You may fill out mi treasury mi 1041 without difficulty in our PDFinity® editor. FormsPal team is relentlessly endeavoring to develop the editor and ensure it is much faster for clients with its handy features. Uncover an constantly revolutionary experience now - check out and find out new opportunities as you go! To start your journey, take these basic steps:

Step 1: Press the orange "Get Form" button above. It will open our pdf editor so that you can begin completing your form.

Step 2: As soon as you start the editor, you'll see the form all set to be filled out. Apart from filling in various fields, it's also possible to perform many other things with the form, including putting on custom text, editing the initial text, adding images, affixing your signature to the form, and much more.

For you to finalize this document, make certain you enter the necessary details in every blank:

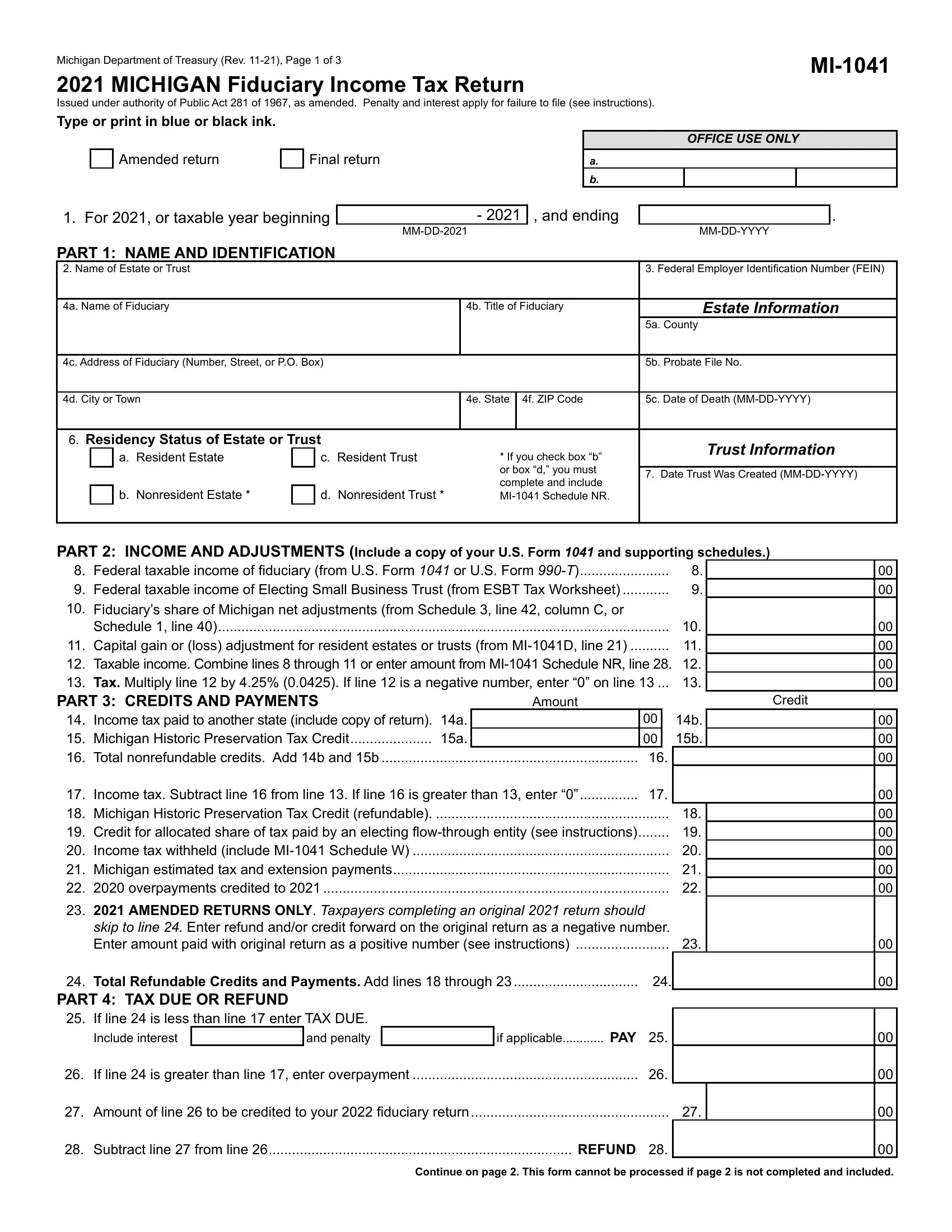

1. It's vital to complete the mi treasury mi 1041 accurately, so be careful while filling out the parts comprising all these fields:

