The PDF editor was built with the objective of allowing it to be as simple and easy-to-use as possible. The following actions will help make creating the MW506NRS quick and easy.

Step 1: The following web page includes an orange button that says "Get Form Now". Click it.

Step 2: You're now on the form editing page. You may edit, add content, highlight selected words or phrases, put crosses or checks, and include images.

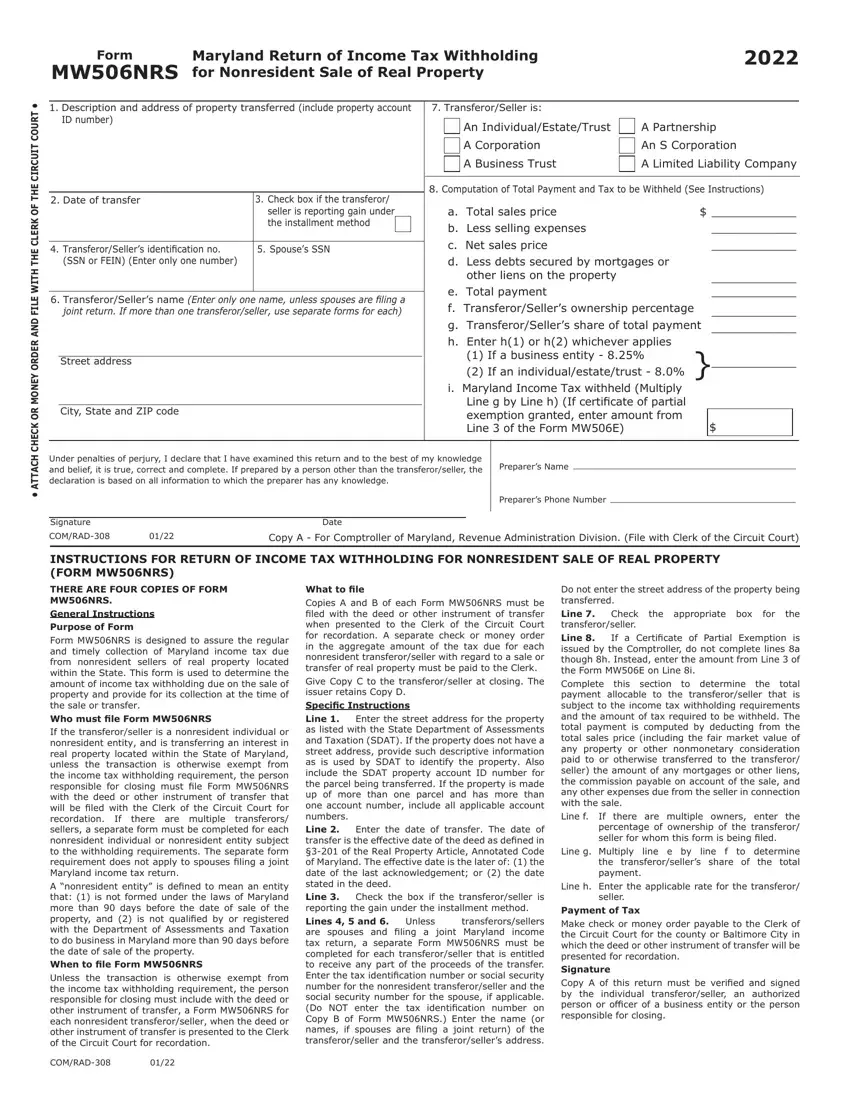

The next parts are what you will need to fill in to receive the ready PDF form.

