You can prepare 21 rfi easily with our online PDF editor. Our development team is ceaselessly endeavoring to expand the tool and ensure it is much faster for clients with its cutting-edge functions. Make use of the latest progressive opportunities, and discover a myriad of unique experiences! To begin your journey, go through these basic steps:

Step 1: Click on the "Get Form" button at the top of this page to access our PDF tool.

Step 2: Using this state-of-the-art PDF tool, you can actually do more than just complete blank form fields. Express yourself and make your docs look great with custom text added, or adjust the file's original input to perfection - all backed up by an ability to insert any pictures and sign it off.

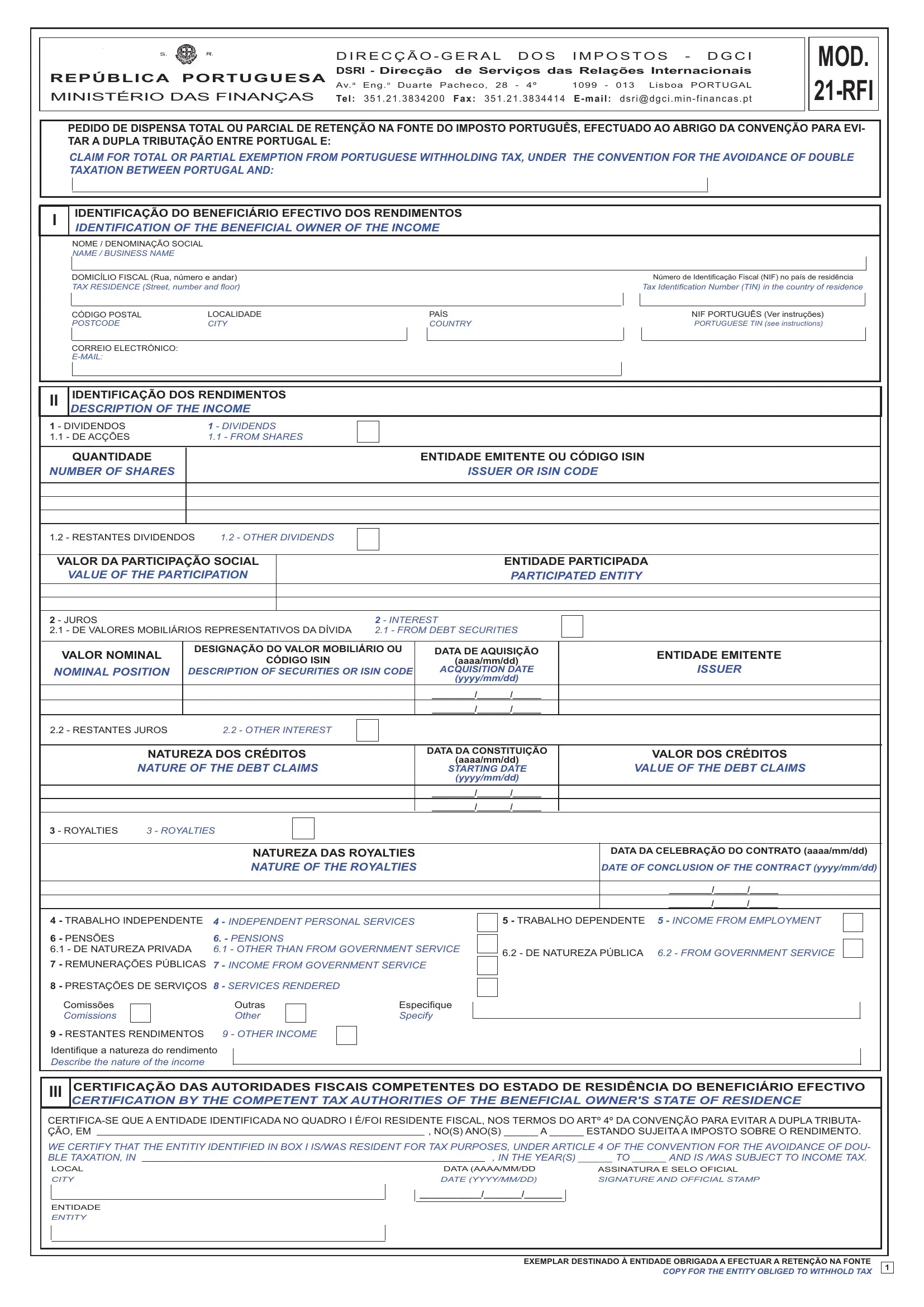

This document requires specific info to be filled out, thus be sure you take your time to enter precisely what is expected:

1. Begin filling out your 21 rfi with a number of essential blank fields. Note all of the information you need and ensure not a single thing overlooked!

