When you would like to fill out sa370 form appeal download, you don't have to install any programs - just try using our online PDF editor. To make our editor better and simpler to work with, we consistently implement new features, with our users' feedback in mind. To get the ball rolling, take these basic steps:

Step 1: Hit the "Get Form" button above. It is going to open up our editor so that you could start filling out your form.

Step 2: With the help of our handy PDF editing tool, it is easy to do more than simply fill in blank fields. Try all of the functions and make your documents seem faultless with custom text put in, or adjust the file's original input to perfection - all that comes along with an ability to insert stunning images and sign the file off.

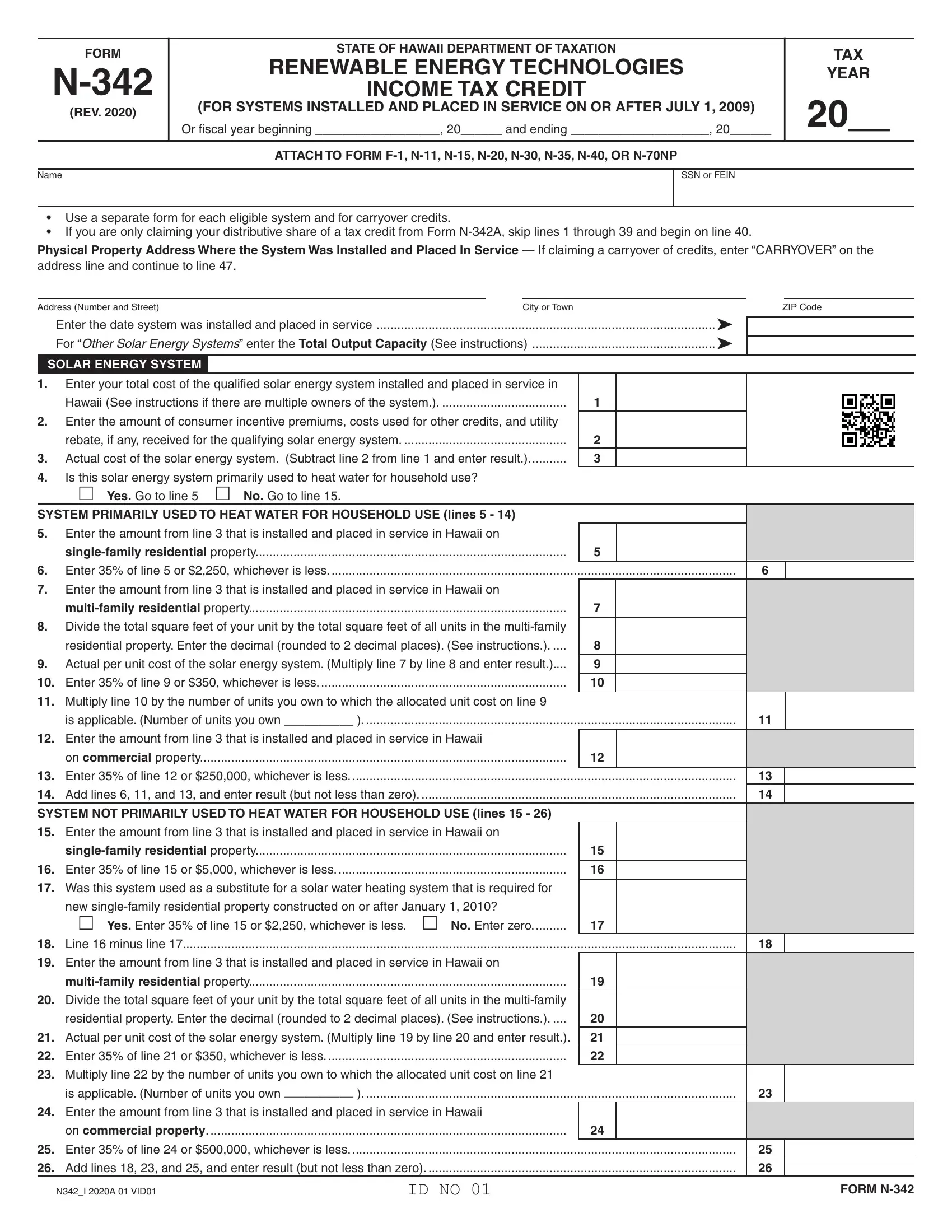

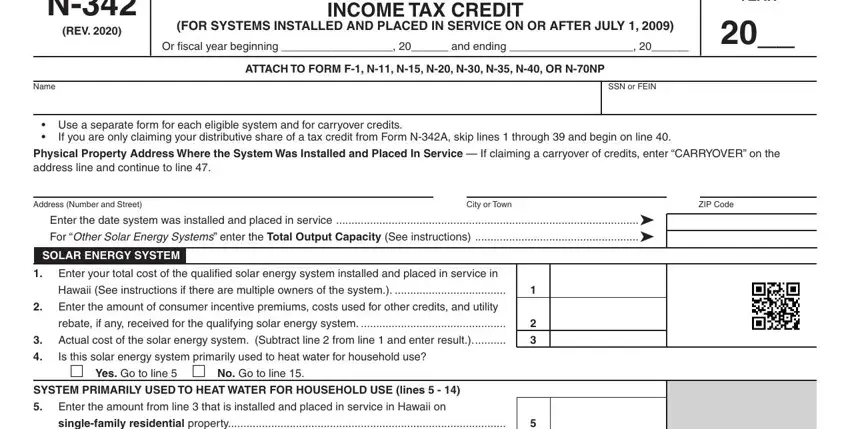