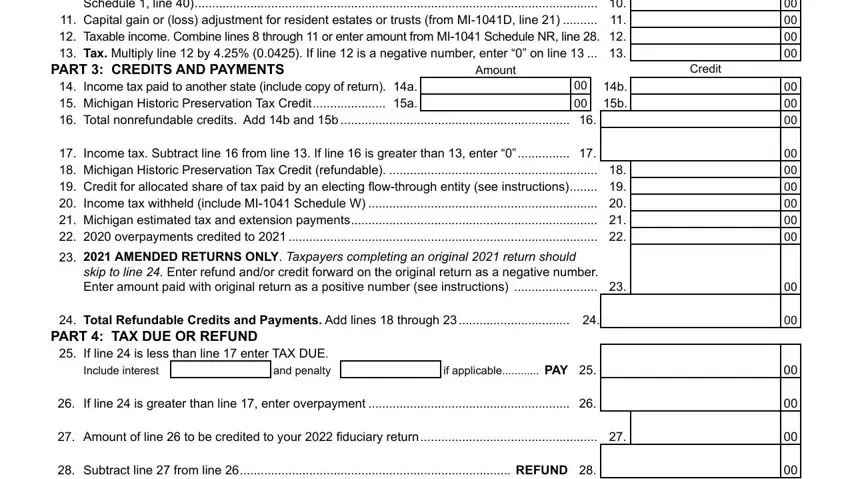

2. Once the last array of fields is completed, go to enter the relevant details in all these - Schedule line Capital gain or, PART CREDITS AND PAYMENTS, Amount, Credit, Income tax paid to another state, b b, Income tax Subtract line from, AMENDED RETURNS ONLY Taxpayers, skip to line Enter refund andor, Total Refundable Credits and, PART TAX DUE OR REFUND If line, Include interest, if applicable PAY, If line is greater than line, and Amount of line to be credited to.