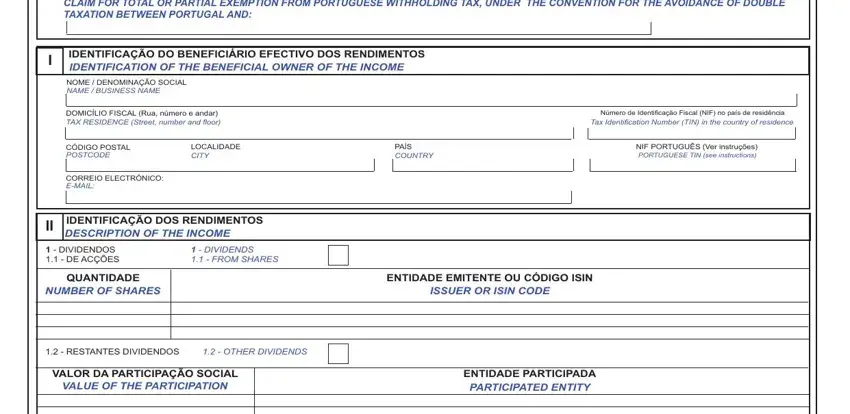

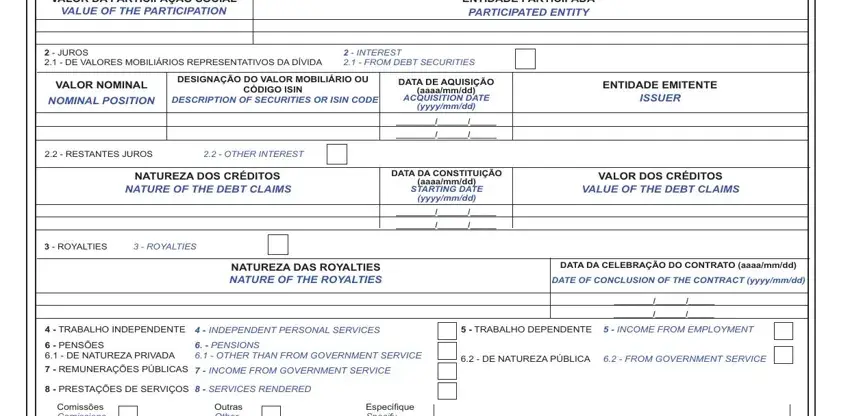

2. After the last segment is completed, you need to add the necessary specifics in JUROS DE VALORES MOBILIÁRIOS, INTEREST FROM DEBT SECURITIES, VALOR NOMINAL, DESIGNAÇÃO DO VALOR MOBILIÁRIO OU, CÓDIGO ISIN, NOMINAL POSITION, DESCRIPTION OF SECURITIES OR ISIN, RESTANTES JUROS, OTHER INTEREST, NATUREZA DOS CRÉDITOS, NATURE OF THE DEBT CLAIMS, ROYALTIES, ROYALTIES, DATA DE AQUISIÇÃO, and aaaammdd in order to move forward to the next part.

In terms of DESCRIPTION OF SECURITIES OR ISIN and ROYALTIES, make certain you get them right here. Both of these are viewed as the most important ones in the form.