In order to fill out this document, be sure to provide the necessary information in each and every field:

1. Whenever filling in the sa370 form appeal download, ensure to include all essential blanks within the corresponding section. It will help expedite the process, allowing for your details to be handled promptly and properly.

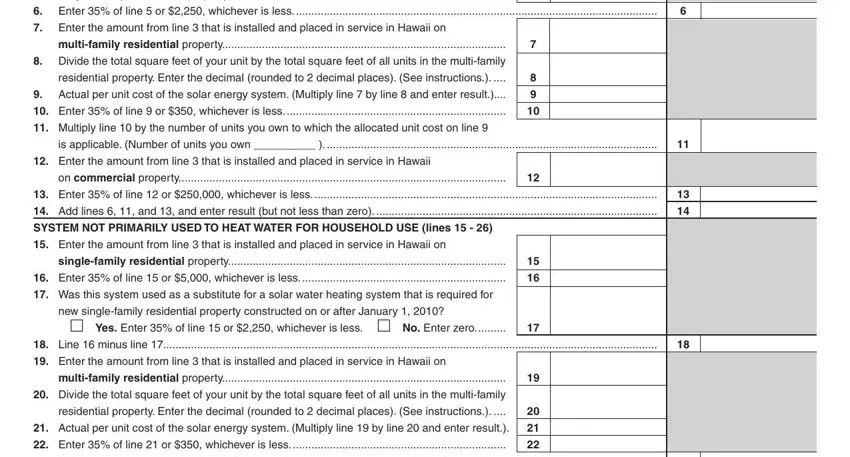

2. When this section is done, go to type in the relevant information in all these - singlefamily residential property, Enter of line or whichever is, Enter the amount from line that, multifamily residential property, Divide the total square feet of, residential property Enter the, Actual per unit cost of the solar, Enter of line or whichever is, Multiply line by the number of, is applicable Number of units you, Enter the amount from line that, on commercial property, Enter of line or whichever is, Add lines and and enter result, and SYSTEM NOT PRIMARILY USED TO HEAT.

