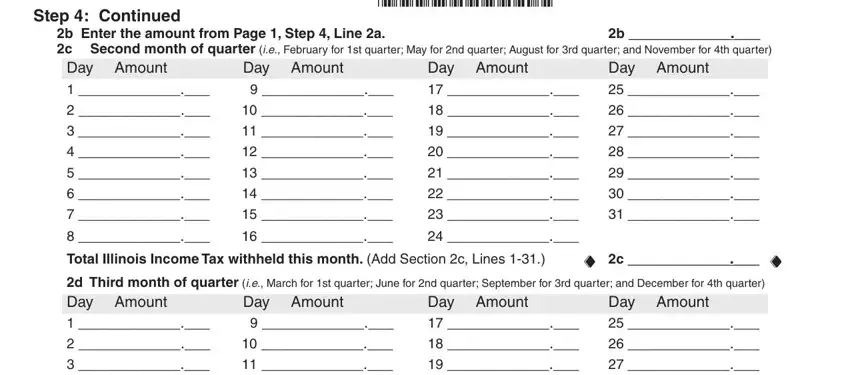

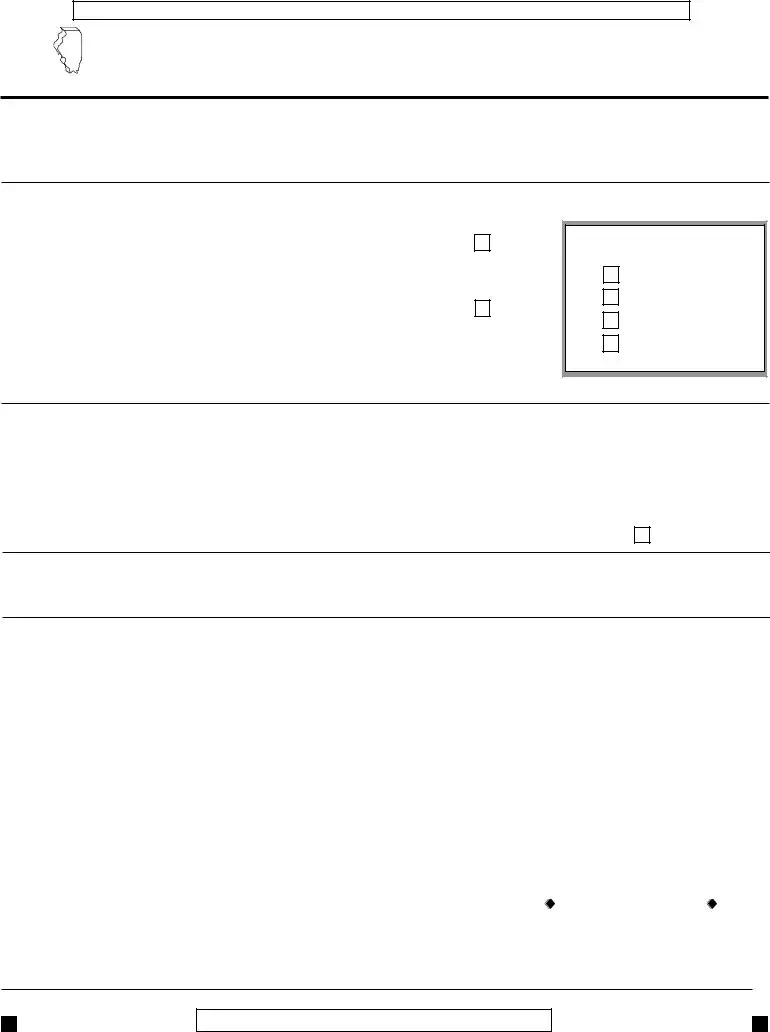

Make sure you provide the fundamental particulars from the Step Continued, b Enter the amount from Page Step, Day Amount Total, Day Amount, Day Amount, Day Amount, d Third month of quarter ie March, Day Amount, Day Amount, and Day Amount part.

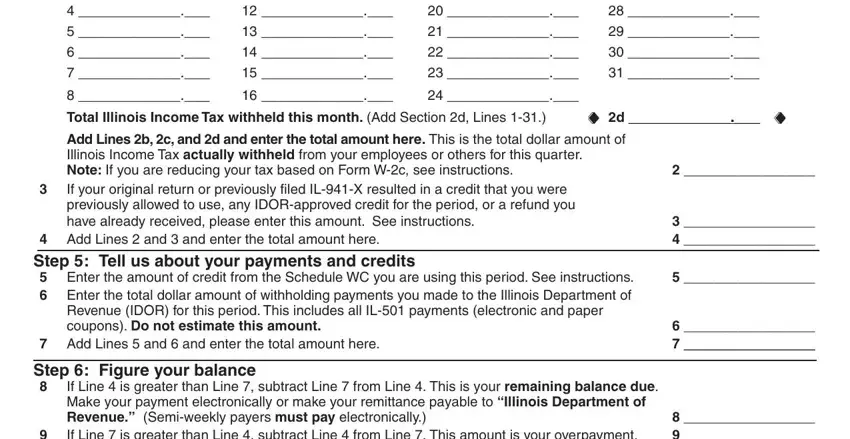

In paragraph d Third month of quarter ie March, Day Amount, Day Amount, Day Amount, Add Lines b c and d and enter the, Add Lines and and enter the, Add Lines and and enter the, Step Figure your balance, and If Line is greater than Line, define the rights and responsibilities.

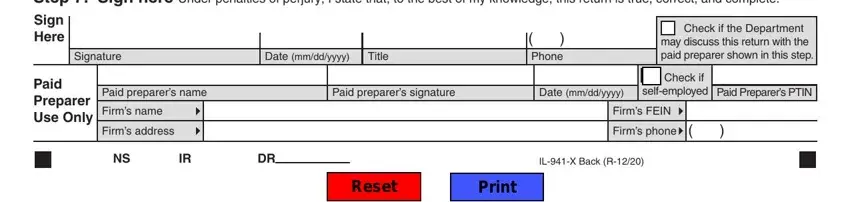

Check the sections Step Sign here Under penalties of, Phone, Check if the Department may, Signature, Date mmddyyyy, Title, Paid Preparer Use Only, Paid preparers name, Paid preparers signature, Date mmddyyyy, Check if selfemployed, Paid Preparers PTIN, Firms name, Firms address, and Firms FEIN and then complete them.

Step 3: The moment you pick the Done button, your finished file is easily exportable to any of your devices. Alternatively, you can deliver it through email.

Step 4: Make sure you stay away from possible future worries by preparing as much as a pair of duplicates of your file.

Attach a completed Schedule P and if required, a Schedule WC. Note:

Attach a completed Schedule P and if required, a Schedule WC. Note:  ”).

”).