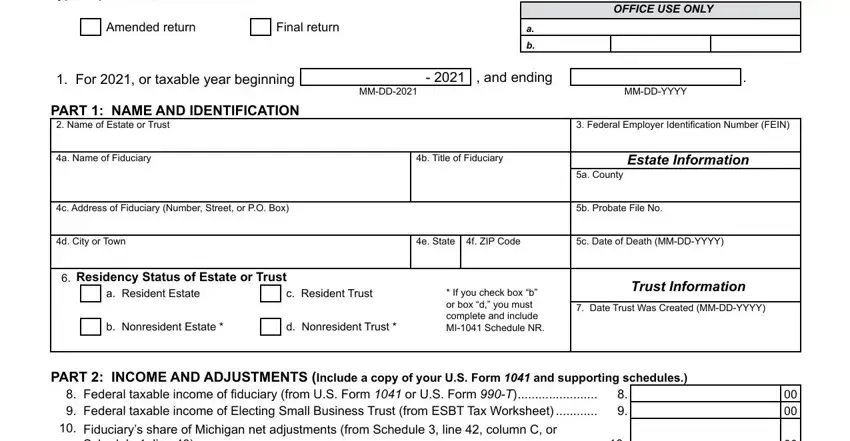

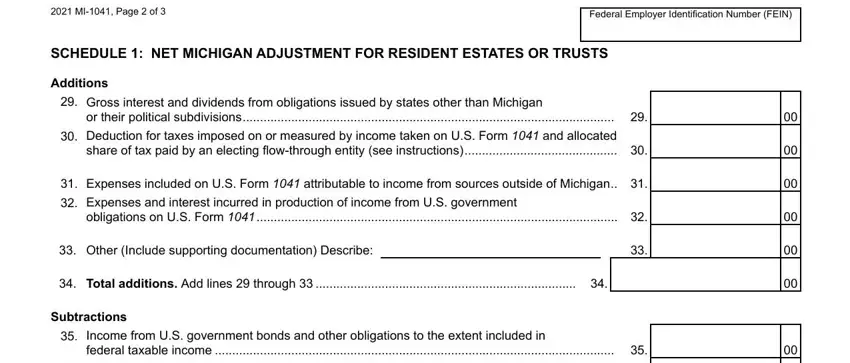

3. Completing MI Page of, Federal Employer Identification, SCHEDULE NET MICHIGAN ADJUSTMENT, Additions, Gross interest and dividends from, or their political subdivisions, Expenses included on US Form, obligations on US Form, Other Include supporting, Total additions Add lines, Subtractions, Income from US government bonds, and federal taxable income is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Regarding federal taxable income and obligations on US Form, be sure you get them right in this section. Those two are the most significant fields in the document.

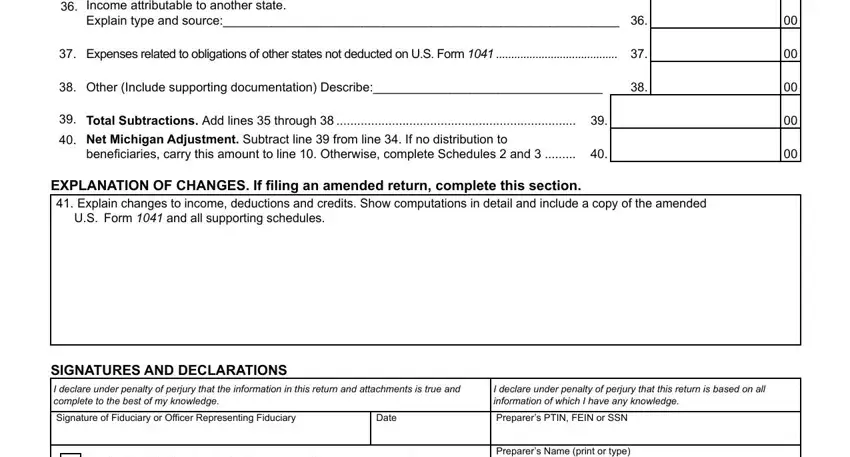

4. To go onward, the next step requires filling in several blanks. Examples of these are Income attributable to another, Explain type and source, Expenses related to obligations, Other Include supporting, Total Subtractions Add lines, Net Michigan Adjustment Subtract, beneficiaries carry this amount to, EXPLANATION OF CHANGES If filing, US Form and all supporting, SIGNATURES AND DECLARATIONS, I declare under penalty of perjury, Date, I declare under penalty of perjury, Preparers PTIN FEIN or SSN, and Preparers Name print or type, which are essential to carrying on with this particular PDF.

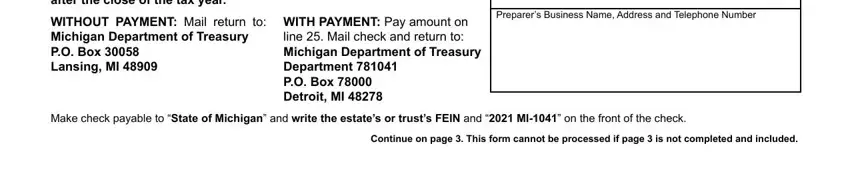

5. Since you approach the finalization of this document, there are actually several extra requirements that have to be fulfilled. In particular, This return is due April or on, WITHOUT PAYMENT Mail return to, Preparers Business Name Address, Make check payable to State of, and Continue on page This form cannot should be done.

Step 3: Before moving forward, make sure that form fields have been filled out the correct way. Once you establish that it is good, click “Done." Right after starting a7-day free trial account at FormsPal, you will be able to download mi treasury mi 1041 or send it through email immediately. The PDF form will also be readily available in your personal cabinet with all your adjustments. FormsPal provides protected form editing with no personal data recording or distributing. Feel safe knowing that your information is in good hands with us!