The entire process of filling in the Form Mo 8453 is fairly simple. Our experts made sure our tool is not difficult to navigate and can help complete any kind of form in no time. Consider a couple of steps you have to take:

Step 1: Select the orange button "Get Form Here" on this page.

Step 2: Once you enter our Form Mo 8453 editing page, you will notice all the functions you can undertake about your form in the top menu.

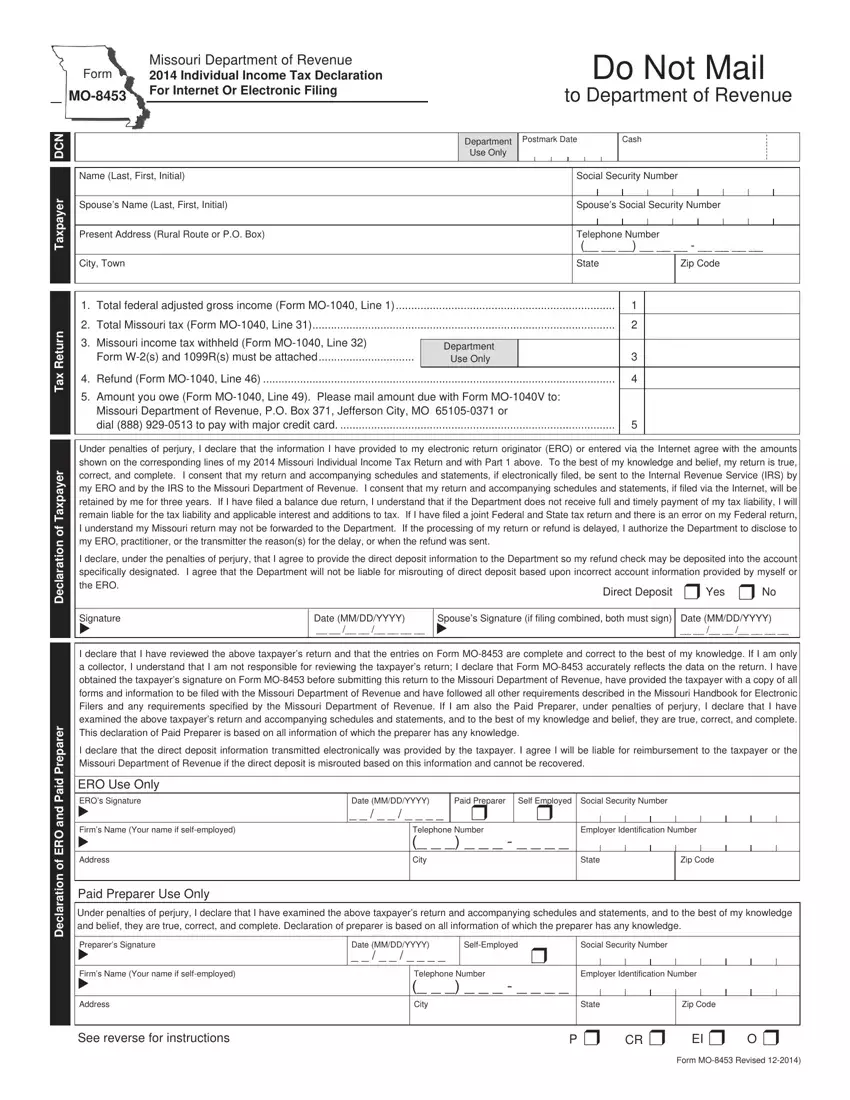

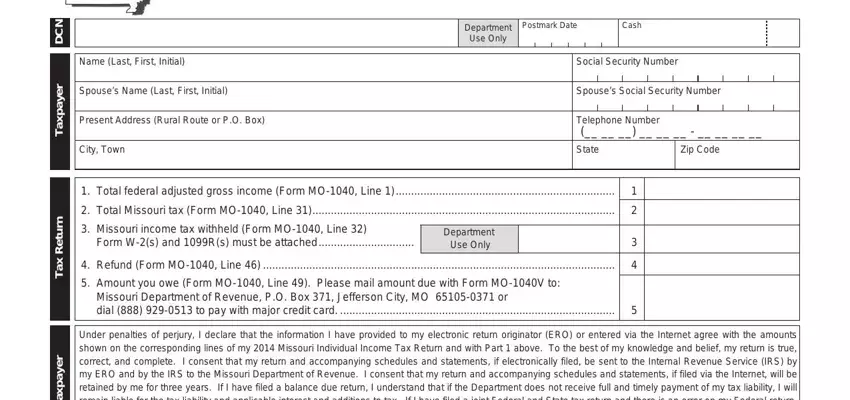

Enter the information demanded by the system to get the form.

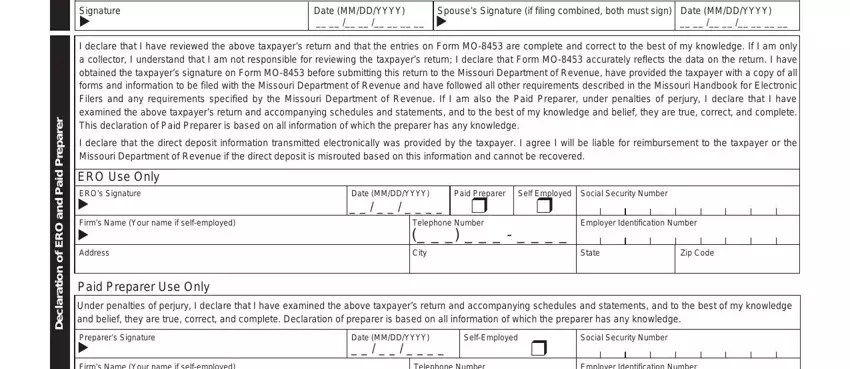

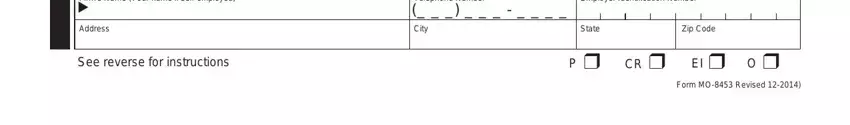

In the re, rape, rP, daP, dna, ORE fon, oita, ra ceD, Signature, t Date, MM, DD, YYYY EROUseOnlyEROsSignature, t Firms, Name, Your, name, if, self, employed, t Address, Date, MM, DD, YYYY r, Telephone, Number, City Employer, Identification, Number State, Zip, Code PreparersSignature, t and Firms, Name, Your, name, if, self, employed, t field, type in the information you have.

In the Firms, Name, Your, name, if, self, employed, t Address, See, reverse, for, instructions Telephone, Number, City Employer, Identification, Number State, Zip, Code PrC, Rr, EIr, Or and Form, MORe, vised part, point out the vital information.

Step 3: Choose the "Done" button. Now you may transfer the PDF form to your device. Aside from that, it is possible to send it through email.

Step 4: Prepare minimally several copies of your form to avoid any possible future concerns.