Completing maryland mw506ae form is not difficult. We developed our editor to make it user-friendly and uncomplicated and help you complete any form online. Below are a few steps that you should adhere to:

Step 1: At first, select the orange "Get form now" button.

Step 2: When you have entered the editing page maryland mw506ae form, you should be able to see every one of the functions intended for the file inside the upper menu.

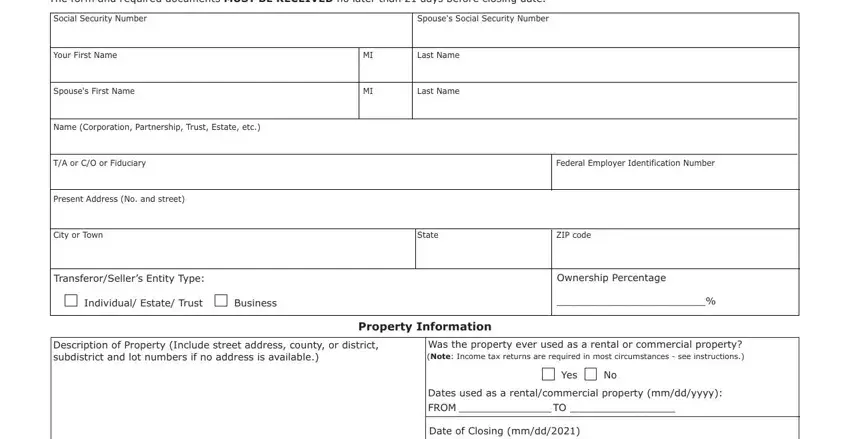

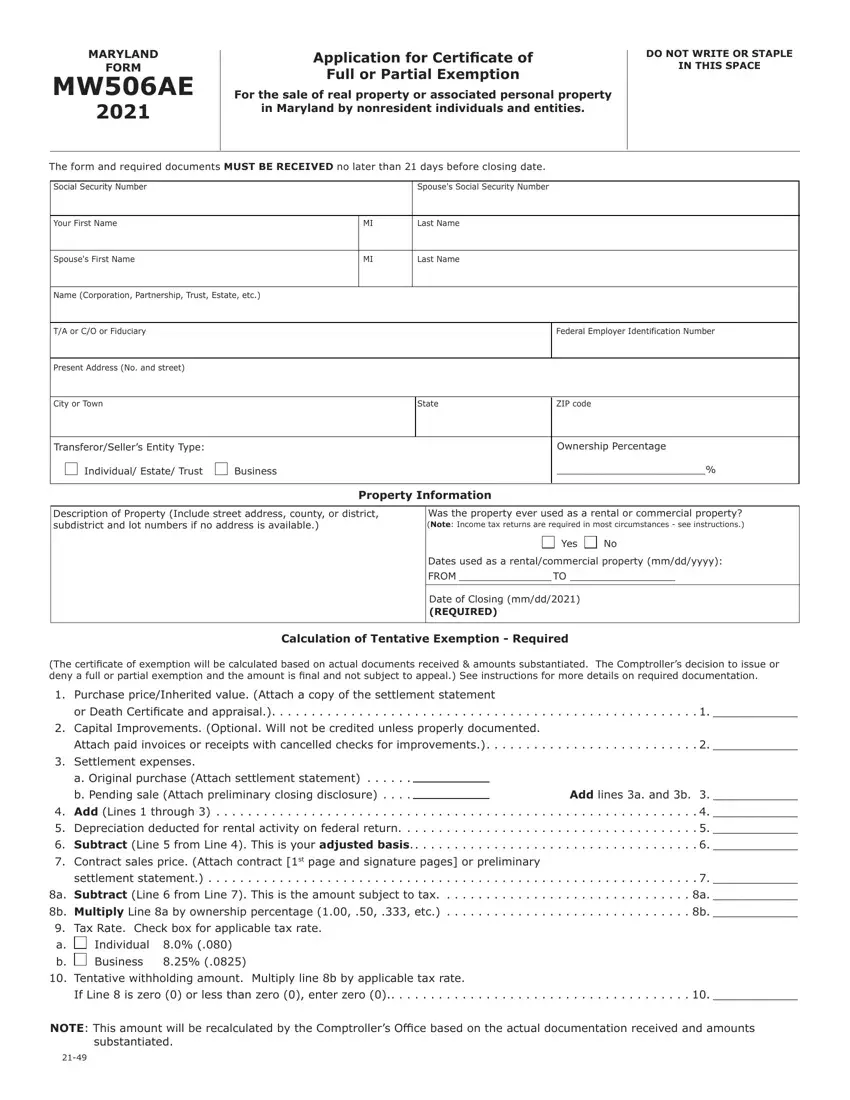

Complete the maryland mw506ae form PDF by providing the content required for each area.

