You may prepare ls 223 form effortlessly in our PDF editor online. To retain our tool on the forefront of efficiency, we aim to put into practice user-oriented features and enhancements on a regular basis. We're always looking for feedback - join us in revolutionizing the way you work with PDF docs. All it takes is several basic steps:

Step 1: Firstly, open the pdf tool by pressing the "Get Form Button" above on this site.

Step 2: With this online PDF tool, you are able to accomplish more than merely fill in blank form fields. Edit away and make your forms seem professional with customized textual content added in, or fine-tune the original content to perfection - all that supported by an ability to add any kind of pictures and sign the document off.

As for the blank fields of this particular form, this is what you want to do:

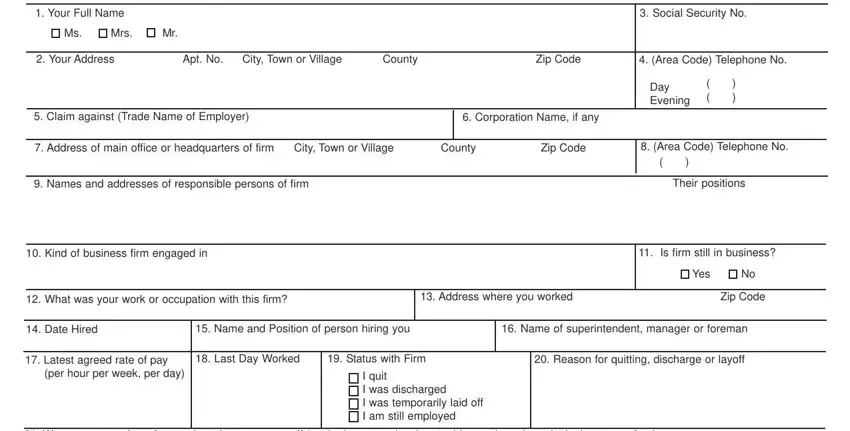

1. Firstly, once completing the ls 223 form, start in the page that contains the subsequent fields:

2. Once your current task is complete, take the next step – fill out all of these fields - Were you a member of any union, Yes, If yes give name local no address, Have you asked your union for, If yes what action has the union, Yes, Wages claimed for period first, Name and address of employers bank, Zip Code, Total amount of wages due, Before answering questions and, From Did you request these wages, Inclusive, Yes, and Date of Request with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

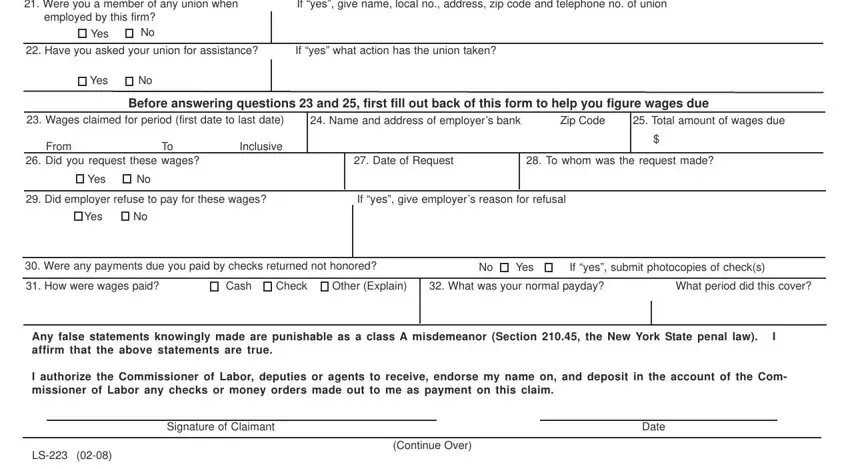

3. This next section is pretty easy, date, Number of hours worked this week, Number of days worked this week, week or month, week, this week, paid to you this week, numbers, per, Gross wage is the amount before, Include any additional, Total, and Amount Due - each one of these empty fields must be completed here.

You can easily make a mistake while completing the paid to you this week, for that reason be sure you reread it prior to deciding to submit it.

Step 3: After proofreading the completed blanks, press "Done" and you're done and dusted! Sign up with us right now and easily gain access to ls 223 form, all set for download. All adjustments made by you are kept , meaning you can modify the form further if needed. FormsPal ensures your data privacy by using a secure system that never records or shares any type of sensitive information used. Be confident knowing your paperwork are kept confidential each time you use our service!