It is simple to fill out forms making use of our PDF editor. Updating the state of illinois self employment record document is a breeze in the event you stick to these steps:

Step 1: Click the orange button "Get Form Here" on the following webpage.

Step 2: So, you're on the file editing page. You may add content, edit current data, highlight particular words or phrases, place crosses or checks, insert images, sign the document, erase unrequired fields, etc.

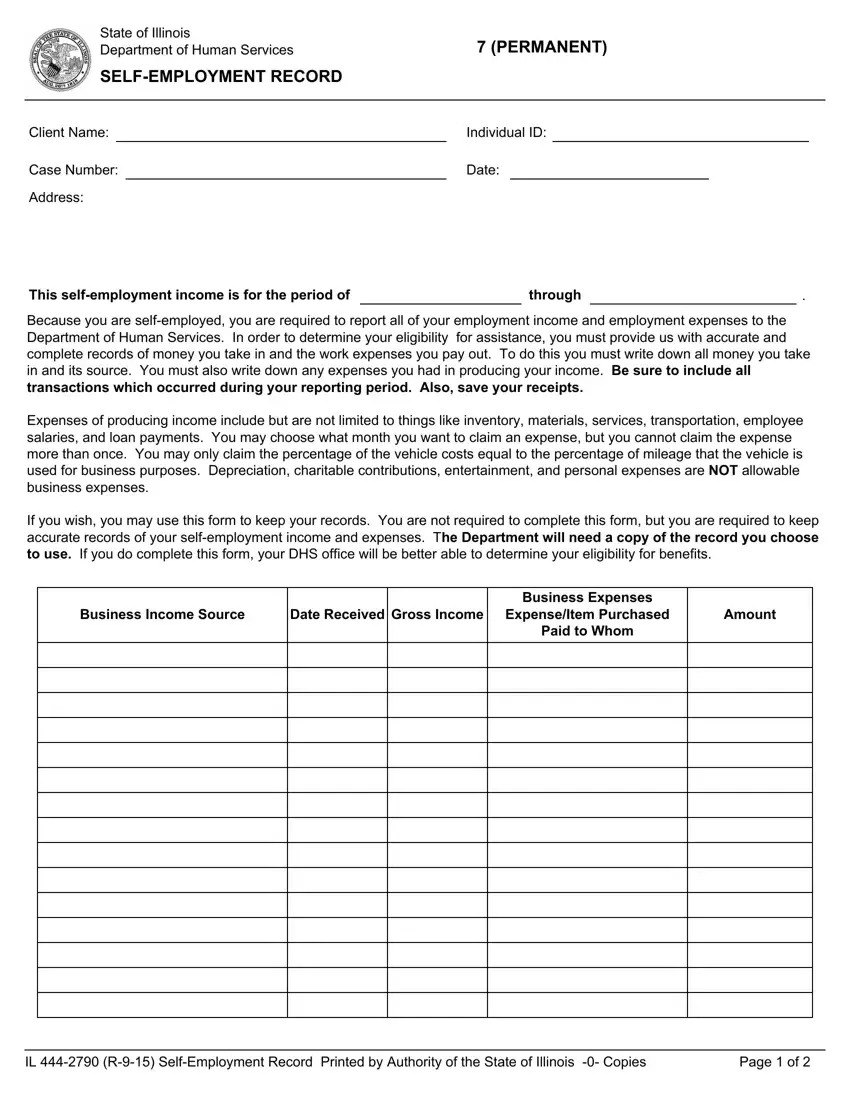

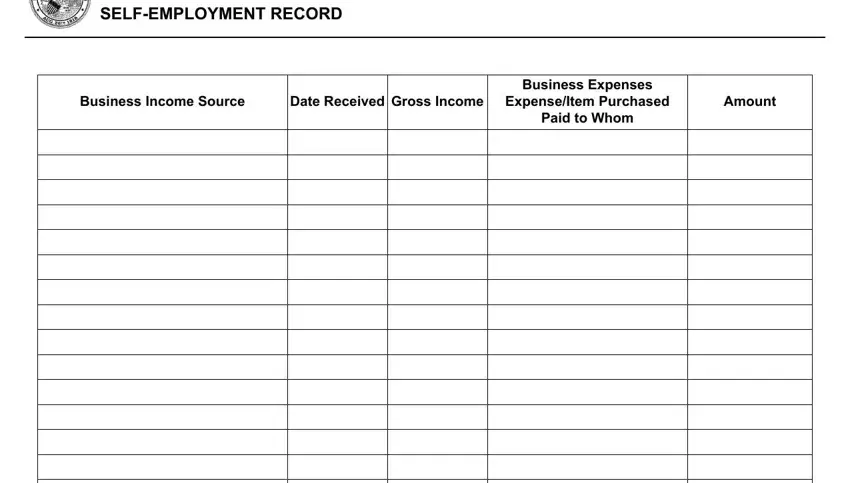

If you want to complete the state of illinois self employment record PDF, enter the details for all of the segments:

