Ls 262 is a Louisiana state tax form that must be filed by individuals and businesses that are doing business in Louisiana. The form is used to calculate the state income tax owed by the taxpayer. There are many rules and regulations surrounding the filing of this form, so it is important to understand all of the requirements before completing it. Filing taxes can be a complex process, but with the right information, it can be done correctly every time. Make sure to consult with a professional if you have any questions about filling out Ls 262 or any other state tax forms.

| Question | Answer |

|---|---|

| Form Name | Form Ls 262 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | ls 262 online 262 form |

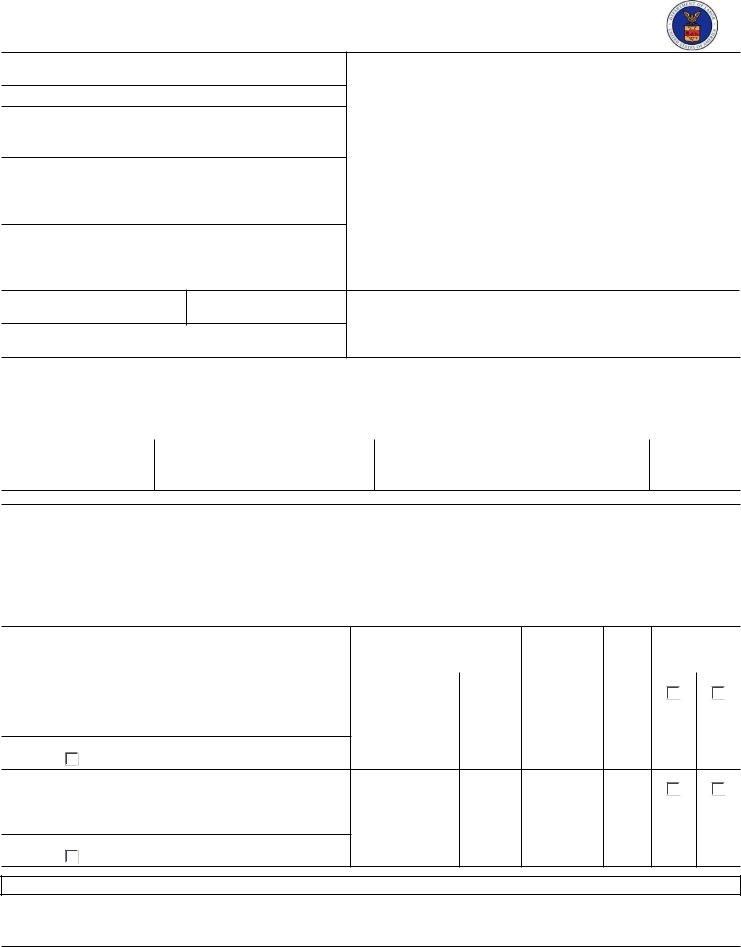

Claim for Death Benefits |

U.S. Department of Labor |

|

Office of Workers' Compensation Programs |

1. Name of deceased employee (First, middle Initial, last)

a. Social Security Number (Required by Law)

2.Last address of last deceased (Number, street, city, state, ZIP)

3.Name and address of employer (Number, street, city, state, ZIP)

4.Name and address of undertaker

For Office |

OWCP Number |

Carrier's Number |

|

OMB No. |

Use Only |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. Place of Death |

|

9. Date of Death |

||

|

|

|

||

10. Place where injury occured |

|

11. Date of Injury |

||

|

|

|

|

|

12.Nature of injury or occupational Illness and cause of death (Give parts of body affected if Injured)

