Item 8 – By submitting this offer, I/we understand and agree to the following conditions:

(a)I/we voluntarily submit all payments made on this offer.

(b)Comptroller of Maryland will apply payments made under the terms of this agreement in the best interests of the state.

(c)If the Comptroller of Maryland rejects the offer or I/we withdraw the offer, Comptroller of Maryland will return any amount paid with the offer. If I/ we agree in writing, Comptroller of Maryland will apply the amount paid with the offer to the amount owed. If I/we agree to apply the payment, the date the offer is rejected or withdrawn will be considered the date of payment. I/we understand that the Comptroller of Maryland will not pay interest on any amount I/we submit with the offer.

(d)Comptroller of Maryland will keep all payments and credits made, received, or applied to the amount being compromised before this offer was submitted. Comptroller of Maryland will also keep any payments made under the terms of an installment agreement while this offer is pending.

(e)I/we understand that I/we remain responsible for the full amount of the tax liability unless the Comptroller of Maryland accepts the offer in writing and I/we have met all the terms and conditions of this offer.

(f)Once Comptroller of Maryland accepts the offer in writing, I/we waive the right to contest, in court or otherwise, the amount of the tax liability.

(g)If I/we fail to meet any of the terms and conditions of the offer, the offer is in default, and the Comptroller of Maryland may:

(i)immediately file suit or levy to collect the entire unpaid balance of the offer, without further notice of any kind;

(ii)immediately file suit or levy to collect the original amount of the tax liability, without further notice of any kind.

If I/we fail to comply with all provisions of state law relating to filing my/our returns and paying my/our required taxes for three (3) years from the date Comptroller of Maryland accepts the offer, the Comptroller of Maryland may treat the offer as defaulted and reinstate the unpaid balance. The Comptroller of Maryland will continue to add interest, as required by law, on the amount the Comptroller of Maryland determines is due after default. The Comptroller of Maryland will add interest from the date the offer is defaulted until I/we completely satisfy the amount owed.

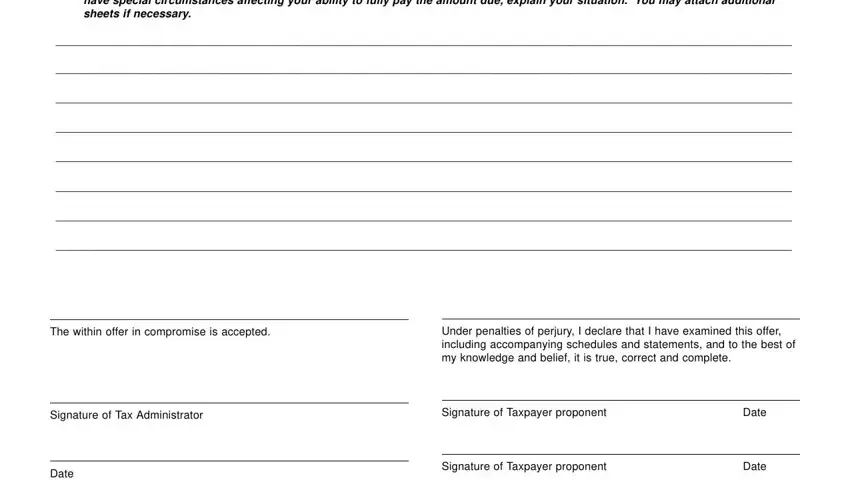

Item 9 – Explanation of Circumstances

I am requesting an offer in compromise for the reason(s) listed below:

Note: If you are requesting compromise based on doubt as to liability, explain why you don’t believe you owe the tax. If you believe you have special circumstances affecting your ability to fully pay the amount due, explain your situation. You may attach additional sheets if necessary.

_______________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________