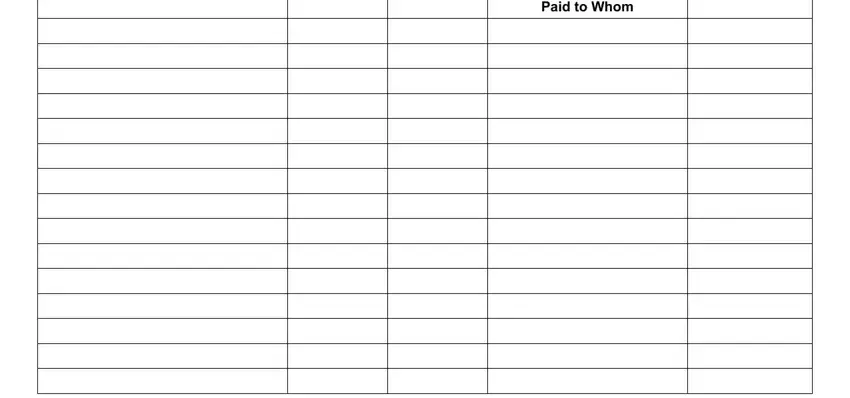

Enter the necessary details in the field Business Expenses ExpenseItem.

You need to point out the vital details in the IL R SelfEmployment Record, and Page of section.