5. Amount of undertaker's bill

6. Amount Paid

13. Name and address of last attending physician (or hospital)

7. Name of person paying undertaker's bill

14. Widow or Widower

a. Full name and address |

|

b. Social Security Number |

c. Date of birth |

d. Nationality |

|

|

|

|

|

|

|

|

|

|

Telephone Number |

|

|

|

|

|

|

|

|

e. Date married to deceased |

f. Place of marriage (City, State, Country) |

g. Signature of widow, widower, and/or |

Date |

||

|

|

|

guardian of children |

|

|

UNITED STATES

15. Children of deceased (see page 2 for qualification)

a. Full name |

b. Address |

c. Social Security Number d. Date of birth |

e. Nationality |

|

|

(Required by Law) |

|

|

|

|

|

|

|

|

|

16. All other persons partially or wholly dependent on deceased |

b. income for one year pre- |

c. Relation- |

d. Age |

e. Dependent |

|

support (See page 2 for instructions) |

ceding death |

|

ship |

|

|

|

Source |

Amount |

|

|

Wholly Partially |

a. Full name and address |

|

|

|

|

|

Signature |

Date (mm/dd/yyyy) |

Guardian?

f. Full name and address

Signature |

Date (mm/dd/yyyy) |

Guardian?

Important Notice

Section 31 (a)(1) of the Longshore Act, 33 U.S.C. 931 (a)(1), provides, as follows: Any claimant or representative of a claimant who knowingly and

willfully makes a false statement or representation for the purpose of obtaining a benefit or payment under this Act shall be guilty of a felony, and on conviction thereof shall be punished by a fine not to exceed $10,000, by imprisonment not to exceed five years, or by both.

Form

This Form Replaces Form |

Rev. April 2012 |

|

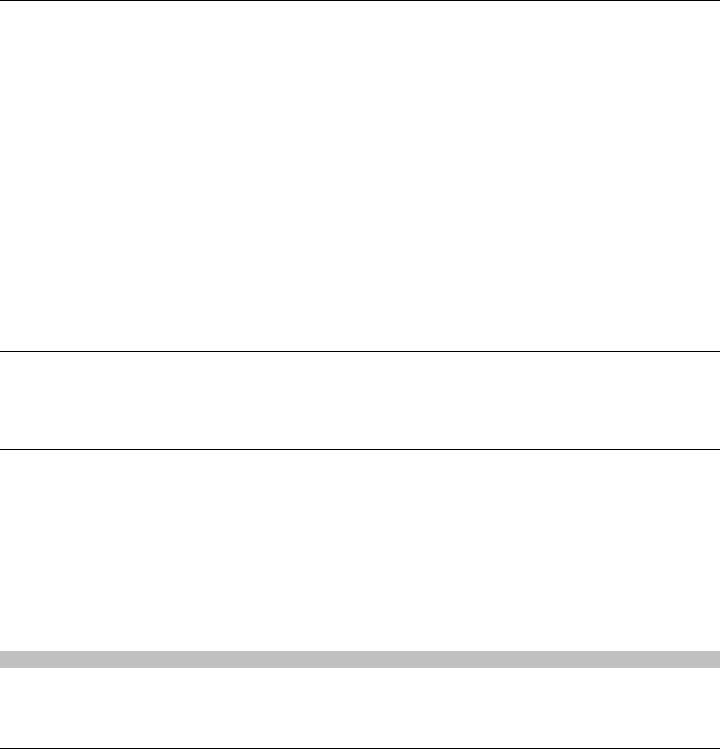

Instructions:

1.Use this form to claim death benefits under the Longshore and Harbor Workers' Compensation Act, Defense Base Act, Outer Con- tinental Shelf Lands Act, or Nonappropriated Fund Instrumentalities Act. The information provided will be used to determine entitlement to benefits.

2.Submit claim in duplicate to a district office of the Office of Workers' Compensation Programs (OWCP).

3.individual claims must be filed by or in behalf of each person eligible for benefits [33 U.S.C. 913(a)]. (included are grandchildren, brothers and sisters under 18 years, parents,

4.Under item 16(b), state all your income for the year preceding death by source (Social Security pension, bonds, etc.) and amount. List separately support deceased furnished you, including the value of any shelter, food, clothing, or other supplies. Use space below or additional sheets if needed.

5.A person other than the claimant may complete claim for the beneficiary.

6.Persons are not required to respond to this collection of information unless it displays a currently valid OMB number.

Conditions of Eligibility

Coverage for Death Benefit

A death benefit is payable under the Longshore Act, or related law, if a covered employee dies as a result of

Who is eligible for a Death Benefit?