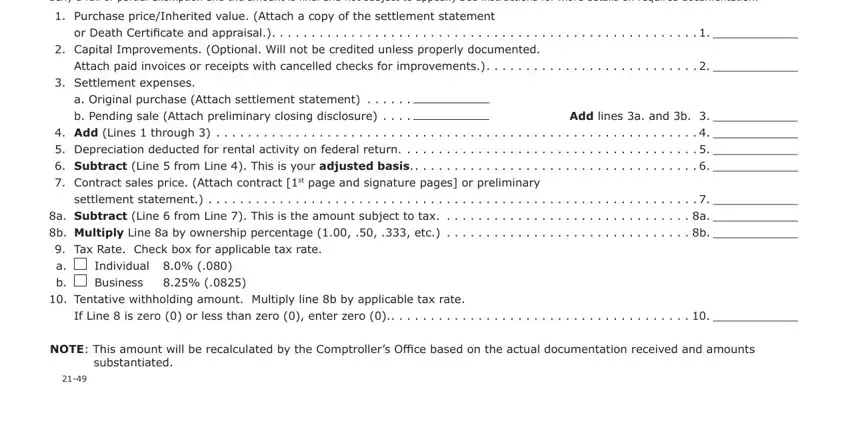

Fill out the The certificate of exemption will, Purchase priceInherited value, or Death Certificate and appraisal, Capital Improvements Optional, Attach paid invoices or receipts, Settlement expenses, a Original purchase Attach, b Pending sale Attach preliminary, Add lines a and b, Add Lines through, Depreciation deducted for rental, Subtract Line from Line This is, settlement statement, a Subtract Line from Line This, and b Multiply Line a by ownership field using the information required by the software.

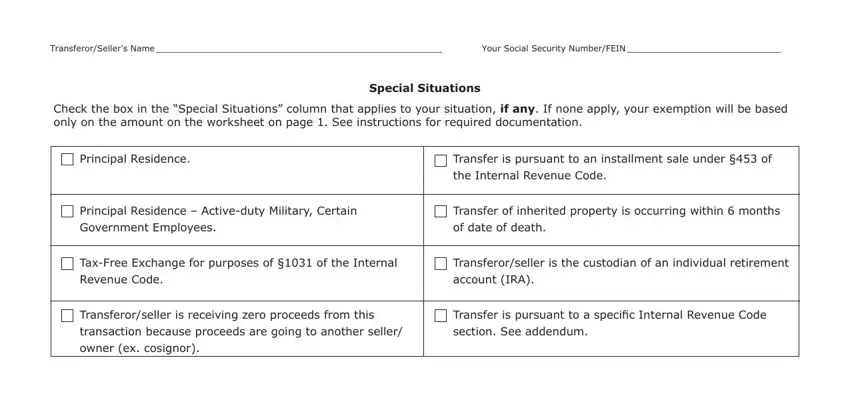

In the MWAE, TransferorSellers Name, Your Social Security NumberFEIN, Check the box in the Special, Special Situations, Principal Residence, Transfer is pursuant to an, the Internal Revenue Code, Principal Residence Activeduty, Government Employees, Transfer of inherited property is, TaxFree Exchange for purposes of, Transferorseller is the custodian, Revenue Code, and account IRA segment, emphasize the necessary information.

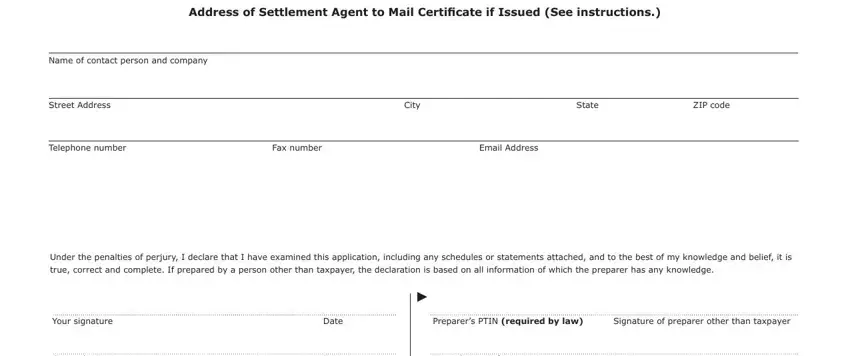

Make sure you list the rights and responsibilities of the sides in the Address of Settlement Agent to, Name of contact person and company, Street Address, City, State, ZIP code, Telephone number, Fax number, Email Address, Under the penalties of perjury I, true correct and complete If, Your signature, Date, Preparers PTIN required by law, and Signature of preparer other than field.

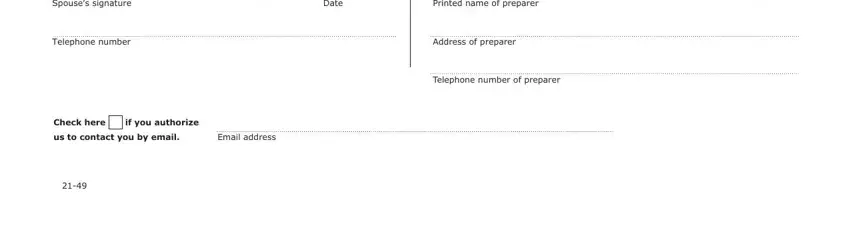

Finish by taking a look at all these areas and completing them accordingly: Spouses signature, Telephone number, Date, Check here, if you authorize, us to contact you by email, Email address, Printed name of preparer, Address of preparer, and Telephone number of preparer.

Step 3: Choose the "Done" button. Now, it is possible to transfer your PDF document - save it to your electronic device or forward it by means of electronic mail.

Step 4: To prevent yourself from different problems down the road, you will need to make minimally a couple of duplicates of your document.

Individual 8.0% (.080)

Individual 8.0% (.080)