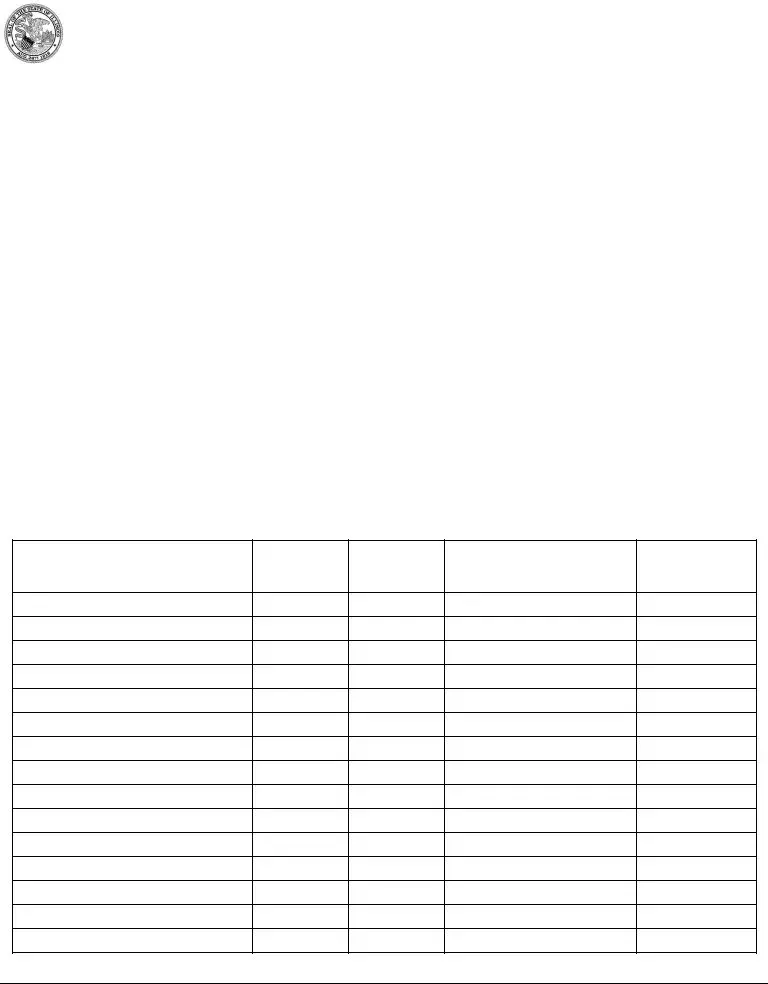

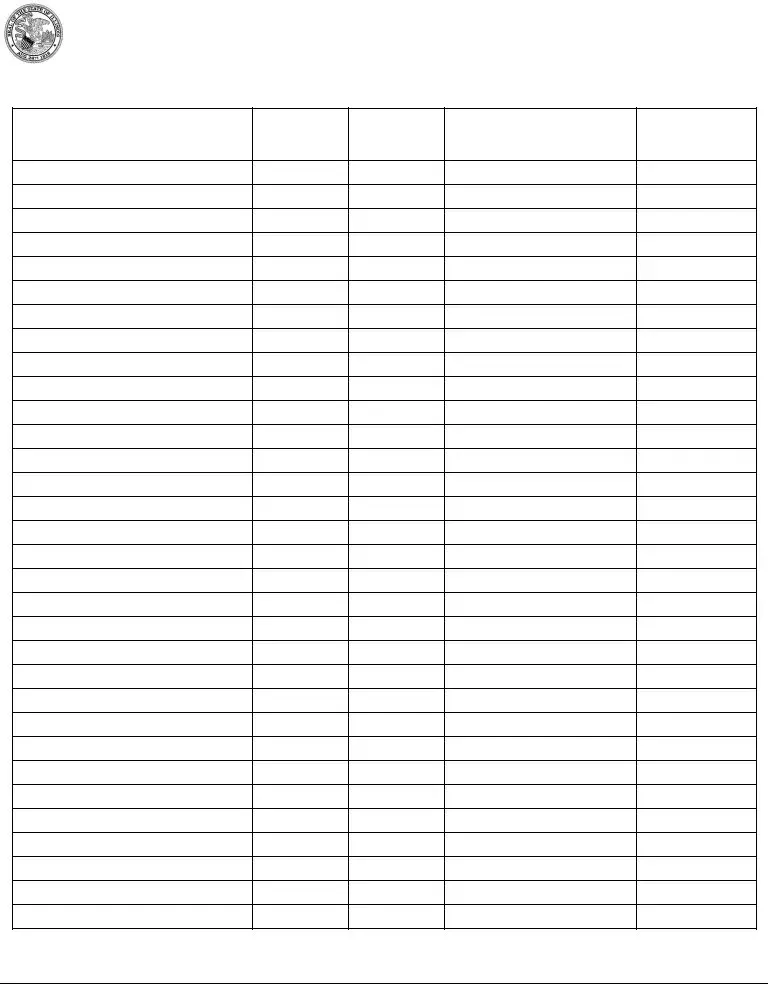

The area SELFEMPLOYMENT RECORD, Business Income Source, Date Received Gross Income, Business Expenses ExpenseItem, and Amount will be where to place all parties' rights and obligations.

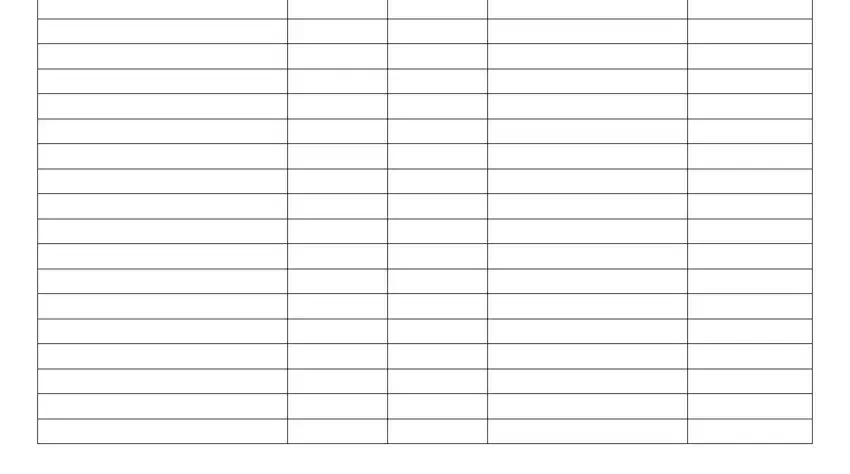

End by checking the following sections and preparing them as needed: .

Step 3: As you press the Done button, your ready form can be easily exported to each of your devices or to electronic mail given by you.

Step 4: Make sure you stay away from potential complications by making a minimum of a pair of copies of the document.