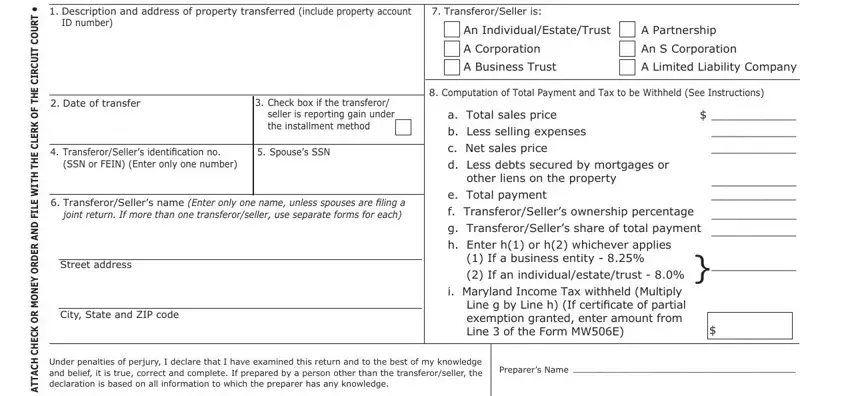

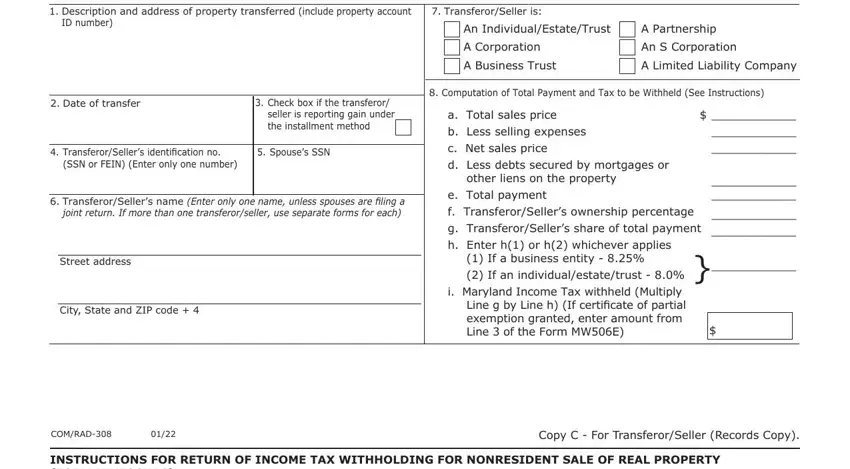

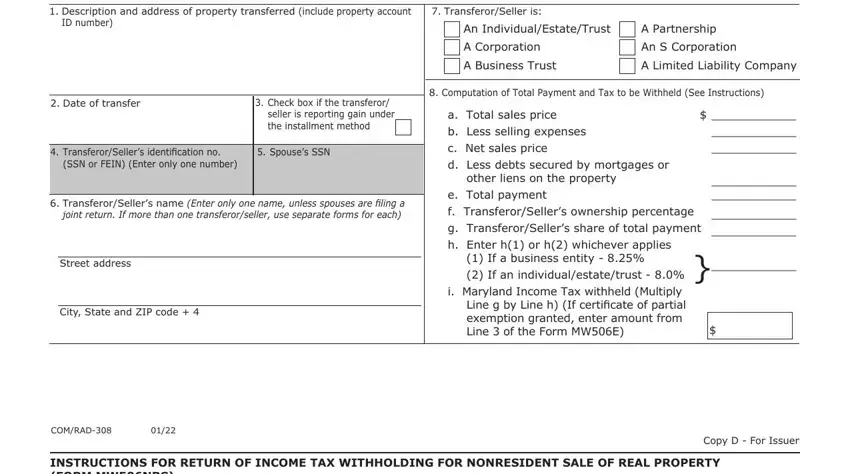

Provide the requested data in the INSTRUCTIONS FOR RETURN OF INCOME, THERE ARE FOUR COPIES OF FORM, What to file Copies A and B of, for the, Check the appropriate box, Do not enter the street address of, and Line g Multiply line e by line f field.

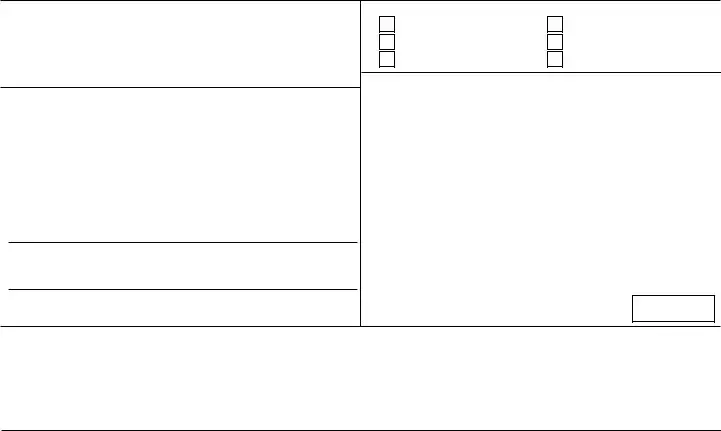

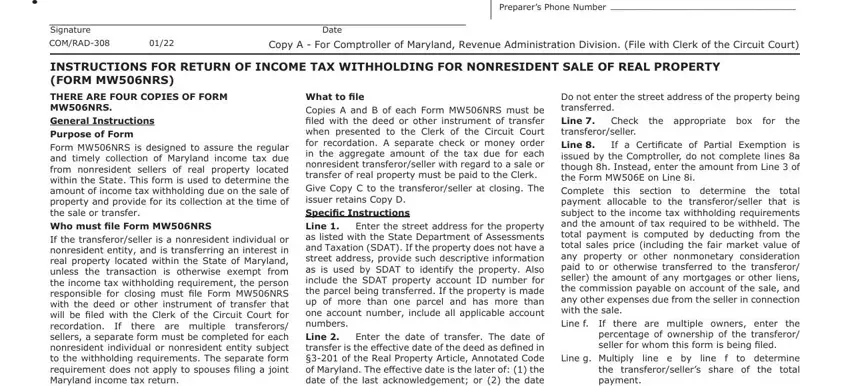

You may be asked for particular crucial information to prepare the ID number, Description and address of, Check box if the transferor, Date of transfer, TransferorSeller is, An IndividualEstateTrust, A Partnership, A Corporation, An S Corporation, A Business Trust, A Limited Liability Company, F O K R E L C E H T H T I W E L I, seller is reporting gain under the, TransferorSellers identification, and Spouses SSN section.

The Description and address of, TransferorSeller is, ID number, An IndividualEstateTrust, A Partnership, A Corporation, An S Corporation, A Business Trust, A Limited Liability Company, Date of transfer, Check box if the transferor, seller is reporting gain under the, TransferorSellers identification, Spouses SSN, and SSN or FEIN Enter only one number area is where both parties can indicate their rights and obligations.

Check the sections Description and address of, TransferorSeller is, ID number, An IndividualEstateTrust, A Partnership, A Corporation, An S Corporation, A Business Trust, A Limited Liability Company, Date of transfer, Check box if the transferor, seller is reporting gain under the, TransferorSellers identification, Spouses SSN, and SSN or FEIN Enter only one number and next complete them.

Step 3: Once you click the Done button, the finished document is easily exportable to any of your devices. Or, you can easily send it using email.

Step 4: Be sure to make as many duplicates of the document as you can to remain away from possible complications.