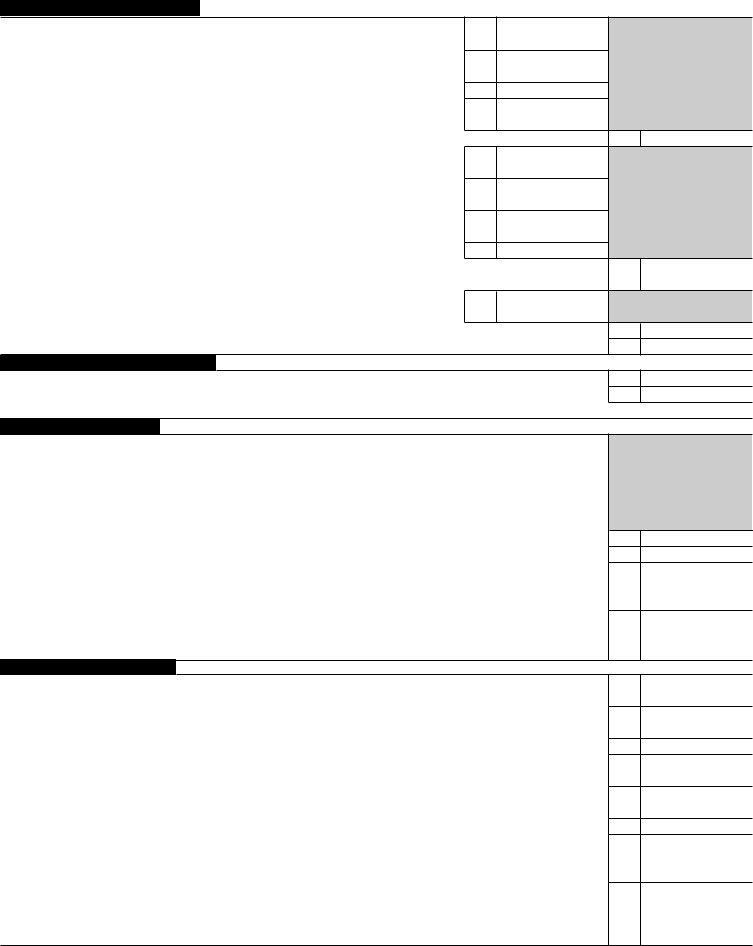

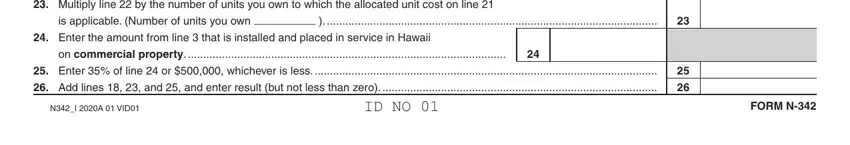

3. The following segment focuses on Multiply line by the number of, is applicable Number of units you, Enter the amount from line that, on commercial property, Enter of line or whichever is, Add lines and and enter result, NI A VID, ID NO, and FORM N - type in all of these fields.

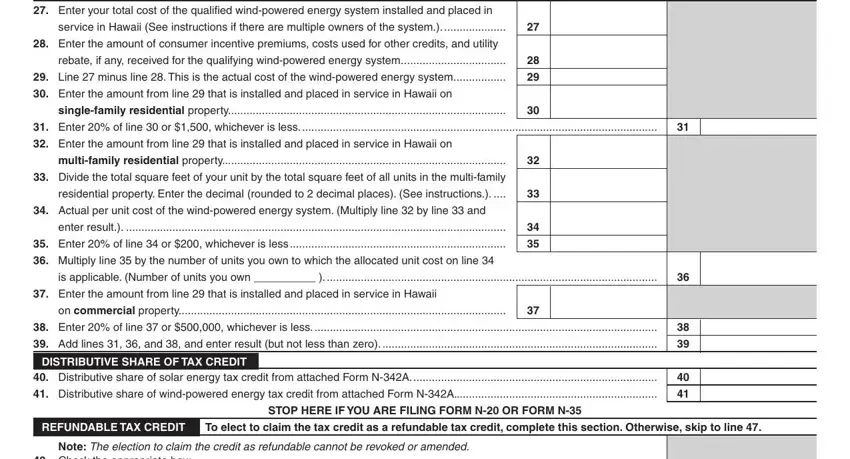

4. Filling out Enter your total cost of the, service in Hawaii See instructions, Enter the amount of consumer, rebate if any received for the, Line minus line This is the, Enter the amount from line that, singlefamily residential property, Enter of line or whichever is, Enter the amount from line that, multifamily residential property, Divide the total square feet of, residential property Enter the, Actual per unit cost of the, enter result, and Enter of line or whichever is is crucial in this next step - be certain to don't hurry and be attentive with each blank!

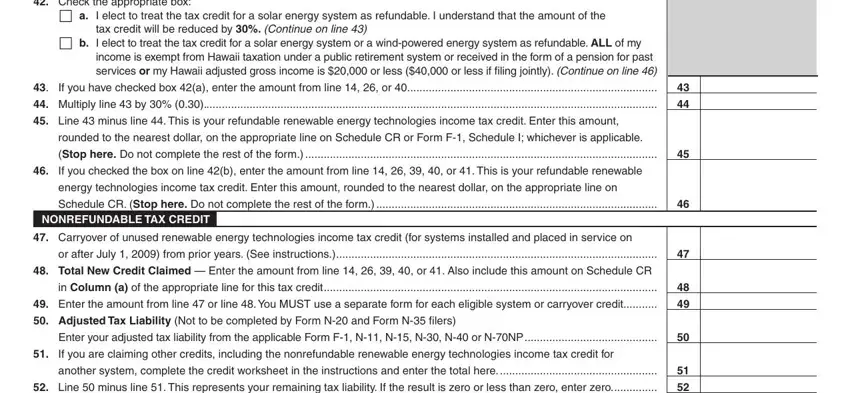

5. This last step to finalize this form is critical. Make sure to fill out the displayed blank fields, which includes Check the appropriate box, a I elect to treat the tax credit, tax credit will be reduced by, income is exempt from Hawaii, If you have checked box a enter, Multiply line by, Line minus line This is your, rounded to the nearest dollar on, Stop here Do not complete the rest, If you checked the box on line b, energy technologies income tax, Schedule CR Stop here Do not, NONREFUNDABLE TAX CREDIT, Carryover of unused renewable, and or after July from prior years, prior to using the file. If not, it might result in an incomplete and probably incorrect form!

It's easy to get it wrong when completing your a I elect to treat the tax credit, therefore make sure that you go through it again prior to when you send it in.

Step 3: Prior to submitting your document, ensure that blanks have been filled out right. The moment you think it's all good, press “Done." Go for a 7-day free trial subscription with us and get immediate access to sa370 form appeal download - which you can then make use of as you want in your personal cabinet. FormsPal guarantees protected document tools with no data record-keeping or distributing. Be assured that your details are safe here!