1.The deceased worker's widow or widower living with or dependent for support at the time of death; or widow or widower living apart for good cause or because of desertion by worker.

2.Unmarried child(ren) under age 18, or if over 18: (a) was (were) wholly dependent on deceased worker and unable to support self(ves) because of mental or physical disability, or (b) student(s) up to age 23 (must meet certain requirements). Includes a posthumous child, legally adopted child, child to whom deceased acted as parent for one year before injury, stepchild, or acknowledged illegitimate child.

3.If the combined amount due a surviving widow or widower and child or children is not greater than

200percent of the national average weekly wage, a benefit is payable for any one of the following: Grandchildren, brothers or sisters (if dependent at time of injury), parents, grandparents, or others satisfying legal requirements of dependency. (Consult the Office of Workers' Compensation Programs for more information.)

What terminates widow's or widower's benefits?

1.Death

2.Remarriage, in which case the widow or widower receives a lump sum payment of two year's compensation.

What evidence is needed to support a claim?

1.Widow or widower. Proof of marriage to deceased worker. If either party was married before, proof that earlier marriage was legally ended. A certified copy of the final divorce decree, or proof of death of a previous marriage partner may be required before benefits are paid. Certified copy of the death certificate of the deceased worker.

2.Children - Certified copy of birth certificate or Order of Adoption. If a legal guardian has been appointed, a certified copy of the Letters of Guardianship.

Time requirement of filing claim

Within one year of employee's death. The time may not begin to run, however, until the person claiming the benefit would reasonably have related the employee's death to his or her employment. In case of death due to an occupational disease, a claim may be filed within two years after the claimant becomes aware, or in the exercise of reasonable diligence or by reason of medical advice should have been aware, of the relationship between the employment, the disease

and the death.

Use the space below or a separate sheet of paper to continue answers. Please number each answer to correspond to the number of the item being continued.

Privacy Act Notice

In accordance with the Privacy Act of 1974, as amended (5 U.S.C. 552a) you are hereby notified that (1) the Longshore and Harbor Workers' Compensation Act, as amended and extended (33 U.S.C. 901 et seq.) (LHWCA) is administered by the Office of Workers' Compensation Programs of the U.S. Department of Labor, which receives and maintains personal information on claimants and their immediate families. (2) Information which the Office has will be used to determine eligibility for and the amount of benefits payable under the LHWCA. (3) Information may be given to the employer which employed the claimant at the time of injury, or to the insurance carrier or other entity which secured the employer's compensation liability. (4) Information may be given to physicians and other medical service providers for use in providing treatment or medical/vocational rehabilitation, making evaluations and for other purposes relating to the medical management of the claim. (5) Information may be given to the Department of Labor's Office of Administrative Law Judges (OALJ), or other person, board or organization, which is authorized or required to render decisions with respect to the claim or other matter arising in connection with the claim. (6) Information may be given to Federal, state and local agencies for law enforcement purposes, to obtain information relevant to a decision under the LHWCA, to determine whether benefits are being or have been paid properly, and, where appropriate, to persue salary/administrative offset and debt collection actions required or permitted by law. Disclosure of the claimant's Social Security Number (SSN) or tax identifying number (TIN) on this form is mandatory. The SSN and/or TIN and other information maintained by the Office may be used for identification, and for other purposes authorized by law. (8) Failure to disclose all requested information may delay the processing of the claim, the payment of benefits, or may result in an unfavorable decision or reduced level of benefits.

Note: The notice applies to all forms requesting information that you might receive from the Office in connection with the processing and/or adjudication of the claim you filed under the LHWCA and related statutes.

Public Burden Statement

We estimate that it will take an average of 15 minutes to complete this collection of information, including time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. If you have any comments regarding these estimates or any other aspect of this collection of information, including suggestions for reducing this burden, send them to the U.S. Department of Labor, Division of Longshore and Harbor Workers' Compensation, Room C4315, 200 Constitution Avenue, N.W., Washington, DC 20210.

DO NOT SEND THE COMPLETED FORM TO THIS OFFICE