With the help of the online tool for PDF editing by FormsPal, you'll be able to complete or edit Form Lgst 12 right here. The editor is continually improved by us, receiving additional features and becoming better. Here is what you will have to do to begin:

Step 1: First of all, open the tool by pressing the "Get Form Button" in the top section of this webpage.

Step 2: As you launch the online editor, you will find the document made ready to be filled out. Aside from filling in various blank fields, you can also perform several other things with the Document, such as putting on any text, changing the original textual content, adding illustrations or photos, signing the document, and a lot more.

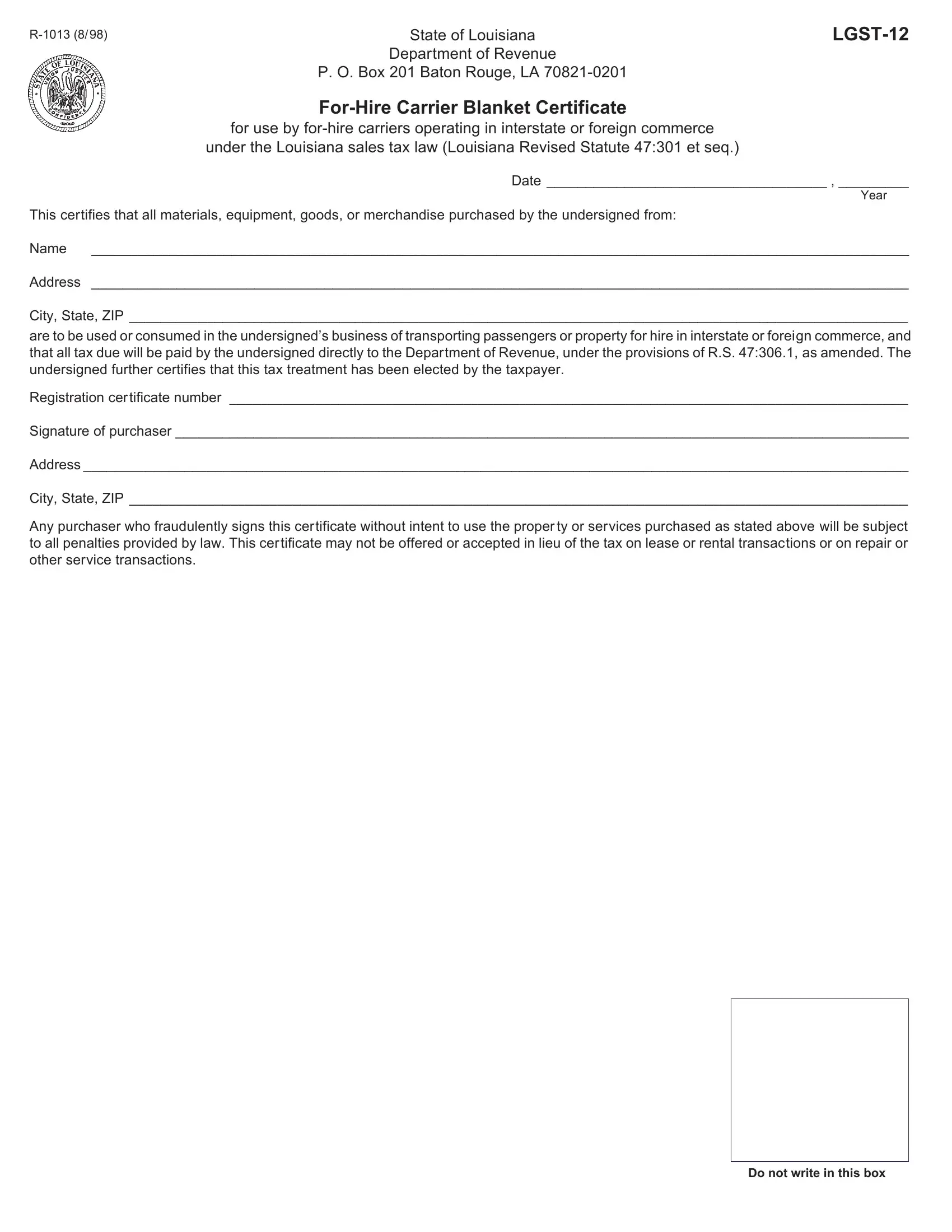

This PDF form requires particular information to be filled out, therefore be certain to take whatever time to enter what's requested:

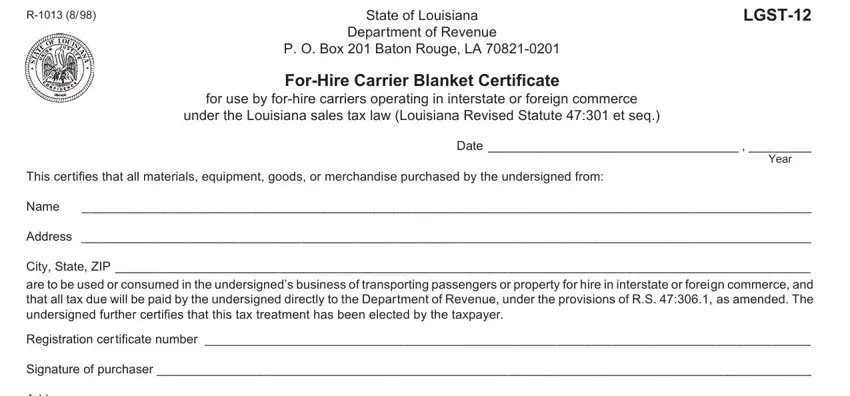

1. To start off, while filling out the Form Lgst 12, beging with the part containing subsequent blank fields:

2. Your next part is to submit all of the following blanks: Address, City State ZIP, and Any purchaser who fraudulently.

3. This next step should be fairly simple, Do not write in this box - these form fields needs to be completed here.

It's simple to get it wrong when filling out the Do not write in this box, hence be sure to look again before you'll submit it.

Step 3: Before moving forward, ensure that all blanks have been filled in correctly. As soon as you are satisfied with it, click on “Done." Join FormsPal right now and immediately gain access to Form Lgst 12, prepared for downloading. Each change made is conveniently kept , making it possible to customize the file at a later stage if necessary. FormsPal provides risk-free document editor devoid of personal information recording or any type of sharing. Feel comfortable knowing that your information is safe here!