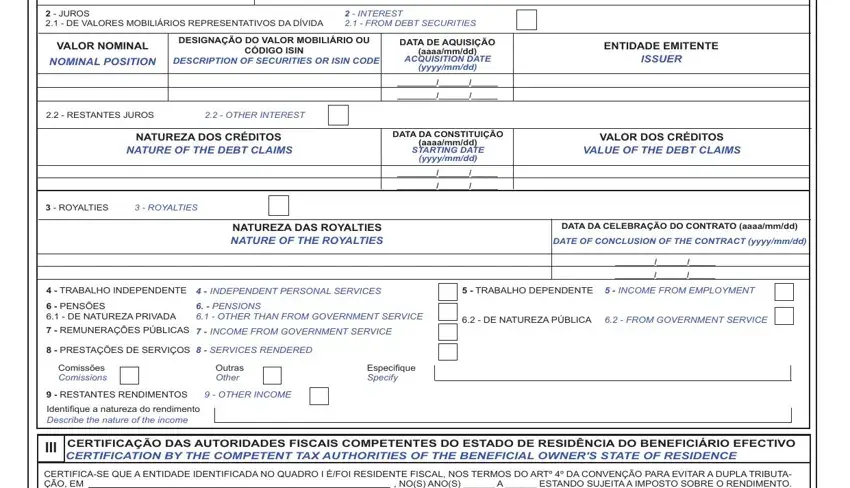

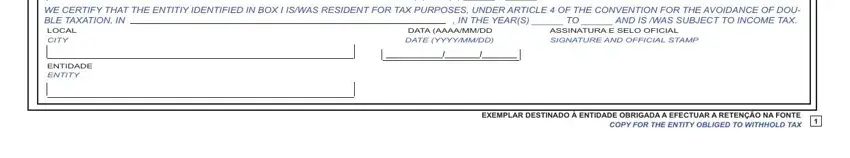

3. In this stage, look at CERTIFICASE QUE A ENTIDADE, WE CERTIFY THAT THE ENTITIY, ASSINATURA E SELO OFICIAL, ENTIDADE ENTITY, and EXEMPLAR DESTINADO À ENTIDADE. Each one of these are required to be filled out with utmost accuracy.

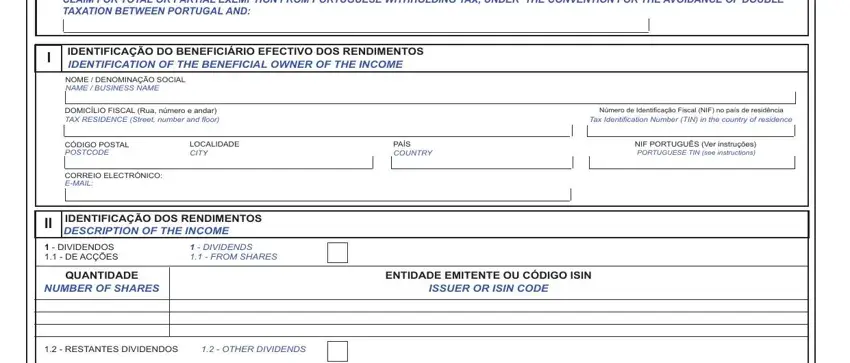

4. To go forward, the next step involves filling in a couple of form blanks. Included in these are PEDIDO DE DISPENSA TOTAL OU, IDENTIFICAÇÃO DO BENEFICIÁRIO, NOME DENOMINAÇÃO SOCIAL NAME, DOMICÍLIO FISCAL Rua número e, Número de Identifi cação Fiscal NIF, Tax Identifi cation Number TIN in, CÓDIGO POSTAL POSTCODE, LOCALIDADE CITY, PAÍS COUNTRY, NIF PORTUGUÊS Ver instruções, CORREIO ELECTRÓNICO EMAIL, IDENTIFICAÇÃO DOS RENDIMENTOS, DIVIDENDOS DE ACÇÕES, DIVIDENDS FROM SHARES, and QUANTIDADE, which are essential to continuing with this process.

5. As a final point, this last part is what you need to finish prior to submitting the document. The blanks at issue include the next: VALOR DA PARTICIPAÇÃO SOCIAL, VALUE OF THE PARTICIPATION, ENTIDADE PARTICIPADA, PARTICIPATED ENTITY, JUROS DE VALORES MOBILIÁRIOS, INTEREST FROM DEBT SECURITIES, VALOR NOMINAL, DESIGNAÇÃO DO VALOR MOBILIÁRIO OU, CÓDIGO ISIN, NOMINAL POSITION, DESCRIPTION OF SECURITIES OR ISIN, RESTANTES JUROS, OTHER INTEREST, NATUREZA DOS CRÉDITOS, and NATURE OF THE DEBT CLAIMS.

Step 3: Before submitting your file, double-check that blank fields have been filled out the proper way. As soon as you’re satisfied with it, click on “Done." Go for a free trial account with us and obtain direct access to 21 rfi - with all transformations kept and accessible inside your personal cabinet. FormsPal provides secure document tools with no data record-keeping or any type of sharing. Feel comfortable knowing that your data is secure here!